- Information

- AI Chat

This is a Premium Document. Some documents on Studocu are Premium. Upgrade to Premium to unlock it.

Mock Exam 1 RE5 2018 - RE5

RE5

Course

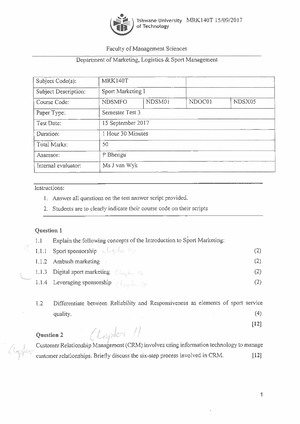

SPORT MARKETING 1 (MRK140T, NDOC01, NDS)

7 Documents

Students shared 7 documents in this course

University

Tshwane University of Technology

Academic year: 2023/2024

Uploaded by:

0followers

3Uploads

3upvotes

Preview text

REGULATORY EXAMINATION RE

MOCK EXAM 1 APRIL 2018

Copyright Notice

© 2015 by Anna Bouhail

All rights reserved. No part of this publication may be reproduced, distributed, or transmitted in any form or by

any means, including photocopying, recording, or other electronic or mechanical methods, without the prior

written permission of the author, except in the case of brief quotations embodied in critical reviews and certain

other non-commercial uses permitted by copyright law.

For permission request write to the author at the address below:

Anna Bouhail

1 Bracken Lodge 10 Roy Campbell Street

New Redruth Alberton

1449 South Africa

E-mail: anna@compliancelearningcenter

Ordering information

If you would like to order the publication please contact author at address above.

1 Bracken Lodge 10 Roy Campbell Street Brackenhurst Alberton 1449

compliancelearningcenter | anna@compliancelearningcenter

Office: 072 039 9097 | Facilitator: 083 821 8801

GUARANTEED RESULTS

What is the main objective of the FAIS Act?

A) Combating money laundering.

B) South African Economic Growth.

C) Client protection.

D) Financial market stability.

Question 2

Which ONE of the following statements best describes financial service as defined in the FAIS Act?

A) Advice or intermediary services.

B) Advice and investment services.

C) Advice and/or intermediary services.

D) Advice or investment services.

Question 3

Financial products are grouped in the various product categories and sub-categories. Which of the following are

examples of financial products in the subcategories that fall under a Category I license?

i. Credit Life Insurance

ii. Money Market funds managed by a Fund Manager

iii. Mortgage Bonds

iv. Short Term Insurance

v. Motor-Vehicle financing

vi. Retirement Annuities Advice

A) i, iii, iv & vi only

B) i, iii, v & vi only

C) i; iii; v & v only

D) i; ii; iv & vi only

Question 4

Which ONE of the following actions falls within the ambit of the FAIS Act?

A) Recommending members of a church group to take out a pay day loan.

B) Handing out a pamphlet setting out specifications of a funeral policy to union members.

C) Advertising a new type of banking account in the local newspaper.

D) Giving a client a leaflet stating the advantages of taking out a household cover if they purchase an appliance.

When an FSP wants to appoint a Representative, it may do the following to establish if a Representative indeed

meets the honesty and integrity requirements. Choose the best answer.

A) The FSP may only rely on declarations made by the representative.

B) The FSP may only rely on declarations made by the Representative and written references from previous

employers.

C) The FSP can use whatever means are reasonable and within fair labour practice to establish if a Representative

meets the requirements for honesty and integrity.

D) The FSP is not limited with regard to means it may use to establish if a Representative meets the requirements

for honesty and integrity requirements.

Question 10

Danny’s father died but his life insurer refuses to pay the benefits under this policy as the father failed to apply for

paid up benefits on retirement. The father was not advised of this requirement when he took out the policy and he

is illiterate so he cannot be expected to read the policy documentation. Which ONE of the following statements is

correct?

A) Danny can lay a complaint with the Financial Services Provider as he is a beneficiary on the policy.

B) Danny must approach the Financial Services Board to mediate the matter.

C) Danny has no recourse as the policy holder is dead and cannot pursue the matter.

D) Danny must appeal the rejection of the claim with the Registrar of short-term insurance.

Question 11

What is not a responsibility of the registrar in terms of debarment by the Financial Services Provider?

A) Adding name of representative on list of debarred representatives.

B) Making the debarment known on the official website.

C) Updating the central register of representatives.

D) Informing all other associated FSPs of the debarment.

Question 12

What is the difference between the suspension and the lapsing of a license? Choose the correct statement below.

A) Suspension or withdrawal of a licence is the result of factors other than non-compliance with the requirements

of the FAIS Act. Lapsing of a licence may be the result of a person's death.

B) Suspension or withdrawal of a licence is the result of noncompliance with the requirements of the FAIS Act.

Lapsing of a licence is the result of a person not meeting the competency fit and proper requirements.

C) Suspension or withdrawal of a licence is the result of one's resignation from the services of an FSP. Lapsing of

a licence is the result of factors other than non-compliance.

D) Suspension or withdrawal of a licence is the result of noncompliance with the requirements of the FAIS Act.

Lapsing of a licence is the result of factors other than non-compliance.

In which of the following instances must the registrar issue a notice of the occurrence on the official website of the

Financial Services Board? Choose the INCORRECT statement.

A) Lifting of suspension of FSP license.

B) Suspension of FSP license.

C) Withdrawal of FSP license.

D) Lapsing of FSP license.

Question 14

A Financial Services Providers receives money in cash on behalf of clients. Which of the following do they need to

comply with according to the FAIS Act?

A) Pay all fees and charges incurred on the applicable bank account.

B) Pay money into FSP transaction account within 1 working day.

C) Ensure that any interest that accrues on money is paid to client.

D) Issue the client with statement of account on a monthly basis.

Question 15

The FAIS Registrar suspended the licence of LMN Brokers. It may have been for which one of the following reasons?

A) Failure to become an authorised Financial Services Provider.

B) Non-payment of annual levies.

C) Allowing administrative staff to sell financial products to clients.

D) Not paying a client complaint their settlement amount.

Question 16

Which ONE of the following role-players must notify clients that services under supervision is being rendered to

the client?

A) The supervisee

B) The Key Individual

C) The supervisor

D) The compliance officer

Thandi provides advice in respect of short term insurance personal and commercial lines. She has completed her

CFP and passed her RE5 but works under supervision to obtain experience. Which of the following applies to her

period under supervision?

A) Direct supervision = 4 months; ongoing supervision = 20 months

B) Direct supervision = 2 months; ongoing supervision = 10 months

C) Direct supervision = 4 months; ongoing supervision = 8 months

D) Direct supervision = 12 months; ongoing supervision = 12 months

Question 21

Fatima works as an insurance planner for a large Life Insurer and regularly visits clients at their place of work or at

home. Before meeting with the client, what is Fatima required to do?

i. Establish whether or not the visit is convenient to the client.

ii. Obtain prior written approval from the client.

iii. Provide the client with information as to where they may lodge a complaint.

iv. Provide information about the financial service at the earliest opportunity.

A) i & iv only

B) iii & iv only

C) i ; ii & iii only

D) i, ii; iii & iv

Question 22

The registrar has informed FSP A that one of their representatives has been debarred. What action must the FSP

take?

A) Amend the register or representatives within 5 days of the notification of debarment.

B) Amend the register or representatives within 15 days of notification of debarment.

C) Amend the register or representatives within 5 days of the date of debarment.

D) Amend the register or representatives within 15 days of the date of debarment.

Question 23

Big Bank sells short- and long-term insurance to clients. These products are created by their internal product house.

Which of the following must representatives of Big Bank declare to clients?

A) All commissions earned by the representative.

B) Rates charged for rendering the financial service.

C) All of the above.

D) None of the above.

Jan and Marie of Dorpie Makelaars sell insurance policies within a small rural farming town, but both unfortunately

tragically passed away in a tractor accident. Their FAIS business matters need to be wrapped up but it is discovered

that Jan was acting as the accountant and compliance officer. They had no lawyer but there was a valid will and a

surviving daughter. Which statement is true?

A) Clients of Dorpie Makelaars will have to contact the Financial Services Board to assist in transferring their

business to another Financial Services Provider.

B) The FAIS Registrar will determine that due to the dishonest behaviour of Jan a fine must be issued against

Dorpie Makelaars.

C) The daughter must apply to the FAIS Registrar to take steps to suspend the license immediately.

D) Executor of the deceased’s estate must provide reasons to the registrar in writing for the lapsing of the licence.

Question 25

The FAIS Registrar wishes to impose the full extent of the law on a Financial Services Provider for gross negligence

and dishonesty. What is the maximum penalty under FAIS?

A) 10 years imprisonment and/or R10 000 000 fine.

B) 5 years imprisonment and/or R1 000 000 fine.

C) 5 years imprisonment and/or R10 000 000 fine.

D) 10 years imprisonment and/or R1 000 000 fine.

Question 26

Folly Financiers are licensed under Category I to sell long term insurance B and short-term insurance personal and

commercial lines. Folly Financiers provide product training and class of business training to all representatives on

employment. Using the information in the table which statement below is FALSE if, supposedly, the person was to

start work at Folly Financiers in Jan 2011?

Candidate Qualification Experience and date first appointed (MM/YYYY)

Patricia

RE5 + NQF 4, 60 Credits skills

module

LTI B (02/2005) and STI Personal Lines (06/2009)

Vinny RE5 + Matric

STI Personal and Commercial lines (09/2006) and

LTI B (04/2009)

Dinah

Will complete her

CFP in 2014

No previous experience in insurance product sales

Lucas RE5 + B Com in Finance

Across short-term insurance and investment products since

1999

A) Patricia would be placed under supervision only for commercial Lines.

B) Lucas will require 12 months supervision for long-term insurance.

C) Vinny will be placed under supervision until he achieves a full qualification.

D) Dinah would have to be placed under supervision until February 2013.

Smalltown Investments, an authorised FSP, is appointing a representative. Which of the following must be done?

i. The candidate must meet all the fit and proper requirements at the time of appointment as representative.

ii. Smalltown Investments must look up on the FSB website to see if the candidate has been debarred.

iii. The candidate must verify the appropriateness of his qualifications with the Financial Services Board.

iv. Small town Investments must obtain and verify details of the candidate’s previous experience.

A) i & iii only

B) ii & iv only

C) i & iv only

D) i, ii & iii only

Question 32

Which of the following is false as far as the FAIS Act is concerned?

A) The FAIS Act was introduced to regulate the business of all Financial Service Providers who give advice or

provide intermediary services to clients, regarding a wide range of financial products.

B) Administration of the FAIS Act is done by the FAIS Registrar. The Registrar has defined functions, powers and

obligations.

C) The FAIS Act only applies to Financial Service Providers who give advice in relation to financial products.

D) The enforcement part of the FAIS Act deals with the Ombud for Financial Services Providers and related

matters.

Question 33

The FAIS Registrar may declare a business practice undesirable, after consultation, if which of the following factors

are present?

i. The business practice must have had a lot of bad publicity in local media, alerting the general public to

potential harm.

ii. The business practice must have, or be likely to have, a direct effect resulting in unreasonable prejudice to

clients.

iii. The business practice must be likely to have an effect resulting in unfairly affecting a client and, if allowed

to continue, defeating one or more objectives of the FAIS Act.

iv. The business practice must have been reported to the FAIS Ombud.

A) i & iv only

B) iii & iv only

C) ii & iii only

D) i, ii; iii & iv

Choose the INCORRECT answer. The Ombud may dismiss a complaint without referral to any other party if on the

facts provided by the complainant it appears to the Ombud that ...

A) The complaint does not have any reasonable prospect of success.

B) The matter has previously been considered by the Ombud.

C) The respondent has failed to co-operate in resolution of the complaint.

D) The essential subject of the complaint has been decided in court proceedings.

Question 35

The FAIS act states the requirements for the displaying of the license certificate. Which one of these is NOT a

requirement pertaining to the FSP ‟ s license certificate?

A) Certified copy of license must be displayed at each branch.

B) Original certificate must be kept in a fire proof safe.

C) The license must be displayed prominently in a durable manner.

D) A copy of the licence certificate may be given to clients.

Question 36

Which ONE of the following statements regarding the record of advice is correct?

A) A record of advice only need to be kept if a transaction was entered into.

B) Records of advice furnished to a client telephonically must be provided to the client within 30 days.

C) Records of advice must be lodged to the responsible key individual for sign-off.

D) Record of advice must be retrievable within 7 working days of request by client or registrar.

Question 37

Kate Johnson is a representative of Future Advisors. A client purchases a product from Multisure, a short-term

insurer on advice rendered by Kate. Which of the following must be disclosed by Kate.

A) The FSP number of Multisure.

B) The registration number of Multisure

C) Physical address of Future Advisors.

D) The contact number of the complaints department of Future Advisors.

Pulane is a representative at 7th Avenue financial services and her client informed her in person that she would like

to lodge a complaint against her. What should Pulane do?

A) Provide the client with the details of the FAIS Ombud.

B) Reduce the complaint in writing and forward it to the complaints department.

C) Inform the client that she must put the complaint in writing.

D) Ask the complaints department to contact the client to assist her further.

Question 43

Mandy started working at Piggy Bank brokers and was appointed to provide advice in long term insurance Category

B1 and B2 to work under supervision as she has not written her RE5 exam as yet. Which of the following persons

can be appointed to supervise the activities performed by Mandy. The table below indicate the position,

qualification an experience for each of the possible supervisors.

Name Position Qualifications Experience and date first appointed (MM/YYYY)

Ronald Representative

NQF 4, 30 Credits skills

module + RE

Selling funeral policies (01/01/2005)

Leo Representative Matric + RE

Sales experience across all long and short term

products (01/01/2011)

Cleopatra Representative Bcom in Finance + RE5 Selling endowment policies (01/04/2012)

Marko key individual CFP + RE

Supervising the processing of claims of life and

endowment policies (01/09/2014)

A) Ronald

B) Leo

C) Cleopatra

D) Marko

Question 44

Which ONE of the following legislation criminalises money laundering?

A) Prevention of organised Crime Act

B) Financial intelligence Centre Act

C) Prevention of Combating of Corrupt Activities Act

D) Anti-money laundering Act

Which ONE of the following statements with regards to the issuance of directives by the FAIS Registrar is correct?

A) A Financial Services Provider must immediately comply with any directive issued by the FAIS Registrar.

B) All directives issued must be published on the official website of the FSB and other media the Registrar may

deem appropriate.

C) A directive is not allowed to deviate from the promotion of Administrative Justice Act.

D) The FAIS Registrar may issue a directive to anyone whom the provisions of the FAIS Act applies.

Question 46

Which of the following recourse actions are available to the FAIS registrar should a Financial Services Provider not

comply with an undesirable practice notice?

i. Imposing a fine of R10 million and/or 10 years imprisonment on the Financial Services Provider.

ii. Issue a notice to the Financial Services Provider to reinstate any damage or loss caused to a client by the

carrying on with the practice within 30 days.

iii. Taking such a Financial Services Provider to the enforcement committee to enforce compliance.

iv. Imposing unlimited cost orders on the Financial Services Provider as per the protection of Fund Act.

A) i & ii only

B) i & iii only

C) ii & iii only

D) i, iii & iv only

Question 47

Which ONE of the following statements regarding the Financial Intelligence Center Act is correct?

A) Representatives of the Financial Intelligence Centre Act is free to access documentation kept by accountable

institutions at any time.

B) Suspicious transactions must be reported to the Financial Intelligence Centre within 5 working days.

C) Records may be kept in recorded format but must be available within 7 days from request.

D) All accountable institutions must appoint a FICA compliance officer to monitor FICA Compliance.

Question 48

What is the maximum penalty that can be awarded to a provider that fails to keep records in term of the Financial

Intelligence Centre Act?

A) R100 million or 15 years imprisonment.

B) R100 million and/or 15 years imprisonment.

C) R10 million or 5 years imprisonment.

D) R10 million and/or 5 years imprisonment.

Was this document helpful?

This is a Premium Document. Some documents on Studocu are Premium. Upgrade to Premium to unlock it.

Mock Exam 1 RE5 2018 - RE5

Course: SPORT MARKETING 1 (MRK140T, NDOC01, NDS)

7 Documents

Students shared 7 documents in this course

University: Tshwane University of Technology

Was this document helpful?

This is a preview

Do you want full access? Go Premium and unlock all 15 pages

Access to all documents

Get Unlimited Downloads

Improve your grades

Already Premium?

REGULATORY EXAMINATION RE5

MOCK EXAM 1 APRIL 2018

Copyright Notice

© 2015 by Anna Bouhail

All rights reserved. No part of this publication may be reproduced, distributed, or transmitted in any form or by

any means, including photocopying, recording, or other electronic or mechanical methods, without the prior

written permission of the author, except in the case of brief quotations embodied in critical reviews and certain

other non-commercial uses permitted by copyright law.

For permission request write to the author at the address below:

Anna Bouhail

1 Bracken Lodge 10 Roy Campbell Street

New Redruth Alberton

1449 South Africa

E-mail: anna@compliancelearningcenter.net

Ordering information

If you would like to order the publication please contact author at address above.

1 Bracken Lodge 10 Roy Campbell Street Brackenhurst Alberton 1449

www.compliancelearningcenter.net | anna@compliancelearningcenter.net

Office: 072 039 9097 | Facilitator: 083 821 8801

GUARANTEED RESULTS

This is a preview

Do you want full access? Go Premium and unlock all 15 pages

Access to all documents

Get Unlimited Downloads

Improve your grades

Already Premium?

Why is this page out of focus?

This is a Premium document. Become Premium to read the whole document.

This is a preview

Do you want full access? Go Premium and unlock all 15 pages

Access to all documents

Get Unlimited Downloads

Improve your grades

Already Premium?

Why is this page out of focus?

This is a Premium document. Become Premium to read the whole document.

This is a preview

Do you want full access? Go Premium and unlock all 15 pages

Access to all documents

Get Unlimited Downloads

Improve your grades

Already Premium?

Why is this page out of focus?

This is a Premium document. Become Premium to read the whole document.

This is a preview

Do you want full access? Go Premium and unlock all 15 pages

Access to all documents

Get Unlimited Downloads

Improve your grades

Already Premium?

Why is this page out of focus?

This is a Premium document. Become Premium to read the whole document.

This is a preview

Do you want full access? Go Premium and unlock all 15 pages

Access to all documents

Get Unlimited Downloads

Improve your grades

Already Premium?

Why is this page out of focus?

This is a Premium document. Become Premium to read the whole document.