- Information

- AI Chat

Was this document helpful?

Revision Cost Accounting copy

Course: Account (AA101)

114 Documents

Students shared 114 documents in this course

University: Kolej Poly-Tech MARA BANGI

Was this document helpful?

Revision Cost Accounting

Question 1

a. limiting factor refers to the factor that limits the production or sale of a product or service due to a

limited availability of resources or materials. For example, labour, materials and manufacturing

capacity.

b. Increase the capacity of the limiting factor that involve investing in new equipment or machinery

to produce more goods or services and potentially increase profits.

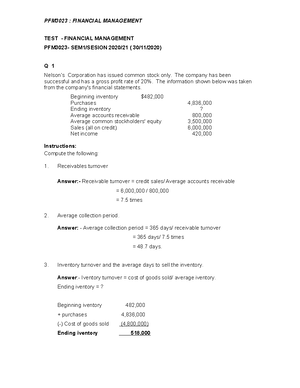

c. Limiting Factor

Verify limiting factor

Fountain F1 Pool F2 Total

Direct material G per unit 1 kg 1.3 kg

Sales demand (unit) 10,000 8,000

Direct material G needed 10,000 kg 10,400 kg 20,400 kg

Direct material G available (20,000 kg)

Shortage 400 kg

The contribution earned by each product per unit of limiting resources

Fountain F1 Pool F2

Sales Price 60 70

(-) Variable Costs

Direct material G 3 6

Direct material H 5 6.5

Direct labour cost 8.5 5

Variable production overhead 5 (21.50) 4 (21.50

Contribution per unit 38.50 48.50

Direct material G per unit 1 kg 1.3 kg

Contribution per material

(per unit of limiting factor)

38.50 37.31

Ranking 1 2

Budgeted production and sales

Products Units Material G needed Contribution Total

Fountain F1 10,000 10,000 kg 38.50 385,000

Pool F2 7,692 10,000 kg 48.50 373,077

PROFIT 758,077

Working:

Unit pool F2

= 10,000 kg / 10,400 kg x 8,000

= 7,692