- Information

- AI Chat

Was this document helpful?

SS AUD689 JUN 2018 SUGGESTED SOLUTION

Course: Auditing (AUD339)

402 Documents

Students shared 402 documents in this course

University: Universiti Teknologi MARA

Was this document helpful?

JUNE 2018

1

Question 1

A. IESBA defined conflict of interest as an interest or relationship that would be seen by

a reasonable and informed third party to influence a professional accountant’s

objectivity.

Examples of situations in which conflicts of interest may arise include:

• Providing a transaction advisory service to a client seeking to acquire an audit client

of the firm, where the firm has obtained confidential information during the course of

the audit that may be relevant to the transaction.

• Advising two clients at the same time who are competing to acquire the same

company where the advice might be relevant to the parties’ competitive positions.

• Providing services to both a vendor and a purchaser in relation to the same

transaction.

• Preparing valuations of assets for two parties who are in an adversarial position

with respect to the assets.

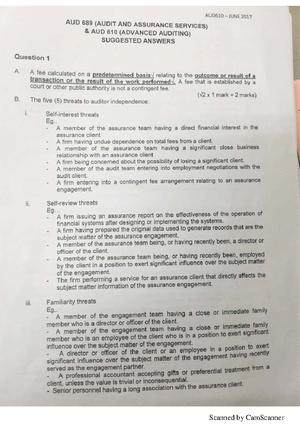

- with an assurance client

- A firm being concerned about the possibility of losing a significant client.

- A member of the audit team entering into employment negotiations with the

audit client.

- A firm entering into a contingent fee arrangement relating to an assurance

engagement.

B. Money laundering is the process by which the proceeds of crime are converted into

assets which appear to have a legal rather than an illegal source. The aim of

disguising the source of the property is to allow the holder to enjoy it free from

suspicion as to its source. √√

Legislation Money laundering is primarily regulated by the Anti-Money Laundering,

Anti- Terrorism Financing and Proceeds of Unlawful Activities Act 2001 (AKTA 613 –

LAWS OF MALAYSIA) √√

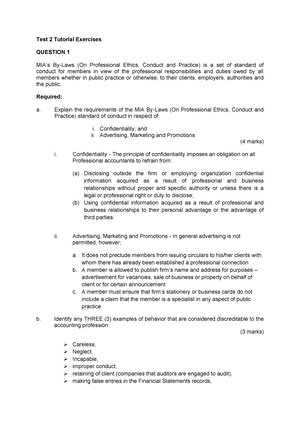

QUESTION 2

Issues

Mia by-laws

1

He ie Amar was not familiar to

audit hospitality business before

This situation may affect MIA by-laws on

Professional competence & due care. The by-laws

states that professional accountants must maintain

professional knowledge and skills at the level