- Information

- AI Chat

ACC466 TEST 2 JULY 2023 - Question

Financial and Management Accounting (ACC466)

Universiti Teknologi MARA

Recommended for you

Preview text

© Hak Cipta Universiti Teknologi MARA

UNIVERSITI TEKNOLOGI MARA

TEST 2

COURSE : FINANCIAL AND MANAGEMENT ACCOUNTING

COURSE CODE : ACC

TIME : 1 HOUR 45 MINUTES

INSTRUCTIONS TO CANDIDATES

- This question paper consists of three (3) questions.

- Answer ALL questions in English.

- Discussion is strictly prohibited.

© Hak Cipta Universiti Teknologi MARA

QUESTION 1

a) Alisya Hair Salon started its business on 1st June 2023 with RM30,000 in cash at the bank. On the same date, Alisya made a purchase of hair washing chairs for RM5, and a tornado hair steamer for RM10,000 by cheque. She also rented a shop lot that costs RM1,000 per month. Alisya hired Siti as an assistant in her hair salon and pays her a salary of RM1,500 per month for the job related to various hair services. Alongside the services, Alisya Hair Salon sells hair care products at prices ranging from RM10 to RM300 to generate extra income for the business. All hair care products are purchased on credit from HC Limited, a supplier from China. Alisya decides to acquire a loan of RM20,000 from CIMC Bank to finance its future working capital, with an annual interest rate of 5%. Besides that, Alisya also plans to approach the bank for a bank overdraft facility, hoping to enhance the salon business cashflow. Required: Identify ten (10) cost items above and classify them into the classification of Asset, Liability, Revenues, and Expenses in the following table: Classification Cost items Asset Liability Revenue Expenses (5 marks) b) Choose the most appropriate answer provided in the table above to fill in the blanks in the following statements. creditors revenue public entity limited liability faithful represented accounting relevant current assets limited company costing expenses verifiability current liabilities material unlimited liability

- Accounting information is _____ if it can provide helpful information about past events and help in predicting future events or in taking action to deal with possible future events.

- _____ specified that if the business fails and the company’s assets are not enough to cover the debt, the creditors do not have a right against the shareholder’s personal properties.

- The group of users of financial statements represents _____ who are interested to know the ability of the business in repaying the amount owed.

- Depreciation of non-current assets is an example of _____ and is recorded in a statement of profit or loss.

© Hak Cipta Universiti Teknologi MARA Accounts payable 155, Discounts received 3500 Insurance 3, 3% Loan from HLG Bank 260, Rental expenses 11, Carriage outwards 750 Duty on Purchases 2300 Interest on loan 7, Packaging expenses 300 Utility Bills 16, Distribution expenses 4800 Administrative Expenses 8100 Motor Vehicles 150, Office Equipment 17, Fixture and fitting 30, Accumulated depreciation as at 1 January 2022: Motor Vehicle 24, Office Equipment 3, Fixture and fitting 21000 1,217,650 1,217, Additional information:

- Inventory as at 31 December 2022 was valued at RM35,800.

- The items below are still outstanding as at 31 December 2022: Commission received RM2, Insurance RM Rental RM

- Prepaid expenses as of 31 December 2021 consist of utilities expenses amounting RM500.

- The owner took RM300 cash in hand for personal used and no record has been made.

- Depreciations for the year are to be provided on yearly basis as follows: Motor Vehicles - 20% on reducing balance method Office Equipment - 10% on straight line method Fixture and fitting - 15% on straight line method

© Hak Cipta Universiti Teknologi MARA 6. One of the account receivables worth RM500 was declared bankrupt.

7. The allowance for doubtful debt is to be adjusted to RM1650 for the year ended 31 December

2022.

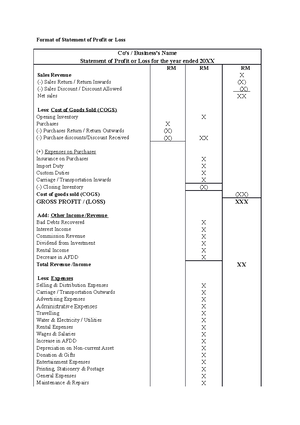

Required: a. A Statement of Profit or Loss for the year ended 3 1 December 2022. ( marks) b. A Statement of Financial Position as at 3 1 December 2022. ( marks) Note 1: Use vertical format presentation for both statements and show all calculations. Note 2: Calculate to the nearest RM. (Total: 30 marks) QUESTION 3 YXW Trading Statement of Financial Position as at 31 December 2022 RM RM Non-Current Assets: Motor vehicle 80000 Office equipment 20000 Current Assets: Inventory 25000 Accounts Receivable 22200 Cash 5000 Bank 38000 Prepaid insurance 900 TOTAL ASSETS 191100 Owner’s Equity: Beginning Capital 77000 Add: Net Profit 30000 Non-current liability: 5% Loan 50000

ACC466 TEST 2 JULY 2023 - Question

Course: Financial and Management Accounting (ACC466)

University: Universiti Teknologi MARA