- Information

- AI Chat

MLL221 - GTAQ - Summary Corporate Law

Corporate Law (MLL221)

Deakin University

Recommended for you

Preview text

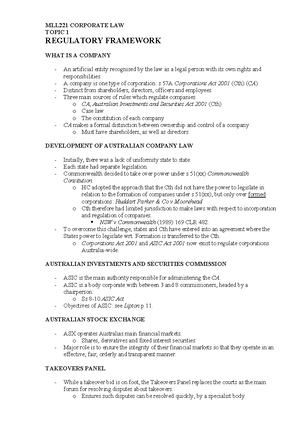

Corporate Law (MLL221) Guide to Answering Questions Sam Merrylees, 2017 Table of Contents REGISTRATION ITS EFFECTS 2 TYPES OF COMPANIES 4 CONSTITUTION AND REPLACEABLE RULES 6 THE COMPANIES RELATIONS WITH OUTSIDERS 8 PROMOTERS AND CONTRACTS 11 FUNDRAISING ISSUING SHARES 13 SHARE CAPITAL 16 MEMBERSHIP 19 DIVIDENDS 20 DEBENTURES 21 DIRECTORS 22 CORPORATE GOVERNANCE 25 DUTIES 27 CARE, SKILL DILIGENCE LOYALTY GOOD FAITH 29 33 MEETINGS 42 REMEDIES 46 ASIC INVESTIGATORY POWERS 51 INSOLVENCY 52 RECEIVERSHIP 52 VOLUNTARY ADMINISTRATION 54 LIQUIDATION 56 VOLUNTARY LIQUIDATION COMPULSORY LIQUIDATION 56 57 MLL221 Corporate Law T1 2017 Registration Its Effects Characteristics of a Company 1. Separate Legal Entity (confirmed in Salomon v Salomon) a. A obligations and liabilities are its own, and not those of its participants (shareholders) i. EFFECT: Limited Liability a shareholder will not be liable for the losses incurred the company (Salomon) 1. Even though a single person may manage and control the company a company is a separate legal entity and a person may concurrently have a variety of legal relationships with that company (employer employee) (Lee v Air Farming Ltd) 2. S 119: A company comes into existence as a body corporate at the beginning of the day on which it is registered 3. S 124: Legal capacity of: a. Natural person (own property, contract, sued) b. Body corporate (issue shares, grant a security interest) i. A statutory declaration that a corporation is not a body corporate does not deprive that corporation of any of those i. is still a body corporate (CEPU v Queensland Rail) 4. S 516: Liability of shareholders is limited to any amount unpaid on the issue price of their shares ii. Exceptions Point 2 (below) b. A company can sue be sued in own name c. A company has perpetual i. A corporation continues to exist despite the death, bankruptcy, insanity, change in membership or an exit of any owner or member, or any transfer of shares d. Company property is NOT the property of its participants i. Shareholders do not have a proprietary interest in a property 1. E. If an insurance policy RE: company property is in an individual shareholders name as opposed to the company shareholder cannot claim on the policy (Macaura v Northern Assurance Co Ltd) e. A company can contract with its participants Personal Liability of Shareholders 1. Piercing the Corporate Veil Exceptions to the Salomon Principles a. Company used to avoid an existing legal duty (CL) i. Will be pierced where the company was formed for the sole or dominate purpose of avoiding an existing legal duty (Gilford Motor Co Ltd v Horne (to avoid a noncompete Jones v Lipman (to avoid a contract for of land)) ii. Okay to form a company to limit personal liability for future obligations but NOT to avoid existing obligations b. Company used to perpetrate a fraud (CL) i. Will be pierced where the company is being used as a vehicle for fraud (Re Dar) c. Group Companies i. Insolvent trading subsidiary 1. Where the business activity of the subsidiary company has been the holding company ii. Consolidated financial statements Taxation consolidation iv. The benefit of the group as a whole v. Pooling in liquidation Sam Merrylees 2 MLL221 Corporate Law T1 2017 Types of Companies Most Suitable Type of Company 1. Key Issue Spotting a. Liability i. Being sued? Limited Company (NOTE: not guarantee) 1. NOTE: ONLY a mining company can be classified as a No Liability Company (s 112(2)) constitution must state that its sole objects are mining purposes (s 112(2)(b)) b. Generating Capital i. If successful and want to attract investment Public Company ii. Not sure if going to be successful and want expose to higher regulations Private Company 1. NOTE: Can have the view of going private in the future should they begin to become successful (Pty Public Pty: via special resolution ASIC App.) TEST: If a Private Company decide if small (SPC) or large (LPC): Must meet to be classified as a SPC) 1. Revenue less than 2. Assets less than 3. Less than 50 employees TABLES INFORMATION No. 1 2 Factor Number Function 3 Membership no. 4 Membership transfer 5 Name 6 7 Replaceable rules and company constitution combination of both Directors 8 9 Secretary Raising Funds 10 AGM 11 Auditors 12 Registered Office Proprietary Company Small and Medium Business Family Run or Tightly Held Min.: 1 (CA, s 114) Max.: 50 (CA, s 113) CA, s 1072 G: directors may refuse to register a transfer of shares for any reason (RR) Proprietary: If limited: Pty Ltd (CA s 148(2)) If unlimited: Pty (CA s 148(3)) No need to lodge with ASIC RR apply to single companies CA s 135(1) Min.: 1 No requirement Prohibition for activity requiring Disclosure to Investors Under CA, Ch. 6D CA, s 113(3) No requirement Exc: Required a Const. Large: Yes Small: if required either shareholder holding or ASIC Existence: Yes Open to the Public: No Sam Merrylees Public Company Large Business Many Investors Min.: 1 (CA, s 114) Max.: No maximum S 1072G does not apply to public companies Ltd Must lodge with ASIC CA, s 136(5) Min.: 3 CA, s 201A Min.: 1 Issue of shares, Debentures, other Securities Compliance with Ch. 6D 1 a year Exc: 1 member CA, s 250N(1) Yes, to audit the Financial Reports Existence: Yes Open to the Public: Yes 4 MLL221 Corporate Law Small Proprietary Company (s 45A(2)) Fewer disclosure obligations have to prepare account or balance sheet Subject to s 292(2) require an auditor T1 2017 Large Proprietary Company (s 45A(3)) More extensive disclosure and reporting obligations S 292(c): financial report and a report must be prepared for each financial year all large proprietary Do require an auditor Average cost of preparing an audited annual report is about 2. ASX Listing Requirements a. Minimum shareholder requirements i. Spread test: there must be at least 300 security holders, each of whom hold a parcel of the main class of securities with a value of at least b. Company size requirement i. Profit test: the aggregated profit for the last 3 full financial years must have been at least million ii. Assets test: net tangible assets of at least million or a market capitalisation of at least million 3. Company Groups a. Body i. S 50: 1. Companies in a holding subsidiary relationship are bodies ii. A company is a subsidiary of a holding company if: 1. S 46: a. Holding Co controls composition of Subsidiary or b. Holding Co could cast or control more than of votes at Subsidiary Co or c. Holding Co holds more than of issued shares in Subsidiary or d. Subsidiary Co is a subsidiary of another subsidiary of Holding Co b. i. Different to a related body corporate (broader definition) ii. S 50AA: 1. A controls B if A has capacity to determine the outcome of decisions about financial or operating policies 2. Consider the practical influence A has over B and patterns of behaviour Sam Merrylees 5 MLL221 Corporate Law T1 2017 2. CA Restrictions a. Entrenching Provisions i. S 136(3): the constitution may provide that the special resolution does not have any effect unless a further requirement specified in the constitution relating to that modification or repeal has been complied with. ii. What are they? 1. E. need for majority over consent of a particular person (typically the founder) b. Compulsion to Buy More Shares etc. i. S 140(2): Member not bound alteration to constitution made after becoming a member that: 1. Requires member to take up additional 2. Increases liability to contribute share capital or money 3. restriction to transfer shares c. Variation of Class Rights i. S 246B: Generally, class rights may only be varied or cancelled with the approval of a special resolution of the company AND the holders of the affected class d. Oppression Remedy i. S 232: Members may apply to court for a remedy if majority votes in favour of resolution to alter that is contrary to interests of members as a whole, oppressive, unfairly prejudicial or unfairly discriminatory to members 3. Common Law Restrictions (Gambotto) a. Expropriation of shares i. TWO PART TEST: an alteration of the constitution that does involve an expropriation of shares is valid only if the expropriation is: 1. For a proper AND a. Proper purpose if the expropriation prevented company from suffering significant detriment or harm b. NOT proper purpose if expropriation to secure tax and administrative advantages for the majority of shareholders 2. Fair (not oppressive) two elements a. Procedure Fairness i. Process used to expropriate must be fair ii. Requires full disclosure of information before alternation and shares to be independently valued b. Substantive Fairness i. Price offered for the shares must be fair ii. Expropriation at less than market value would NOT be fair ii. (Reverse) Onus: lies on the majority to prove that the alteration IS for a proper purpose and fair b. No expropriation of shares i. An alteration of the constitution that does not involve an expropriation of shares is valid unless the alteration is either beyond any purpose contemplated the constitution or oppressive 1. NOTE: HCA did not elaborate how this test would apply Sam Merrylees 7 MLL221 Corporate Law T1 2017 The Companies Relations with Outsiders Company Contracting 1. Directly a. With Company Seal i. Transaction and 1. Given a formal resolution of the board of directors ii. S 127(2): Company with a common seal may execute a document if seal affixed and witnessed : 1. 2 or 2. Director and or 3. Sole b. Without Company Seal i. S 127(1): Company may execute a document without seal if document signed : 1. 2 or 2. Director and or 3. Sole c. BOTH must also be authorised: i. Generally a formal resolution of the board of directors 2. Via an Agent a. Firstly an agent must have authority to enter contract on behalf of the company i. Actual Authority: Company has actually agreed the Agent can act on behalf of the Company 1. Express Actual Authority a. May be verbal or written. May arise from: i. Authority delegated the board to an agent ii. Authority arising from a provision of the Corporations Act or Company constitution 2. Implied Actual Authority a. Derived from things said and done. May arise from: i. Appointing person to a particular office 1. Individual Directors a. A single director acting alone does NOT have implied actual authority to bind the company to contracts b. can act only collectively as a board and the function of an individual director is to participate in decisions of the (Northside Developments) 2. Managing a. Has customary authority to make any contracts related to the management of the business 3. Chair a. Chairperson does NOT have implied actual authority to bind the company 4. Secretary a. Secretary has implied authority to sign contracts relating to administrative matters (Panorama Developments) ii. Other conduct, including acquiescence 1. Satisfied where: a. A director has been purporting to enter into contracts on behalf of the b. They have no express authority to do c. The other directors are aware the director has been entering into these contracts but have done nothing to stop 2. Therefore: the board has the conduct of the contracting director and subsequently ratified his conduct 3. This gives the director implied authority to enter into similar contracts in the future Sam Merrylees 8 MLL221 Corporate Law T1 2017 3. Do any EXCEPTIONS apply? a. Indoor Management Rule i. exception applies 1. Where the Third Party (TP) actually knew that the Agent had insufficient authority or the contract was defective, TP can not rely on IMR 2. Exception also applies if the TP deliberately his eyes in order not to discover the problem ii. on exception applies 1. Objective Test: TP cannot argue an Agent has implied actual authority, apparent authority or the IMR applies if: a. TP failed to make inquires that would usually be made someone in that or b. A reasonable person in position would have been put on inquiry and investigated b. Statutory Assumptions i. S 128(4): Not permitted to make assumption if person or the assumption was incorrect 1. Test is subjective. What the person knew or suspected rather than what a reasonable person would know or suspect in such circumstances a. Because the s 128(4) test is subjective, may be more difficult to show this limitation applies 2. S 128: When Can Assumptions Be Made? a. A person is entitled to make the assumptions in s 129 in relation to dealings with a company: s 128(1) b. The company is not entitled to assert in proceedings in relation to the dealings that any of the assumptions are incorrect: s 128(1) c. Assumptions apply even where fraud is involved: s 128(3) Sam Merrylees 10 MLL221 Corporate Law T1 2017 Promoters and Contracts Promoter 1. Who is a Promoter? a. promoter is one who undertakes to form a company with reference to a given project to set it going and who takes the necessary steps to accomplish that (Twycross v Grant) 2. Duties a. Act bona fide and in the best interests of the company (not profit at the expense of the company) b. Avoid conflict of interest (COI) (re: interest in contracts (Erlanger v New Sombrero Phosphate Company) or profits (Gluckstein v Barnes)) 3. Remedies for Breach 1. Rescission i. Cannot rescind if: 1. Fails to do so reasonably promptly after company becomes aware of facts 2. Company aware of facts and affirms the contract 3. Restoring the parties to their original positions is impossible 4. Innocent have already acquired rights 2. Recovery of Profits ii. Where promoter profits at expense of the company 3. Constructive Trust Order Where a promoter obtains property for personal gain that should have been obtained for company Contracts 1. S 131(1): If a person enters into, or purports to enter into, a contract on behalf of, or for the benefit of, a company before it is registered, the company becomes bound the contract and entitled to its benefit if the company, or a company that is reasonably identifiable with it, is registered and ratifies the contract: a. Elements: i. Is 1. If never becomes registered there will be no company to be bound ii. Ratifies (adopts) the Within the agreed time (or a reasonable time) 1. S 131(1)(a): Within the time agreed to the parties to the or 2. S 131(1)(b): If there is no agreed time within a reasonable time after the contract is entered into 2. (Personal) Liability in the Absence of Ratification a. S 131(2): The person contracting on behalf of the company is liable to pay damages to each party to the contract if the company is not registered, or the company is registered but does not ratify the contract or enter into a substitute for it: i. (a) Within the time agreed to the parties to the or ii. (b) If there is no agreed time within a reasonable time after the contract is entered into. Sam Merrylees 11 MLL221 Corporate Law T1 2017 Fundraising Issuing Shares Share Classes 1. 2. 3. 4. 5. 6. Ordinary shares Preference shares Redeemable preference shares Deferred shares shares Employee shares Member Approval 1. When is member approval required? a. Creating a new class of shares i. Must amend constitution b. Variation of class rights c. When related party transaction provisions apply d. When member approval is required under the constitution or agreement e. If ASX listing rules require member approval Need for Disclosure Documents 1. Public Company? a. Yes can invite the public to invest b. No (Proprietary) cannot invite the public to invest 2. S 706: General Rule: An offer of securities for issue requires disclosure to investors unless s 708 or s 708AA say otherwise a. S 761A: include: shares, debentures, options and legal or equitable rights in relation to them 3. S 708: Exceptions a. S Small scale, personal offers i. Private offers resulting in: 1. No more than 20 new members AND 2. Raising no more million in a period ii. There must be an existing relationship to trigger this exception b. S Sophisticated investors i. Large offers only: must be a minimum of per offer accepted 1. Wealthy investors ii. Certified gross income of in previous 2 financial years or net assets of at least million (including their controlled Offers to experienced investors, if made through a financial services licensee (AFS license) who judges client to be sufficiently experienced (professional investors) iv. Underlying rationale: investors have the requisite to make wise investments c. S 708(12): Senior managers i. A person (not a director) who makes or participates in making decisions that affect the whole or a substantial part of the business 1. Includes: senior family d. S 708(13): Existing security holders i. Certain offers, e. dividend reinvestment scheme ii. Certain rights issues 1. Offer of securities to existing shareholders in proportion to their current shareholding 2. No disclosure required if certain ASIC conditions are met (including issuing a stating specific information) Sam Merrylees 13 MLL221 Corporate Law T1 2017 Type of Disclosure Documents NOTE: Extent of disclosure depends on type of disclosure document Prospectus (most common) prospectus refers to ASIC information rather than including it in the document Profile statement (fairly rare) where approved ASIC, it may be sent to investors so long as they are informed that the full prospectus is available on request Offer information sheet (OIS) Limited disclosure document for relatively small fundraisings million or less) General Disclosure Requirement It must contain all the information necessary to enable an investor to make a reasonably informed decision whether or not to buy the securities: see ss Should contain information reasonably required and expected (objective test) Must be clear and concise: s 715A Breach of Disclosure Requirements S 728: criminal offence to offer securities under a disclosure document which contains: o statements o Material omissions Liability Personal liability extends to: o Person making the offer o Each director of the body making the offer o Any person named as proposed director of body whose securities are offered o Named underwriter to the offer Also any person (e. expert) named with their consent and who provided information grounding a statement in relation to that statement Defences Due Diligence in Relation to a Prospectus (s 731) o Made reasonable inquiries and believed on reasonable grounds that statement was not misleading General Reliance (s 733(1)) o Reasonably relied on information provided another who is not a director, employee or agent (e. professional service Withdraw Consent (s 733(3)) o Public withdrawal of consent to being named in disclosure document Variation of Class Rights 1. Common Law: variation that alters the substance, as opposed to the mere enjoyment, of a class right a. White v Bristol Aeroplane Co Ltd Bonus issue of shares to ordinary shareholders had the affect of diluting the voting rights of preference shareholders. HOWEVER did not affect the substance of the preference shareholders rights as they still had their voting rights (substance the same). Only their enjoyment of their voting power was affected the share issue Sam Merrylees 14 MLL221 Corporate Law T1 2017 Share Capital Share Capital: the total amount of money (or other property) that investors provide to the company in consideration for the shares issued to them Reduction of Share Capital 1. General Rule (Maintenance of Share Capital) a. Starting Point: Companies are PROHIBITED from reducing their share there is an obligation on companies to maintain their share capital. i. Underlying Rational to protect creditors: a reduction in share capital prejudices creditors diminishing the pool of funds available to the company to pay its debts b. Common Law Rule: i. Trevor v Whitworth persons who deal with, and give credit to a limited company, naturally rely upon the fact that the company is trading with a certain amount of capital already paid, as well as upon the responsibility of its members for the capital remaining at and they are entitled to assume that no part of the capital which has been paid into the coffers of the company has been subsequently paid out, except in the legitimate course of its business (per Lord Watson) c. Modern Statutory Rules (CA): i. Companies must maintain their share capital due to: 1. Restrictions on a company purchasing its own shares (Part 2J) 2. Restrictions on a company giving financial assistance to a person to acquire shares in the company (Part 2J) 2. S 256A: Permission in Limited Circumstances to Reduce Share Capital (CA) a. The rules are designed to protect the interests of shareholders and creditors : i. (a) Addressing the risk of these transactions leading to the insolvency ii. (b) Seeking to ensure fairness between the shareholders (c) Requiring the company to disclose all material information. b. S 256B: Permitted Share Capital Reduction i. A company may reduce its share capital if the reduction: 1. (a): Is fair and reasonable to the shareholders as a and (Winpar Holdings Ltd v Goldfields Kalgoorie Ltd) a. Factors include: i. Adequacy of consideration paid to shareholders ii. Whether reduction would have practical effect of depriving some shareholders of their rights Whether reduction used to effect a takeover and avoid takeover provisions iv. Whether reduction involved arrangement that should more properly proceed as a scheme of arrangement 2. (b): Does not materially prejudice the ability to pay its and a. Injunction i. Creditors may apply for an injunction to prevent a reduction of capital if the solvency is an element of a contravention of s 256B(1)(b) (s 1324(1A) ii. Company has the onus of proving the reduction does not prejudice its ability to pay creditors (s 1324(1B)) b. ASIC Disclosure i. S 256C(5) requires company to lodge details of proposed capital reduction with ASIC to assist creditors in discovering details of the proposed capital reduction Sam Merrylees 16 MLL221 Corporate Law T1 2017 3. (c): Is approved shareholders under s 256C a. Shareholder approval requirements vary depending on whether reduction is: i. S 256B(2): Equal Reduction if: 1. Relates only to ordinary shares 2. Applies to each shareholder in proportion to number of ordinary shares held 3. Reduction terms same for each ordinary shareholder 4. See s 256B(3) for differences in that may be ignored in defining reduction ii. S 256B: Selective Reduction if: 1. Not an equal reduction b. Required Vote: i. Equal Reduction 1. S 256C(1): Approved ordinary resolution at general meeting ii. Selective Reduction 1. Approved : a. Special resolution at general meeting i. With no votes cast in favour person (or associate) to receive consideration as part of reduction or whose liability to pay amounts unpaid on shares is to be reduced OR ii. Unanimous resolution at general meeting PLUS If reduction involves cancellation of shares: iv. Reduction must also be approved special resolution of members whose shares are to be cancelled c. ADDITIONALLY Notice Requirements: i. S 256C(4): Notice of meeting must include statement setting out all known information that is material to the decision on how to vote on the resolution to approve the capital reduction ii. S 256C(5): Before notice of meeting is sent, company must lodge notice and material information statement with ASIC Purpose is to give shareholders and creditors advance notice of reductions so they may oppose c. S 257A: Permitted Share Buy Backs i. Company may buy back its own shares if: 1. Buy back does not materially prejudice creditors 2. Company follows procedure in Division 2 of Part 2J ii. The limit 1. Companies may buy back up to of their shares within a 12 month period without shareholder approval and with minimum procedural requirements (does not apply to selective Permitted buy back schemes include: 1. buy backs a. Conducted listed company on ASX b. Company offers to buy shares the c. Members have equal opportunity to participate d. Member approval only required if over the limit 2. Equal access buy backs 3. Selective buy backs 4. Employee share scheme buy backs 5. Minimum holding buy backs Sam Merrylees 17 MLL221 Corporate Law T1 2017 Membership Rights and Duties 1. 2. 3. 4. 5. Vote at general meetings Receive dividends Liable to pay calls (s 254M(1)) Liable to contribute to debt when being wound up (s 514) Share in surplus assets on winding up Becoming a Member 1. S 231: Process a. Members of the company in its registration b. Applying for an receiving an issue of shares c. Accepting a transfer of shares from another member d. Receiving shares on transmission on the of a member e. Conversion to company limited shares 2. Register a. Must be maintained (s 168) b. Information about shareholders and their shares (various requirements) (s 169) c. Location (s 172(1)) i. (a) the registered or ii. (b) the principal place of business in this or (c) a place in this jurisdiction (whether of the company or of someone else) where the work involved in maintaining the register is or iv. (d) another place in this jurisdiction approved ASIC. d. Inspection (s 173(1)) i. Anyone can inspect ii. Shareholders can inspect for free e. Shareholder Right to Privacy (s 177) i. put name on mailing list ii. Cant use for 1. Unless relevant to shareholder rights or approved company 3. Share Certificate a. S 1070C(2): A share certificate is prima facie evidence of the title of a shareholder to the number of shares specified i. This is the legal effect of a share certificate b. S 1070C(1): share certs must state: i. The name of the company and its jurisdiction of ii. The class of and The amount unpaid on the shares Sam Merrylees 19 MLL221 Corporate Law T1 2017 Dividends Dividends: The distribution of the profits to shareholders When Can Dividends Be Paid 1. Starting Point: a. Directors determine whether a dividend is payable and the amount paid b. Once a dividend is declared becomes a debt (Marra Developments Ltd v BW Rofe Pty Ltd) i. NOTE: s 254V 1. A company does not incur a debt merely fixing the amount or time for payment of a dividend. The debt arises when the time fixed for payment arrives and the decision to pay the dividend may be revoked at any time before then. 2. However, if the company has a constitution and it provides for the declaration of dividends, the company incurs a debt when the dividend is declared. ii. An interim dividend may be revoked before payment (Marra Developments) 2. S 254T: Company may not pay dividend unless: a. A assets must exceed their liabilities (balance sheet solvency) b. Payment of dividend must be fair and reasonable to shareholders as a whole c. Payment of dividend must not materially prejudice ability to pay creditors 3. Remedies for Improper Dividend Payment a. Injunction i. Company contravenes s 254T if it pays dividend other than out of profits ii. S 1324 gives shareholders and creditors right to apply for injunction to restrain company from contravention if insolvency is an element of the contravention b. Unauthorised Reduction of Capital i. Dividends paid other than under s 254T may involve a reduction of capital ii. If reduction not authorised s 256B, company contravenes s 256D 1. Dividend payment not invalidated 2. Directors involved liable for civil penalty order: s 256D(2) c. Insolvent Trading i. Directors contravene s 588G if they fail to prevent company from incurring debt when there are reasonable grounds for suspecting company is insolvent Directors may be personally liable to compensate creditors d. Breach of Fiduciary Duty i. Directors who authorise dividend in breach of fiduciary duty may be personally liable to repay the amount of the dividend to the company Can Shareholders Force Payment of Dividends? 1. General Rule a. NO shareholders cannot force directors to pay dividends even though a company has available profits i. S 254U: (RR) directors may determine that a dividend is payable and fix: 1. (a) The 2. (b) The time for 3. (c) The method of payment 2. Exceptions a. S 232: Exceptional circumstances, where the refusal of the directors to recommend a dividend amounts to oppressive or unfair conduct (Sanford v Sanford Courier Service Pty Ltd) b. The company constitution may allow for: i. Compulsory shareholder approval of directors ii. Shareholders to determine dividends etc. Sam Merrylees 20

MLL221 - GTAQ - Summary Corporate Law

Course: Corporate Law (MLL221)

University: Deakin University

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

Why is this page out of focus?

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

Why is this page out of focus?

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

Why is this page out of focus?

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

Why is this page out of focus?

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

Why is this page out of focus?

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

Why is this page out of focus?

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

Why is this page out of focus?

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

Why is this page out of focus?

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

Why is this page out of focus?

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

Why is this page out of focus?

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

Why is this page out of focus?

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

Why is this page out of focus?

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

Why is this page out of focus?

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

Why is this page out of focus?

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

Why is this page out of focus?

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

Why is this page out of focus?

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

Why is this page out of focus?

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

Why is this page out of focus?

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

Why is this page out of focus?

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

Why is this page out of focus?

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

Why is this page out of focus?

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

Why is this page out of focus?

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

Why is this page out of focus?

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

Why is this page out of focus?

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

Why is this page out of focus?

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

Why is this page out of focus?

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

Why is this page out of focus?

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

Why is this page out of focus?

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

Why is this page out of focus?

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

Why is this page out of focus?

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

Why is this page out of focus?

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

Why is this page out of focus?

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

Why is this page out of focus?

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

Why is this page out of focus?

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

Why is this page out of focus?

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

Why is this page out of focus?

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

Why is this page out of focus?

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

Why is this page out of focus?

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

Why is this page out of focus?

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

Why is this page out of focus?

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

Why is this page out of focus?

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

Why is this page out of focus?

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

Why is this page out of focus?

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

Why is this page out of focus?

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

Why is this page out of focus?

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

Why is this page out of focus?

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades