- Information

- AI Chat

Was this document helpful?

ACC466 GP2 Financial Statement Analysis Jan 2024

Course: Financial and Management Accounting (ACC466)

49 Documents

Students shared 49 documents in this course

University: Universiti Teknologi MARA

Was this document helpful?

UNIVERSITI TEKNOLOGI MARA CAWANGAN NEGERI SEMBILAN

KAMPUS SEREMBAN

ACC466

GROUP PROJECT 2 – FINANCIAL STATEMENT ANALYSIS (20%)

Chapter: FINANCIAL STATEMENTS ANALYSIS

Objective: Demonstrate communication skills in task related to management and financial accounting

for business enterprise.

Instructions:

1. In a group of four (4-5) members, you are required to choose ONE (1) public listed company

(listed in Bursa Malaysia’s website) and download the annual report/financial statement of the

company for the year ended 2017 and 2022:

(Note: Financial institutions/insurance/service company should be excluded).

(Website: https://www.bursamalaysia.com/market_information/equities_prices?top_stock=top_active)

2. You are required to prepare a pre-recorded video in 10-15 minutes presentation of financial

analysis contains of the following information.

a) Introduction (Type of business, principal activity and background of both companies)

b) Analyse the performance of the selected company in terms of:

i. Liquidity - The ability to pay back the short- term obligations

ii. Profitability - The effectiveness in generating profit

iii. Efficiency - The efficiency in managing its sources/ assets

iv. Leverage - The level of riskiness in settling long-term obligations

c) Conclusions.

3. Presentation material (to be submitted together with the video):

a. Cover page (Financial Statement Analysis of ‘Name of company’ for year… (For

eg 2017 & 2022), Group/Class, Group members (Name & ID)

b. Acknowledgment

c. Table of content

d. Findings

Calculation of financial ratios:

i. Liquidity ratios (current ratio, quick ratio)

ii. Profitability ratios (net profit margin, gross profit margin, return on assets,

return on capital employed)

iii. Efficiency ratio (inventory turnover, average collection period, total assets

turnover)

iv. Leverage ratios (debt ratio, debt to equity ratio, time interest earned)

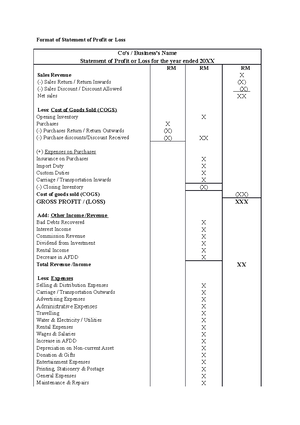

e. Appendix (Financial Statements of the business - SOFP and SOPL only)

4. Important notes:

a. Each group must select different companies. Please note that a penalty will be imposed if

the same company is chosen by multiple groups.

b. Please be informed that the video and report should be uploaded to the Microsoft Teams

platform. Kindly note that only softcopy versions are required for submission by the group

leader.

c. Submission date : Week 15 (22/1/2023- by 5.00 pm)