- Information

- AI Chat

Auditing&Corporate governence- -Bcom-Short note

Auditing (ADT2019)

University of Calicut

Related Studylists

AuditingPreview text

Juraz-Enhance Your Commerce Skills with Us

AUDITING AND CORPORATE GOVERNANCE (B)

Module I

Reasons for the development of professional audit

- Renaissance

- Introduction of double entry.

- Industrial revolution.

- Introduction of statutory audit.

- Companies act, 1956.

- International standard for accounting and auditing.

- Court judgements

- Computer accounting.

- Auditing practices. 10 SEBI Act

- Corporate governance.

- Emergence of multinational companies.

- Globalization.

- Nano technology.

- Independence of auditor.

- Removal of restrictions on taking up audit work in US.

- Right to information Act.

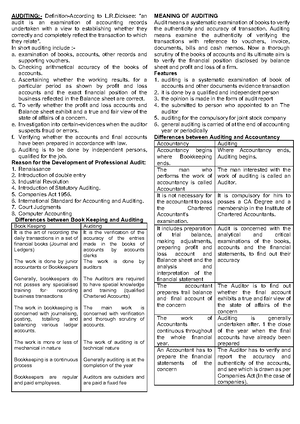

- The companies Act, 2013. Auditing The international auditing practice committee defines, “the independent examination of an entity, whether profit oriented or not, irrespective of its size or legal form when such an examination is conducted with a view to expressing an opinion thereon.” Difference between audit and book keeping Auditing Book keeping It is verification of accuracy of entries made in the books of accounts.

It is the art of recording daily transactions in the books of accounts. It is done by auditors. It is done by book keepers.

It is retrospective. It is of the current period. It is analytical in approach. It is constructive in approach. Auditors are outsiders. Book keepers are paid employees. It is at the completion of year. It is a continuous process. Difference between auditing and accountancy Auditing Accounting Where accounting ends, auditing begins.

Where book keeping ends. Accounting begins. It is done by auditor. It is done by accountant. Auditor is an independent person. Accountant is a permanent employee. An auditor is remunerated in the form of professional fee.

An accountant is remunerated in the form of salary. Auditing was a luxury concept. Accounting is a necessity. Objects of audit Primary object To ensure the accounts reveal a true and fair view of business and its transactions. Subsidiary objects a. Detection and prevention of errors. b. Detection and prevention of frauds. A) Detection and prevention of errors Errors in accounting are a) Errors of omission Errors of omission arises when a transaction is wholly or partly omitted being properly recorded in the books. b) Errors of commission It arises when a transaction has been recorded and wrongly entered in the original entry ledger due to negligence. c) Compensating error A compensating error is one which is counter balanced by another error.

- Audited accounts of company create a confidence in the mind of investors.

- Easily calculate purchase consideration on the basis of audited accounts. Disadvantages / Limitations of auditing

- It is costly.

- Loss of initiative.

- It is mechanical.

- Possibility of alteration.

- Impossibility of checking all transactions.

- Unsuitable for small concern.

- Rely on experts. Auditor as a watch dog not a bloodhound An auditor is appointed by the shareholders in case of a limited company. He is expected to play the role of watch dog for shareholders. His duty is verification not detection. If he finds something suspicious he should raise to the shareholders. In case of frauds and errors the auditor has the duty of reasonable care only. Watch dog concept limit the scope of the audit, that it is merely verification of accounts and does not deeply cover the object of detection and prevention of fraud. Investigation Investigation means an act of detailed examination of books and accounts and financial position of a business firm. Objects/ purpose of investigation

- When the proprietor suspects fraud.

- When a person intend to purchase business.

- When a person wishes to purchase share of a company.

- When a person wishes to lend money to a business.

- It maybe conducted on behalf of income tax authority.

Difference between auditing and investigation Auditing Investigation The purpose of audit is to determine true and fair view.

The purpose of investigation varies from business to business. The audit relates to checking of all books and records.

Investigation relates to critical checking of particular records. Auditing is compulsory. Investigation is not compulsory. The auditing is conducted before the investigation of accounts.

The investigation is conducted after the auditing of accounts. The person who conduct auditing is called auditor.

The person who conduct investigation called investigator. The Qualification of auditor is chartered accountant.

There is no specific qualification for investigator. It has a narrow scope. It has a wide scope. Auditing is done at the end of the financial year.

Investigation can done over a period of years. Qualities and qualification of a professional auditor Professional qualification The auditor must pass Chartered Accountant examination conducted by ICAI. Professional qualities Knowledge of theory and practice of accountancy Knowledge of commercial law Knowledge of techniques of audit Knowledge of management accounting Knowledge of cost accounting Knowledge of economics Knowledge of mathematics and statistics Knowledge of industrial management Personal qualities Honesty Ability to work hard

General basic principles of auditing Principles of objectivity Principles of materiality Principles of independence Principles of full disclosure Principles of professional ethics Basic concepts of auditing Evidence Due audit care Fare Presentation Independence Ethical conduct Audit techniques Audit techniques are the devices, which are adopted in applying the basic principles and auditing standards. Important audit techniques

- Vouching

- Confirmation

- Reconciliation

- Analysis of financial statements

- Physical examination

- Test checking

- Scanning

- Verification of the posting

- Enquiry Audit planning Pre-arranging and coordinating the work of audit of a client is called audit planning. Preliminary steps involved in audit planning Letter of appointment Letter of engagement Study nature, scope, duties

Acquire knowledge about business and its nature Verification of legal documents He should obtain the list of all books maintained in the office. If it is not a new audit Examine the accounting system Internal check system Duties of the members of the client staff List of principal officials Instruction to the client Preparation of an audit program System audit Distribution of audit work Preparation and submission of audit report Audit note book It is a register or dairy maintained by audit clerk during the course of audit. It is also called audit memorandum. Advantages of audit note book

- It helps to prepare audit report.

- It is a tool for measuring efficiency of an audit.

- It is a guide for subsequent audit.

- It is an evidence for future.

- It avoid repetition of work. Disadvantages of audit note book

- It create misunderstanding between client and audit staff.

- It create faultfinding attitude in the mind of audit staff.

- If it is not properly maintained it considered as evidence for auditors negligence. Audit working papers Audit working papers are the documents which record during the course of audit. It is also called audit files. Content of audit working paper

- The trail balance

To assess the cost of audit Hurry in completion Timely completion of audit Not suitable for all types of firms It helps to new audit staff No chance to use intelligence Effective control over audit staff Rigidity Tick mark Tick marks are the symbols used during the course of audit, which indicates how much of audit works are done. Test checking It means to select and examine a representative sample from a large number of similar items. Routine checking The process of checking posting, casting balancing in ledger and subsidiary books are done in a routine manner are called routine checking. Surprise check It is a technique used by an auditor. He pays surprise visit to the client office and make surprise checking on certain important items. Audit classification Audit on the basis of organizational structure Audit on the basis of degree of independence Audit on the basis of conduct of audit Audit on the basis of specific objectives New generation audits I. Audit on the basis of organization structure Statutory audit It is a legally required audit to present the fair picture of the financial health of the organisation. It is a compulsory audit. Following are the undertakings in which statutory audit is compulsory a) Joint stock companies b) Banking companies c) Insurance companies d) Cooperative societies e) Public charitable companies

Private audit Private audit refers to the audit of accounts of private business enterprises. It is not compulsory audit. It includes a) Sole trader b) Partnership c) Private individual Difference between company and partnership audit Company Audit Partnership audit It is compulsory It is not compulsory Auditor is appointed by members Auditor is appointed by partners The power, duties and rights of auditor defined in companies act.

Defined as per agreement.

It is done year after year. It is done at discretion of partners. The auditor must be qualified u/s 226 of companies act.

Auditor need not hold those qualifications. Auditor reports to the members. Auditor reports to the partners. Government audit It means audit of accounts of government department and offices, government companies and government statutory corporations. Objectives of government audit To ensure every payment is made as per rules. To ensure expenditure sanctioned by competent authority. To ensure payment made to the right person. To verify payment made is duly entered in proper books. To verify system of granting travel allowances to employees. To verify system of granting daily allowances to employees. To ensure expenditure is classified into capital and revenue. To verify existence of stock and store. Difference between government & private (commercial) audit Government Audit Private Audit It is compulsory. It is optional. It is a continuous audit. It is done periodically.

No dislocation in the work of client

Does not help preparation of interim accounts 3. Balance sheet audit It is a type of audit. In this type auditor verify balance sheet items such as capital, liabilities, reserves, Provisions, assets and other items given in the balance sheet. 4. Interim audit It is a type of audit conducted in between two annual meetings. Advantages of interim audit

- Easy to find out interim results.

- It helps to declare interim dividend.

- Errors and frauds are quickly detected.

- It imposes moral check as the client staff.

- Final audit can be completed quickly. Disadvantages of interim audit

- More expensive.

- Dislocation of work of client staff.

- It required more detailed and exhaustive checking.

- It creates additional work of audit.

- It is easy to alter already audited figures.

- Suitable for large firms only.

- Occasional audit If the sole trader or partners conduct an audit for a specific object on special occasion such audit are called occasional audit.

- Partial audit It is a type of audit, which is carried out in respect of specified aspect of books of accounts of the business.

- Standard audit It is a type of audit rarely conducted in business firms. Under this type certain items in the accounts are thoroughly scrutinized and analyzed.

IV. Audit based on special objectives

- Management audit

It is the systematic evaluation of the performance of management of an enterprise. It is the critical review of all aspects and process of management. 2. Cost audit Cost audit is the verification of the correctness of cost records with a view to ascertain the cost of product. 3. Cash audit It is a type of audit under which only cash transactions are audited. 4. Special audit It is a type of audit conducted by the central government for some special objectives. The person who conduct special audit is called special auditor. 5. Operation audit It is a part of management audit. It is usually conducted by external auditor known as management consulting services. 6. Efficiency audit It is a type of audit conducted for the purpose of increasing efficiency of the firm. It is an aid to management. 7. Detailed audit It referred as continuous audit, running audit or complete audit. Under this type of audit, the auditor checks detail all books of accounts with regular intervals. 8. Propriety audit It is a part of management audit. It is treated as high form of audit. 9. Performance audit It is a part of management audit. In this type of audit, auditor evaluate the performance of the firm. 10. Regulatory audit It is conducted by private business firm. The main object is to see whether every transaction is approved and sanctioned by competent authority.

Vouchers Vouchers is documentary evidence, in support of transactions in the books of accounts. Types of vouchers

Primary vouchers Primary vouchers are original vouchers. They are written or printed, or typed evidence in original. Example: Cash memos, Invoices. Pay in slip

Secondary vouchers When original voucher is not available copy of the original evidences are produced in support or subsidiary evidence such vouchers are called secondary or collateral vouchers. Example: Bank reconciliation statement, copy of sales memo. Essentials of valid voucher

The authority of the voucher.

The authenticity of the voucher.

The genuineness of the voucher.

The accuracy of the voucher.

The correctness of the voucher.

Proper classification of accounts in to capital and revenue. While examine the vouchers following points must be paid special attention

All the vouchers are consecutively numbered and arrange serially.

He should examine the date of the vouchers.

He should see that information in the voucher is fully self- explanatory.

He should see that voucher is related to business in the name of the firm.

He should see that each voucher is original in face.

He should accept voucher in printed form.

He should not accept voucher in over writing or erasure.

He should complete vouching work in a one siting.

He should not take help of client staff for vouching.

He should see that every voucher is passed in the order by responsible officer. Vouching of cash book Vouching of cash book means checking of cash receipts and cash payments with supporting documents. Vouching of receipt side/ Debit side of the cash book Cash receipts Supporting vouchers Opening balance Previous years audited balance sheet Cash sales Cash memos with summary of salesman Receipts from debtors Counterfoils, pay in slip Receipts from B/R Debtors explanation for outstanding debt Bills discounted Cashbook, passbook, bills receivables book Sales of fixed assets Auctioneers note, sales deed Loans received Legal provisions, loan agreement Interest on bank deposit Bank passbook with bank advice Insurance claim money Correspondence insurance claim Receipts from Hire purchase

Purchase agreement, counterfoils of agreement

Subscription received Register of subscription, counterfoil receipt Commission received Agreement between client and party, cash book counterfoils

Vouching of payment side/credit side of cash book Cash receipts Supporting vouchers Bank overdraft Previous years audited balance sheet Cash purchases Cash memo, invoice, good in work book Payment to creditors Receipts issued by creditors, goods inward register, invoice minutes book Payment of wages Wage sheet, wage record, time and piece work card or record Payment of salary Salary register, attendance book, appointment letter, agreement minutes

Vouching of purchase return book The auditor needs to verify following points in case of vouching of purchase return books: He should compare credit notes with purchase return book. He should examine goods outward book. He should check entries in the purchase returns journal. He should check heavy returns at the start or end of the year. He should check the totals and postings to purchase returns and suppliers accounts. Vouching of credit sales or sales book The auditor should vouch credit sales in the following manner: He should apply test check. He should check some invoices with orders and outward entries. He should confirm sales of capital items not included in the sales. He should confirm trade discount allowed is not included in sales ac. He should send accounts statements to customers. He should confirm goods on consignment is not included in sales. He should check cancelled invoice against duplicate invoice copy. Vouching of sales returns The auditor should vouch sales return in the following manner: He should vouch sales returns entries with stock register. He should verify the copy of the credit note issued to customer. He should check posting from sales returns book to customer ledger. He should verify customer returns at the start and end of the year. Verification of assets and liabilities It means examination of establishing truth as existence, ownership, possession and valuation of assets and liabilities in the balance sheet. Difference between vouching and verification Vouching Verification It examine all the business transactions recorded in the original entry.

It examine assets and liabilities appearing in the balance sheet.

It is based on documentary evidence. It is based on both physical and documentary evidence. Work done by junior staff. Work done by auditor himself. It is not include valuation of assets It include valuation of assets. It is continuous and throughout the year.

It is one at the end of the year.

It take place first. It take place after vouching.

Objectives of verification of assets and liabilities

- To ensure assets and liabilities shown in the balance sheet actually exist.

- To satisfy that auditor assets and liabilities are properly valued.

- To ensure that assets are actually the properties of business.

- To ensure liabilities are actually held.

- To verify that they are free from any mortgage.

- To see that assets and liabilities are properly classified.

- To detect fraud and check arithmetical accuracy of posting. Verification of various types of assets Cash in hand Auditor use cash weighing machine to count cash. He should count cash, stamps, IOU in hand. He should check remittance from branches. He should check purpose of holding large cash balances. Documentary evidences should be verified in case of cash in transit. Cash at bank Auditor should verify pass book with cash book. He should compare pass book with BRS. He should obtain certificate regarding bank balances. He should see outstanding cheque are genuine. Loans advanced He should examine loans granted through loan agreements. He should see that loan amounts are confirmed by the borrower He should examine the mortgage deal.

Auditing&Corporate governence- -Bcom-Short note

Course: Auditing (ADT2019)

University: University of Calicut

- Discover more from: