- Information

- AI Chat

Was this document helpful?

SS AUD689 DEC 2018 SUGGESTED SOLUTION

Course: Auditing (AUD339)

402 Documents

Students shared 402 documents in this course

University: Universiti Teknologi MARA

Was this document helpful?

DEC2018

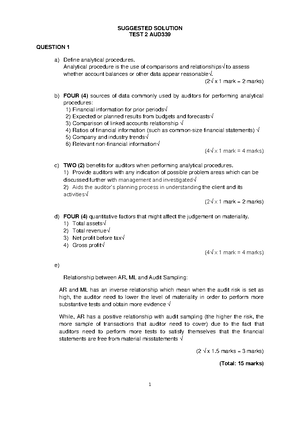

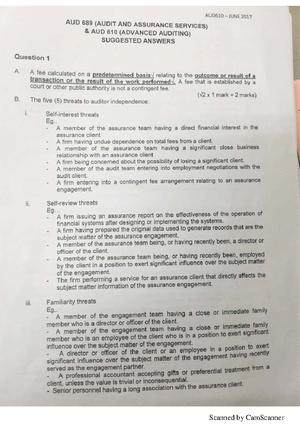

QUESTION 1

A.

i. Define contingent fees

A fee calculated on a predetermined basis relating to the outcome of a transaction or

the result of the services performed by the firm.

ii. Explain any TWO (2) safeguards that could be applied to reduce the threats on

contingent fees.

The safeguards include:

- An advance written agreement with the client as to the basis of remuneration.

- Disclosure to intended users of the work performed by the professional

accountant in public practice and the basis of remuneration.

- Quality control policies and procedures.

- Review by an objective third party of the work performed by the professional

accountant in public practice.

An inquiry into the financial affairs of a business including the examination of its audited

accounts for recent years and its current and estimated future position, as will enable the

investigating accountant to ascertain and marshal in his report the information relevant to

the purpose of his enquiries and to give recommendations and conclusions based on this

information.

Example:

a. Business or employee fraud

b. Criminal investigations

c. Shareholder and partnership dispute

d. Business economic losses

e. Prospectus reports

f. Purchase of shares in a private company or partnership

g. Request for loan

h. Investigations under statutes

QUESTION 2

A.

Issues)

MIA by-laws)

1.

Audit manager has family relationship

with the CEO of the company

Familiarity – family relationship may

create conflict of interest as the manager

may act to the best interest of the client

2.

Audit manager promoting the

company they are auditing

Advocacy threat may arise as the audit

manager may promote a client’s position

to the point that the professional

accountant’s objectivity is compromised

3.

Audit manager has been auditing the

same company for the last five years

Familiarity threat due to long association

with assurance client

4.

Consultancy service

May create self-review and self interest

B.