- Information

- AI Chat

Was this document helpful?

Audit planning - notes

Course: Auditing (AUD339)

402 Documents

Students shared 402 documents in this course

University: Universiti Teknologi MARA

Was this document helpful?

Free notes: Not for sale

Jismi Md. Salleh

1

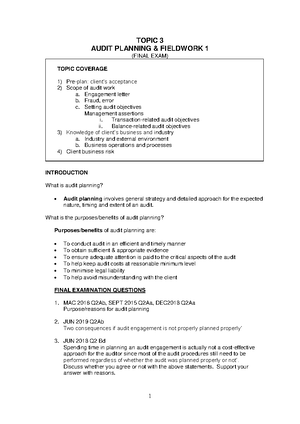

AUDIT PROCESS: Audit Planning

Benefits of audit planning

• Helps auditor to obtain sufficient appropriate evidence

• Helps to keep audit costs reasonable

• Avoid misunderstanding with clients

• Helps minimise legal liability and reducing the audit risk

Steps in planning

➢ Initial audit planning

▪ Decide whether to accept or continue doing the audit – to investigate new clients and to

evaluate existing client

▪ Identify client’s reasons for the audit – financial audit or special audit such as for loan

application, acquisition of business, take-overs & mergers

▪ Factors that should be considered by an auditor before accepting appointment from a new

client:

Management integrity;

Overall risks in the engagement;

Familiarity with the nature of client’s business;

Ability to perform the audit work. (Whether we are competent or not)

Ability to comply with the ethical requirements (such as MIA by-laws)

▪ Issue an engagement letter

A written agreement between the auditor and the client concerning the conduct of the

audit and the related terms of the engagement.

Is written by the auditor to his client after accepting appointment but before starting the

audit work.

Contents of an engagement letter:

• The objective of the audit of financial statements.

• Management’s responsibility for the financial statements.

• The scope of the audit, including reference to applicable standards.

• Degree of auditors assurance (the auditor is not responsible for the discovery of all

frauds).

• The inherent limitations of an audit (material misstatements may remain

undiscovered).

• Auditor’s right to access records, documents and information.

• The form of auditor’s reports.

• Deadlines for completing the audit.

• Basis for determination of audit fees

• Acknowledgement of acceptance of the terms by the client.

Purpose of engagement letter:

• to provide written confirmation of the acceptance of appointment;

• to clearly define the auditor’s responsibility and scope of audit;

• minimise possibility of misunderstanding between the client and auditor;