- Information

- AI Chat

SS AUD339 FEB 2022 - Answer Scheme

Auditing (AUD339)

Universiti Teknologi MARA

Recommended for you

Preview text

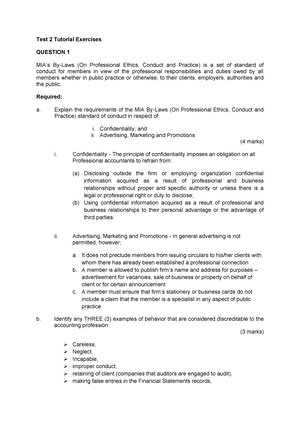

UNIVERSITI TEKNOLOGI MARA

FINAL EXAMINATION

ANSWER SCHEME

COURSE : AUDITING

COURSE CODE : AUD

EXAMINATION : FEBRUARY 2022

QUESTION 1

A. a. Definition of audit engagement letter:

An audit engagement letter is a letter issued by the auditor to his audit client containing the information regarding the acceptance of the audit engagement by the auditor and the important terms of the engagement including the scope of the audit and the responsibilities of both parties which should be acknowledged by the audit client. √√√ (3√ x 1 mark = 3 marks)

b. Differences between the management assertion of existence and completeness:

Existence: Management claims that all assets, liabilities and equities presented in the financial statements really exist. √

Completeness: The management claims that all transactions and account balances have been reported completely. √ (2√ x 1 mark = 2 marks)

c. The importance of incorporating each of the following information in the engagement letter:

i. Management responsibility:

Information on management responsibility is important to emphasis to the audit client of the management responsibility for the maintenance of the accounting records and preparation of the financial statements. This would in turn minimise possible misunderstanding by the client regarding the auditor’s responsibility. √√

ii. Degree of auditor’s assurance:

Information on degree of auditor’s assurance is important to highlight the inherent limitation of the audit whereby the auditor’s report may only provide a form of reasonable assurance on the truth and fairness of the financial statements instead of an absolute assurance of accuracy of the financial information. This would help in ensuring that the management is aware of the scope and limitation of the audit. √√ (4√ x 1 mark = 4 marks)

d. i. The auditor is qualified but he is not familiar with the nature of the client’s business.

Generally, the auditor should turn down the appointment because he might not be able to perform the audit effectively and efficiently due to unfamiliarity with the nature of the client’s business. However, the auditor might still consider to accept the appointment if he could engage a specialist with adequate experience of the client’s industry. √√

ii. The auditor is able to comply with various ethical requirements but the management team has lacks of integrity.

b. The consequences if the auditor finds the analytical procedures reveals no unusual fluctuation to compare to current year.

Auditor to perform fewer detailed tests, √ audit procedures can be eliminated √ and sample size is to be reduced. √ (3√ X 1 mark = 3 marks)

c. The component of audit risk that is most suitable for each of illustration below:

NO ILLUSTRATION COMPONENT OF AUDIT RISK

- The complexity of regulating financial institutions due to frequent changing of rules and regulations.

Inherent risk√

- Confirmation received from account receivable could not detect that there was a material misstatement in the account balance.

Detection risk√

- The cashier who is responsible to receive the cash from the counter is also responsible to record and keep the money in the strong room.

Control risk√

(3√ X 1 mark = 3 marks)

d. The meaning of population and sampling units.

Population is the entire set of data from which a sample is selected and about which the auditor wishes to draw conclusions. √ A population may be divided into strata, or subpopulation, with each stratum being examined separately. √ (2√ X 2 marks = 4 marks)

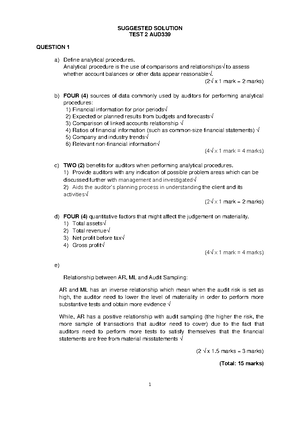

B. a.

NO. SITUATION QUALITATIVE / QUANTITATIVE

Amount involving fraud. Quantitative √

Improper description of accounting policy. Qualitative √

Inadequate explanation on calculation on depreciation for property, plant and equipment in the notes to the accounts.

Qualitative √

- The proportion of the amount paid in directors’ fees.

Quantitative √

(4√ X 1 mark = 4 marks)

b. There is an inverse relationship √ between materiality and the level of audit risk, that is, the higher the materiality level, the lower the audit risk and vice versa. √ The auditor takes the inverse relationship between materiality and audit risk into account when determining the nature, timing and extent of audit procedures. √ For example, if, after planning for specific audit procedures, the auditor determines that the acceptable materiality level is lower, audit risk is increased. √ (4√ X 1 mark = 4 marks) (Total: 20 marks)

QUESTION 3 A. a. Audit procedure is a detailed instruction or steps, usually in the form of instructions, for the accumulation of seven types of audit evidence, in order to determine if specific audit objectives are met. √ (1√ x 2 marks = 2 marks)

b. Any TWO (2) reasons for auditors in performing audit procedures. 1) To spell out the procedures in sufficiently specific terms so that the auditor may follow the instructions during the audit. √

- Audit procedure is considered as a very important step that helps develop a much-needed trust in the market. It helps to establish that there are no material misstatements in the financial statements of the company, and the company is free and fair from all types of frauds. √ (Or any other acceptable answer) (Any 2√ x 1 marks each = 3 marks)

c. Type of audit evidence obtained by auditor for each of the following audit procedures performed:

No Audit procedures performed Type of audit evidence

- Obtain letter from the client’s solicitor which states that there are no lawsuits against the client.

Confirmation√

- Sight client warehouse personnel carrying out the stock taking procedures.

Observation√

- Agree the total amount of sales journal to the amount stated in the sales account.

Documentation √

- Recompute the unit sales price times the number of units for a sample of duplicate sales invoices and compare the totals with the calculations.

Recalculation√

- Perform a test count of the inventory during the stock take.

Physical examination√

(5 √ x 1 mark = 5 marks)

(Any 2√ x 1 marks = 3 marks) c. No. Type of audit report with audit opinion

Reason

i Modified audit report with disclaimer opinion√

The auditor is unable to form an opinion because all the related documents and records are destroyed in the fire. √ ii Modified audit report with adverse opinion√

Disagreement with management on the accounting treatment involving amount that is possibly material and significantly affecting the financial statement of the company. √ iii Standard unmodified audit report√

The financial statements were prepared in accordance with the applicable standard. √ iv Modified audit report with disclaimer opinion√

The auditor is prohibited to verify material and significant accounts receivable balance. Thus, forced the auditor to have limitation on the scope of audit. The effect is material and pervasive. √ v Unmodified audit report with emphasis of matter √

The management has the solution for the possible going concern problem and the matter has been adequately disclosed in the financial statements. √ (10√ x 1 mark = 10 marks)

B. Any TWO (2) Management objectives in designing effective internal control system:

Objectives Description Reliability of financial reporting

Management is responsible to produce financial statements which are fairly presented in accordance with reporting requirements of accounting frameworks. The objective of effective internal control over financial reporting is to fulfill these financial reporting responsibilities. √ Efficiency and effectiveness of operations.

Controls within a company encourage efficient and effective use of its resources to optimize the company’s goals. An important objective of these controls is accurate financial and non-financial information about the company’s operations for decision making. √ Compliance with laws and regulations.

Public, non-public, and not-for-profit organizations are required to follow many laws and regulations such as environmental protection and civil right laws, income tax regulations and anti-fraud legal provisions. √ (Any 2√ x 2 marks = 5 marks) (Total: 20 marks)

QUESTION 5

A. a. Any TWO (2) misstatements that can be prevented by having adequate controls on the timekeeping and payroll preparation. i. Manipulation of time records by employees. √ ii. Error in the calculation of gross pay, deductions, and net pay. √ (Or any other acceptable answer) (Any 2√ x 1 mark = 2 marks)

b. Any TWO (2) tests of controls that can be performed to ascertain the recorded payroll payments are for work actually performed by existing employees.

i. Examine time records for indication of approvals to ensure that the time records are approved by supervisor. √ ii. Examine human resource files to ensure adequate human resource files are maintained. √ iii. Review organization chart, discuss with employees and observe duties being performed. (Or any other acceptable answers.) (Any 2√ x 1 marks = 3 marks)

B. a. Weaknesses b. Possible effects c. Recommendations i. The purchasing officers are delegated a certain spending limit, but they are too busy to track the actual spending. √

The purchasing officers have tendency to spend more than the spending limit. √

The company should establish a system for the purchasing officers to keep track their spending. √

ii. The other two purchasing officers are struggling to fulfil their duties in the absence of clear job scope, thus, have no time to teach the newly hired purchasing officer. √

In the absence of a clear job scope, the purchasing officer might do task that is unnecessary which can cause them to delay some more important job. √

A clear job scope for every purchasing officer must be established to guide the completion of work for each of the purchasing officers. √

iii. The newly hired purchasing officer has made a lot of mistakes in purchasing items that are not needed urgently by the production department has caused hiccups in the factory operation. √

Purchasing the items that are not needed can cause hiccups to the factory operation as well as cause the company to suffer loss due to unnecessary spending. √

The Human Resource department must organize training for newly hired staff to help them in performing their task more efficiently. √

iv. The Head of Purchasing Department has too many roles to

The Head of the Purchasing Department might involve in manipulation or unable

The company must appoint different people to handle the planning and distribution sections to ensure the

SS AUD339 FEB 2022 - Answer Scheme

Course: Auditing (AUD339)

University: Universiti Teknologi MARA

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

Why is this page out of focus?

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades

Why is this page out of focus?

This is a preview

Access to all documents

Get Unlimited Downloads

Improve your grades