- Information

- AI Chat

Was this document helpful?

TEST 2 AUD339 DEC19 SS - Lecture notes 1.2

Course: Auditing (AUD339)

402 Documents

Students shared 402 documents in this course

University: Universiti Teknologi MARA

Was this document helpful?

1

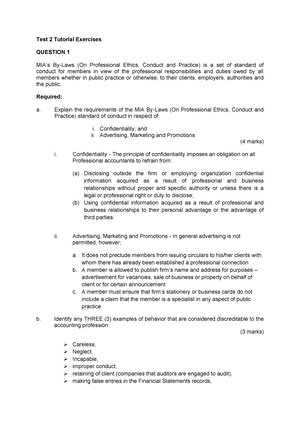

SUGGESTED SOLUTION

TEST 2 AUD339

QUESTION 1

a) Define analytical procedures.

Analytical procedure is the use of comparisons and relationships√ to assess

whether account balances or other data appear reasonable√.

(2√ x 1 mark = 2 marks)

b) FOUR (4) sources of data commonly used by auditors for performing analytical

procedures:

1) Financial information for prior periods√

2) Expected or planned results from budgets and forecasts√

3) Comparison of linked accounts relationship √

4) Ratios of financial information (such as common-size financial statements) √

5) Company and industry trends√

6) Relevant non-financial information√

(4√ x 1 mark = 4 marks)

c) TWO (2) benefits for auditors when performing analytical procedures.

1) Provide auditors with any indication of possible problem areas which can be

discussed further with management and investigated√

2) Aids the auditor’s planning process in understanding the client and its

activities√

(2√ x 1 mark = 2 marks)

d) FOUR (4) quantitative factors that might affect the judgement on materiality.

1) Total assets√

2) Total revenue√

3) Net profit before tax√

4) Gross profit√

(4√ x 1 mark = 4 marks)

e)

Relationship between AR, ML and Audit Sampling:

AR and ML has an inverse relationship which mean when the audit risk is set as

high, the auditor need to lower the level of materiality in order to perform more

substantive tests and obtain more evidence √

While, AR has a positive relationship with audit sampling (the higher the risk, the

more sample of transactions that auditor need to cover) due to the fact that

auditors need to perform more tests to satisfy themselves that the financial

statements are free from material misstatements √

(2 √ x 1.5 marks = 3 marks)

(Total: 15 marks)