- Information

- AI Chat

Was this document helpful?

AUD589 SOLUTION PAST YEAR GOOD FOR YOU TO REFER

Course: Auditing (AUD339)

402 Documents

Students shared 402 documents in this course

University: Universiti Teknologi MARA

Was this document helpful?

AUD589 – JUNE 2018

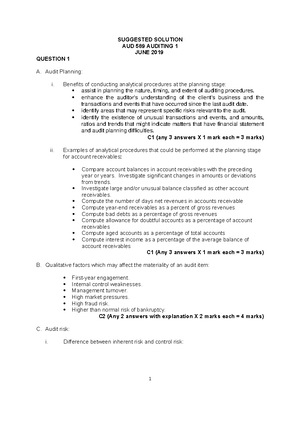

SUGGESTED SOLUTION – AUD 589

JUNE 2018

QUESTION 1

a. Purposes of audit planning:

To devote appropriate attention to important areas of the audit.

To identify and resolve potential problems on a timely basis.

To effectively and efficiently organize and manage the audit engagement.

To select engagement team members with appropriate levels of capabilities and

competence.

To direct and supervise engagement team members.

To coordinate work to be done among the engagement team members.

To assist in the review of the findings by the engagement team members.

(Any 6 purposes x 1 mark each = 6 marks)

b. Benefits of conducting ratio analysis for the analytical procedures:

Ratio analysis makes it easy to grasp the relationship between various items and

helps in understanding the financial statements.

Ratio analysis establishes the numerical or quantitative relationship between two

figures of a financial statement to ascertain strengths and weaknesses of the

company as well as its current financial position and historical performance.

Ratio analysis helps the auditors to make an evaluation of certain aspect of a

firm’s performance and going concern prospect.

(Any 2 with explanation x 2 marks each = 4 marks)

c. Risks of material misstatements noted from the conversation:

Lack of training during the two hours on operating the sales system could lead to

error.

oLead to errors in the initial setting-up of the menu and prices.

oEmployees not trained by the vendor, but trained by the two employees,

might make errors when using the system.

Lack of accounting skills and segregation of duties.

oAccount executive just recently appointed hence could lead to errors in

recording, since not familiar with the accounting system.

oIncompatible duties, authorization, record keeping and physical custody are

done by one person.

The company operations are subject to regulations (JAKIM’s halal certification).

oNon-compliance with the regulation could result in litigations.

oCompany might have to temporarily close the business and this could result

in writing off of spoilt perishable goods.

The company depends on foreign kitchen workers on contract basis.

oPoor retention rates, might affect the completeness payroll registers.

oAttendance and overtime need to be closely monitored and approved in

order to avoid fraudulent claims.

The cash are kept overnight for protection.

1