- Information

- AI Chat

Tutorial Question CVP Analysis Answer

Account (AA101)

Kolej Poly-Tech MARA BANGI

Recommended for you

Preview text

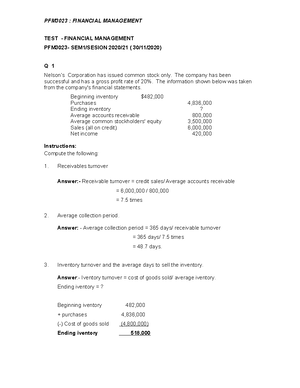

TUTORIAL QUESTION

QUESTION 1 : AltaVista Company’s

a. What is the company's contribution margin ratio?

CM ratio : (SP per unit – VC per unit)/SP per unit SP per unit : RM1,200,000 / 20,000 = RM VC per unit : RM800,000 / 20,000 = RM

CM ratio : (RM60 – RM40)/ RM : 0. b. What is the company's break-even in units?

BEP (units) = FC/ CM per unit = RM300,000/ (RM60 – RM40) = 15,000 units

c. If sales increase by 100 units, how much should net operating income increase? Sales unit increase by 100 = 20,000 + 100 = 20, Total (RM) Price per unit (RM) Sales (20,100) 1,206,000 RM (-) VE 804,000 RM Contribution margin 402,000 20 (-) Fixed expenses (300,000) Net operating income 102,

When sales units increase by 100 units, Net operating income also increase by RM2,000.

d. How many units would the company have to sell to attain target profits of RM125, 000? Attaining target profit (units) = (FC + targeted profit)/ CM per unit = (RM300,000 + RM125,000)/RM = 21,250 units

e. What is the company's margin of safety in RM? MOS (RM) = Total sales (RM) – BEP (RM) = RM1,200,000 – (15,000 x RM60) = RM1,200,000 – RM900, = RM300,

f. What is the company's degree of operating leverage? Degree of operating leverage = CM (RM)/ NOI

= RM400,000 / RM100,

= 0 @ 40%

QUESTION 2 : Pinkberry Corporation

a. What are total sales in RM at the BEP? Total sales : RM 60,000 / RM : 6,000 units Variable expenses per unit = RM45,000/ 6,000 units = RM7.

BEP (units) = FE / CM per unit = RM18,000 / (RM10 – RM7) = 7,200 units

BEP RM = 7,200 x RM = RM72,

QUESTION 3 : DKMY SDN BHD

Total cost (RM)

Price per unit (RM)

Percentage (100%) Sales (5,500) 445,500 81 100 (-) Variable expenses 192,500 35 43 Contribution margin 253,000 46 57 (-) Fixed expenses 190, Net operating income 62,

SP per unit = RM477,900/ 5,900 = RM 81

VE per unit = RM206,500/ 5,900 = RM 35

QUESTION 4 : Kawazaki Corporation's

Calculate the break-even in units for the following statement (consider each case independently):

a. The sales volume increases by 10% and the price decreases by RM0 per unit. New units sold = 110% x 15,000 = 16, New SP = RM15 – RM0 = RM14. New VC per unit = 135,000/16,500 = RM8. New CM per unit = RM14 – RM8 = RM6. BEP (units) = FC/CM per unit = 35,000/6. = 5,537@5,538 units

b. The selling price decreases RM1 per unit, fixed expenses increase by RM15,000, and the sales volume decreases by 5%.

SP per unit = RM15 – RM1 = RM FC = 35,000 + 15,000 = 50, Units sold = 95% x 15,000 = 14, VC per unit = 135,000/14,250 = RM9. CM per unit = RM14 – RM9 = RM4. BEP (units) = 50,000/4. = 11,037@11,038 units

c. The selling price increases by 25%, variable expense increases by RM0. per unit, and the sales volume decreased by 15%.

SP per unit = 125% x RM15 = RM18. VC per unit = RM9 + RM0 = RM9. CM per unit = RM18 – RM9 = RM

BEP (units) = 35,000/ = 3,888@3,889 units

d. The selling price increases by RM1 per unit, variable cost increases by RM1 per unit, fixed expenses decrease by RM15,000, and sales volume decreases by 12%.

SP per unit = RM15 + RM1 = RM16. VC per unit = RM9 + RM1 = Rm FC = 35,000 -15,000 = 20,

BEP (units) = 20,000/6. = 3,076@3,077 units

c. Assuming the company proceeds with the automation project (refer to information in b), compute how many units would the company have to sell to earn the same income it earned last year if the selling price remains the same? (End answer: 255,532 units)

NOI last year Total (RM) Price per unit (RM) Sales (310,000) 1,426,000 RM4. (-) VC 1,007,500 RM3. Contribution margin 418,500 RM1. (-) Fixed expenses (200,025) Net operating income 218,

Attaining target profit (units) = FC + Target profit/CM per unit = (200,025 + 182,000) + 218, 4 – 2. = 600,500/2. = 255,532 units

d. Assume that the company is operating above its break-even point and decide to increase the selling price of its product without changing its fixed or variable costs. Also, assume that the number of units sold is the same. How would the change in selling price affect the company’s margin of safety?

MOS (RM) = Total Sales (RM) – BEP sales (RM)

= RM1,426,000 – RM 681,568.

= RM744,431.

When selling price increase and break-even points (BEP) will decrease affect the company’s margin of safety will increase

QUESTION 6: Your Coffee Prince (YCP) Berhad

a. Compute the company’s contribution margin ratio. (End answer: 0 @ 25%)

Contribution margin ratio = (SP per unit - VC per unit)/ SP per unit = (RM 60 - RM 45) / RM 60 = 0 / 25%

b. Compute the company’s break-even point both in units and RM. (End answer: BEP = 8,000 units; RM480,000)

BEP (unit) = Total Fixed cost / Contribution margin per unit = RM 120,000 / RM 15 = 8,000 units

BEP (RM) = BEP (unit) x SP per unit = 8,000 units x RM 60 = RM 480,

c. Assume that sales will increase by RM40,000 for next year. Analyze, if other costs remain unchanged, by how much will the company’s net operating income increase?

(End answer: Expected increase in NOI = RM10,000)

Total (RM) Per unit (RM)

Sales (15,667 unit) 940, (900,000 + 40,000)

60

(-) variable expense 705,015 45 Contribution margin 234,985 15 (-) fixed expense 120, Net operating income 114,

When total sales increased by RM40,000, NOI also increase by RM10,

(End answer: BEP = 7,917 units; RM475,020)

BEP (unit) = Total Fixed cost / Contribution margin per unit = (RM 120,000 - RM 25,000) / (RM 60 - (RM45 + RM 3)) = RM 95,000 / RM 12 = 7,917 units

BEP (RM) = BEP (unit) x SP per unit = 7,917 units x RM 60 = RM 475, ii. Give your recommendation, should changes be made?

Total (RM)

Sales (17,250 units) 1,035, (-) variable expense (828,000) Contribution margin 207, (-) fixed expense (95,000) Net operating income 112,

The change should not be made because the original sales units will produce more NOI

QUESTION 7 : Idea Kreatif Sdn Bhd

a. Calculate the variable cost per unit. (End answer: VC = RM28)

CM ratio = SP per unit – VC per unit/SP per unit 0 = 40 – x / 12 = 40 – x X = 28

b. Calculate the break-even point in units and RM. (End answer: BEP = 12, units; RM500,000)

BEP (units) = FC/CM per unit = 150,000/(40 – 28) = 150,000/ = 12,500 units

BEP (RM) = BEP units x SP per unit = 12,500 x RM = RM500,

c. Determine the sales in units to earn a profit of RM60,000 and the margin of safety in units. (End answer: 17,500 units; MOS = 5,000 units)

Total (RM) Per unit (RM)

Sales (17,500 unit) 700,000 40 (-) variable expense 490,000 28 Contribution margin 210,000 12 (-) fixed expense 150, Net operating income 60,

QUESTION 8 : Healthy Living Manufacturer

a. Compute the contribution margin and contribution margin ratio for the company. (End answer: CM = RM20; CM ratio = 0 @ 20%) CM per unit = SP per unit – VC per unit

= RM 100 – RM 80 = RM 20

CM ratio = CM per unit / SP per unit

= RM 20 / RM 100 = 0.

b. Compute the break-even point in units and RM for the company. (End answer: BEP = 500 units; RM50,000)

BEP (units) = FC / CM per unit

= RM 10,000 / RM 20 = 500 units

BEP (RM) = FC / CM ratio

= RM 10,000 / 0. = RM 50,

c. Compute the margin of safety (in percentage %) for the company. (End answer: 23%) MOS (%) = [(Total sales (RM) – BEP (RM)) / Total sales] x 100 = [(RM 65,000 – RM 50,000) / RM 65,000] x 100 = 23%

d. Due to an increase in labor rates, the company estimates that variable costs will increase by RM3 per ball in July. If this change takes place and the selling price and fixed costs remain unchanged, analyze how many balls should be sold in July 20XX to earn the same net income in June 20XX. (End answer: 765 units)

Variable cost = RM80 + RM

= RM83 per unit

Achieving targeting profile = Fixed Cost + Target Profit / Contribution Margin Per Unit

= RM10,000 + RM3000 / RM100 – RM = 765 Units

e. The company is considering purchasing a new automated machine to manufacture the fitness balls. The new machine will slash variable costs by 70%, but it would cause fixed costs to increase to RM32,000 per month. If the new machine is purchased, what would be the company’s new break-even point (in units)? Should the company purchase the new machine or not? Analyze and give the reason why? (End answer: 421 units).

Variable Cost = 70% x RM

= RM = RM52000 – RM = RM

Variable Cost Per Unit = RM15600 / 650

= RM

Fixed Cost = RM

BEP ( Unit ) = Fixed Cost / Contribution Margin Per Unit

= RM32,000 / RM100 – RM = 421 Units

Yes, the company should buy the new machine because the new BEP is lowest than the old.

iii. Margin of safety based on the original budgeted data noted above.

MOS (RM) = TOTAL SALES(RM) – BEP SALES(RM)

= RM540,000 – RM423,

= RM117,

b. Calculate the expected impact on profitability of a reduction in sales demand of 25%.

When sales demand decrease by 25%, the NOI also decrease to (6,000) loss

TOTAL PER UNIT

Sales (27,000 units) 405,000 15 Variable expenses (270,000) (10) contribution Margin 135,000 5 Fixed expenses (141,000) Net Operating Income (6,000)

Tutorial Question CVP Analysis Answer

Course: Account (AA101)

University: Kolej Poly-Tech MARA BANGI

- Discover more from: