- Information

- AI Chat

FR Study Notes- Skans ECampus

acca financial reporting (ACCA F7)

Preview text

FINANCIAL REPORTING

STUDY NOTES

ACCA

TABLE OF CONTENTS

Sr. # Topic Page

1. Conceptual and regulatory framework 3

2. IAS 1 Presentation of Financial Statements 14

3. Companies – Basic adjustments 18

4. IAS 16 Property, Plant and Equipment 22

5. IAS 38 Intangible Assets 30

6. IAS 36 Impairment of Assets 38

7. IAS 40 Investment Property 45

8. IAS 2 Inventories 50

9. IAS 41 Agriculture 53

10. IAS 8 Accounting Policies, Changes in

Accounting Estimates and Errors

56

11. IAS 23 Borrowing Costs 61

12. Financial instruments 64

13. IAS 37 Provisions, Contingent Liabilities and

Contingent Assets

82

14. IFRS 16 Leases 88

15. IFRS 13 Fair Value Measurement 97

16. IAS 20 Accounting for Government Grants and

Disclosure of Government Assistance

102

17. IAS 10 Events after the Reporting Period 106

18. IAS 12 Income Taxes 109

19. IFRS 15 Revenue from Contracts with Customers 120

THE CONCEPTUAL AND REGULATORY FRAMEWORK FOR FINANCIAL REPORTING

CONCEPTUAL FRAMEWORK

The IFRS Framework describes the basic concepts that underlie the preparation and presentation of financial statements for external users. A conceptual framework can be seen as a statement of generally accepted accounting principles (GAAP) that form a frame of reference for the evaluation of existing practices and the development of new ones.

Purpose of framework

It is true to say that the Framework:

Seeks to ensure that accounting standards have a consistent approach to problem solving and do not represent a series of ad hoc responses that address accounting problems on a piece meal basis Assists the IASB in the development of coherent and consistent accounting standards Is not a standard, but rather acts as a guide to the preparers of financial statements to enable them to resolve accounting issues that are not addressed directly in a standard Is an incredibly important and influential document that helps users understand the purpose of, and limitations of, financial reporting Used to be called the Framework for the Preparation and Presentation of Financial Statements Is a current issue as it is being revised as a joint project with the IASB's American counterparts the Financial Accounting Standards Board.

Advantages of a conceptual framework

Financial statements are more consistent with each other Avoids firefighting approach and a has a proactive approach in determining best policy Less open to criticism of political/external pressure Has a principles based approach Some standards may concentrate on effect on statement of financial position; others on statement of profit or loss

Disadvantages of a conceptual framework

A single conceptual framework cannot be devised which will suit all users Need for a variety of standards for different purposes Preparing and implementing standards may still be difficult with a framework The purpose of financial reporting is to provide useful information as a basis for economic decision making.

CONCEPTUAL FRAMEWORK FOR FINANCIAL REPOTING (Revised - March 2018)

In March 2018, the International Accounting Standards Board (the Board) finished its revision of The Conceptual Framework for Financial Reporting (the Conceptual Framework) a comprehensive set of concepts for financial reporting. The Board needed to consider that too many changes to the Conceptual Framework may have knock-on effects to existing International Financial Reporting Standards (IFRS®). Despite that, the Board has now published a new version of the Conceptual Framework.

It sets out:

the objective of financial reporting the qualitative characteristics of useful financial information a description of the reporting entity and its boundary definitions of an asset, a liability, equity, income and expenses criteria for including assets and liabilities in financial statements (recognition) and guidance on when to remove them (derecognition) measurement bases and guidance on when to use them concepts and guidance on presentation and disclosure

Chapter 1 – The objective of general purpose financial reporting

The objective of financial reporting is to provide financial information that is useful to users in making decisions relating to providing resources to the entity. Users’ decisions involve decisions about buying, selling or holding equity or debt instruments, providing or settling loans and other forms of credit and voting, or otherwise influencing management’s actions. To make these decisions, users assess prospects for future net cash inflows to the entity and management’s stewardship of the entity’s economic resources. To make both these assessments, users need information about both the entity’s economic resources, claims against the entity and changes in those resources and claims and how efficiently and effectively management has discharged its responsibilities to use the entity’s economic resources.

As with any major renovation, all issues, both significant and minor, need to be considered. When considering the objective of general purpose financial reporting, the Board reintroduced the concept of ‘stewardship’. This is a relatively minor change and, as many of the respondents to the Discussion Paper highlighted, stewardship is not a new concept. The importance of stewardship by management is inherent within the existing Conceptual Framework and within financial reporting, so this statement largely reinforces what already exists.

Chapter 2 – Qualitative characteristics of useful financial information

Qualitative characteristics identify the types of information likely to be most useful to users in making decisions about the reporting entity on the basis of information in its financial report.

Fundamental qualitative characteristics

Relevance Relevant financial information is capable of making a difference in the decisions made by users if it has predictive value, confirmatory value, or both. Materiality is an entity-specific aspect of relevance based on the nature or magnitude (or both) of the items to which the information relates in the context of an individual entity's financial report

Faithful representation Information must be complete, neutral and free from material error

Issue of asymmetry As is often the case with projects, making one minor change may lead to others. The problem was that by adding in the reference to prudence, the Board encountered the further issue of asymmetry.

Many standards, such as International Accounting Standard (IAS®) 37, Provisions, Contingent Liabilities and Contingent Assets, apply a system of asymmetric prudence. In IAS 37, a probable outflow of economic benefits would be recognised as a provision, whereas a probable inflow would only be shown as a contingent asset and merely disclosed in the financial statements. Therefore, two sides in the same court case could have differing accounting treatments despite the likelihood of the pay-out being identical for either party. Many respondents highlighted this asymmetric prudence as necessary under some accounting standards and felt that a discussion of the term was required. Whilst this is true, the Board believes that the Conceptual Framework should not identify asymmetric prudence as a necessary characteristic of useful financial reporting.

The 2018 Conceptual Framework states that the concept of prudence does not imply a need for asymmetry, such as the need for more persuasive evidence to support the recognition of assets than liabilities. It has included a statement that, in financial reporting standards, such asymmetry may sometimes arise as a consequence of requiring the most useful information.

Chapter 3 – Financial statements and the reporting entity

This chapter describes the objective and scope of financial statements and provides a description of the reporting entity.

A reporting entity is an entity that is required, or chooses, to prepare financial statements. It can be a single entity or a portion of an entity or can comprise more than one entity. A reporting entity is not necessarily a legal entity.

Determining the appropriate boundary of a reporting entity is driven by the information needs of the primary users of the reporting entity’s financial statements.

Since the inception of the Conceptual Framework, the chapter on the reporting entity has been classified as ‘to be added’. Finally, this addition has been made.

This addition relates to the description and boundary of a reporting entity. The Board has proposed the description of a reporting entity as: an entity that chooses or is required to prepare general purpose financial statements.

This is a minor terminology change and not one that many examiners could have much enthusiasm for. Therefore, it is unlikely to feature in many professional accounting exams.

Chapter 4 – The elements of financial statements

As part of this project, the Board has changed the definitions of assets and liabilities. To casual observers, it may seem like some of these changes are the decorative equivalent of ‘repainting cream walls as magnolia’, but to some accountants it can feel like a seismic change.

The changes to the definitions of assets and liabilities can be seen below.

2010 definition 2018 definition Supporting concept

Asset (of an entity) A resource controlled by the entity as a result of past events and from which future economic benefits are expected to flow to the entity.

A present economic resource controlled by the entity as a result of past events.

Economic resource A right that has the potential to produce economic benefits

Liability (of an entity) A present obligation of the entity arising from past events, the settlement of which is expected to result in an outflow from the entity of resources embodying economic benefits.

A present obligation of the entity to transfer an economic resource as a result of past events.

An entity’s obligation to transfer and economic resource must have the potential to require the entity to transfer an economic resource to another party.

Obligation A duty of responsibility that an entity has no practical ability to avoid

The Board has therefore changed the definitions of assets and liabilities. Whilst the concept of ‘control’ remains for assets and ‘present obligation’ for liabilities, the key change is that the term ‘expected’ has been replaced. For assets, ‘expected economic benefits’ has been replaced with ‘the potential to produce economic benefits’. For liabilities, the ‘expected outflow of economic benefits’ has been replaced with the ‘potential to require the entity to transfer economic resources’.

The reason for this change is that some people interpret the term ‘expected’ to mean that an item can only be an asset or liability if some minimum threshold were exceeded. As no such interpretation has been applied by the Board in setting recent IFRS Standards, this definition has been altered in an attempt to bring clarity.

The Board has acknowledged that some IFRS Standards do include a probability criterion for recognising assets and liabilities. For example, IAS 37 Provisions, Contingent Liabilities and Contingent Assets states that a provision can only be recorded if there is a probable outflow of economic benefits, while IAS 38 Intangible Assets highlights that for development costs to be recognised there must be a probability that economic benefits will arise from the development.

The proposed change to the definition of assets and liabilities will leave these unaffected. The Board has explained that these standards don’t rely on an argument that items fail to meet the definition of an asset or liability. Instead, these standards include probable inflows or outflows as a criterion for recognition. The Board believes

This is potentially controversial, and the 2018 Conceptual Framework addresses this specifically in chapter 5; paragraph 15 states that ‘an asset or liability can exist even if the probability of an inflow or outflow of economic benefits is low’.

The key point here relates to relevance. If the probability of the event is low, this may not be the most relevant information. The most relevant information may be about the potential magnitude of the item, the possible timing and the factors affecting the probability.

Even stating all of this, the Conceptual Framework acknowledges that the most likely location for items such as this is to be included within the notes to the financial statements.

Finally, a major change in chapter 5 relates to derecognition. This is an area not previously addressed by the Conceptual Framework but the 2018 Conceptual Framework states that derecognition should aim to represent faithfully both:

a) the assets and liabilities retained after the transaction or other event that led to the derecognition (including any asset or liability acquired, incurred or created as part of the transaction or other event); and b) the change in the entity’s assets and liabilities as a result of that transaction or other event.

Chapter 6 – Measurement

The 2010 version of the Conceptual Framework did not contain a separate section on measurement bases as it was previously felt that this was unnecessary. However, when presented with the opportunity of re-drafting the Conceptual Framework, some additions which are helpful and practical may be considered, even if we have previously managed without them.

In the 2010 Framework, there were a brief few paragraphs that outlined possible measurement bases, but this was limited in detail. In the 2018 version, there is an entire section devoted to the measurement of elements in the financial statements.

The first of the measurement bases discussed is historical cost. The accounting treatment of this is unchanged, but the Conceptual Framework now explains that the carrying amount of non-financial items held at historical cost should be adjusted over time to reflect the usage (in the form of depreciation or amortisation). Alternatively, the carrying amount can be adjusted to reflect that the historical cost is no longer recoverable (impairment). Financial items held at historical cost should reflect subsequent changes such as interest and payments, following the principle often referred to as amortised cost.

The 2018 Conceptual Framework also describes three measurements of current value: fair value, value in use (or fulfilment value for liabilities) and current cost.

Fair value continues to be defined as the price in an orderly transaction between market participants.

Value in use (or fulfilment value) is defined as an entity-specific value, and remains as the present value of the cash flows that an entity expects to derive from the continuing use of an asset and its ultimate disposal.

Current cost is different from fair value and value in use, as current cost is an entry value. This looks at the value in which the entity would acquire the asset (or incur the liability) at current market prices, whereas fair value and value in use are exit values, focusing on the values which will be gained from the item.

In addition to outlining these measurement bases, the Conceptual Framework discusses these in the light of the qualitative characteristics of financial information. However, it stops short of recommending the bases under which items should be carried, but gives some guidance in the form of examples to show where certain bases may be more relevant.

The factors to be considered when selecting a measurement basis are relevance and faithful representation, because the aim is to provide information that is useful to investors, lenders and other creditors.

Relevance is a key issue here. The 2018 Conceptual Framework discusses that historical cost may not provide relevant information about assets held for a long period of time, and are certainly unlikely to provide relevant information about derivatives. In both cases, it is likely that some variation of current value will be used to provide more predictive information to users.

Conversely, the Conceptual Framework suggests that fair value may not be relevant if items are held solely for use or to collect contractual cash flows. Alongside this, the Conceptual Framework specifically mentions items used in a combination to generate cash flows by producing goods or services to customers. As these items are unlikely to be able to be sold separately without penalising the activities, a cost-based measure is likely to provide more relevant information, as the cost is compared to the margin made on sales.

Chapter 7 – Presentation and disclosure

This is a new section, containing the principles relating to how items should be presented and disclosed.

The first of these principles is that income and expenses should be included in the statement of profit or loss unless relevance or faithful representation would be enhanced by including a change in the current value of an asset or a liability in OCI.

The second of these relates to the recycling of items in OCI into profit or loss. IAS 1 Presentation of Financial Statements suggests that these should be disclosed as items to be reclassified into profit or loss, or not reclassified.

The recycling of OCI is contentious and some commenters argue that all OCI items should be recycled. Others argue that OCI items should never be recycled, whilst some argue that only some items should be recycled. Sometimes the best way forward on a project isn’t necessarily to seek the wisdom of crowds.

Luckily, the Board has managed to find a middle ground on recycling. The 2018 Conceptual Framework now contains a statement that income and expenses included in OCI are recycled when doing so would enhance the relevance or faithful representation of the information. OCI may not be recycled if there is no clear basis for identifying the period in which recycling should occur.

Ratios like Return on capital employed are distorted It does not measure any gain/loss of inflation on monetary items arising from the impact Comparability of figures is not accurate as past figures are not restated for the effects of inflation

STANDARD SETTING PROCESS

The due process for developing an IFRS comprises of six stages:

- Setting the agenda

- Planning the project

- Development and publication of Discussion Paper

- Development and publication of Exposure Draft

- Development and publication of an IFRS Standard

- Procedures after a Standard is issued

REGULATORY FRAMEWORK

International Financial Reporting Standards Foundation (IFRS Foundation)

Responsible for governance of standard setting process. It oversees, funds, appoints and monitors the operational effectiveness of:

IFRS Advisory Council (IFRS AC)

Provide advice to IASB on:

their agenda and work prioritization the impact of proposed standards Provides strategic advice

International Accounting Standards Board (IASB)

Develop new accounting standards Liaise with national standard-setting bodies to promote convergence of international and national accounting standards

International Financial Reporting Standards Interpretations Committee (IFRS IC)

Assist the IASB to establish and improve standards

Issues Interpretations (known as IFRICs) which provide timely guidance on emerging accounting issues not addressed in full standards

Assist in the international/national convergence process

PRINCIPLES VS RULES-BASED APPROACH

Rules-based accounting system

Likely to be very descriptive Relies on a series of detailed rules or accounting requirements that prescribe how financial statements should be prepared Considered less flexible, but often more comparable and consistent, than a principles-based system Can lead to looking for ‘loopholes’

Principles-based accounting system

It relies on generally accepted accounting principles that are conceptually based and are normally underpinned by a set of key objectives More flexible than a rules-based system Require judgment and interpretation which could lead to inconsistencies between reporting entities and can sometimes lead to the manipulation of financial statements Because IFRSs are based on The Conceptual Framework for Financial Reporting, they are often regarded as being a principles-based system.

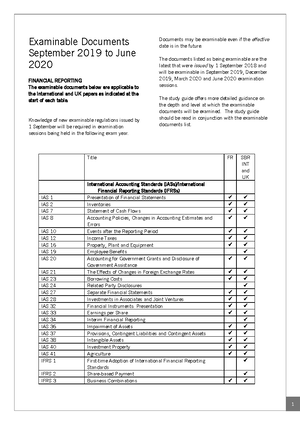

PAST EXAMS ANALYSIS

Topic Exam Attempt Question

Framework

Sept. 16 Spec. exam Sept. 16 June 15 Dec. 14 Dec. 13 Dec. 12

####### MCQ. 1,

####### MCQ, 13

####### MCQ,

####### MCQ,5,7,

Q (a) Q(a)

STATEMENT OF FINANCIAL POSITION

A recommended format is as follows:

XYZ Co. Statement of Financial Position as at 31 December 20X

Assets $ $ Non-current assets: Property, plant and equipment X Intangible assets X X Current assets: Inventories X Trade receivables X Cash and cash equivalents X X Total assets X Equity and liabilities Capital and reserves: Share capital X Share premium X Revaluation reserve X Other components of equity X Retained earnings X X Total equity X Non-current liabilities: Long-term borrowings X Deferred tax X X Current liabilities: Trade and other payables X Short-term borrowings X Current tax payable X Short-term provisions X X Total equity and liabilities X

Current assets include all items which:

Will be settled within 12 months of the reporting date, or Are part of the entity's normal operating cycle.

STATEMENT OF CHANGES IN EQUITY

The statement of changes in equity provides a summary of all changes in equity arising from transactions with owners in their capacity as owners.

This includes the effect of share issues and dividends.

XYZ Group

Statement of changes in equity for the year ended 31 December 20X

Share Share Revaluation Retained Total capital premium surplus earnings equity $ $ $ $ $ Balance at 31 December 20X8 X X X X X Change in accounting policy __ __ __ (X) (X) Restated balance X X X X X Dividends (X) (X) Issue of share capital X X X Total Comprehensive income for the year

####### X X X

Transfer to retained earnings __ __ (X) X -- Balance at 31 December 20X9 X X X X X

This is a very basic format of statement of changes in equity. Workings and relevant columns will be added to it as the course proceeds and relevant Standards are covered.

COMPANIES – BASIC ADJUSTMENTS

TYPES OF SHARES

There are a number of different types of shares which companies may issue.

Ordinary shares Preference shares There are two types of preference shares:

Irredeemable preference shares exist, much like ordinary shares. The amount issued in form of Irredeemable preference shares is not payable after a fixed period. Redeemable preference shares are issued for a fixed term. At the end of this term, the shareholder redeems their shares and in return is repaid the amount they initially bought the shares for (normally plus a premium). In the meantime they receive a fixed dividend.

ACCOUNTING FOR A SHARE ISSUE

The accounting entry to record the issue of shares is:

Dr. Cash Proceeds received

Cr. Share capital Nominal value of shares issued

Cr. Share premium Premium on issue of shares.

ACCOUNTING FOR A RIGHTS ISSUE

A rights issue is an issue of new shares to existing shareholders in proportion to their existing shareholding. The issue price is normally less than market value to encourage shareholders to exercise their rights and buy shares.

Dr. Cash Proceeds received

Cr. Share capital Nominal value of shares issued

Cr. Share premium Premium on issue of shares.

ACCOUNTING FOR A BONUS ISSUE

A bonus issue is an issue of new shares at no cost to existing shareholders, in proportion to their existing shareholding. An issue of this type does not raise cash, but is funded by the existing share premium account (or retained profits if the share premium account is insufficient), and accounted for as:

Dr. Share premium/Retained profits Nominal value of shares issued

Cr. Share capital Nominal value of shares issued

LOAN NOTES

A company can raise finance either through the issue of shares or by borrowing money.

An issue of loan notes is recorded by:

Dr. Cash

Cr. Loan notes (non-current liability)

Interest paid on the loan notes is recorded by:

Dr. Finance cost (interest expense)

Cr. Cash / Accrual

Finance cost is charged on effective rate of interest Cash paid is as per the nominal rate of interest The differential amount becomes a part of the closing liability of loan

DIVIDENDS

Ordinary dividends = No. of shares x Per share dividend

Preference dividends = Amount of preference shares x % of dividend

SUSPENSE ACCOUNTS AND ERROR CORRECTION

A suspense account is a temporary resting place for an entry that will end up somewhere else once its final destination is determined. There are two reasons why a suspense account could be opened:

- A bookkeeper is unsure where to post an item and enters it to a suspense account pending instructions

- There is a difference in a trial balance and a suspense account is opened with the amount of the difference so that the trial balance agrees (pending the discovery and correction of the errors causing the difference). This is the only time an entry is made in the records without a corresponding entry elsewhere (apart from the correction of a trial balance error – see error type 8 in Table 1).

Suspense accounts and error correction are popular topics for examiners because they test understanding of bookkeeping principles.

FR Study Notes- Skans ECampus

Module: acca financial reporting (ACCA F7)

University: Association of Chartered Certified Accountants

- Discover more from: