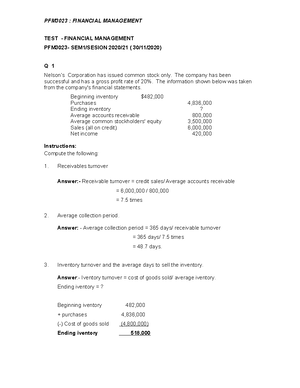

- Information

- AI Chat

B6AF111 Summer 2020 EXAM Paper

Account (AA101)

Kolej Poly-Tech MARA BANGI

Recommended for you

Preview text

Quality & Qualifications Ireland (QQI)

BA (Hons) Accounting and Finance

BA (Hons) Financial Services

SUMMER 2020 EXAMINATIONS

Module Code: B6AF

Module Description: Principles of Accounting

Examiner: Georgina Skehan

Internal Moderator: Andrew Quin

External Examiner: Date: Time:

INSTRUCTIONS TO CANDIDATES

Time allowed is TWO hours

SECTION A – Answer Question 1 (30 Marks)

SECTION B – Answer Question 2 (40 Marks)

SECTION C – Answer any ONE Question from Section C (30 Marks)

Section A This question is compulsory and must be answered (Answer sheets are provided for this question at the back of the exam paper)

Question 1

Section A consists of 10 multiple-choice questions, each question has 4 possible answers. There is ONL Y ONE correct answer in each part. Each correct answer is worth 3 marks.

i. Which of the following balances would appear on the same side in the trial balance? A. Drawings and sales

B. Drawings and purchases

C. Capital and purchases

D. Capital and buildings

ii. John posted and invoice for motor repairs to the motor vehicles at cost account. What term is used to describe this type of error?

A. Error of omission B. Error of commission C. Error of principle D. Error of transposition

iii. Started a business with €85,000 in the bank. What is the double entry?

A. Debit Bank Credit Cash

B. Debit Bank Credit Purchases

C. Debit Bank Credit Capital

D. Debit Bank Credit Assets

iv. Which of the following best explains what is meant by ‘capital expenditure’?

A. Expenditure on non-current assets, including repairs and maintenance

B. Expenditure on expensive assets

C. Expenditure relating to the issue of share capital

D. Expenditure relating to the acquisition or improvement of non-current assets

viii. The double entry for goods taken from the business by the owner for personal use

would be? The goods had a selling price of €600 and a cost price of €400.

A. Debit Drawings €400 Credit Purchases €

B. Debit Drawings €400 Credit Closing Inventory €

C. Debit Drawings €600 Credit Purchases €

D. Debit Drawings €600 Credit Closing Inventory €

ix. Which of the following would normally be a debit balance in the trial balance?

A. Land

B. Bank overdraft

C. Capital

D. Sales

x. Which of the following explains the imprest system of operating petty cash?

A. Weekly expenditure cannot exceed a set amount.

B. All expenditure out of the petty cash must be properly authorised.

C. Regular equal amounts of cash are transferred into petty cash at intervals.

D. The exact amount of expenditure is reimbursed at intervals to maintain a fixed float.

Section B

The following trial balance has been taken from the books of Sapphire Ltd for the year ended 31 st December 2019. Dr Cr

________ ________

- Question This question is compulsory and must be answered

- Ordinary share capital 600, € €

- Land 300,

- Buildings (cost €600,000) 276,

- Machinery (cost €300,000) 243,

- Retained profits 31 December 2018 40,

- Opening inventory 1 January 2019 90,

- Purchases 900,

- Carriage in 3,

- Sales 1,680,

- Returns in 5,

- General expenses 70,

- Directors remuneration 110,

- Wages and salaries 80,

- Rent 35,

- Insurance 40,

- Electricity 17,

- Advertising 16,

- Motor expenses 15,

- Bad debts 5,

- Accounts receivable 85,

- Accounts payable 194,

- Allowance for doubtful debts 5,

- Bank 460,

- 8% Debentures 250,

- Ordinary dividend paid 10,

- Debenture interest paid 9,

- 2,770,500 2,770, ________ ________

Section C Answer any ONE question Question 3

On 10 January 2020 Mary received her bank statement for the month ended 31 December 2019. The bank statement showed a balance of €88,480 (overdraft) as at 31 December while the cash book showed a balance of €89,518 (credit) as at the date. On examination of the cash book and the bank statement the following were discovered:

- Bank charges of €402 had not been recorded in the cash book.

- Mary exceeded her overdraft limit during the month of December. The bank had therefore charged her a penalty of €500. This was not reflected in the cash book.

- A cheque of €2,460 had been returned by the bank as dishonoured. As the cheque had been dishonoured the bank charged Mary €30. This was not reflected in the cash book.

- Standing orders and direct debits of €2,230 had not been posted to the cash book.

- Receivables had lodged €5,600 directly to the bank account. No record had been made of this in the cash book.

- Lodgements of €15,240 lodged to the bank on 31 December, had not been credited by the bank.

- Cheques valuing €16,300, drawn on the bank account, had not been presented to the bank for payment as at 31 December.

Required

A. Prepare the adjusted cash book for the month of December 2019 (16 marks) B. Prepare a bank reconciliation statement for the 31st December 2019 (12 marks) C. List the amount for bank to include in the Statement of Financial Position (2 marks)

(Total: 30 marks)

Question 4

The following summary information has been extracted from the financial statements of Ruby Ltd a wholesale supplier to high street fashion retailers. Statement of Profit or Loss for the year ended 31 December 2019 € € 2019 2018 Revenue 1,391,820 1,159, Cost of sales (1,050,825) (753,450) Gross Profit 340,995 406, Operating expenses (161,450) (170,950) Profit from operations 179,545 235, Finance costs (10,000) (14,000) Profit before tax 169,545 221, Tax (50,800) (66,300) Net profit 118,745 155,

Statement of Financial Position as at 31 December 2019 € € € € 2019 2019 2018 2018 Non-Current Assets Property, Plant and Equipment

459,590 341,

Current Assets Inventory 109,400 88, Trade receivables 419,455 206, Bank 0 95, 528,855 390, 988,445 732,

Equity and Liabilities Ordinary Share Capital 120,000 120, Retained earnings 376,165 496,165 287,420 407,

Non Current Liabilities Loan 61,600 83,

Current Liabilities Trade payables 345,480 179, Overdraft 30,20 0 Tax 55,000 430,680 62,000 241, 988,445 732,

Cont’d...

2020 SUMMER EXAMINATION

EXAMINATION PAPER: to be returned to the examination’s official at the end of the examination.

COMPLETE THE SECTION BELOW

Module Code: B6AF

Module: Accounting

Student Number

Part-time student Full-time Student

QUESTION 1 (30 Marks)

Section A consists of 10 multiple choice questions and each question has 4 possible answers.

There is ONLY ONE correct answer in each question. Each correct answer is worth 3 marks

ANSWER: A, B, C, or D

QUESTION 1 ANSWER

i

ii

iii

iv

v

vi

vii

viii

ix

x

Lecturer

B6AF111 Summer 2020 EXAM Paper

Course: Account (AA101)

University: Kolej Poly-Tech MARA BANGI

- Discover more from: