- Information

- AI Chat

Audit of PPE Cash Profit or Loss AUD339 lecture notes

Auditing (AUD339)

Universiti Teknologi MARA

Recommended for you

Preview text

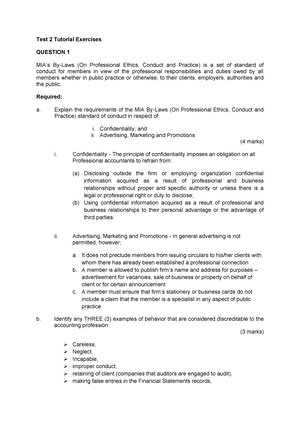

TOPIC COVERED IN TEST 2:

Audit Planning and Fieldwork ( cont’d ) Preliminary analytical procedures Materiality o Definition and concept of materiality o Types of materiality - Quantitative - Qualitative Assessment of Risk o Types of risks o Audit risk Audit risk model Inherent risk Control risk Detection risk Sampling o Criteria - representative samples Reasonable assurance

Audit of Statements of Financial Position and Comprehensive Income Substantive audit procedures for statement of financial position – account balances and disclosures o Property, plant and equipment o Cash o Income statement Repair and Maintenance Entertainment

VERIFICATION OF PROPERTY, PLANT AND EQUIPMENT (PPE)

Internal Control Procedures / Activities

Acquisition of PPE is approved by a responsible person and is within the entity’s budget. Disposal of PPE is approved by a responsible person. Adequate records such as the PPE register are maintained/ kept. Physical PPE items should be adequately safeguarded by keeping them under lock and key. Physical count in order to verify the PPE items is conducted at regular intervals.

Audit Objectives To ensure that PPE items included in the SOFP exist (existence) To ensure that ALL PPE items are included in the SOFP (completeness) To ensure that PPE are properly valued as at the reporting date (valuation). To ensure that accumulated depreciation is correctly computed for each category of PPE. (accuracy) To ensure that PPE items are properly classified (classification) To ensure that PPE are included in the proper period (cut-off) To ensure that the client has a right over ownership of the PPE (right & obligation)

Examples of Tests of Account Balances Perform physically examination of major assets to determine their existence. Review lease agreements and ensure that only assets acquired under ‘finance lease’ are reported as PPE. Physically examine a sample of PPE items and trace them to the PPE register. Cast figures of PPE as per ‘PPE register’ and agree total of PPE to the general ledger balances. Recalculate the gain or loss on disposal of PPE. Evaluate the basis used in revaluing the entity’s PPE. Recalculate the surplus or deficit on revaluation of PPE. Evaluate the method and percentage of depreciation to determine their reasonableness. Examine the acquisitions and disposals of PPE a few days before and after the year-end. Verify ownership documents (e., examine land title, S&P agreement, vehicle registration card, invoice or official receipt) to determine ownership of the asset. Examine whether capital and revenue expenditures are properly classified by reviewing a sample of transactions. Examine compliance to the disclosure requirements as stipulated in the relevant financial reporting standards.

VERIFICATION OF CASH AND BANK BALANCES

Audit Objectives To ensure that the cash balance and bank account exists. (existence) To ensure that ALL balances in cash and bank accounts are included in the financial statements. (completeness) To ensure that cash and bank balances are stated accurately. (accuracy) To ensure that the client has a right to the cash and bank balances. (rights and obligation) To ensure that cash receipts and cash disbursements are recorded in the proper period. (cut-off) To ensure that cash and bank balances are properly presented and disclosed in the financial statements. (presentation and disclosure)

Examples of Tests of Account Balances Count the cash balances as at the reporting date (financial year-end) and agree the balances counted against the balance as per cash book. Examine bank statement to ensure that the bank account is maintained under the client’s name. Obtain confirmation of balances from the bank by sending confirmation letter. Examine cash receipts and payments a few days before and after the year-end. Examine whether cash equivalents are properly classified. Perform test of kiting (test of interbank money transfers) to determine whether money deposited were properly recorded. Test bank reconciliation statement : - Verify that the bank reconciliation statement is mathematically accurate. - Agree the bank balance on the bank reconciliation statement with the balance shown on the bank confirmation letter. - Agree the adjusted cash book balance as per the bank reconciliation statement to the cash book. - Examine uncredited deposits/deposits in transit on the bank reconciliation statement to the subsequent bank statement. - Trace the unpresented cheques on the bank reconciliation statement with the cheques cleared shown in the subsequent bank statement. - Examine reconciling items in the bank reconciliation statement such as bank errors, service charges, standing orders, credit transfer etc to ensure that they are properly treated by the client.

AUDIT OF EXPENSES: 1) REPAIR & MAINTENANCE

2) ENTERTAINMENT

Audit objectives :

To ensure that recorded expenses represent existing transactions. (existence) To ensure that all expenses incurred are duly recorded during the accounting period. (completeness) To ensure that expenses are properly classified. (classification) To ensure that expenses are recorded at the correct amount. (accuracy) To ensure that expenses are recorded in the proper accounting period and the appropriate adjustments are made for accrual and prepayments. (cut- off) To ensure that expenses are presented and disclosed in accordance with the requirements of the reporting standards. (presentation & disclosure)

Audit procedures

Trace the recorded expenses from the accounting records to the supporting documents such as payment vouchers. (Vouching procedure) Examine evidence of approval by the authorised person on the supporting documents such as payment voucher. Trace a sample of supporting documents to the entries in the books of prime entry. Select a sample of expense items and examine whether they are properly classified. Verify the authenticity and mathematical accuracy of the supporting documents. Trace posting from the books of original entry to the ledger accounts.

Audit of PPE Cash Profit or Loss AUD339 lecture notes

Course: Auditing (AUD339)

University: Universiti Teknologi MARA