- Information

- AI Chat

Tutorial Topic 5 Q and A

Financial and Management Accounting (ACC466)

Universiti Teknologi MARA

Recommended for you

Preview text

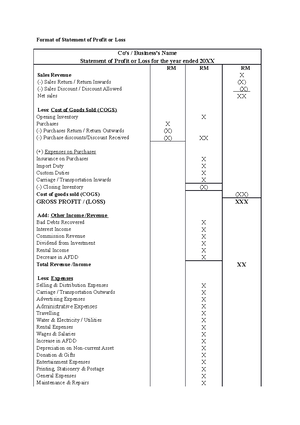

####### TUTORIAL TOPIC 6: FINANCIAL STATEMENTS WITH ADJUSTMENTS

December 2020.

Particulars Debit (RM)

Credit

Purchases 250,

Return inwards 11,

Carriage outwards 9,

Carriage outwards 9,

Inventory as at 1 January 2020 36,

General expenses 1,

Rental received 3,

Commission received 4,

3% loan from Bank Rahmat 50,

Accounts payable 23,

Furniture and Fittings 60,

Motor vehicles 95,

Machinery 60,

Investment 83,

Machinery 12,

Drawings 5,

Capital 296,

729,000 729,

Additional information:

Inventory as at 31 December 2020 was valued at RM22,000.

The bank loan was approved on January 2020 and part of the interest on loan was still

One of the credit customers owing RM800 was declared bankrupt and the debt needs to be written off. Allowance for doubtful debt is to be adjusted to 2% on the remaining accounts receivable.

Depreciations for the year are to be provided as follows: Motor vehicles - 20% per annum on cost, yearly basis Furniture and Fittings - 15% per annum on cost, yearly basis Machinery - 10% per annum on carrying amount, yearly basis

During the year, the owner took goods worth RM700 for his personal use.

The following were prepayments as at 31 December 2020: Prepaid salary expenses RM6, Prepaid commission received RM2,

Utilities bill for the month of December 2020 of RM250 was not yet paid.

Required:

a. The Statement of Profit or Loss for the year ended 31 December 2020. (18 marks)

b. The Statement of Financial Position as at 31 December 2020. (12 marks)

Note 1: Use vertical format presentation for both statements and show all calculations. Note 2: Calculate to the nearest RM. (Total: 30 marks)

Hermas Trading Statement of Financial Position as at 31 December 2020 RM RM RM NON-CURRENT ASSETS Motor vehicles 95,000 41,500 53, Furniture & Fittings 60,000 9,000 51, Machinery 60,000 16,800 43,

Patents 12, Investment 83,

243 , 300 CURRENT ASSETS Inventory 22, Account receivable (22,500 - 800) 21, (-) AFDD (2% * 21,700) 434 21 , 266 Cash at bank 20, Cash in hand 10, 950 Prepaid salary 6,500 80 , 916

324 , 216

####### OWNER'S EQUITY

Capital 296 , (-) Net loss (42,034) of (-) Drawings (5,000+700) (5,700) 248 , 266 NON-CURRENT LIABILITIES Loan- Bank Rahmat 5 0,

####### CURRENT LIABLITIIES

Account Payables 23, Accrued Interest on loan 700 Prepaid commission received 2, Accrued Utilities 250 25, 950

324 , 216 (24/ * ½ = 12 marks)

(Total:30 marks)

September 2020.

Additional information:

Inventory as at 30 September 2020 was valued at RM 27,000.

Loan from AB Bank was taken on 1 January 2020 and the interest at 9% per annum has not yet been paid.

Accrued rental received was RM12,600 and RM2,340 of wages and salaries were still outstanding on 30 September 2020.

####### SOLUTION QUESTION 2

Falini Enterprise Statement of Profit or Loss for the year ended 30 September 2020 RM RM RM

Sales 348,

Return inwards 5,

Less: Discount Allowed (6,200) Net Sales 337, Less: cost of goods sold opening stocks 66, (+) purchases (108600-1150) 107,

Return outwards 5,

Net Purchase 101, Add: Carriage Inwards 3,

Duty on Purchase 9,

Cost of goods purchased 114, Cost of Goods available for sale 181, (-) Closing stocks (27,000) Cost of Goods sold 154, Gross Profit 182, Add: Other revenues rental received (87450+12600) 100,

Commission revenue 18,

####### 117,

####### 299,

Less: Expenses Advertising expenses 20, Insurance (12780-2000) 10, Carriage outwards 9, Wages & salaries (43200+2340) 45, Interest on loan (9%(150000X9/12) 10,

Water and electricity 14,

Repairs 4,

Sundry expenses 7,

Administrative expenses 6,

Rental expenses 24,

Depreciation - Machinery (20%x138600) 27, Depreciation - Furniture (15%x23400-4680) 2, Increase in AFDD (2500+2160-3780) 880 (183,193) Net profit 116,

(Total 36 ticks/2= 18 marks)

Falini Enterprise Statement of Financial Position as at 30 September 2020 RM RM RM Non- Current Assets Cost Acc. Deprn NBV - Land 200,000 - 200, Machinery 138,600 55,440 83, Furniture 23,400 7,488 15,

Copyright 6,

Total Non-Current assets 305, Current assets Cash 17, Bank 149, Inventory 27, Accounts Receivable (37800-2160) 35, Less: Allowance for doubtful debts (2,500) 33, Accrued Rent Received 12, Prepaid Insurance 2, Total current assets - 240, Total Assets 546,

Financed by: Owner's equity Capital 237, Net profit 116, Less: Drawings (8820+1150) (9,970) 343, Long term liabilities

Loan from AB Bank 150,

Current liabilities Accounts payable 37, Accrued Wages& salaries 2, Accrued interest on loan 10, Prepaid commission revenue 1, 52, Total equity and liabilities 546,

####### SOLUTION QUESTION 3

Sales 1,793, Less: Sales return/Return inwards (500) Discount allowed (200) Net sales 1,792,

Less: Costs of goods sold Opening inventory 16, Purchases (740,000-250) 739, Less: Purchase return/Return outwards (1,000) Discount received (200) Net purchases 738, Add: Custom duty 1, Cost of goods purchased 739, Cost of goods available for sales 756, Less: Closing inventory (20,000) Cost of goods sold (736,050) Gross profit 1,056,

Add: Other Revenues/Income Income on investment (11,000+3,000) 14,

Less: Operating Expenses Depn: Motor vehicle [10% x(520,000 - 192,500)] 32, Office furniture (15% x 75,000) 112, Administrative expense 85, Interest on loan (8% x 300,000) 24, Advertising expense 50, Audit fees (11,000+1,000) 11, Doutful debts (3,090-1,500+500) 2, Insurance expense 2, Rental expense 12, Carriage outwards 3,000 (334,340) Net profit 736,

Amra Enterprise Statement of Profit or Loss for the year ended 30 June 2019

- QUESTION

- The following trial balance was extracted from the books of Hermas Trading as at

- Sales 298, (RM)

- Purchases 250,

- Return outwards 16,

- Return inwards 11,

- Discounts 4,550 2,

- Carriage outwards 9,

- Duty on purchases 2,

- Inventory as at 1 January 2020 36,

- Salary expenses 20,

- Advertisement expenses 5,

- General expenses 1,

- Stationary

- Utilities expenses 11,

- Interest on loan

- Rental received 3,

- Commission received 4,

- Allowance for doubtful debt 1 January 2020 1,

- 3% loan from Bank Rahmat 50,

- Accounts payable 23,

- Accounts receivable 22,

- Furniture and Fittings 60,

- Motor vehicles 95,

- Machinery 60,

- Investment 83,

- Motor vehicles 22, Accumulated depreciation as at 1 January 2020:

- Machinery 12,

- Cash in hand 10,

- Cash at bank 20,

- Drawings 5,

- Capital 296,

- Insurance expenses 2,

- Repairs and maintenance 4,

- Patents 12, - 729,000 729,

- QUESTION

- The following is the trial balance extracted from the books of Falini Enterprise as at

- Capital 237, Debit (RM) Credit (RM)

- Cash at bank 149,

- Cash in hand 17,

- Accounts payable 37,

- Advertising expenses 20,

- Carriage inwards 3,

- Accounts receivable 37,

- Allowance for doubtful debts as at 1 October 2019 3,

- Land 200,

- Machinery 138,

- Furniture 23,

- Discount allowed 6,

- Rent received 87,

- Drawings 8,

- Carriage outwards 9,

- Commission revenue 18,

- Administrative expenses 6,

- Insuranse expenses 12,

- Loan from AB Bank 150,

- Purchases 108,

- Rental expenses 24,

- Copyright 6,

- Repairs 4,

- Return inwards 5,

- Return outwards 5,

- Sales 348,

- Sundry expenses 7,

- Inventory as at 1 October 2019 66,

- Duty on Purchase 9,

- Wages and salaries 43,

- Water and electricity 14,

- Accumulated depreciation as at 1 October

- Machinery 27,

- Furniture 4, - 921,900 921,

- QUESTION

Tutorial Topic 5 Q and A

Course: Financial and Management Accounting (ACC466)

University: Universiti Teknologi MARA

- Discover more from: