- Information

- AI Chat

Was this document helpful?

Tutorial EPS 2 - Tuturial EPS chapter 2 yang sangat membantu kepada sesiapa yang tak tahu buat

Course: Account (AA101)

114 Documents

Students shared 114 documents in this course

University: Kolej Poly-Tech MARA BANGI

Was this document helpful?

EPS/JAN 2018/FAR430

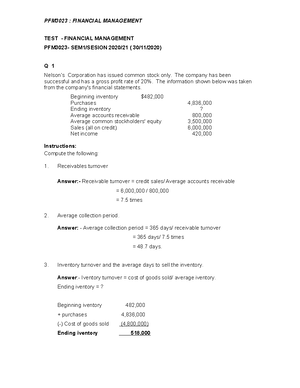

QUESTION 1

Simple Delicacies Bhd is a well-established entity listed in Bursa Malaysia since 2010. The

following are the information available during the year ended 31 December 2015 and 31

December 2016.

31 December 2015

Particulars RM Units

Ordinary shares @ RM1 each 1,500,00

0

1,500,00

0

5% Non-cumulative preference shares @ RM0.50 each 2,000,00

0

4,000,00

0

EPS 2012 1.80

EPS 2013 1.72

EPS 2014 1.60

EPS 2015 1.50

31 December 2016

Particulars RM Units

Ordinary shares @ RM0.50 each ? ?

5% Non-cumulative preference shares @ RM0.50 each 2,000,00

0

4,000,00

0

Net profit attributable to ordinary shareholders 2,500,00

0

-

Additional information:

1. On 1 March 2016, the board of directors decided to issue a rights to purchase

ordinary shares at lower than market price. The price agreed for the rights issue was

RM1.50 per unit for every 4 shares held. The market price before the right issue was

RM2.00 per unit.

2. The board of directors also agreed in a recent meeting dated 1 December 2016 to

split each ordinary shares into 2 shares at a par value of RM0.50 each.

Required:

a. Explain potential ordinary shares in the context of MFRS 133: Earnings Per Share.

Gives TWO (2) examples.

(5 marks)

b. Compute the company’s basic EPS for the year ended 2016. Restate the

comparative basic EPS if necessary.

(6 marks)

c. Comment on the performance of the company based on EPS trends given and

calculated above.

(4 marks)

(Total: 15 marks)