- Information

- AI Chat

Was this document helpful?

Audit Evidence - All the best

Course: Auditing (AUD339)

402 Documents

Students shared 402 documents in this course

University: Universiti Teknologi MARA

Was this document helpful?

Free notes: Not for sale

Jismi Md. Salleh

1

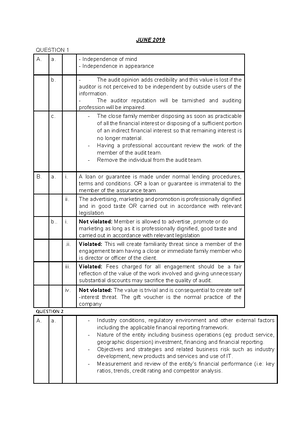

AUDIT EVIDENCE AND AUDIT DOCUMENTATION

Audit Evidence

▪ The information used by the auditor in arriving at the conclusions by which the auditor’s

opinion is based.

▪ Sources of audit evidence:

➢ Obtained directly by the auditor

➢ From the management

➢ From third party

Persuasiveness of Evidence

▪ Persuasiveness of evidence depends on:

1. Sufficiency – The quantity of evidence (in the form of samples selected for test),

whether it is adequate to achieve the audit objective.

2. Appropriateness – The quality of evidence, whether it is suitable to meet the audit

objective.

Pop quiz: If the audit obj is to determine whether the MV purchased during the year exists or not,

which of the following audit procedures is deemed as appropriate?

1. Examine the supporting documents for the purchase of MV.

2. Physically examine a sample of motor vehicles purchased during the year.

❑ Relevance – The appropriateness & suitability of the evidence to the audit

objective that the auditor is testing.

❑ Reliability – The degree to which evidence can be considered believable or

worthy of trust.

Characteristics of reliable information

a. Independence of provider – Evidence obtained from external source is

more reliable than the one obtained from internal source. E.g.,

confirmations obtained from client’s banks or debtors are more reliable

than documents obtained from the client.

b. Effectiveness of client’s internal control – Evidence is more reliable if the

client’s internal control system is effective.

c. Auditor’s direct knowledge – Evidence obtained directly by the auditor

through physical examination, observation, computation and inspection is

more reliable than information obtained indirectly.

d. Qualifications of individuals providing the information – Evidence is more

reliable if it is obtained from a qualified person.

e. Degree of objectivity – Objective evidence is more reliable than evidence

that requires considerable judgement.

❑ Timeliness – The timing in obtaining the evidence. Refer to when the evidence

was accumulated and the period covered by the audit.

E.g.,

1) Evidence for assets, liabilities or equity is more persuasive if it is closer to

the date of SOFP.

2) Evidence for revenues and expenses is more persuasive if it covers the entire

period under audit.

![Chapter 1 Partnership, FAR 160 [Lecturer Notes]](https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/1725fd64c6586cc441c660830d3a6800/thumb_300_388.png)