- Information

- AI Chat

Was this document helpful?

Audit Risk issue - Student version

Course: Association of Chartered Certified Accountants - ACCA (PAC150)

181 Documents

Students shared 181 documents in this course

University: INTEC Education College

Was this document helpful?

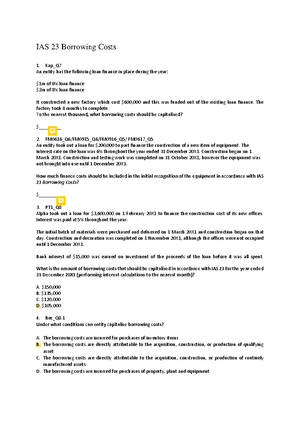

AUDIT RISK

Issue in Q

Audit Risk

Audit Response

1

Co. may not include

inventory quantity from

all warehouse into

their records.

- 10 warehouse

If the co. did not include all

inventories in 10 warehouse in

their records, then INVENTORY

might be understated.

Obtain list of all inventory in 10

warehouse and make sure it is

included in final inventory listing.

2

Co. introduced

perpetual inventory

count where all

inventory must be

counted at least once

during the year.

If the co. did not count their

inventory once a year, then

inventory might be

MATERIALLY MISSTATED.

Obtain Inventory count sheet for the

inventory count performed during

the year.

Ensure physical same as in the

system. / no discrepancies.

3

Co. have a lot of old

trade debtors, which

pay slowly.

If the co. did not provide

sufficient allowance for DD,

Then trade receivable might be

overstated.

Inspect POST YEAR END

PAYMENT RECEIVED from old

debtor if any to assess whether old

balance is recovered.

Inspect trade rec. ageing to identify

amount of long outstanding debt.

4

Co. released entire

bad debt provision.

If the co. released BD provision

while it is not VIRTUALLY

CERTAIN, then TRADE

RECEIVABLE is overstated.

Obtain bank statement for any

payment received.

And obtain correspondence from

the debtor.

5

Co. issues shares at

premium.

If the co. did not split between

SC and SP, then SC will be

overstated.

Recalculate SC and SP amount

and agree to the FS to verify

accuracy.

6

Co. took long term

loan from the bank.

If the. Co did not split loan

amount between CL and NCL,

Then NCL or CL might be

overstated.

Recalculate the split between CL

and NCL based on the loan

agreement and agree to FS.

Co. in negotiation

process to obtain loan.

The co. might manipulate their

FS to be able to get the loan

hence FS as a whole could

contain MM.

Apply professional scepticism while

auditing the FS.

Perform extensive Substantive

procedure.

7

The loan carried

interest rate of 5% per

annum.

If the co. wrongly calculate its

interest, then interest expense

might be materially misstated.

Recalculate interest expenses

based on loan agreement and

agree to the figure in FS.

8

Employee took legal

case on company. If

there is probable

chance to lose the

case.

If the co. did not recognise

provision for legal action,

Then PROVISION might be

understated

Enquire co’s lawyer on the

probability of the legal case and if it

is probable, ensure sufficient

provision recognise.

9

Employee took legal

case on company. If

there is possible

chance to lose the

case.

If the co. did not disclose

contingent liability for legal

action,

Then FS contain material

misstatement.

Enquire co’s lawyer on the

probability of the legal case and if it

is possible, ensure sufficient

disclosure.