- Information

- AI Chat

5_6197350109743678030.pdf Auditing Calicut University 6 th sem bcom

Auditing (ADT2019)

University of Calicut

Related documents

Related Studylists

AuditingPreview text

AUDITING:- Definition-According to L.R: "an audit is an examination of accounting records undertaken with a view to establishing whether they correctly and completely reflect the transaction to which they relate". In short auditing include :- a. examination of books, accounts, other records and supporting vouchers. b. Checking arithmetical accuracy of the books of accounts. c. Ascertaining whether the working results. for a particular period as shown by profit and loss accounts and the exact financial position of the business reflected in the Balance sheet are correct. d. To verify whether the profit and loss accounts and Balance sheet exhibit and a true and fair view of the state of affairs of a concern. e. Investigation into certain-evidences when the auditor suspects fraud or errors. f. Verifying whether the accounts and final accounts have been prepared in accordance with law. g. Auditing is to be done by independent persons, qualified for the job. Reason for the Development of Professional Audit:

- Renaissance

- Introduction of double entry

- I ndustrial Revolution

- Introduction of Statutory Auditing.

- Companies Act 1956.

- International Standard for Accounting and Auditing.

- Court Judgments

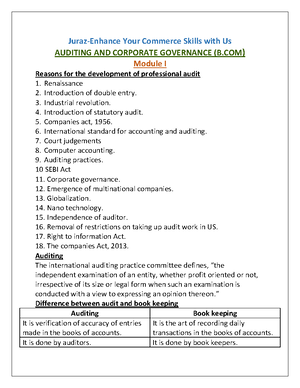

- Computer Accounting Differences between Book Keeping and Auditing Book Keeping Auditing It is the art of recording the daily transactions in a set of financial books (Journal and Ledgers)

The work is done by junior accountants or Bookkeepers

Generally, bookkeepers do not posses any specialised training for· recording business transactions

The work in bookkeeping is concerned with journalising, posting, totalling and balancing various ledger accounts.

The work is more or less of mechanical in nature

Bookkeeping is a continuous process

Bookkeepers are regular and paid employees.

It is the verification of the accuracy of the entries made in the books of accounts by accounts clerks The work is done by auditors

The Auditors are required to have special knowledge and training (qualified Chartered Accounts)

The main work is concerned with verification and thorough scrutiny of accounts.

The work of auditing is of technical nature

Generally auditing is at the completion of the year

Auditors are outsiders and are paid a fixed fee

MEANING OF AUDITING

Audit means a systematic examination of books to verify the authenticity and accuracy of transaction. Auditing means examine the authenticity of verifying the transactions with reference to vouchers, invoice, documents, bills and cash memos. Now a thorough scrutiny of the books of accounts and its ultimate aim is to verify the financial position disclosed by balance sheet and profit and loss of a firm. Features

- auditing is a systematic examination of book of accounts and other documents evidence transaction

- it is done by a qualified and independent person

- the opinion is made in the form of audit report

- the submitted to person who appointed to an The auditor

- auditing for the compulsory for joint stock company

- general auditing is carried of at the end of accounting year or periodically Differences between Auditing and Accountancy Accountancy Auditing Accountancy begins where Bookkeeping ends.

Where Accountancy ends, Auditing begins.

The man who performs the work of accountancy is called Accountant

The man interested with the work of auditing is called an Auditor.

It is not necessary for the accountant to pass the Chartered Accountant's examination.

It is compulsory for him to posses a CA Degree and a membership in the Institute of Chartered Accountants.

It includes preparation of trial balance, making adjustments, preparing profit and loss account and Balance sheet and the analysis and interpretation of the financial statement

Audit is concerned with the analytical and critical examinations of the books, accounts and the financial statements, to find out their accuracy

The accountant prepares trail balance and· final account of the concern

The Auditor is to find out whether the final account exhibits a true and fair view of the state of affairs of the concern The work of Accountants continuous throughout the whole financial year.

Auditing is generally undertaken after. 1 the close of the year when the final accounts have already been prepared An Accountant has to prepare the financial statements of the concern

The Auditor has to verify and report the accuracy and authenticity of the accounts, and see which is drawn as per Companies Act (In the case of companies).

OBJECTS OFAUDITING:

(a)Primary Object (Main or Principal object): As Taylor and Parry observes, "Today, the main object of Audit is to ensure the accounts reveal a true and fair view of business and its transactions. This leads to greater emphasize being placed on ascertaining the reliability of records from which the accounts are drawn up and also on verifying the assets, liabilities and transactions within the accounts" (b)Subsidiary objects or ancillary or incidental objects: 1. D etection and prevention of errors 2. Detection and prevention of frauds I) Detection a nd prevention of errors Types of Errors: a. Errors of Omission b. Errors of Commission c. Compensating Error or Offsetting Error d. Errors of Principles. Location of Errors : For locatio n of errors following steps are suggested

- Check the totals of trial balance

- Check the totals of all books with original entry.

- Compare t he names of accounts in the ledger with names of the accounts shown in trial balance

- He should check journal in the jour nal proper and its posting to the ledger

- He should check the total list of debtor and creditor and compare them with the trial balance

- If the books are maintained as the self-balancing system, error can been located with exhaustive scrutiny of the books of acco unts.

- Compare the items in the trial balance with the items of the trail balance of previous year to see if any item has been omitted. Prevention of Error: The prevention of error is not the primary object of audit. The auditor is not directly involv ed in prevention of error. The responsibility of the auditor rests with management. The auditor informs the weakness of internal check system and inadequacy in accountancy in the firms. The auditor an recommend the method for improvement in internal contro l system and accounting. II) Detection and prevention of fraud The fraud has been defined “ as intentional misrepresentation of financial information by one or more individuals among management, employees or third parties. Fraud may involve manipulation of records or documents misappropriation of assets suppression or omission of the effected transaction from records or documents, recording transactions without substance or misapplication of accounting policies. The responsibility, of an auditor to detect fraud arises only in the following circumstances ADVANTAGES OF AUDITING Advantages to the business a. Auditing of accounts helps in detecting and preventing errors and fraud in accounts b. It puts a moral check on employee and defalcations are avoided. c. Audit ensure the accuracy of the account records are made up to date. d. i t ensures the authenticity and reliability of the financial statements

e. Loans and credit can be easily obtained from Banks and financial Institutes f. If an auditor audit client account regularly he can give a close touch with the business and its accounts. Advantages to the owners of business a. The business owned by soul trader and partners in partnership can rely on the audited financial statement b. In the case of shareholders of joint stock companies who have no hand in the actual running businesses, auditing assured them of the proper maintenance of the account and prevents direction from taking in undue advantages of their position c. A case of a co-operative society or trust, audit assures the members that the affairs of the society or trust can conducted properly and their interests are looking after properly. Advantages to the society a. Audited statement of accounts more reliable to creditors and banks for sanctioning credit and other advantages b. Income tax and sale tax authority consider audited account to be reliable c. Settlement of dispute between workers regarding demand for more wages and bonus, audited accounts are considered valuable and reliable document d. For determining fire insurance claims previous year audited financial statements are useful Limitations of auditing a. Auditing does not show signals and insufficient of management and business ethics b. The auditing may not reveal cleverly done manipulations c. In most cases the genuineness of audit is questionable d. Due to lack of time and cost of audit sometimes auditor adopt a method of test checking. it means that audited account may be in completed and incorr ect. e. The personal judgement of auditor is sometimes faulty. there for the audited account may not exhibit the correct position Investigation: Investigation means an act of detailed examination of books and accounts and commercial and financial position of a business firm. Investigation is carried out in an organization for a specific purpose. The gravit y of the enquiry runs m to several years' business activities. On the basis of investigation report, opinion can be formed and action taken accordingly. Theref ore the term Investigation maybe referred to as “ Special Audit''. But Investigation is not compulsory; it is in addition to the regular audit. Definition : "Investigation involves enquiry into facts behind the books and accounts, into the technical, financial and accounts, in to the technical, financial and economic position of the business of organizations" "Taylor and Perry Lancaster defines investigation as to an examinations of and enquiry into the accounts of a business with a view to disclose the true position of affairs in relation to the special matters failing within the scope of investigations".

the state of affairs of the company, he must ask the directors to set the irregularities alright and if the directors failed to give satisfactory explanations of irregularities (answered in the negative) as referred in section 227 (2) the auditor must mention the fact in his report. So a qualified report is a report in which the auditor inserts any qualifications or modification or reserv ations. A qualified report is also called a negative report or an adverse report. RELEVANT AUDIT: Appropriateness is to measure of quality of audit evidence ie its relevance and reliability. To be appropriate, audit evidence must be both relevant and reliable in providing support for the conclusions which the auditor's opinion is based. T o ensure that information provided into financial statements are of high quality and are acceptable worldwide the Auditing and Assurance standards board under the Council of institute of Chartered Accountants ICAI have formulated few standard Basic Principles of Auditing or Rules of Auditing or Philosophy of Auditing Meaning: The Basic Principles of Auditing are the set of rules according to which the books of accounts of the firm should be audited. The set of rules are called basic principles of auditing on the basis of these principles the whole work of auditing should be done. The basic principles of auditing are also called the rules of auditing or philosophy of auditing Definitions: W. Homes defines "Auditing principles are the basic truth, which are indicative of the objective of auditing” statements on the Standard Audit Practices (SAP 1) describe the basic principles, which govern the auditor's professional responsibilities, and these should be complied with whenever an audit is Carried out

- Integrity objectivity and independence: The auditor should be straightforward, honest and sincere in his approach to his personal audit work.

- Confidentially: The auditor should maintain strict confidentiality of the information’s acquired in the course of this audit work

- Skilled and competence: An efficient auditor must poses certain general qualities beside statutory qualifications, so that he can carry out work efficiently and smoothly

- Work performed by others: When auditor delegate work of audit to Junior auditors or exports he will continue to be responsible.

- Documentation: The auditor should collect and preserve all documents according to their importance of materiality

- Planning of audit : R earranging and coordinating the work of audit of a client is called planning of audit

- Audit evidence: The auditor gathers sufficient appropriate audit evidence to his satisfaction to frame this report and form opinion as financial informations.

- Accounting systems and internal control:It is the responsibility of the management to maintain an adequate accounting system suitable to the nature and the size of business

- Audit conclusion and reporting: At the end of the audit of a firm, the auditor should review the audit work DISCLAIMER OF OPINIONS

If the auditor may not have any sufficient information's upon which has can base his opinion on the accounts and the financial s tatement, he can dis claim an opinion. He should report that he has insufficie nt information's to form an opinion as regar ds the financial statements REPORT ON CORPORATE GOVERNANCE As per n ew clause 49, of listing agreement of SEBI every listed Company is required to obtain a certificate from the auditor of the company regarding compliance if the conditions of corporate governance as stipulated in the clause. this certificate is required to be not only annexed to the director's report but also suit to the Stock Exchanges along with the annual returns of the company GENERAL BASIC PRINCIPLES OF AUDITING l)Principles of Objectivity: The financial positions of the business as revealed by the financial state ments must be based on facts. 2)Principles of Evidence or Materiality: The Auditor should collect and preserve all documents according to their importance or materiality. 3)Principles of Independence: The auditor should not be influenced by any bias in discharging his duties 4)Principles of full Disclosure: An auditor must p repare audit report correctly and forcefully precisely and clearly 5)The Principle professional Ethics: An auditor has to observe certain Code of Conduct and professional ethics 6)Objectives of Auditing Principles: According to changing economic nature, globalisation and evaluation of corporate governance Aud it procedures and Concept of Auditing Audit procedures are acts to be performed during the course of Audit. Audit procedures are adopted to obtain true and fair view of the accounts under audit Basic Concept of Auditing There are five basic concept of auditing they are:

- Evidence

- Due audit care

- Fair presentation

- Ind ependence

- Ethical Conduct

- Evidence: the auditor collects sufficient an d appropriate audit e vidences from vouchers and other documents through verification, inspection, enquiries and observa tio n.

- Due audit care : The audit due care means that the auditor has

Auditing techniques: this are the devices which are adopted in applying the basic principles and auditing standards the techniques of suit are devices or methods through which an auditor conducts his audit work obtain maximum perfection Important Audit techniques:

Vouching

Confirmation: It is the technique through which an auditor communicates with outside parties

Enquiry: Enquiry is the technique of making enquiries with the responsible officials of the client and obtaining in depth information.

R econciliation: It is the technique of identification and explanation of the items which cause the difference between two related items.

Physical examination: It is the technique of ascertaining the actual existence.

Test checking

Analysis of financial statements

Scrutiny or scanning: It is the technique of making a quick and overall examination of books of accounts to verify whether the transactions are correctly and completely recorded in the books of account.

Extension verification: It is the technique of multiplying two or more amounts to verify whether the totals have been correctly arrived at.

Posting verification

Documentary examination

Observation: It is the technique by which an auditor observes or witnesses an act performed by others.

Footing: Footi ng is the technique of adding the columns of different accounting figures to test the accuracy of the total.

Flow charting: It is the technique of using flow chart to describe graphically the cause of the transactions through different stages from the beginning to the end. Nature of audit techniques: auditing techniques are not constant they are subject to change according to business to business period to period technique of tools adopted by and auditor in performing the work of audit Planning audit: Pre -a rranging and coordinating· the work of Audit of a client is called planning of Audit. After deciding the type of Audit, the auditor takes the following preliminary steps:

Letter of Appointment.

Study nature scope and duties.

Acquire knowledge about Business an its nature of Study of legal documents pertaining to business

He. should. obtain the li~t of all book maintained in the office. 6. Verification of openfug. entries

Exam ine accounting system

Internal check system·

Dut ies of members of the ·. clients staff

List of principal officials

Instruction to the client

Preparation of an audit programme

Distribution of work

Preparation submission of audit report. Audit Note Book: Audit notebook (audit memorandum) is the book kept by the audit clerk. It is a register or diary maintained by audit clerk during the course of audit. A separate audit notebook is miaintailied for each concern It is kept as a pepnanent record. lt helps th e auditor in his subsequent audits. It is also used as a guide to the other audit clerk. Advantages of audit notebook:

it enables the auditor to record all-important points which arise during the course of audit.

It. acts as documentary evidence in favor of auditor in future.

It helps to prepare audit report.

It can also. be a guide for audif clerks during subsequent audit.

It is a tool to measure the efficiency of audit staff.

Disadvantages:

- It may create misunderstanding between the client staff and the audit staff.

- If the Audit Notebook is not properly rly and carefully prepared, it can be used as an evidence against the auditor for negligence

- It develops a fault finding attitude in the minds of the audit staff. Documentation: According to Statement on the Standard Audit Practices (SAP) issued by the council of Institute of Chartered Accountants of India, defines as " The auditor should document matters which are important in providing evidence that the audit was carried out in accordance with the basis principle of auditing” audit work paper : connection with each audit the auditor will be e having number of detailed document statement note and other valuable information pertaining to the accounts which are under audit these paper are properly arranged and process received carefully does file are called to working papers Audit programme : it is a detailed plan of the audit work to be performed specifying the procedure to be followed in verification of each item in the financial statement and giving the estimated time required Advantage of audit program

- it define duties of clearly clearly

- it know the volume of work done earlier

- audit program fixes responsibility of audit staff

- if defends the auditor

- tim ely completion of audit Disadvantage of Audi program

- out of data useless

- no chance to use intelligence

- unable to cover all the point

- not suitable to all type of firm

Procedure of Audit*

- Routine checking

- Test checking

- Surprise checking.

- Audit in depth.

- Adoption of distinctive tick mark, check mark etc... Surprise checks: constitute a system under which an auditor makes a surprise checking of some of the important items. Surprise check, wholly cover; a) Verification of cash. b) Verification of investment. c) Verification of records relating to stocks and stores. d) Verification of books of original entry. Routine checking: It is the checking and casting common books of accounts by the auditor. It involves following activities. a) Checking, casting and sub casting of such books. b) Checking of posting into ledger book. c) Checking the balances transferred from one book to another Advantages of routine checking:

- It facilitate through checking of books of original entry. 2)Posting under routine checking, posting are completely checked. 3)Thorough checking of casting and posting are involved.

- Verifying the arithmetical accuracy in the entries.

C)cash audit:It is the type of audit under which only cash transactions are andited D)special audit:It is the type of audit conducted by the Central government for the same special objectives under section 233A of the companies act 1956 of the central government is empowered appointment to special auditor in the case of companies and under certain circumstances E)operation audit: it is a part of management audit it is usually conducted by external auditor is known as “management consulting service” F)efficiency audit: this type of audit is conducted for the purpose of increasing efficiency of the firm it is also aimed at reaping maximum profit from existing situations G)detailed audit:it is referred as continuous audit or a running audit or complete audit H)propriety audit: it is a part of management audit it is treated as high form of audit I)performance audit: it is a part of management audit under the audit the auditor has evaluate the performance of the concerned with their determined target to see whether the firm is yielding the result which are expected J)regulatory audit: it is conducted by private business for the main object of this audit is to see whether every transactions as approval and sanitioned by competent authority transaction made as per law Vouch and post audit :it is a detailed audit it involves the detailed examination of all transactions by the auditor which are the preparations of original entry till it has been posted new generation audit :New dimension of auditing are the auditing area in the recent years the instability in the purchasing price in the last three decades made a considerable change in the present value of the asset and liability especially valuation of closing stock ,providing depreciation value of asset are different from original price and present value

- infla tion audit:Price instability is common phenomenon in the business world the accounting effect of change in price is known as inflation accounting during inflation period net profit will be alarming figure that the real profit it is due to limitations historical cost based on accounting system

- Human resource accounting and auditing: its auditing is in blueprint stage it required so many researches and experiments to develop an effective system of human resource accounting in coming years the auditors will be called upon to evaluate human resource investment

- Social audit:Social audit is now receiving worldwide acclaim and is declared all over the world it is device to measure the benefit made by an enterprise to the society

- energy audit: Energy audit offers industry an opportunity to maximise energy conservation it is an opportunity to hike profit and certain global competitiveness

- peer review: it is a system is a supervision audit it is an audit of auditors performance it is conducted by another auditing firm authorised by institution of

chartered accountant of India peer review aims it is improving auditors skills and care also improving quality of audit work 6. IFRS: The emergence of multinational companies which authoriseb the same auditing firm to the audit their companies accounts the worldwide cope with the new demand international Federation of accountants last step up for coordinating worldwide according profession international financial reporting standard 7. Foresenic Audit: foresenic auditing is a recent origin in the sphere of auditing this type of auditing may be conducted for collecting evidence that can be used in court of law or legal proceeding for foresenic auditing is detailed investigation of financial and non-financial records regarding the allegation of financial fraud and other financial crimes of your firm or its executives Vouching : Vouching is the act of checking or examining the entries made in the books of account with the supporting the documentary evidences or vouchers. In the wordsof .L ,”Vouching is an act of comparing entries in the books of account with the documentary evidence in support there off Obectives of vouching:

- The principal objective of vouching is to ensure that the transactions, as recorded in the books of accounts, are acceptable, genuine, properly authorised and correctly recorded.

- Another objective of vouching is to ensure that all the entries made in the books are supported by necessary documentary evidence.

- To see that all the transactions connected with the business have been recorded in the appropriate books of account.

- To ensure that no transactions, which is not connected with the business, has been recorded in the books of accounts. Detection of errors and frauds. Importance of vouching

- The success of an audit largely depends upon the care and attention with which vouching is accomplished.

- Vouching is the most potent tool in the hands of an auditor to ascertain the accuracy of the transactions recorded in the books of account.

- To see that all the transactions connected with the business have been recorded in the appropriate books of account.

- To ensure that there are no transactions, which are not connected with the business, has been recorded in the books of accounts.

- Detection of errors and frauds

- Vouchers *- A voucher is the documentary evidence in support of a transaction recorded in the books of account. It is a documentary evidence of an entry in a book of account. The following are the some of the examples of vouchers. a) Receipt obtained from a payee. b) Counter foil of a receipt. c) Purchase invoice. d) Sales invoice. e) Cash memo. f) Bank pay-in-slip.

g) A contract or an agreement. h) A resolution passed at the meeting of the board

Types of vouchers

- Primary vouchers:- a primary voucher is written evident in original. Purchase invoice, cash memos for goods purchased etc. are examples.

- Collateral or secondary vouchers:- even evidences in original are not available, copies of the evidences are produced in support. Again, sometimes, subsidiary evidences are also provided for the purpose of audit. Such vouchers are usually known as collateral or secondary vouchers.

Vouching of the important items on the debit side of the cashbook or cash receipt transactions* 1) Opening balance:- The opening balance of the cash book should be vouched by comparing it with the closing balance of cash book as shown in the audited copy of the balance sheet of the previou s year, 2) Cash sales:- The vouching procedure in regard to cash sales should be on the following lines:

- He should examine the system of internal check in operation in regard to cash sales.

- After ascertaining the efficiency of the internal check system as regards cash sales, auditor should vouch the cash sales as follows: a) Cash memos written by the salesman should be checked with the summery sales prepared at the end of the day. b) He should examine the rough cash book, if any. c) He should check up the rough cash book with the main cash book. d) The summaries of daily sales should be checked with the entries in the stock register. e) He should verify the daily deposit of cash received into the bank, pay-in slip also should be vouched.

- Receipts from debtors:- While vouching the receipts from debtors, an auditor should bear in mind the following points:

- He should enquire into the system of internal check in operation in regard to the receipt from debtors.

- After satisfying himself about the eff iciency of internal check in operation in regard to the receipt from the debtors, the auditor should conduct the vouching of receipts on the debtors on the. 4). Receipts from bills receivable:- Bills receivable include bills of exchange, promissory notes, and I.O’s received from debtors. The receipts from bills receivable can be in two ways. 5). Receipts from sale of investment: Vouching of receipts from the sale of investment should be on the following lines: a) Investments are usually sold through brokers, as such, broker’s sold notes or contract notes should be examined to vouch the amount from the sale of investments. If the sale of investment has been effected through the bank, then, the bank advice should be examines to vouch the amount receiv ed from the sale of investments. b) The sale proceeds of the investments should also be checked with the related investment account with the stock market quotations.

Vouching of payment made for the acquisition of patents

- If the patent has been purchased, the auditor should vouch the payment made for the patent with the help of the contract for sale and the receipts for the payment obtained from the seller.

- If the patent has been purchased through an agent, the auditor should vouch the agent commission wit h the help of agents account and receipt given by the agent. He should see that the agent’s commission is capitalized.

- He should see that expenses incurred on the purchase of the patent are capitalized.

- Where the patent is acquired through research, the auditor should see that all the expenses incurred on the experiments and the research connected with patents are capitalized.

- He should see that payments made towards the renewal fee are charged to revenue account.

- He should actually see the patent. Vouching of wages

- He should enquire into the system of internal check in force in regard to the maintenance of wage records, preparation of wage sheet and payment of wages.

- If the internal check is effective, the auditor can conduct the vouching of wages on the following lines. a) He should check a few items of wage sheets here and there to ensure that the calculations are correct. b) He should check totals of wage sheet with the cash book. c) He should see that the amount of cheque drawn for wages tallies with the totals of wage sheet. d) He should see that deduction from wages have properly adjusted and recorded in the books. e) He should see that wages recorded in the cash book have actually been paid. f) He should examine the system of employment of casual labour and check the payment made Valid voucher:

- the authority of the voucher

- The authenticity of a transaction

- The genuineness of the voucher accuracy and correctness of the voucher Teaming and lading or lapping :it is method of committing fraud in connection with the receipt of cash from debtors. Prof meigs says “lapping may be defined as concealment of a shortage by dealing the recording of cash receipts”. Vouching impersonal ledger : this are other than personal ledger .it is also termed as general ledger or nominal ledger .it as classified in to two nominal and real accounts

- Deferred Revenue Expenditure

- Capital Expenditure

- Revenue Expenditure

- Contingent Liability

- Contingent Assets

Verification of various assets:

- Cash in hand and bank balance

- Physically count the cash in hand

- Surprise visit to business premises

- Count different kinds of cash balances simultaneously

- Count currency notes,

- Cash at bank

- Compare bank balance as shown by the cash book with the bank balance

- Preparation of bank reconciliation statements

- Obtain separate certificate for fixed deposit account, savings bank account, etc. 3 advanced

- Examine the schedule of loans granted.

- Verify the loans advanced with the help of loan agreement

- Examine the authority of person granting the loans.

- Bills receivable

- Examine each bill in hand to ensure that it is properly drawn.

- obtaining certified schedule of bills

- Compare the schedule of bills in hand with bills receivable book and bills receivable account.

- Debtors

- Check internal control system

- Test checking

- Discount allowed

- Bad debt and its provisions

- Stock in trade

- Raw material - Work in progress – Finished goods

- Ensure existence of stock and its correct valuation

- Investment

- Schedule of investment

- Certified list of investments

- Verify trust deed if investment held by trust.

- Free hold property

These are the properties owned by the client on

permanent basis. It includes land and building,

premises, etc.

- Verify legal existence with the client

- Check opening balance

- Lease hold property

It includes land and building taken on lease by

the client for a fixed period.

- Verify lease hold property with lease Agreement

INTERNAL CONTROL Internal control is the whole system of control established by the management for the proper conduct of various activities of the organization. It is not only internal check and internal audit but also the whole system of control financially and otherwise established by the organization in order to carry out the business in orderly and efficient manner. It is useful for the organization to safeguard the assets and serve the reliability of accounting records. In other words, it is the overall control adopted by the organization.

Features

- It is the overall control adopted by the management.

- It comprises of plans, methods and procedures for the effective control of the operations of the business.

- It comprises of internal check, internal audit, accounting system and administrative control.

- It is established by the management.

- It intended to help the management to run the business efficiently. Objectives of internal control:

- To ensure that transactions are recorded proper books of account.

- See that all transactions are carried out only on account of a sanction of authority.

- See that management policies and decisions are properly implemented.

- To ensure efficient conduct of business.

- To evaluate the efficiency of performance of the various personnel Scope or Area of internal control

- Accounting Control.:- It ensures the reliability of accounting transactions. Accounting transactions are recorded by using accounting principles.

- Administrative Control:- It is concerned with distribution of authority and decision making process of management. Overall operation efficiency of the organization is ensured. Essentials of Good internal Control

- It should be clear and well developed plan of organization.

- There should be competent and trust worthy personnel for the success of the business.

- There should be segregation of duties: - Operational duties are separated from recording duties. Physical handling of asset must be separated from accounting records.

- There should be administrative traditions and practices for the performance of the duties.

- There should be well developed and adequate accounting system.

- There should be a sound system of maintenance and recording of accounts.

- There should be effective internal check system.

- There should be good audit system.

- Periodical review of internal control. Advantages

- Provide accurate and reliable data to the management for taking correct decisions.

- Ensure that policies and procedures are complied with.

- Promotes operational efficiency.

- Help to attain organizational goal.

- To safeguard the assets of the organization.

- To ensure the reliability of accounting records. B. Advantages to the auditors

- Helps the auditor in framing the audit program.

- To ascertain extent of test check can apply.

Limitations of Internal control

- Expensive.

- Transactions of unusual nature may not be subject to internal control.

- Human errors remain in any system of control.

- Limitation of preventing frauds committed through collusion between persons.

- It may not be keep pace with the change in the

condition.

Internal check : It is an arrangement of accounting work

under which the work of one person comes under the

security of another person. So, that it is not possible to

commit fraud without collusion between two or more

persons. In other words, it is an arrangement of

accounting system under which no one person is

allowed to carry out one work completely Specialization

& division of work is important one. The work of one staff

is automatically checked by another person in order to

locate errors and frauds.

Advantages

A. Advantages to business

- Proper division of work

- Fixation of responsibility

- Greater efficiency of the staff.

- Increased carrying capacity.

- Early detection of errors and frauds.

- Easy preparation of final account.

- Truth and accuracy of accounting can be available. Limitations:

- Suitable only for big concerns

- Sacrifice of quality for quickness.

- Certain type of disorder, confusions etc. in the working of the organization.

- Useful only when there is no collusion between employees.

- Risky for the auditor. Objectives

- Proper division of work.

- Minimization of errors and frauds.

- Easily detection of errors and frauds.

- Ensures the reliability of accounts.

- Easily preparation of final accounts.

- Simplification of the external auditors work Internal Audit: The management of an organization may want the safety of having an independent audit team within the organization, that keeps a constant check on the accounting and finance practices. So they usually set up an internal audit. This is quite different from a statutory audit Objectives of internal audit

- To ensure the management that the internal check and the accounting system are effective in design and operation

- it is the independent review of operation of the business

- keeps watch over the income and expenditure of the business Operational auditing : the contribution of internal audit .this operational audit is the same as internal audit .opration audit is generally applied in large business firm

Object ives of operational audit: 1 make suggestions for improving operational efficiency and increase profitability 2 help to achieve other operational objectives such as development and better utilisation of man power 3 see whether the control are efficient to help management 4 see wether the cost control are efficient in proportion to volume of business Rights and duties of an auditor

- Right of Access to Books of Accounts: Every auditor of a Company has a right of access at all times to the books of accounts and vouchers of the company whether kept at the head office of the company or elsewhere. Thus, the auditor may consult all the books, vouchers and documents whenever he so likes. This is his statutory right. He may pay a surprise visit without informing the Directors in advance but in practice, the auditors inform the Directors before they pay their visits.

- Right to obtain Information and Explanations: He has a right to obtain from the Directors and officers of the company any information and explanation as he thinks necessary for the performance of his duties as an auditor. This is another important power in the hands of the auditor.

- Right to Correct any Wrong Statement: The auditor is required to make a report to the members of the company on the accounts examined by him and on every Balance Sheet and Profit and Loss Account and on every other document declared by this Act to be part of or annexed to the Balance Sheet or Profit and Loss Account which are laid before the company in General Meeting during his tenure of office. The Directors have a duty to prepare them and present them to the auditor.

- Right to visit Branches: According to section 228, if a company has a branch office, the accounts of the office shall be audited by the company’s auditor appointed under section 224 or by a person qualified for appointment as auditor of the company under section

- Where the Branch Accounts are not audited by a duly qualified auditor, the auditor has a right of access at all time to the books, accounts and vouchers of the company and thus, may visit the branch, if he deems it necessary.

- Right to Signature on Audit Report: Under section 229, only the person appointed as auditor of the company, or where a firm is so appointed, only a partner in the firm practicing in India, may sign the auditor’s report, or sign or authenticate any other document of the company required by law to be signed or authenticated by the auditor. Duties of an Auditor

- Prepare an Audit Report : An audit report, in simple terms, is an appraisal of a business’s financial position. The auditor is responsible for preparing an audit report based on the financial statements of the company. The books of accounts so examined by him should be maintained in accordance with the relevant laws. He must ensure that the financial statements comply with the relevant provisions of the Companies Act 2013, relevant Accounting Standards etc.

sections are made compulsory for a case specified categories of asssess to assessnient year1985-86. Special areas of audit:

- Audit of public trust:sec 12A of income tax act 1961 provide tax audit for accounts of public trusts 11 and 12 of income tax act exempt certain incomes of public trust religious trust and institutions from calculating the taxanble income

- audit for claiming deductions u/s 35D 36E

- audit for claiming deductions u/s 80HH

- audit for claiming deductions u/s 80HHB for project outside India Management audit: in this word L. HOWARD “management audit is an investigation of business from highest level downward in order to ascertain whether sound management prevails throughout this facilitating to the most effective relationship with out side world and the most efficient org and smooth running of internal organisation “ Objectives of management audit:

- To Identify the overall objectives of the organisation

- To suggest improved and Better method of managerial operations

- To reviews the managerial service according to the requirements of the business

- To see that enterprise is successful in adopting itself to the technological change Features of management audit:

- The approach of the management audit is objectives and constructive

- The management auditor has to submit the report to management

- Management auditor looks beyond the accounting and financial matters

- The emergence of Management audit is from the limitations of financial audit

- it is a method of evaluating managerial policies Advantage of management audit:

- Management audit helps the management to achieve target

- it is good tool for management

- it is anticipated problems and suggests remedies

- it identifies to overall objectives of an enterprise Limitations of management audit:

- it lock the management from taking risky and dynamic decisions

- it would discourage the initiative and dynamic of potential managers

- introduction to management audit will be costly affairs

- it audit too be expensive and not suitable for small firm Scope of management audit : The management audit has certain objectives this new branches of audit as acclaimed good status along with the statutory audit prescribed by law hence not Compulsory is a kind of Internal audit which reveales defect in working and suggesting improvement to obtain the best result of operation the concern there for Management audit is the latest developed from of internal audit Appointment of management auditor : as management audit note statutory it is a Compulsory by law this audit is voluntary nature the enterprise can

appoint any person to undertake management audit the law does not prescribe any professional or educational qualification for your management auditor the scope of audit the period to be covered the time for submitting the reports are to be suggested by management and noted stipulator in this letter of appointment of the auditor Qualities of management auditor:

- He should be tactful dealing with the staffs with organisation

- He should have the ability to hard work

- He should be methodology in the performance of his duties

- He should be impartial

- He should have planning and dynamic personality

- He should have the courage and the ability to discharge his duties

- He should have a sound knowledge in preparing various report

- He should not be suspicious humble planet or operative in nature

- He should have ability to communicate the fact forcefully 10 should have knowledge in economics Duties of management auditor:

- All functional areas should be reviewed by the management auditor

- He a ssisted the management in drafting on the implementing plan and policies

- He can suggest best system for Interwell control system in the organisation

- He has the duty to suggest ways and meanings to achieve management objectives

- The recommended management for better utilisation of resources

Right of management auditor:

- Right to prepare and sign audit report

- right to receive remuneration for the work

- he has the right of access to books of accounts records

- right to make evaluation and monitoring various managerial policies

- Right to have legal and technical advise from experts Removal management auditor: The board of directors of the shareholders or the management have the power to terminate service of the management auditor before determination of the auditor a proper note is required to be so in advance this is the reason for termination of the auditor must be reported to the board of directors Replace management auditor: The management audit can be replaced by pursuing of resolution with the special notice in the general meeting the resolution has to be supported by three fourth majority of the members present in the meeting Qualities of good management audit :

- audit report should be correct

- it should be courteously worded

- it should be foreful and convincing

- it should unbiased free from mistakes

- it should express opinion

Auditing assurance standards:( AAS) 1: Basic principles 2: objective and scope 3: audit documentation 4: Auditor’s responsibility 5: Audit evidence 6: Risk assessment and internal control 8: audit planning 26: Terms of audit engagement 27: Communication of audit matters CORPORATE GOVERNANCE Corporate governance Conducting of business in accordance with shareholders desire while confirming to the basic rules of the in the law. It refers to the structure & process for the efficient and proper direction & control of companies in the interest of all stakeholders. Theories of CG

- Agency theory:Agency theory defines the relationship between the principals (such as shareholders of company) and agents (such as directors of company). According to this theory, the principals of the company hire the agents to perform work. The principals delegate the work of running the business to the directors or managers, who are agents of shareholders.

- Stewardship theory :The steward theory states that a steward protects and maximizes shareholders wealth through firm Performance. Stewards are company executives and managers working for the shareholders, protects and make profits for the shareholders.

- Stake holder theory:Here the business has accountability towards different stakeholders in the society. Under this theory no only shareholders but also the other stakeholders are eligible for a fair return from the organization.

- Resource dependence theory:The Resource Dependency Theory focuses on the role of board directors in providing access to resources needed by the firm. The directors bring resources to the firm, such as information, skills, access to key constituents such as suppliers, buyers, public policy makers, social groups as well as legitimacy. Models of CG

- American model :It is a rule based model. They always check “is it legal” according to the law of the company. Also known Anglo-Saxon unitary board model. It consists of independent outside directors.

- UK/Commonwealth model: It is a principal based model rather than rule based. Here regulators enquire only “is it right” according to common law.

- Continental European model :It is basically rule based model. It is a two tire system in which there are two types of board; the management board and supervisory board. Management board is dominated by top management. Supervisory board is dominated by employees.

- Japanese business network model :This model follows a more stakeholders approach rather than shareholders approach.

- Asian family model :Under this model the power of decision making is vested with family and they have more influence in the government also.

Board committees

- Audit committee:The primary task of the audit committee is to oversee the relationship with external auditors to ensure the quality of the company’s financial statements. The audit committee’s role includes making recommendations on the appointment and reappointment of the external auditors, their remuneration, and their terms of engagement.

- Nomination committee :The nomination committee is responsible for leading the board appointment process, considering the requirements of the company and making recommendations to the board. This responsibility covers both executive and non-executive directors.

- Remuneration committee: The members of remuneration committees must keep independence, transparency and potential conflicts of interest at the front of their minds when deciding on remuneration arrangements.

- Stakeholders committee: It is to create policies, pro cedures, and statutory guidelines to ensure fast consideration of various issues raised by the stakeholders.

- CSR committee :To ensure the corporate governance and social responsibility and practices are followed by the organizations. This committee monitors and report on CSR activities.

Insider trading Insider trading refers to the practice of purchasing or selling a publicly-traded company’s securities while in possession of material information that is not yet public information. Material information refers to any and all information that may result in a substantial impact on the decision of an investor regarding whether to buy or sell the security. Rating agencies Corporate Governance Rating (CGR) is an opinion on relative standing of an entity with regard to adoption of corporate governance practices. It provides information to stakeholders about the level of corporate governance practices of the entity.

- Moody’s Investors service: Moosy’s Corporation was founded by John Moody’s in 1909 headquartered at New York

- Standards and poor’s: S&P global is popularly known as Standards and poor is one of the global financial service agency provides incorporated in 1941.

- Fitch Rating :It is an international credit rating agency head quartered at New York and London, founded by John Knowles Fitch in 1914.

- CRISIL :It is the first credit rating agency in India established in 1987. It provides separate rating services for corporate governance.

- CARE :CARE rating is considered to be the second largest credit rating agency in India. The agency started in operation in 1993.

- ICRA :ICRA was established in 1991 by leading financial institutions and companies.

Common governance problems

- Regulators mistake

- Supremacy of CEO

- Lack of vigilance by auditors

- Individual/concentrated ownership

- Incompetent board

- Misleading accounting policies

- Insider trading

- Poor investment policies

- Exorbitant rate of borrowing

CODES AND STANDARDS ON CORPORATE GOVERNANACE

- CADBURY REPORT (1992) UK

- Appointment of independent non- executive directors.

- Board should form audit committee

- Divide responsibilities between chairman of the board and chief executives

- Establish remuneration committee

- Nomination committee

- GREENBURY REPORT

- Remuneration committee should consist independent no-executive directors

- Chairman should answer to shareholders

- Annual report should mention remuneration

- Directors contract should not exceed 1 year

- HAMPEL REPORT

- CG should base on board principles

- Separation of responsibility

- Board should accountable to shareholders

- Self -regulation is required

- UK COMPAINED CODE (1998)

- It is the combination of Cadbury, Greenbury, and Hampel recommendations on matters of corporate governance.

Other reports Turnbull report (1999): for internal control mechanism Higgs Report (2003): re-examination of corporate governance practices Smith report (2003): for audit committee Tyson report (2003): for recruitment and development of directors

Code from international agency Organisation for Economic Cooperation and Development (OECD) recommendations:

- Effective and efficient governance framework

- Protect shareholders right

- Equitable treatment to all shareholders

- Recognise role of shareholders

- Disclosure and transparency

**CORPORATE GOVERNANCE CODE IN INDIA

- CII Code (1998)**

- The Confederation of Indian Industries (CII)

- Board should consist professionals

- Board should meet six times in a year

- No directors who hold directorship in more than 10 companies

- Commission for their siting fee

- Che ck attendance register before appointing director

- All key information should pass to the board 2. Kumar Mangalam Birla Committee (1999)

- Board should consist executive and non- executive directors

- Audit committee with 3 independent directors

- Remuneration committee

- 4 meeting of board should held in a year

- Define role of management

- Directors can be member in up to 10 committees

- Information related to shareholders should pass to them Non mandatory recommendations:

- Role of chairman

- Declaration of half year performance

- Postal ballot 3. Naresh Chandra Committee (2002)

- Constituted by ministry of corporate affairs to find corporate frauds.

- Main objective is to suggest amendment on auditor client relationship 4. Narayana Murthy Committee (2003) Constituted by SEBI:

- Strengthening audit committee

- Audit committee member should be qualified

- Disclose all risk in the annual report

- Assessment of risk by board periodically

- Code of conduct to all to be implemented

- Nominee director is appointed by shareholders

- Whistl e- blower system 5. JJ Irani committee Constituted by central govt.

- 1/3rd of directors should be independent

- Maximum directorship limited to 15

- Implement clear remuneration policy

- Clearly mention duties of directors

- Compensation for frauds

- Fund for investor education and protection

- Framework for self-regulation

- N o relaxation in matters of CG

- E- filing of all mandatory documents

- Stakeholders relationship committee

- Describe duties of directors 6. Uday Kotak Committee (2017) Constituted by SEBI

- Increased minimum size of board from 5 to 6 and one women director

- 5 board meeting to listed companies

- Succession planning and risk should discussed with board

- Listed companied should prepare cash flo w

- Listed firm disclose earnings quarterly

- Minimum remuneration should be 5 lakh and sitting fee of 20000-

5_6197350109743678030.pdf Auditing Calicut University 6 th sem bcom

Course: Auditing (ADT2019)

University: University of Calicut

- Discover more from: