- Information

- AI Chat

Was this document helpful?

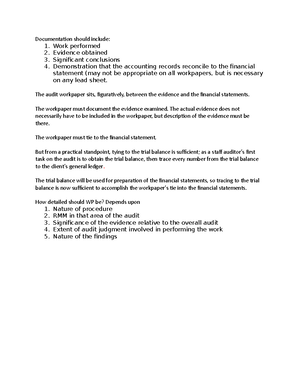

Substantive analytical test of depreciation expense

Course: Auditing (ACG 4651)

6 Documents

Students shared 6 documents in this course

University: University of West Florida

Was this document helpful?

Substantive analytical test of depreciation expense

1999 depreciation expense (per prior year’s working papers)

$17,000

Current year additions: 2,500

Average useful life of vehicles (based on prior years’ audits ÷ 5

On average, the vehicles were added mid-way into the year ÷ 2

Estimated increase in depreciation expense

250

Expected balance in depreciation expense for this asset category

$17,250

After developing this expectation, we should compare with the trial balance.

If, for example, the trial balance for the depreciation account is $17,272,

and account-level materiality is $4,000, then this analytic would provide

meaningful evidence regarding the account balance.