- Information

- AI Chat

Was this document helpful?

Tips MIA By Law / its easy and catchy feel free to download

Course: Auditing (AUD339)

402 Documents

Students shared 402 documents in this course

University: Universiti Teknologi MARA

Was this document helpful?

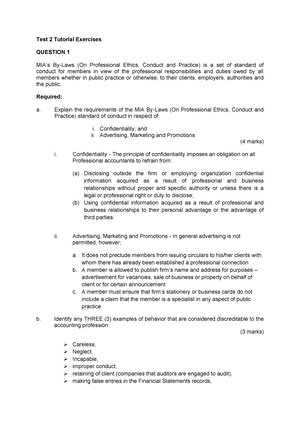

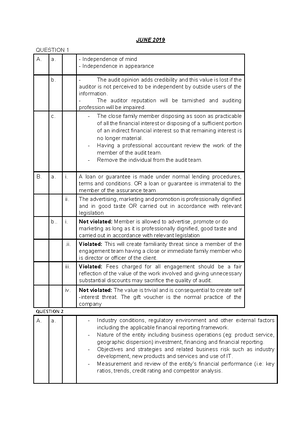

EXAMPLE OF QUESTIONS AND SUGGESTED REASONS

Reasons

1. Nazura provides accounting service since 3 years

ago. Nazura recently appointed as auditor.

Violated. This may create a self-review threat. Nazura

might be biased in issuing audit opinion

2. Nazura disclosed certain confidential info to

investigation committee of MIA without seek

permission from Client

Not violated. Under confidentiality, auditor has

professional duty to disclose such information

without seeking permission

3. General manager of Mukmin Bhd wants Aryan,

the audit partner in charge for Mukmin Bhd to help

in preparing interim FS

Violated. This may create a self-review threat. Aryan

might be biased in issuing audit opinion

4. Aryan was offered 20 free tickets to Sunway

Lagoon which worth RM4,000 in recognition of good

work. Aryan accepted.

Violated. This may create a threat to

independence/self-interest threat. Aryan might be

biased in issuing audit opinion

5. Aryan found material misstatement of net income

on previous year’s tax return. Management refused

to take corrective action. Aryan informed IRB.

Not violated. Under confidentiality, auditor has a legal

duty to disclose such information

6. Mukmin Bhd traditionally gives hampers during

festive seasons. This year, Aryan was sponsored

with a family dinner worth RM3,000 in a 5-star hotel

Violated. This may create a self-threat due to

acceptance of undue hospitality. Aryan might be

biased in issuing audit opinion or the independence

might be impaired

7.Rahim , Chartered Accountant has outstanding

loan of RM110,000 from Setia Bhd. The loan is on

normal lending policy and no special treatment was

given to Rahim. Rahim & Chia accepted the

appointment as external auditor of Setiaraya. Chia

will be partner in charge

Not violated. There is no issue of independence as the

outstanding loan is made under normal lending policy.

8. Rahim & Chia provide accounting & tax services

to Bahtera from 1.8.2014 to 31.12.2015. The

management proposed Rahim & Chia to be

company’s auditor to audit FS for YE 31.3.2016.

Violated. This may create a self-review threat as they

will be auditing FS that they were involved in

preparing before. They might be biased in issuing

audit opinion

9. Rahim & Chia appointed as auditor of K Bhd for YE

31.12.2015 but not reappointed again after that.

Immediately after AGM in 2016,Rahim & Chia

accepted offer to provide tax consultancy services

Not violated. There is no issue of independence as the

appointment of auditor was made before they

provide the tax consultancy services

10. Chia bought 2nd hand car worth RM150,000 from

audit client. The company offered 50% discount and

Chia accepted.

Violated. This may create threat to

independence/self-interest threat as the purchase

was not made on normal term. Chia might be biased

in issuing audit opinion

11. Haikal just graduated with Bachelor in

Accountancy. He has accepted offer as branch

manager in an accounting firms

Violated. Under method of practice, any branch of

accounting firm should be under management and

control by a person who is a member of MIA