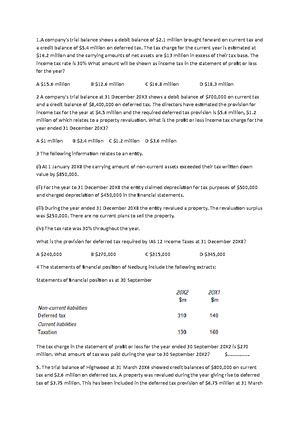

- Information

- AI Chat

Transfer ACCA 2013 March 17Docs Handouts to Revision Kits P 4 Questions and Answers for Revision Kit

acca financial reporting (ACCA F7)

Recommended for you

Preview text

P4 Questions and Answers for Revision Kit – March/June 2017

December 2014 Questions

1. Nahara Co and Fugae Co

Nahara Co is a private holding company owned by the government of a wealthy oil-rich country to invest its sovereign funds. Nahara Co has followed a strategy of risk diversification for a number of years by acquiring companies from around the world in many different sectors. One of Nahara Co’s acquisition strategies is to identify and purchase undervalued companies in the airline industry in Europe. A recent acquisition was Fugae Co, a company based in a country which is part of the European Union (EU). Fugae Co repairs and maintains aircraft engines. A few weeks ago, Nahara Co stated its intention to pursue the acquisition of an airline company based in the same country as Fugae Co. The EU, concerned about this, asked Nahara Co to sell Fugae Co before pursuing any further acquisitions in the airline industry. Avem Co’s acquisition interest in Fugae Co Avem Co, a UK-based company specialising in producing and servicing business jets, has approached Nahara Co with a proposal to acquire Fugae Co for $1,200 million. Nahara Co expects to receive a premium of at least 30% on the estimated equity value of Fugae Co, if it is sold. Given below are extracts from the most recent statements of financial position of both Avem Co and Fugae Co.

Avem Co Fugae Co $ million $ million Share capital (50c/share) 800 100 Reserves 3,550 160 Non-current liabilities 2,200 380 Current liabilities 130 30 Total capital and liabilities 6,680 670

Each Avem Co share is currently trading at $7∑50, which is a multiple of 7∑2 of its free cash flow to equity. Avem Co expects that the total free cash flows to equity of the combined company will increase by $40 million due to synergy benefits. After adding the synergy benefits of $40 million, Avem Co then expects the multiple of the total free cash flow of the combined company to increase to 7∑5. Fugae Co’s free cash flow to equity is currently estimated at $76∑5 million and it is expected to generate a return on equity of 11%. Over the past few years, Fugae Co has returned 77∑3% of its annual free cash flow to equity back to Nahara Co, while retaining the balance for new investments.

Fugae Co’s non-current liabilities consist entirely of $100 nominal value bonds which are redeemable in four years at the nominal value, on which the company pays a coupon of 5∑4%. The debt is rated at B+ and the credit spread on B+ rated debt is 80 basis points above the risk-free rate of return.

Proposed luxury transport investment project by Fugae Co

In recent years, the country in which Fugae Co is based has been expanding its tourism industry and hopes that this industry will grow significantly in the near future. At present tourists normally travel using public transport and taxis, but there is a growing market for luxury travel. If the tourist industry does expand, then the demand for luxury travel is expected to grow rapidly. Fugae Co is considering entering this market through a four-year project. The project will cease after four years because of increasing competition.

The initial cost of the project is expected to be $42,000,000 and it is expected to generate the following after-tax cash flows over its four-year life:

Year 1 2 3 4 Cash flows ($000s) 3,277 16,134 36,504 35,683.

The above figures are based on the tourism industry expanding as expected. However, it is estimated that there is a 25% probability that the tourism industry will not grow as expected in the first year. If this happens, then the present value of the project’s cash flows will be 50% of the original estimates over its four-year life.

It is also estimated that if the tourism industry grows as expected in the first year, there is still a 20% probability that the expected growth will slow down in the second and subsequent years, and the present value of the project’s cash flows would then be 40% of the original estimates in each of these years.

Lumi Co, a leisure travel company, has offered $50 million to buy the project from Fugae Co at the start of the second year. Fugae Co is considering whether having this choice would add to the value of the project.

If Fugae Co is bought by Avem Co after the project has begun, it is thought that the project will not result in any additional synergy benefits and will not generate any additional value for the combined company, above any value the project has already generated for Fugae Co.

Although there is no beta for companies offering luxury forms of travel in the tourist industry, Reka Co, a listed company, offers passenger transportation services on coaches, trains and luxury vehicles. About 15% of its business is in the luxury transport market and Reka Co’s equity beta is 1∑6. It is estimated that the asset beta of the non-luxury transport industry is 0∑80. Reka Co’s shares are currently trading at $4∑50 per share and its debt is currently trading at $105 per $100. It has 80 million shares in issue and the book value of its debt is $340 million. The debt beta is estimated to be zero.

March calls Strike price March puts 0∑882 95∑50 0∑ 0∑648 96∑00 0∑

Option prices are quoted in basis points at 100 minus the annual % yield and settlement of the options contracts is at the end of March 2015. The current basis on the March futures price is 44 points; and it is expected to be 33 points on 1 January 2015, 22 points on 1 February 2015 and 11 points on 1 March 2015. Rozu Bank has offered Keshi Co a swap on a counterparty variable rate of LIBOR plus 30 basis points or a fixed rate of 4∑6%, where Keshi Co receives 70% of any benefits accruing from undertaking the swap, prior to any bank charges. Rozu Bank will charge Keshi Co 10 basis points for the swap. Keshi Co’s chief executive officer believes that a centralised treasury department is necessary in order to increase shareholder value, but Keshi Co’s new chief financial officer (CFO) thinks that having decentralised treasury departments operating across the subsidiary companies could be more beneficial. The CFO thinks that this is particularly relevant to the situation which Suisen Co, a company owned by Keshi Co, is facing. Suisen Co operates in a country where most companies conduct business activities based on Islamic finance principles. It produces confectionery products including chocolates. It wants to use Salam contracts instead of commodity futures contracts to hedge its exposure to price fluctuations of cocoa. Salam contracts involve a commodity which is sold based on currently agreed prices, quantity and quality. Full payment is received by the seller immediately, for an agreed delivery to be made in the future. Required: Based on the two hedging choices Keshi Co is considering, recommend a hedging strategy for (a) the $18,000,000 borrowing. Support your answer with appropriate calculations and discussion. (15 marks) Discuss how a centralised treasury department may increase value for Keshi Co and the (b) possible reasons for decentralising the treasury department. (6 marks) Discuss the key differences between a Salam contract, under Islamic finance principles, and (c) futures contracts. (4 marks)

(25 marks)

3. Riviere Co

Riviere Co is a small company based in the European Union (EU). It produces high quality frozen food which it exports to a small number of supermarket chains located within the EU as well. The EU is a free trade area for trade between its member countries.

Riviere Co finds it difficult to obtain bank finance and relies on a long-term strategy of using internally generated funds for new investment projects. This constraint means that it cannot accept every profitable project and often has to choose between them.

Riviere Co is currently considering investment in one of two mutually exclusive food production projects: Privi and Drugi. Privi will produce and sell a new range of frozen desserts exclusively within the EU. Drugi will produce and sell a new range of frozen desserts and savoury foods to supermarket chains based in countries outside the EU. Each project will last for five years and the following financial information refers to both projects.

Project Drugi, annual after-tax cash flows expected at the end of each year (€000s)

Year Current 1 2 3 4 5 Cash flows (€000s) (11,840) 1,230 1,680 4,350 10,240 2,

Privi Drugi Net present value €2,054,000 €2,293, Internal rate of return 17∑6% Not provided Modified internal rate of return 13∑4% Not provided Value at risk (over the project’s life) 95% confidence level €1,103,500 Not provided 90% confidence level €860,000 Not provided

Both projects’ net present value has been calculated based on Riviere Co’s nominal cost of capital of 10%. It can be assumed that both projects’ cash flow returns are normally distributed and the annual standard deviation of project Drugi’s present value of after-tax cash flows is estimated to be €400,000. It can also be assumed that all sales are made in € (Euro) and therefore the company is not exposed to any foreign exchange exposure.

Notwithstanding how profitable project Drugi may appear to be, Riviere Co’s board of directors is concerned about the possible legal risks if it invests in the project because they have never dealt with companies outside the EU before.

Required:

Discuss the aims of a free trade area, such as the European Union (EU), and the possible (a) benefits to Riviere Co of operating within the EU. (5 marks) Calculate the figures which have not been provided for project Drugi and recommend which (b) project should be accepted. Provide a justification for the recommendation and explain what the value at risk measures. (13 marks) Discuss the possible legal risks of investing in project Drugi which Riviere Co may be concerned (c) about and how these may be mitigated. (7 marks)

(25 marks)

○ There are sometimes integration problems following an acquisition.

Identifying undervalued companies If Nahara can successfully underpay for companies and subsequently increase their value by improving performance then the effect on shareholder wealth will be positive. In order to make this strategy work, Nahara must be able to identify these companies, successfully acquire them, possibly dealing with competitor acquirers, and then increase the value of the acquired companies. There are a number of conditions needed for this to be a successful strategy. Nahara would need to have access to the finance necessary to ensure a quick transaction: the longer the transaction is delayed, the greater the risk that Nahara will be forced to pay more as other firms will look at acquiring obviously undervalued companies and the shareholders of the target company may become reluctant to sell. Nahara will need to be able to unlock the value in target companies by using its own expertise and resources. Nahara will need access to better quality information than the market (implying at least some level of market inefficiency). Risk diversification Diversification can reduce specific risk and as Nahara’s portfolio of investments becomes more diversified then the variability of returns would be expected to decrease, assuming that its investments in different companies are negatively correlated (for example, investments in different countries or sectors). Another possible benefit of diversification is an overall reduction in the volatility of cash flows, leading, potentially, to a lower cost of capital. However, while the diversification argument is often made as an argument in favour of expansion by merger and acquisition, there is a counter argument which states that individual investors can gain the same benefit from constructing a diversified portfolio of equities and/or bonds and so the companies that they invest in do not deliver any additional benefits from diversifying. Nevertheless, in the case of Nahara, there may well be some benefits from expansion by acquisition, if the sovereign fund has its entire investment in the holding company and is not well-diversified itself.

(b) The competition authorities will assess the benefits and risks, to stakeholders, of proposed significant mergers and acquisitions. In particular, they will consider the impact on competition of any reduction in the number of firms offering a product or service and/or any significant increase in market share and market power. The EU can block a merger or acquisition that carries a significant risk of abuse of dominant market position that may result in, for example, less consumer choice or higher prices.

Rather than block a transaction outright, the EU may impose conditions, such as price controls or part-disposals as part of the approval process.

(c) Report

To: Board of Directors, Avem Co From: X Subject: Proposed acquisition of Fugae Co Date: XX/XX/XXXX Introduction This report evaluates the benefits to Avem of acquiring Fugae. The report first determines the value of the two individual companies compared with the theoretical value of the new combined entity in order to assess the additional value created from the business combination. Secondly, the report sets out possible ways of increasing value after the combination, together with some working assumptions and limitations. The report concludes by demonstrating the overall financial position as a result of the proposed acquisition. Value created for Avem (without luxury transport project) As shown in Appendix I, the additional value created as a result of the acquisition is approx. $452 billion. The shareholders of Nahara will gain approximately $277 billion of this (approximately 61% of the total). This represents a premium of about 30% which is the minimum acceptable to Nahara. The remaining $175 billion will benefit Avem, and this represents an increase of 1% in the company’s value. Value created for Avem (with luxury transport project) As shown in Appendix II, accepting the luxury transport project would increase Fugae’s value as the expected net present value is positive. Lumi’s offer increases the expected net present value. Therefore, it would be worthwhile for Fugae to take on the project and accept Lumi’s offer. Assumptions and limitations The following assumptions have been made in preparing this analysis, and these simplifying assumptions may limit the reliability of the calculations.

○ All figures relating to synergies, growth rates and multipliers, as well as those relating to risk (eg cost of capital) are accurate.

○ Growth continues in perpetuity.

○ The probability analysis is reliable.

Fugae Co

MVe = $923m

MVd = 388m (W1)

(W1)

Kd = Rf + spread = 4% + 0% = 4%

MVd (per $100) = (5∑40 ◊ (1∑048– 1 + 1∑048– 2 + 1∑048– 3 + 1∑048– 4 ) + 100) = 102∑

MVd = (102 / 100) ◊ $380m = $388m

Project risk adjusted equity beta

1∑4 ◊ ($923m + $388m ◊ 0∑8)/$923m = 1∑

Project risk adjusted cost of equity

4% + (1∑87 ◊ 6%) = 15∑2%

Project risk adjusted cost of capital

(15∑2% ◊ $923m + 4∑8% ◊ 0∑8 ◊ $388m)/($923m + $388m) = 11∑84%, approx 12%

Estimate of expected value of the project without the offer from Lumi

Time Cash DF 12% PV 1 3,277 1-1 2,926. 2 16,134 1-2 12,859. 3 36,504 1-3 25,991. 4 35,683 1-4 22,694.

For expected net present value calculations, probabilities have been assigned to possible outcomes based on whether or not the tourism market will grow.

PV year 1: 2,926, 50% of PV years 1 to 4: 32,236, PV years 2 - 4: 61,545, 40% PV years 2 to 4: 24,618,

Expected present value of cash flows = (0∑75 ◊ (2,926,900 + (0∑8 ◊ 61,545,100 + 0∑2 ◊ 24,618,040))) + (0∑25 ◊ 32,236,000) = 50,873,

Expected NPV of project = 50,873,941 – 42,000,000 = 8,873,

Estimate of expected value of the project with the offer from Lumi

Value of Lumi offer is $50,000,000 ◊ 1-1 = $44,650,

Value of PV of years 2-4 cashflows = $30,800,000 approx Therefore if the tourism industry does not grow as expected in the first year, Fugae should accept the offer made by Lumi. 50% of year 1 PV = 1,463, Expected present value of cash flows = (0∑75 ◊ (2,926,900 + 54,159,688)) + (0∑25 ◊ (1,463,450 + 44,650,000)) = 54,343, Expected NPV of project = 54,343,304 – 42,000,000 = 12,343,

2. Keshi Co

Tutor Tips

- This question focuses on interest rate risk management, specifically swaps and options.

- To maximise your marks, lay out your calculations clearly in part (a) and deal with options and swaps one at a time.

- Both parts (b) and (c) offer the chance to pick up some marks for good background knowledge and sensible suggestions.

- You might not remember what a Salam contract is so don’t worry too much about trying to pick up every mark in every question. If you make some sensible points about futures you will still get at least one mark!

(a)

(i) Traded options Keshi needs to hedge against a rise in interest rates, therefore needs to buy put options. Requirement is for 42 March put option contracts. ((18,000,000/1,000,000 ◊ 7/3) = 42) Expected futures price on 1 February if interest rates increase by 0∑5% is 100 – (3∑8 + 0∑5) – 0∑22 = 95∑ Expected futures price on 1 February if interest rates decrease by 0∑5% is 100 – (3∑8 – 0∑5) – 0∑22 = 96∑ If interest rates increase by 0∑5%: Exercise price 95∑50 96∑ Futures price 95∑48 95∑ Exercise? Yes Yes Gain in basis points 2 52 Underlying cost of borrowing: 4∑7% ◊ 7/12 ◊ 18m 493,500 493,

Floating rate loan (L + 0) Fixed rate paid (4) Floating rate received L + 0. Net cost (4) Total gain (5 – 4) 0. Keshi gain (70% ◊ 0) 0. Net outcome: 5. (0) 0. 5.

(iii) Recommendations The interest cost under two alternative scenarios of interest rates rising and falling is as follows:

Interest rates increase by 0%

Interest rates decrease by 0%

Do nothing – variable 4 3.

Do nothing – fixed 5 5.

Option at 95 5 4.

Option at 96 5 4.

Swap 5 5.

The best choice would appear to be to borrow at variable rates, without using futures or swaps. However, if interest rates rise significantly then Keshi is exposed to the risk of significantly higher costs. The second choice would be to undertake a swap, which increases the cost to only 5% (significantly below the market fixed rate) while eliminating risk. This illustrates the trade-off between minimising overall forecast cost and reducing risk. (b) The key advantage of centralising the treasury function is eliminating duplication of resource and effort. This has become increasingly important as globalisation has led to a more complex international business environment. According to Bloomberg, a number of individual areas can be identified as offering advantages from treasury centralisation. For example, centralising hedging and trading operations eliminates the need for each business line to have their own traders and trade lifecycle management resources. Agreements with

counterparties are streamlined, reducing the operational burden of managing different external agreements and associated requirements. Centralised cash management can provide similar efficiencies. (International trade requires that cash is managed across various currencies with diverse banking partners.) Banking relationships can be optimised across the regions and partners with which a firm transacts. Central management of bank-to-bank payments increases the controllership over these transactions, reducing interest and other claims against the firm. Regulatory burdens have also increased, requiring cross-border management of the varying regulatory regimes. A centralised treasury department will normally be in a good position to evaluate the financing requirements of Keshi and may allow Keshi to benefit from better rates for borrowing, for example. A centralised treasury function may also be able to better match surplus cash in one subsidiary with a financing need in another, thus reducing the eternal finance needed and potentially increasing the return on surplus funds invested. Multilateral hedging (eg on currency risk) across the group may also generate savings. There are, however, some barriers to and disadvantages of centralisation. The largest impediments to centralisation are often technology limitations. Although treasury activities are linked with each other, few systems offer the capability of connecting cash management with hedge management, requiring manual touch points or interfaces and manipulation of data. Many treasuries manage forecasted cash exposures within spreadsheets, for example, making the aggregation of exposures at the consolidated level a time-consuming and error-prone manual process. Those systems that do offer this functionality are expensive, with implementation taking months or years. Some companies or groups may find that a <hybrid= approach works better for their business – for example, subsidiaries are tasked with identifying exposures related to their line of business and then request head office operations to execute hedges. It may be that individual subsidiaries are better placed to deal with local regulations and markets: for example Suisen uses Salam contracts rather than conventional futures. Allowing a degree of autonomy within subsidiaries may also increase staff motivation among local managers.

(c) The main principles contained within Islamic finance are summarised by the Financial Times as follows:

○ adherence to interest- (riba-) free financial transactions

○ prohibition of fixed return

○ profit-and-loss sharing and hence risk sharing

○ participatory financing

market each country will tend to specialise in that activity where it has comparative advantage, resulting in an overall increase in aggregate income and wealth. Riviere can gain benefits from operating within the EU:

○ privileged access to the EU market and protection from non-EU competition

○ common standards of food production and packaging will reduce administration and compliance costs

○ access to labour resource

○ easy to set up local offices in other EU countries

○ access to government support

(b) Project Drugi calculations

(i) Internal rate of return At 10% NPV = 2,293,000 (given in question, some rounding) At 15% NPV = 309,000 (W1) At 20% NPV = −1,310,000 (W1) Interpolating between 10% and 20%, IRR = 10 + (10 ◊ (2,293 / (2293 + 1,309))) = 16. (W1) IRR calculations r = 0 r = 0 r = 0. 0 (11,840) (11,840) (11,840) (11,840) 1 1,230 1,118 1,070 1, 2 1,680 1,388 1,270 1, 3 4,350 3,268 2,860 2, 4 10,240 6,994 5,855 4, 5 2,200 1,366 1,094 884

2,295 309 (1,309)

(ii) Modified internal rate of return At 10% total PV years 1–5 = 11,840,000 + 2,293,000 = 14,133, MIRR = (((14,133 / 11,840)(1/5)) ◊ 1) – 1 = 0 ie 14% (iii) Value at risk A 95% confidence level requires the annual present value VAR to be within approximately 1∑645 standard deviations from the mean.

A 90% confidence level requires annual present value VAR to be within approximately 1∑ standard deviations from the mean. 95% 5 year PV VAR = 400,000 ◊ 1∑645 ◊ 51/2 = 1,471, 90% 5 year PV VAR = 400,000 ◊ 1∑282 ◊ 51/2 = 1,147, (iv) Summary of analysis

Privi Drugi NPV at 10% 2,054,000 2,293, IRR 17∑6% 16∑4% MIRR 13∑4% 14∑0% VAR (95% confidence level) 1,103,500 1,471, VAR (90% confidence level) 860,000 1,147,

(v) Recommendations

The net present value indicates that project Drugi is preferable. The modified internal rate of return calculations also support this decision. The internal rate of return for project Privi is higher. However, this method should not be used to choose between two mutually exclusive projects of different sizes because it may produce give an answer which is inconsistent with shareholder wealth maximisation. Therefore, based on discounted cash flows, project Drugi should be accepted due to the higher net present value and modified IRR. However, there is one area where the calculations could be improved. Although the investments appear to involve different risk levels (see VAR calculations) the cash flows have been discounted at the same rate, which is incorrect: the discount rate applied to the cash flows should be risk-adjusted. The VAR provides an indication of the potential riskiness of the projects. The calculations show that if Riviere invests in project Drugi then it can be 95% confident that the present value will not fall by more than €1,471,000 over its life. Even in this case the net present value would still be positive. There is a 5% chance that the loss could be greater than €1,471,000. With project Privi, the potential loss in value is smaller and therefore it is in this sense less risky. Therefore, when risk is also taken into account, the choice between the projects is not obvious and involves Riviere’s directors making a decision which takes into account the trade-off between risk and return. Project Drugi gives the higher potential net present value but at a higher level of risk.

Transfer ACCA 2013 March 17Docs Handouts to Revision Kits P 4 Questions and Answers for Revision Kit

Module: acca financial reporting (ACCA F7)

University: Association of Chartered Certified Accountants

- Discover more from: