- Information

- AI Chat

This is a Premium Document. Some documents on Studocu are Premium. Upgrade to Premium to unlock it.

Was this document helpful?

This is a Premium Document. Some documents on Studocu are Premium. Upgrade to Premium to unlock it.

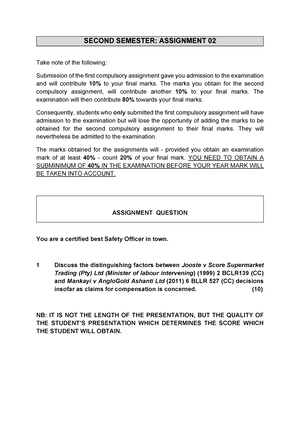

2024 examination

Course: Occupational health ,safety and law (OHS2601)

61 Documents

Students shared 61 documents in this course

University: University of South Africa

Was this document helpful?

This is a preview

Do you want full access? Go Premium and unlock all 3 pages

Access to all documents

Get Unlimited Downloads

Improve your grades

Already Premium?

STUDENT NUMBER: 53384555

NAME AND SURNAME: SILINDILE ZAMA CONCO

OHS2601 EXAMINATION

DATE: 13 May 2024

QUESTION 1

i. The South African social security has some shortcomings, and it cannot provide

comprehensive social security protection to everyone in the country. The major

shortcomings are:

• Social insurance schemes only protect workers in the formal sector of the

economy (formal employment bias).

• The extent of inequality in the system between genders, races, and rural

and urban employees.

• Social insurance only provides protection against certain risks (risk-based

approach); and

• The administration of the system is fragmented, which leads to increasing

inefficiency, confusion, and lack of accountability.

ii. (1) The compulsory deductions to be made from the salary of its employees

(2) When, where and to which funds these must be paid.

(3) What contributions the employer has to make

1) Must know partie’s rights

2) Duties

3) Entitlement and the process to foll to access these benefits

iii. Social assistance is sometimes also called ‘welfare’ because social assistance

in South Africa is mainly concerned with the payment of grants to the poor

Social insurance refers to scheme where an employee contributes to an

insurance fund and when the employee comes across specific risk which affects

her/his ability to earn an income (for example, when she/he loses her/his

employment or falls pregnant) the employee may claim some form of benefit

from that insurance fund.

QUESTION 2

i) An employer may not dismiss an employee, reduce his/her salary or detrimentally

alter his/her service conditions because the employee provided information that he/she

Why is this page out of focus?

This is a Premium document. Become Premium to read the whole document.