- Information

- AI Chat

Summary Understanding Company Law - chapter 8

Corporate Law (MLL221)

Deakin University

Recommended for you

Preview text

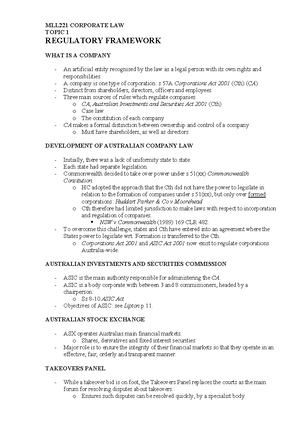

MLL221 CORPORATE LAW

Chapter 8 Notes – Share Capital

Introduction

- Issuing shares to investors is one of the main sources of funds for a company limited by shares.

- Share capital (a.k. “equity capital”) is the total amount of money or other property that investors provide to the company in consideration for the shares issued to them.

- Directors usually have the power to issue shares and raise equity capital for a company.

- Shares issues are regulated: o Partly by company’s constitution or applicable replaceable rules; and o Partly by the Corporations Act (CA).

- Shares come within the definition of securities: s 9.

- When shares are issued they are allotted to the holders who become members after their names are entered in the register of members.

- A company may also wish to issue shares that carry rights and obligations that differ from those of other shares i. company may issue different classes of shares.

- There is an obligation imposed on companies to maintain their share capital known as the rule in Trevor v Whitworth, which has been modified by the CA.

Nature of shares

A share is an item of intangible property also known as a “chose in action” a share = a right to a specified proportion of the company’s share capital.

Ownership of a share gives the shareholder (SH) proprietary rights as defined by the company’s constitution and the law. These rights include: o The right to participate in the payment of a dividend; and o The right to vote at a general meeting.

Share ownership may also impose obligations e. an obligation to pay calls on partly paid shares.

NB: A SH does NOT have any proprietary interest in the company’s assets.

Shares may be bought and sold, bequeathed and given as security for loans.

The High Court has stated in Pilmer v The Duke Group [2001] HCA 31 that: “Once issued, a share comprises a collection of rights and obligations relating to an interest in a company of an economic and proprietary character, but not constituting a debt.”

Ownership of a share is capable of being divided into legal and equitable interests: s 1070A(3). o Generally, the same person holds both the legal and equitable interest in a share. o However, in some cases, they be held by different persons. E. when shares are held on trust, the trustee has the legal interest and the beneficiary holds the equitable interest.

A share is a proportionate interest of a SH in the net worth of a company i. a share’s value is that proportion of the total net worth of the company’s enterprise.

Share options

- A company grants an option when it agrees to issue shares to a person (the “option- holder”) at a future date.

- If the option-holder agrees to take up the shares, they are said to exercise the option and can require the company to allot the shares.

- As with any other contract, an option requires the option-holder to provide consideration for being granted the share option.

- Another form of option arises when a person, other than the company, grants someone else an option on relation to shares option may be either a “put” or “call” option.

- NB: an option-holder is NOT a member of the company until the option is exercised.

- To ensure disclosure of future capital commitments, s 170 requires companies to maintain a register of option-holders and copied of option documents containing the required particulars.

- Companies often grant share options to their directors and executives as part of their remuneration.

- The CA ensures that SHs receive information about options the company grants to its directors and senior officers.

Stock

- Stock is a collection of shares expressed in units of money.

- Stock has the characteristic that, unlike a share, a holder can freely divide stock into amounts of any value each unit of stock can then be sold individually.

- Companies are prohibited from issuing stock or converting shares into stock: s 254F.

Bearer shares

Section 254F prohibits a company issuing bearer sharers.

Bearer shares or share warrants are documents sealed by a company that state the bearer is entitled to specified shares.

A company may may give security over its uncalled capital: s 124(1)(e).

Issue of shares

Contractual rules

Offer and acceptance

- Normal rules of contract law apply to share issues. o Offer: investor usually makes an offer for shares by sending the company an application form and paying the issue price o Acceptance: offer is accepted when the company, through its directors, decides to allot the shares and sends the notice of allotment.

- As these communications are usually by POST, acceptance by post is deemed effective when posted: Byrne v Van Tienhoven (1880) 5 CPD 344.

Household Fire & Carriage Accident Insurance Co v Grant (1879) 4 Ex D 216

A notice of allotment sent by the company was lost in the mail.

The applicant was held to be a member and therefore liable on a call even though he did not receive communication of acceptance.

The requirement of communication of acceptance was impliedly dispensed with by the offeror in using the post.

Under law of contract, an offer lapses if not accepted within a reasonable time.

In Ramsgate Victoria Hotel Co v Montefiore (1866) LR 1 Exch 109, it was held that an investor’s offer to take up a share issue lapsed after a period of five months after being sent to the company. Therefore, the application for shares was no longer capable of acceptance by the company when it purported to allot the shares.

Rights issues

- A rights issue is made when a company offers to issue shares to existing SHs in proportion to shares held.

- A contract is formed when the SH accepts the company’s offer.

- Company usually specifies a closing date after which its offer lapses from date of offer until closing date the SH owns rights to take up shares under the rights issue.

- Distinction made between renounceable rights issue and non-renounceable rights issue: o A renounceable rights issue is one that gives the SH the power to sell their rights prior to the closing date.

Issue of fewer shares than applied for

- Application forms for share issues usually provide that the applicant agrees to take the number of shares applied for or any lesser number that is allotted prevents problems arising where the number of shares applied for exceeds the number the company proposes to issue.

- An allotment of a lesser number than applied for would otherwise constitute a counter-offer the terms of the offer and acceptance are not identical.

Allotment and issue of shares

- Expressions, “allotment of shares” and “issue of shares” sometimes used interchangeably, although there IS a distinction: “But and allotment” of shares really bears a double aspect. In the formation of a contract of membership it may be the acceptance of the offer constituted by the application or the making or authorisation of an offer or counter-offer accepted by the subsequent assent of the allottee. But it is also the appropriation of a given number of shares to the allottee. Shares are personal property. Allotment, entry in the share register and the sealing and delivery of share certificates are matters of fact which constitute the issue of shares, considered as a form of property.” (Commonwealth Homes & Investment Co Ltd v Smith (1937) 59 CLR 443, as per Dixon J).

- It thus follows that allotment is one step in the broader process of an issue of shares.

Restrictions on allotment

- Several provisions in the CA that prohibit or make it an offence to issue securities in certain circumstances where conditions set out in a disclosure document are not met aims to protect SHs.

Minimum subscription

If a disclosure document states that the securities will not be issued unless applications for a minimum number of securities are received or a minimum amount is raised, the person making the offer must not issue any of the shares until that minimum subscription condition is satisfied: s 723(2).

Application money received from investors must be held in trust until the minimum subscription condition is fulfilled and the securities are issued: s 722.

Purpose of s 723 is to protect early subscribers where the company is unable to raise the minimum amount it needs to be a viable concern.

Gillard J held that in the exceptional circumstances of the case it was “just and equitable” to validate the allotments so as to assist a large number of innocent people who would otherwise be victims of invalid allotments.

Kokotovich Constructions Pty Ltd v Wallington (1995) 13 ACLC 1113

- An allotment of shares was validated because the parties had proceeded for 20 years on the basis that shares had been properly issued and an order validating the issue was just and equitable.

- The court rejected the argument that its discretion under the predecessor of s 254E should only be exercised where the validation was non-contentious.

Consideration for share issue

- Issue price of shares = the consideration for the share issue.

- In most cases consideration is cash. However, companies may issue shares for a non- cash consideration: Re Wragg Ltd [1897] 1 Ch 796.

- The payment of a non-cash consideration for a share issue often occurs when a

partnership or sole tradership evolves into a proprietary company. E. the partners

or sole trader may sell their property to a newly formed company that they control

and in return shares are allotted to them: Salomon v A Salomon & Co Ltd [1897] AC

- Policy of the CA is to ensure that the issued capital of a company reflects the amount of funds and assets received by the company that is available to its creditors ahead of being returned to shareholders i. a company cannot issue shares gratuitously.

- In Re White Star Line Ltd [1938] 1 All ER 607, it was held that the value of the consideration for an allotment of shares must be more than “sufficient” consideration required under the law of contract. It must represent money’s worth for the allotment.

- The application for registration of a company limited by shares must, among other things, set out the amount (if any) each member agreed in writing to pay for each share: s 117(2)(k)(ii).

- The application for registration of a public company that is limited by shares must set out the prescribed particulars about the share issue if shares will be issued for a non- cash consideration: s 117(2)(1) this is NOT required if the shares will be issued under a written contract and a copy of the contract is lodged with the application.

- Section 254X requires a company to lodge a notice of share issue with ASIC.

- It is common for a company to issue shares for non-cash consideration to its promoters or directors.

Classes of Shares

- A company may wish to issue different classes of shares for various reasons: o It may wish to raise share capital on terms similar to borrowing from external creditors. This can be done by issuing shares that carry a specified rate of dividend but with limited voting rights and no rights to participation in distribution of surplus assets on winding up. o Small family companies may wish to concentrate control in the hands of the holders of a particular class of shares. Such shares often have weighted voting rights. o Some taxation minimisation schemes involve the issue of different classes of shares. o A home unit company may own a building and issue different classes of shares, each of which entitles the shareholder to certain rights in respect of a particular unit in the building to the exclusion of the holders of other classes of shares.

- The most common ways in which different classes of shares differ among each other are as follows: o Entitlement to dividend; o Right to priority in payment of dividend; o Voting rights; o Right to priority of repayment of capital on winding up; and o Right to participate in a distribution of surplus assets on winding up.

- If a company wishes to differentiate between the rights of different classes of shares, these rights should be clearly set out in the constitution or the share issue contract.

- The application for registration of a company must include the class of shares that the persons who consent to be members agree in writing to take up: s 117(2)(k).

- A company must lodge a notice with ASIC setting out particulars of any division of shares into classes if the shares were not previously so divided or the shares were converted into shares in another class: s 246F.

- A public company must lodge (within 14 days) with ASIC a copy of each document ore resolution that attaches rights or varies or cancels rights attaching to issued or unissued shares: s 246F(3).

Preference shares

The most common classes of shares are ordinary and preference shares.

Holders of preference shares have preferential rights to receive dividends ahead of ordinary SHs.

Usually have the right to receive dividends at a fixed percentage of the issue price of their shares.

Accordingly, the relationship between deferred and ordinary shares is similar to that between ordinary and preference shares.

Voting rights

- Preference SHs usually have LIMITED voting rights. Examples of limited voting rights are rights to vote only: o During a period when dividends are in arrears; o On a proposal to vary class rights; o On a proposal for reduction of capital; or o On a proposal to wind up the company.

Setting out preference shareholder rights

- The main rights attaching to preference shares MUST be set out in the company’s constitution.

- Sections 254A(2) and 254G(2) require a company that issues preference shares or converts ordinary shares into preference shares to set out in its constitution or otherwise approve by special resolution the rights of preference shareholders with respect to the following: o Repayment of capital; o Participation in surplus assets and profits; o Cumulative and non-cumulative dividends; o Voting; and o Priority of payment of capital and dividends in relation to other shares or other classes of preference shares.

- This enables prospective and existing preference SHs to ascertain the rights attaching to the shares.

- Also seeks to ensure that the rights attaching to preference shares are more entrenched than they would be if contained in an ordinary resolution of the company or board of directors.

Consequences of failure to set out preference shareholders’ rights

At common law certain presumptions can be made regarding the rights of preference SHs where the constitution is silent on the matter.

It is unclear what effect a contravention of ss 254A(2) and 254G(2) has on those common law presumptions.

Also uncertain whether there are any civil consequences where the provisions are contravened.

E. it may be that contravention of these provisions only constitutes an offence by the company and officers in default and does not otherwise alter preference SHs’ presumed common law rights.

On the other hand, a contravention may mean that the issue to preference SHs is illegal.

Under law of contract where a contract is illegal because it is prohibited by a statute, the courts will not permit either party to enforce it such an interpretation would have dire consequences for preference SHs who may not even be able to obtain a refund of their investment. However, there may be an exception that assists preference SHs in this situation.

Courts do allow actions for recovery of money paid under an illegal contract by parties who are not in pari delicto (equal fault). E. a party to an illegal contract is not in pari delicto if the purpose of the statutory prohibition is to protect persons in such a position.

Sections 254A(2) and 254G(2) prohibit the issue of or conversion into preference shares only if the rights are not set out in the constitution or otherwise approved by special resolution.

Redeemable preference shares

- A company may issue redeemable preference shares: s 254A(1)(b).

- Main feature = the company can pay back the issue price of the shares to the SH. This is referred to as the company “redeeming” its shares.

- Redeemable preference shares may be redeemed at a fixed time or at the option of the company or SHs: s 254A(3).

- Redeemable preference shares may be redeemed only on the terms on which they were issued: s 254J(1).

- Shares may be redeemable preference shares even though no ordinary shares were issued and the redeemable preference shares therefore did not have a preference over any other class of shares.

- There is a great similarity between an issue of redeemable preference shares and borrowing money in both cases the company pays a set rate of return and the issue price (in the case of redeemable preference shares) and the amount borrowed (in the case of a loan), is repaid at an agreed future time.

- NB: a redeemable preference shareholder is not a creditor: Heesh v Baker [2008] NSWSC 711.

- The issue of redeemable preference shares has certain advantages over borrowing from the company’s point of view: o Company is under no legal obligation to declare dividends, however, there is a contractual obligation to meet interest payments.

246B(2).

Application to set aside variation

- Section 246D(1) gives members of a class the right to apply to the court to set aside a variation or cancellation of their rights or a modification of the constitution to allow their rights to be varied or cancelled, if the members in a class do not all agree to the variation, cancellation or modification.

- Application must be maid by members holding at least 10% of the votes of the class concerned and, under s 246D(2), must be made within one month after the variation, cancellation or modification is made.

Remedies

- After hearing a s 246D(1) application, the court may set aside the variation, cancellation or modification if it is satisfied that it would unfairly prejudice the applicants: s 246D(5).

- The CA provides a number of other remedies that can be pursued by members including members with fewer than 10% of the votes.

What is a variation of class rights?

- Both s 246C and the common law regard certain actions as varying class rights.

- See page 225 for variations of class rights under s 246C.

- The common law meaning of a variation of class rights is quite narrow at common law, a variation of class rights is a variation that affects the strict legal rights of the member of the class.

- Variations that merely affect the value of the shares of a class member or indirectly reduce voting rights are not regarded as variations of class rights and consequently the provisions of ss 246B – 246G do not apply.

Share Capital Transactions

In order to protect creditors and SHs a general rule was developed that limited liability companies must maintain their share capital this rule = “the rule in Trevor v Whitworth” (Trevor v Whitworth (1887) 12 App Cas 409) it prohibits a company from reducing its issued share capital. o A clear way in which a company may reduce its capital is to purchase its shares from a SH.

Locking in SHs’ capital was especially important for the growth of companies that established long-term highly specific investments such as railways and mining.

The CA provides detailed procedures and requirements that must be complied with where a company engages in various share capital transactions – these provisions stem from the rule in Trevor v Whitworth.

The CA deals with the following transactions: o Share capital reductions; o Share buy-backs; o Self-acquisition and control of shares; and o Financial assistance.

The rule in Trevor v Whitworth

- Again, this rule means that a company is generally prohibited from reducing its issued share capital because a reduction in capital could prejudice the rights of creditors.

- The reduction would in effect diminish the pool of funds available to the company to pay its creditors.

Trevor v Whitworth (1887) 12 App Cas 409

- The executors of Whitworth, a deceased SH in James Schofield & Son Ltd, sold Whitworth’s shares in the company back to the company.

- Payment was to be by 2 instalments.

- Prior to the payment of the second instalment the company went into liquidation.

- The executors claimed this sum from the company’s liquidator, Trevor.

- While the company’s memorandum did not authorise it to purchase its own shares, its articles did.

- The HOLs held that a company had no power to purchase its own shares even if its articles permitted such an acquisition. Hence, as the purchase was void. Whitworth’s claim for the balance failed.

- This decision based on principle that the capital of a limited liability company should remain available to creditors.

- The law does not expect that capital will be returned to SHs ahead of creditors.

xx

- While companies cannot generally acquire their own shares, a seemingly analogous situation arises when shares are forfeited as a result of non-payment of a call by a SH.

- In some respects, a forfeiture of shares has similarities to a reduction of capital.

Summary Understanding Company Law - chapter 8

Course: Corporate Law (MLL221)

University: Deakin University

- Discover more from: