- Information

- AI Chat

Was this document helpful?

Audit of Sales, Purchases, Payroll

Course: Auditing (AUD339)

402 Documents

Students shared 402 documents in this course

University: Universiti Teknologi MARA

Was this document helpful?

Free notes: Not for sale

Jismi Md. Salleh

1

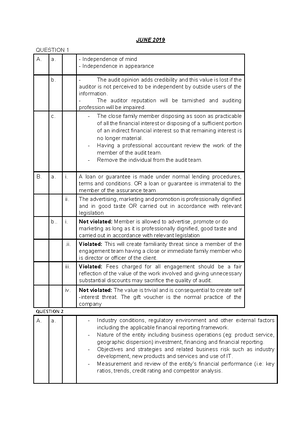

AUDIT OF SALES AND COLLECTION CYCLE

Aspects of Operations

Internal Control

Possible errors/ weaknesses

Processing

customer

orders and

despatch of

goods

Approval of sales

order

Checking of credit

limit

Preparation of

despatch

documentation

Despatch of goods

All orders received are recorded on pre-numbered

sales order forms

Credit limit of customers must be approved prior to

delivery/ shipment of goods

All sales orders are checked against the credit limit

(to be evidenced by an initial of the authorised

person)

Despatch of goods must be supported by authorised

despatch notes/shipping documents

Despatch notes are prenumbered and cross-

referenced to sales orders

Acknowledgement should be obtained from

customer for delivery of goods.

Segregation of duties between receiving orders,

approving credit limit, authorising despatch of

goods, delivering goods and billing to customers

Credit limit granted to

unauthorised customer

Goods not despatched to

customers

Goods released before proper

approvals of customer credit.

Sales recorded on fictitious

customers

Proof of deliveries not obtained

from customers

Invoicing/

billing

customers

and

recording

sales

Preparation of sales

invoices

Processing of invoice–

recording in sales

journal and posting to

sales ledger (debtor

a/c) and general ledger

(sales a/c)

Preparation of debtors

statement

Sales invoices are pre-numbered and accounted for

Issuance of sales invoices are duly authorised

Invoices are correctly priced and independently

checked for accuracy of quantities, prices, trade

discounts and totals

Segregation of duties between billings, posting to

the accounts and receiving cash/cheque.

Double-recording of sales

invoices

Omission in recording sale

transactions

Incorrect particulars e.g., amount,

quantity sold on the sales invoices

Prepares invoices without

verifying whether the goods have

been delivered.

Sales

returns and

adjustments

Preparation of credit

notes for valid claims

of defective goods

returned by customer

Credit notes/memorandum must be pre-numbered

and accounted for

Issuance of credit notes are duly authorised

Credit notes are checked to supporting evidence

i.e., goods returned notes and sales invoices

Prices are checked to sales invoices

Incorrect/invalid allowances

given

Incorrect particulars on the credit

notes

Recording

of cash/

cheques

received

Initial recording of

cash received

Bank-in of

cash/cheque into the

Bank account

Recording of

cash/cheque received

in cash book

Posting to sales ledger

control account, sales

ledger (debtor a/c) and

general ledger (cash/

bank a/c)

Reconciliation of bank

balances against bank

statements

Segregation of duties between handling of cash and

record keeping

Prepare “pre-listing” of all cheques and cash

received.

Procedure that all cheques must be deposited on a

daily basis.

Official receipts are issued at the point of receipt of

cash

Official receipts are pre-numbered and accounted

for

Receipts in the initial record must be independently

checked to cash book and debtors ledger

Bank balances were reconciled with bank

statements on monthly basis

Cash-in-hand were independently verified against

balances as per cash book at the end of the day

(Cash balancing procedure)

Unrecorded cash receipts

Cash receipts not deposited

promptly.

Incorrect accounting (recording &

posting) of cash received from

customers in the relevant accounts

Unauthorised issuance of official

cash receipts

General

recording

Posting to sales ledger

Sales Ledger Control a/c and Schedule of Debtors

(listing of individual debtor’s a/c as per sales

ledger) are prepared

Balance as per Sales Ledger Control a/c are

reconciled/ tallied to Schedule of Debtors. Any

differences noted are investigated

Invalid/incorrect entries

(sales/sales return/ cash received)

in the sales ledger and sales

ledger control a/c

Overdue

accounts

To follow-up on

overdue accounts

To write-off bad debts

To make provision for

doubtful debts

Status of overdue accounts is closely monitored by

using aging schedule. Reminder letters are sent to

customers with overdue a/cs.

Writing-off of bad debts are duly authorised by

higher authority

Allowance made for doubtful debts is

independently reviewed

Bad debts not written-off

Under/over provision of doubtful

debts

![Chapter 1 Partnership, FAR 160 [Lecturer Notes]](https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/1725fd64c6586cc441c660830d3a6800/thumb_300_388.png)