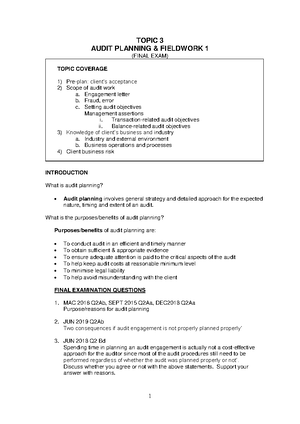

- Information

- AI Chat

Chap 4 - PART A Audit of Financial statement cycle ( Answer)

Auditing (AUD339)

Universiti Teknologi MARA

Recommended for you

Preview text

Chapter 4: Audit of Financial Statement cycles – PART A

- Systems, Policies and Procedures Table of Contents

- Accounting Systems

- Financial Controls

- Control objectives – similar with audit objectives (i. assertions)

- Control activities

- Sales and receivables (sales cycle) [1st system]

- Purchases and liabilities (purchase cycle) – 2 nd system

- Wages (payroll cycle)

- Cash receipts and payments

Chapter 4: Audit of Financial Statement cycles – PART A

SYLLABUS:

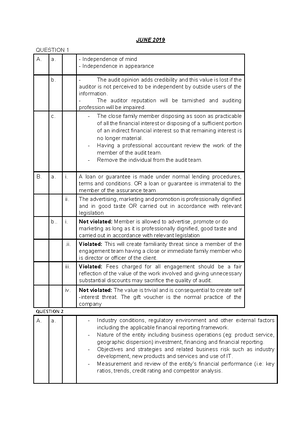

PART A – INTERNAL CONTROL SYSTEM (ICS) – FINAL EXAM – Q

Types of financial statements cycles & related internal controls

- Sales and collection cycle

- Purchases and payment cycle

- Payroll and Personnel cycles (i. wages)

Components in financial statements cycles

- Classes of transactions

- Related Accounts

- Business functions and ICS flowchart

- Documents and records

Internal control objectives, audit procedures for test of control (TOC) and test of substantive (TOS) – CHAP 3

PART B – TEST 2

Substantive audit procedures for statement of financial position – account balances and disclosures: 1) Property, plant and equipment 2) Cash 3) Non-current liabilities 4) Shareholders’ equities

Substantive audit procedures for Statement of Profit or Loss and Other Comprehensive Income 1) Repair and Maintenance expenses 2) Entertainment expenses 3) General or miscellaneous expenses 4) Travelling expenses

1. Systems, Policies and Procedures Table of Contents

Overview – self-reading

Organisations are open and dynamic and operate in an environment that is constantly changing and setting new challenges for those who operate within that environment.

a company’s board of directors:

is collectively responsible for promoting the success of the company by directing and supervising the company’s affairs (this includes monitoring the CEO);

should provide entrepreneurial leadership of the company, within a framework of prudent and effective controls which enable risk to be assessed and managed (this includes monitoring the effectiveness of the controls, e. through internal audit); should set the company’s strategic aims (taking into account stakeholder claims), ensure that the necessary financial and human resources are in place for the company

Chapter 4: Audit of Financial Statement cycles – PART A

and analysis of the various transactions. In considering the various accounting systems, this objective is taken as standard.

3. Financial Controls – self-reading

Internal control

The controls placed over the financial information systems are part of the overall internal controls operated within an organisation. Considers the overall framework of internal control in detail.

Definition

Internal control is the process designed, and effected by, those charged with governance and management, to provide reasonable assurance about:

the achievement of the entity’s objectives with regard to reliability of managerial and financial reporting;

the effectiveness and efficiency of its operations; and the entity’s compliance with applicable laws and regulations

Committee of Sponsoring Organisations (COSO)

The internal control system includes all the policies and procedures (internal records) adopted by the directors and management of an entity to succeed in their objective of ensuring, as far as practicable, the: orderly and efficient conduct of the business; adherence to internal policies; safeguarding of the assets of the business; prevention and detection of fraud and error within the business; accuracy and completeness of the business accounting records; timely preparation of financial information.

4. Control objectives – similar with audit objectives (i. assertions)

Control objectives are the expected outcome to be achieved by the financial accounting system. They aim to ensure that only: CHAP 3

valid (V) authorised (A) transactions are accurately (A) and completely (C) recorded in the appropriate (A) accounts in the correct accounting period (cut-off – C) and that recorded assets/ transaction exist (E).

Chapter 4: Audit of Financial Statement cycles – PART A

The procedure are (or control activities): 1. Adequate segregation of duties – separate duties for staff signed cheque and prepare the account. NOTE – Not all must have segregation of duties.

Purpose of having the segregation of duties?

Proper authorization of transactions and activities – e. purchases above RM5k, need to be authorised.

Adequate documents and records

Physical control over assets and records

Independent checks on performance

Supervision

Arithmetical and accounting – to check the correct and accurate recording and processing of transactions, e. Reconciliation, trial balances.

E. sale good on credit to customer control activities, - check the client credit worthiness or client credit rating (history).

5. Control activities

Control activities are the specific controls that need to be in place to ensure that the control objective can be achieved.

For the purchases example asked above, the control objective would be “to ensure that payments are only made for goods and services received and required by the company”.

To achieve this overall objective, control activities over placing the order, receipt and acceptance of the goods/services, recording and analysing the invoice and settling the liability need to be operative.

Controls may be manual or they may be electronic (e. sequence checks, credit limit checks, correctness of inventory codes input, password access).

Examples of appropriate control activities include:

a) Authorisation, (basically, “if it can move (i. pay, credit background), authorise it”) e.:

- purchase or disposal of non-current assets

- new suppliers (i. buy the materials or stock)

- journals

- payments

- bad debt write-offs

b) Performance reviews, e.:

- actual against budget, prior year and variance analysis

- analytical review (comparison & relationship), internal verses external data

- functional or activity performance in that activities that should take place, actually took place

Chapter 4: Audit of Financial Statement cycles – PART A

FINAL EXAM: Type of scenario – sale, purchase and payroll 1. Manufacturing 2. Trading 3. Workshop – car workshop or motorcyles 4. Tailor 5. Bakery – bake 6. Food panda, Grab, Lazada, Shoppee 7. Scenario – HR – clock the attendance using smartphone 8. Furniture or kitchen cabinets 9. Telco companies or IT or computer components, 10. Sport equipment 11. Chalet or resort 12. Tuition center or private college or pre-school 13. Pizza hutt, McD or KFC (fast food)

Identify control activities lacking consequences (objectives) of NOT having the control activities Suggestion

Sales and receivables (sales cycle) [1st system]

The overall objective of sales can be considered to be to ensure that all goods and services despatched are correctly invoiced and processed. In the case of receivables, that all receivables (i. credit sales) are collectable and will not result in bad debts.

Sales order received

Depending on the business, orders may be received by post, fax, telephone, in person or through an e-system (e. e-mail, website, electronic data interchange, smartphone).

In all cases (cash or credit), a base record of all orders (control activities) should be made to enable completeness checks (control objectives) to be made to ensure all have been correctly processed and dealt with.

Sales orders – CONTROL ACTIVITIES:

- Authorised (especially credit sales – checking on the client’s credit worthiness/ credit history)

- Serially numbered (i. pre-numbered or generated in strict numerical sequence)

- Copy retained/Register kept

- Validated (price, quantity, availability, customer creditworthiness (i. credit sales))

Chapter 4: Audit of Financial Statement cycles – PART A

Order processed 1. Goods should only be approved for despatch if: customers are valid credit risks (i. have not exceeded their approved credit limits – i. credit sales) or have paid cash in advance; and the goods are in inventory.

An order confirmation may be sent to the customer detailing when the goods will be despatched.

e. Authorisation – control activities (credit sales), or any other control activities that should be in place based on scenario case study

Goods despatched (i. send the goods to customer)

Goods selected, despatch note raised and agreed to order.

The goods are despatched to the customer who confirms receipt (e. by signing a manual or electronic copy of the despatch note).

Despatched/ deliver the goods to customers – CONTROL ACTIVITIES:

Creditworthiness check – credit sales.

Matched to authorised order.

Goods despatched agreed to order.

Serially numbered despatch notes (“DNs”).

DN authorised for dispatch.

Sequence check for completeness.

Proof of delivery – e. client must confirm received the goods

Invoicing (i. to collect the money)

An invoice is raised and approved after agreement to the dispatch note and authorised price list. Sent to the customer. E. pre-numbered documents.

Sales invoices – CONTROL ACTIVITIES: 1. Matched with order/DN, address, detail of goods and quantity. 2. Explanations for unmatched DNs obtained. 3. Price checked to authorised price list/order/contract. 4. Calculation check (re-performance) to ensure accuracy. 5. Serially numbered (i. pre-numbered) and sequentially controlled for completeness.

Recorded in the accounts

The invoice is recorded and analysed in the sales day book.

Posted to the sales ledger and receivables control in the general ledger.

Recording – CONTROL ACTIVITIES: 1. Pre-listing (e. in a sales day book)/Batch control system. 2. Sequence checks to identify invoices not recorded. 3. Control a/cs and reconciliation thereof. 4. Monthly statements sent to customers.

Chapter 4: Audit of Financial Statement cycles – PART A

Despatches/ deliver the goods to customers

Creditworthiness check.

Matched to authorised order.

Goods despatched agreed to order.

Serially numbered despatch notes (“DNs”).

DN authorised for dispatch.

Sequence check for completeness.

Proof of delivery.

Sales invoices

- Matched with order/DN, address, detail of goods and quantity.

- Explanations for unmatched DNs obtained.

- Price checked to authorised price list/order/contract.

- Calculation check (re-performance) to ensure accuracy.

- Serially numbered (i. pre-numbered) and sequentially controlled for completeness.

Recording

- Pre-listing (e. in a sales day book)/Batch control system.

- Sequence checks to identify invoices not recorded.

- Control a/cs and reconciliation thereof.

- Monthly statements sent to customers.

Cash receipts

- Mail opening procedures include 2 staff members – bank-in transfer

- Pre-listing of receipts.

- Regular bank control a/c reconciliations prepared/reviewed.

Chapter 4: Audit of Financial Statement cycles – PART A

CLASS EXERCISES NO. 1:

Salina & Associates (auditor) have performed a thorough review of three main subsystems of D’KEEN Bhd, its new audit client. The company supplies car parts directly to workshops in Melaka and it does not have any retail outlet. The following narrative descriptions were provided by one of the team members:

Sales & Cash receipts

Sales were made on cash and credit terms. For cash sales, a pre-numbered cash bill is issued and delivered together with the goods to the customer. The cash is collected immediately by the delivery person at the point of delivery of goods. For credit sales, a pre-numbered sales invoice is issued and faxed to the customer. The payment is usually received by cheque..

a. Weaknesses b. Possible effects c. Recommendations

- The cash collected at the point of delivery of goods to customer

The delivery person might steal the cash received from the customer

The company should implement the online transfer for the payment paid by the customer

- The goods are delivered to customers without any proof of delivery

The goods might be sent by delivery at the wrong types of goods. Or customer might claim not received the goods and re- order again.

The delivery person must ensure the customer signed the upon received the goods as proof of delivery – or by giving IC number

- Cash bill is issued and delivered together with the goods to the customer without copy kept in the premises (assumption).

The amount might subject to manipulation since no original copy

Make a copy of the cash bill issued to the customer

The Accounts Clerk is in-charge of receiving the cheques from credit customers and he is responsible for preparing a list of all cheques received on a daily basis. The particulars of the customer’s name, amount received and cheque number are written on the list. Cheques are deposited daily by the Accounts Executive. The Accounts Clerk uses the list of cheques to update the daily collection in the cash receipts journal.

a. Weaknesses b. Possible effects c. Recommendations

- The particulars only recorded customer’s name, amount received and cheque number without the details on the date

Report cannot be submitted on time because no date

Report (B/S & PL) submitted with the wrong cut-off period for the income received due to wrong date

The particulars’ on list for cheque received must include the date the cheque received.

- No segregation of duties between receiving the cheque, preparing the list and updating the daily collection cash receipts – done by the same person

The account clerk might manipulate or overlooked on the recording of the cheque received before updates

There should be a segregation of duties between those preparing the list and updating the daily collection.

- No supervision on the work done by

Chapter 4: Audit of Financial Statement cycles – PART A

Purchases and liabilities (purchase cycle) – 2 nd system

The overall objective of the purchase cycle can be considered as ensuring that payments are only made for goods and services received and required by the entity. That purchases are not overstated (e. false) and that liabilities are not under stated (that all have been correctly recorded).

A typical system and its general procedures would comprise:

Purchase requisition

Departmental staff (e. production or inventory stores) decide what goods/services they wish to purchase (e. inventory level reaches the re-order level) and produce a purchase requisition (may be manual or electronic initiation).

This is AUTHORISED by the department manager/supervisor/budget and passed to purchasing/ordering department.

Requisition – CONTROL ACTIVITIES:

Authorised

Serially numbered for completeness

Inventory checks (to prevent overstocking) 2 order (PO)

Purchase department obtains several quotations from approved suppliers based on price, delivery time and quality.

Order placed with “winning” supplier.

Order would normally be AUTHORISEd, especially if for a large amount.

Purchase order – CONTROL ACTIVITIES:

- In writing (hard copy)

- Serially numbered and sequence checked to ensure completeness.

- Competitive price using authorised supplier.

- Authorised.

- Outstanding orders followed up with supplier.

3 received

Goods received are inspected to ensure that they are in good condition and the detail (quantity, quality) received agrees with the purchase order (PO).

A record is made of all goods received (e. using a goods received note – GRN). Purchase order (PO)

Good received note (GRN)

Goods received – CONTROL ACTIVITIES:

- Goods checked for quality.

Chapter 4: Audit of Financial Statement cycles – PART A

Quantity agreed to order (PO).

Serially numbered (completeness) and authorised (goods accepted) GRNs.

Accounts notified (e. by copy GRN). 4 invoice received

Supplier invoices the company for goods/services sent.

The invoice detail is checked to ensure the goods/services were received (e. to the GRN) and that the price is correct (i. same as the order, contract or approved price list from supplier).

i. the invoice received from suppliers must be checked again the PO and GRN.

- AUTHORISATION for payment made.

Purchase invoices – CONTROL ACTIVITIES:

- Recorded promptly (e. in purchase day book) and serially numbered on receipt.

- Agreed to GRN/PO for detail.

- Outstanding GRNs followed up with buying department.

- Prices agreed to PO, authorised price lists, contracts.

- Calculations checked.

- Authorised for payment.

5 recorded

Recorded and analysed within the purchases daybook and posted to the appropriate expense and liability accounts within the general ledger.

Recording – CONTROL ACTIVITIES:

- Batch control system.

- Control a/cs and reconciliation.

- Supplier statements reconciled and authorised.

6 made

A cheque or bank transfer is raised for the amount owing to the supplier.

Approved for payment by a senior manager who should agree the payment details to supporting documents (e. purchase invoice, PO, GRN ).

Payment made is recorded as part of the cash payments system.

Cash payments – CONTROL ACTIVITIES:

- Authorised cheque signatories.

- Two signatures for larger payments.

- Review supporting documents (internal or external supporting documents – invoice, PO, & GRN).

Chapter 4: Audit of Financial Statement cycles – PART A

- Recorded promptly (e. in purchase day book) and serially numbered on receipt.

- Agreed to GRN/PO for detail.

- Outstanding GRNs followed up with buying department.

- Prices agreed to PO, authorised price lists, contracts.

- Calculations checked.

- Authorised for payment.

Recording

- Batch control system.

- Control a/cs and reconciliation.

- Supplier statements reconciled and authorised.

Cash payments

- Authorised cheque signatories.

- Two signatures for larger payments.

- Review supporting documents.

CLASS EXERCISES NO. 1:

Salina & Associates have performed a thorough review of three main subsystems of D’KEEN Bhd, its new audit client. The company supplies car parts directly to workshops in Melaka and it does not have any retail outlet. The following narrative descriptions were provided by one of the team members:

Sales & Cash receipts

Sales were made on cash and credit terms. For cash sales, a pre-numbered cash bill is issued and delivered together with the goods to the customer. The cash is collected immediately by the delivery person at the point of delivery of goods. For credit sales, a pre-numbered sales invoice is issued and faxed to the customer. The payment is usually received by cheque.

The Accounts Clerk is in-charge of receiving the cheques from credit customers and he is responsible for preparing a list of all cheques received on a daily basis. The particulars of the customer’s name, amount received and cheque number are written on the list. Cheques are deposited daily by the Accounts Executive. The Accounts Clerk uses the list of cheques to update the daily collection in the cash receipts journal.

Purchases & Cash payments (2nd system)

Purchases of car parts from the supplier were made by an authorised Purchasing Officer. A two- copy pre-numbered purchase order is prepared by the Purchasing Officer and approved by the Purchasing Manager. A softcopy of the approved purchased order is sent to the supplier by e-mail. The car parts would be received from the supplier by the Purchasing Officer who would compare the physical item received against copy 1 of the purchase order.

a. Weaknesses b. Possible effects c. Recommendations

- Segregation of duties

No segregation of duties on the part of purchasing officer who make the purchases, received the goods and compare the physical items received.

Might be fraud, manipulation or overlook, etc.. the point.

There should be a segregation of duties between purchases, received the goods and compare the physical items received.

Chapter 4: Audit of Financial Statement cycles – PART A

- The purchase order is sent to the supplier by e-mail.

Manipulation – alteration of the figure on the PO or client claimed not received.

The PO should be sent to supplier through hardcopy PO, not emailed.

- Goods received from supplier without preparing the Good Received Notes (GRN).

The company might receive goods in bad quality, wrong quantity, etc.

Purchasing officer should prepare the GRN.

When the invoice is received from the supplier, the Accounts Clerk matches it with copy 2 of the purchase order. The Accounts Clerk would then prepare a payment voucher and a cheque for submission to the Accountant. The Accountant would ensure that the amount on the cheque matches with the amount on the payment voucher (i. internally generated) before signing on the cheque.

a. Weaknesses b. Possible effects c. Recommendations

- Invoice – not recorded, only matched with PO

(note: write full sentence in final exam)

Cut-off, missed the important, etc.

Refer the weakness ---

- The work of account clerk – prepare payment voucher and cheque with no supervision from other staff/ checked by others

Human error, etc. Refer the weakness ---

- The cheque was signed without proper or full verification against the supporting document such as invoice and GRN – rely only on internally generated document such as payment.

Fraud (between account and supplier), human error, personal use, etc.

Refer the weakness ---

Required:

(a) Identify any TWO (2) of the general internal control objectives or assertions. (2 marks)

(b) Determine any THREE (3) inherent limitations of an internal control system. (3 marks)

(c) Discuss any FIVE (5) major weaknesses in the above internal control system and the possible effect of each of the weaknesses identified. Suggest also a recommendation to overcome each of the weaknesses. (15 marks)

Chapter 4: Audit of Financial Statement cycles – PART A

Payment to employees

- In most organisations, payment will be made directly to each employee’s bank account.

- If payment is made by cash, care must be taken to ensure the correct employee receives the correct payment and provides signed documentary evidence of having done so.

- The payment should be AUTHORISED and will be dealt with through the cash payments cycle.

Cash payments – CONTROL ACTIVITIES:

- Payout witnessed

- Wage receipts evidence

- Safe custody of pay packets

- Specific authority to disburse unclaimed wages

- Unclaimed wages re-banked intact

- Use of credit transfer facilities

- Control a/cs for wages/salaries/PAYE etc

- Payments for deductions (EPF, SOCSO, PCB) reconciled to payroll

Recording – CONTROL ACTIVITIES:

- Referencing to N/L a/c codes on posting

- Review of control a/cs

Wages (payroll cycle)

Control objectives cover:

Chapter 4: Audit of Financial Statement cycles – PART A

Control activities would include:

Recording time and work done

- Safe custody and restricted issue of time cards (e. clock cards)

- Pre-numbered recording documents and issue/receipt control

- Supervised clocking in/out

- Authorisation/Overtime approved

Payroll preparation

- Checked and approved

- Amendment forms authorised

- Authorised supporting documents for starters/leavers

- Independent review

Cash payments

- Payout witnessed

- Wage receipts evidence

- Safe custody of pay packets

- Specific authority to disburse unclaimed wages

- Unclaimed wages re-banked intact

- Use of credit transfer facilities

- Control a/cs for wages/salaries/PAYE etc

- Payments for deductions reconciled to payroll

Recording 3. Referencing to N/L a/c codes on posting 4. Review of control a/cs

CLASS EXERCISES NO. 1:

Salina & Associates have performed a thorough review of three main subsystems of D’KEEN Bhd, its new audit client. The company supplies car parts directly to workshops in Melaka and it does not have any retail outlet. The following narrative descriptions were provided by one of the team members:

Sales & Cash receipts – 1 st system

Sales were made on cash and credit terms. For cash sales, a pre-numbered cash bill is issued and delivered together with the goods to the customer. The cash is collected immediately by the delivery person at the point of delivery of goods. For credit sales, a pre-numbered sales invoice is issued and faxed to the customer. The payment is usually received by cheque.

The Accounts Clerk is in-charge of receiving the cheques from credit customers and he is responsible for preparing a list of all cheques received on a daily basis. The particulars of the customer’s name, amount received and cheque number are written on the list. Cheques are deposited daily by the Accounts Executive. The Accounts Clerk uses the list of cheques to update the daily collection in the cash receipts journal.

Purchases & Cash payments – 2 nd system

Purchases of car parts from the supplier were made by an authorised Purchasing Officer. A two- copy pre-numbered purchase order is prepared by the Purchasing Officer and approved by the

Chap 4 - PART A Audit of Financial statement cycle ( Answer)

Course: Auditing (AUD339)

University: Universiti Teknologi MARA

- Discover more from: