- Information

- AI Chat

Artificial Intelligence

Civil Engineering (BSCE 01)

Ateneo de Davao University

Recommended for you

Preview text

Artificial Intelligence and

Entrepreneurship:

Implications for Venture

Creation in the Fourth

Industrial Revolution

Dominic Chalmers

1

, Niall G. MacKenzie

1

, and Sara Carter

1

Abstract

This article explores the ways artificial intelligence (AI) may impact new venture processes, practices and outcomes. We examine how such technology will augment and replace tasks associated with idea production, selling, and scaling. These changes entail new ways of working, and we consider implications for the organizational design of entrepreneurial ventures. While AI can enhance entrepreneurial activities, liabilities stem from this technological leverage. We advance a research agenda that draws attention towards negative social and economic impli- cations of AI, particularly for more traditional small firms at risk of disintermediation in an AI economy.

Keywords

artificial intelligence, industry 4, scaling, selling, entrepreneurship, new venture, opportunity, external enabler

Digital technologies are transforming the nature and scope of entrepreneurial activity (Nambisan, 2017; von Briel et al., 2018). One specific feature of digitization is the capacity to automate activities that require significant human input and effort. Recent developments in Artificial Intelligence (AI) are enabling machines to process large unstructured data sets using complex, adaptive algorithms to perform tasks normally requiring human intelligence (Choudhury et al., 2018; Stone et al., 2016). This has led some to reflect on the generativity of AI (Amabile, 2019), with suggestions that the technology may not only represent a method of achieving cost and productivity benefits, but a fundamental innovation to the tools by which we innovate (Cockburn et al., 2018). Equally, these innovations have wider, potentially negative effects to which entre- preneurs must adapt. Popular concerns abound that AI threatens both low-skilled service-based work (e., contact centers) and professional work (e., medical care, legal work, and financial services), with some predicting the consequences may include mass unemployment and

1Adam Smith Business School, University of Glasgow, Glasgow, Scotland

Corresponding Author: Dominic Chalmers, Adam Smith Business School, University of Glasgow, Glasgow, G12 8QQ, Scotland. Email: dominic. chalmers@ glasgow. ac. uk

Paper submission to a special issue

Entrepreneurship Theory and Practice 2021, Vol. 45(5) 1028– © The Author(s) 2020

Article reuse guidelines: sagepub. com/ journals-permissions DOI: 10. 1177/ 1042 2587 20934581 journals. sagepub. com/ home/ etp

Chalmers et al. 1029

increasing levels of inequality in the near future (Korinek & Stiglitz, 2017; Susskind & Susskind, 2015). Such a seismic shift to socio-political, economic and technological landscapes invites closer scrutiny from entrepreneurship scholars. Specifically, while the existing focus of AI/automation literature has reflected upon the nature of more traditional forms of skilled and unskilled employ- ment (The World Bank, 2019), there is a need to understand how novel technological affordances will affect entrepreneurs and the myriad creative, cognitive and physical processes enacted when launching a new venture (Obschonka & Audretsch, 2019; Townsend & Hunt, 2019). We contend that emerging forms of automation, together with some of the policy responses designed to coun- tervail their socio-economic effects, have the potential to shift some of the foundations on which existing conceptualizations and practical assumptions about entrepreneurship rest. Despite the increasing ubiquity of both mechanical and cognitive automation, little has been written specifically on the entrepreneurship-AI intersection (e., Liebregts et al., 2019; Obschonka & Audretsch, 2019; Townsend & Hunt, 2019). Instead, theoretical understanding of AI and broader processes of automation has been driven by economists who have taken a largely macro- level perspective to explore implications for employment, income and policy (Acemoglu & Restrepo, 2018; Agrawal, Gans, Goldfarb et al., 2019a; Korinek & Stiglitz, 2017). At a firm level, progress has been led by marketing and service industry scholars, who have made strides analyzing the impact new technologies are having on established organizational practices (e., Huang & Rust, 2018; Syam & Sharma, 2018). By far the most prolific area of research however has been practitioner-focussed, with a significant body of strategy-oriented literature reflecting the excitement associated with AI and its many potential implications for the firm (Davenport & Ronanki, 2018; Kolbjørnsrud et al., 2016; Ransbotham et al., 2017). The purpose of this article is to accelerate theoretical progress on AI, specifically within the entrepreneurship domain. We complement existing digital entrepreneurship theories (Nambisan, 2017; Nambisan & Baron, 2019) by developing a conceptual framework that maps the impacts of AI on new venture processes, practices and outcomes. In doing so, we recognize the diffusion of AI technology and other digital technologies will not happen in isolation, but rather as part of a broader trajectory of interlinked economic and political changes. Taking a “big picture” approach, our framework synthesizes entrepreneurship, economic and digital technology theo- ries (Korinek & Stiglitz, 2017; Nambisan, 2017; Obschonka & Audretsch, 2019) to envisage how future scenarios may shape different aspects of entrepreneurship. From there, we identify potential research avenues for understanding the effects of AI on entrepreneurship. Specifically, we ask: how will AI influence the antecedents of venture formation; how will AI affect venture- level processes such as prospecting, developing and exploiting activities; and finally, how will AI shape outcomes of entrepreneurship such as rewards? We offer several contributions to the emerging entrepreneurship-AI intersection. First, the concept of “liabilities of technological leverage” is introduced to describe a new set of risks to scaling companies stemming from the “unexplainable” nature of many machine learning/AI algorithms. These liabilities have organizational consequences too, as the automation or aug- mentation of a significant volume of tasks and jobs will change the organizational design and decision- making systems within new ventures. Second, we examine different ways in which AI may be used by entrepreneurial actors to develop new venture ideas. We identify a valuable stream of research that might examine how competing paradigmatic approaches within machine learning (ML) can be used to address different knowledge tasks in the development of new ven- ture ideas. Finally, we identify some “grand challenges” (Wiklund et al., 2019) for entrepreneur- ship scholars relating to AI. Specifically, after reflecting on the rapid onset of Industry 4. technologies, and some of the potential negative externalities of such technological change, including growing inequality, labor displacement and algorithmic bias, we question the role of

Chalmers et al. 1031

algorithms; and finally, ML, which is the “engine” of an AI system, works to detect patterns and makes predictions from the unstructured data. While most AI systems have the same overarching objectives – to learn and predict in a way that is appropriate for their environment – there is sig- nificant variability in how systems function and what tools, or combination of tools are used to endow machines with intelligence.

The Origins of AI

AI is central to current technological changes, though its origins can be traced to the Analytical Engine, developed by Ada Lovelace and Charles Babbage in the 1830s. Lovelace composed what is considered to be the first operating program to compute the Bernoulli numbers on Babbage’s machine, and in doing so established a blueprint for contemporary AI and machine learning systems. Though Lovelace was enthusiastic about the potential of the Analytical Engine to generate insights human minds could not, she argued the machine could not produce original ideas. This was disputed by Alan Turing, the English logician who was central to the develop- ment of modern computing. In his seminal article Computing Machinery and Intelligence (Turing, 2004 [1950]), Turing addressed what he called “the Lady Lovelace objection” by dis- puting the notion that a machine cannot be creative (Korukonda, 2003). His research was instru- mental in theorizing how computers could “automatically” learn, and he outlined the still-influential Turing Test as a measure of machine intelligence. Building on these foundations, the genesis of AI as an organized field of research is widely agreed to be the Dartmouth Summer Research Project on Artificial Intelligence in 1956 (Ertel & Black, 2018). During the summer, mathematicians and computing scientists such as Marvin Minsky, John McCarthy and Claude Shannon convened to discuss the development of intelligent machines, leading to the development of several of the subfields that form the foundations of modern AI systems, and most notably, machine learning.

Contemporary AI

Following the Dartmouth meeting, the field of AI experienced periods of expansion and retrench- ment (Haenlein & Kaplan, 2019) leading to sporadic developments over the ensuing decades. Since the early 2010s however, there has been a resurgence of interest in AI (Brock & von Wangenheim, 2019). Rapid advances in statistical machine learning techniques have broadened the scope for AI applications, and commercial uses now span diverse areas such as marketing (Davenport et al., 2019), molecule discovery (Gawehn et al., 2016), automotive manufacturing (Luckow et al., 2018) and beyond. A subset of machine learning called deep learning has also advanced rapidly (LeCun et al., 2015 ). Influenced by human biology, deep learning employs the concept of deep neural networks (DNNs) to create hierarchical layers of synthetic neurons that each extract different patterns from an input (e., an image). To assesses their closeness to reality, one layer may look for the outline of a cat’s ear, while another looks for the tip of a tail, and if it recognizes this, will trigger a spe- cific neuron on a subsequent (hidden) layer and etc., until an object can be accurately classified as a cat. Deep learning uses backpropagation methods to optimize learning processes, and this has catalyzed progress within the field. The implications of these new techniques are profound, as “rather than focusing on small well-characterized datasets or testing settings, it is now possi- ble to proceed by identifying large pools of unstructured data which can be used to dynamically develop highly accurate predictions of technical and behavioral phenomena” (Cockburn et al., 2018, p. 14). Applications of deep learning now pervade everyday life, from computer vision

1032 Entrepreneurship Theory and Practice 45(5)

used by Facebook to recognize or “tag” friends, through to natural language processing being applied to Amazon’s Alexa or Apple’s Siri voice assistants. These breakthrough advances in machine learning/neural networks are converging with increased computational power (Taddy, 2018), inexpensive sensors and increasingly economical methods of collecting and preparing training data (e., Amazon SageMaker) to spur a new wave of AI start-up activity. Commercial applications of AI are increasingly visible to investors, and AI-related ventures are attracting significant venture capital funding (Su, 2019). Thus, after a number of so-called AI “winters”, there appears to be sufficiently broad-based commercial trac- tion with AI technology (Furman & Seamans, 2019) to ensure a more sustained period of development.

The Implications of AI on New Ventures Processes and Practices:

A Framework

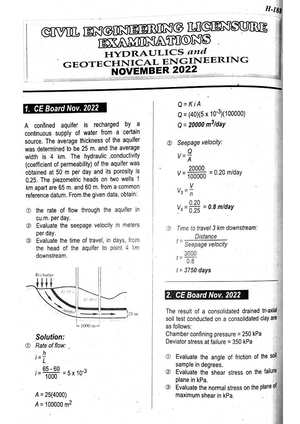

We now turn to our organizing framework that examines AI as a digital external enabler of new venture ideas (von Briel et al., 2018). We begin by examining how AI impacts upon the anteced- ents of venture formation, then consider how the technology will shape a range of firm-level activities, before turning to the potential implications for entrepreneurial outcomes (Figure 1 , above).

Figure 1. Artificial Intelligence and new venture processes and practices. The refernces cited are as follows: (Andreassen et al., 2017; Douglas & Shepherd, 2002; Fischer & Reuber, 2011; Fleming, 2018; Garbuio & Lin, 2019; Glikson & Woolley, in press; Gregory et al., in press; Hoynes & Rothstein, 2019; Ireland et al., 2003; Kronblad, in press; Kumar et al., 2019; Nambisan et al., 2019; Salomons, 2018; Vaghely & Julien, 2010; Yoo et al., 2010).

1034 Entrepreneurship Theory and Practice 45(5)

further note a large skills-gap and labor shortage in the key job roles required to implement com- plex AI systems (Marr, 2018). Where there are skilled individuals who are capable of performing these technical roles, the high salaries paid by leading technology companies mean it is often challenging for many nascent entrepreneurs to build a team with requisite skills to successfully pursue an opportunity (Cheng, 2018).

Research Implications Our overview of individual and system-level new venture antecedents surface some interesting tensions that requires further exploration. First, will the global race for AI developers lead to established and well-resourced corporations capturing leading AI talent? If so, what are the implications for AI start-ups? Will start-up and scaleup activity be stunted by this skilled labor shortage? Second, we suggest entrepreneurship scholars shift analytical focus from a firm-level towards a more macro- level of analysis to understand the unique characteristics of venture for- mation in an AI economy. We do so as there are multiple overlapping external enablers of AI- based new venture ideas, including other interrelated industry 4 technologies and evolving public sentiment towards the use of private data that will materially shape the formation of new venture ideas. Finally, we suggest that scholars reflect not only on AI-based ventures but consider some of the economic changes these new firms may induce that will affect non-AI ventures. For example, how will entrepreneurial opportunities change for non tech-focused companies that operate in a highly automated economy? And, will a UBI that is brought in because of automa- tion lead to a flourishing of small businesses?

Prospecting and the Production of New Venture Ideas

Turning now to venture-level activities, Cockburn et al. (2018) suggest that AI is leading to a new “innovation playbook” that leverages large datasets and learning algorithms to precisely predict phenomenon. It therefore logical to assume that such datasets and algorithms could be turned towards entrepreneurial opportunity identification and exploitation. The novelty of these AI systems for innovation search processes lies in the ability to see patterns or detail in data that are imperceptible to humans. In a medical science context this might involve applications that can recognize cancer at an earlier stage than human experts (Leachman & Merlino, 2017; Miller & Brown, 2018) or new technology firms such as Atomwise (Agrawal et al., 2019) who use AI to predict the outcome of chemical interactions, removing the need to manually test hundreds to thousands of compounds and in doing so reducing discovery and optimization processes that take years to a matter of weeks. This superhuman information search and prediction is also being applied to a range of com- mercial contexts. The real estate company Skyline 2 collects millions of data points on property trends such as yield levels and default rates to predict where investors should buy. Scoop Markets 3 meanwhile analyzes the content of Twitter messages to predict which breaking news stories may influence exchange prices, thus enabling equity and cryptocurrency traders to act before markets move. Reflecting the heterogeneity of new ventures in terms of their form, function and purpose, we identify three ways 4 in which AI may be used by entrepreneurs to augment information search and idea production. First, we recognize there will be a subset of science and technology-focussed start- ups that will use AI to search for technical solutions across complex combinatorial problem spaces (Agrawal et al., 2019). As LeCun et al. (2015) observe “(deep learning) has turned out to be very good at discovering intricate structure in high-dimensional data and is therefore applica- ble to many domains of science, business, and government.” Such an approach has parallels with positivist conceptualisations of entrepreneurial opportunities (Shane, 2000; Shane &

Chalmers et al. 1035

Venkataraman, 2000) where there is typically an objective “thing” (e., a material, molecule or gene sequence) that is a priori theoretically possible but requires vast experimentation to dis- cover. AI offers the potential to address such experimentation through its computational power at a relatively low cost. The second approach entails a more bottom-up method that utilizes social sentiment analysis (Gaspar et al., 2016) and natural language processing to analyze social media and other online content to identify customer needs. For example, entrepreneurs may be able to scan online cus- tomer forums for a product or service category they hope to disrupt to identify an untapped need; or they may look at broader enabling trends (Davidsson et al., 2018) on social media, seeking counterintuitive or emerging insights that provide advantageous information asymmetries. While this can be done manually or intuitively, AI-augmented approaches have the scope to identify needs (or market failures) at significant scale and can connect disparate pieces of knowledge to offer new insights that can drive business development. Finally, we see potential for entrepreneurial firms to test assumptions with a high level of confidence using AI systems, perhaps utilizing their existing data assets to predict how customers react to a feature or pricing change. Current practitioner methods such as Lean Start-up and Business Model Canvas emphasize customer engagement as a means of sourcing ideas and val- idating assumptions; however, such methods - while obviously useful - are prone to various biases (e., recall bias or social acceptability bias) and limited generalisability. The integration of “one- click machine learning” 5 research tools (such as Massive Analytics Oscar platform or Oneclick) into such processes may reduce search costs and the failures associated with time- consuming product/service iterations.

Research Opportunities It is far from obvious how research and development activities within new ventures will be trans- formed by AI technology. We see value in extending foundational work by Townsend and Hunt (2019) who contrast notions of uncertainty and action within various opportunity theories (e., effectuation, discovery) to conceptualize how AI-augmented search activities shape entrepre- neurial processes. Specifically, we propose Davidsson et al.’s (2018) external enablers frame- work as a valuable additional approach to consider, particularly as it attempts to sidestep the more intractable philosophical debates around entrepreneurial opportunities by focussing on the venture- level effects of (technological) enabling mechanisms. Finally, we suggest future research that examines information search and idea production within new ventures unpacks the compet- ing paradigms within machine learning theory. For example, Domingos (2015) identifies sym- bolist, connectionist, evolutionary, Bayesian and analogist traditions that each adopt distinct algorithmic approaches to prediction tasks. We suggest a deeper understanding of these approaches, which each prioritize different qualities such as inverse deduction or probabilistic inference, could be used to theorize new venture ideation and clarify which approach should be employed to address specific knowledge problems within entrepreneurial firms.

Developing: Organizational Design

A central pillar of emerging digital entrepreneurship theory is that spatial and temporal boundar- ies of entrepreneurial activities are becoming increasingly porous and fluid (Nambisan, 2017). This has implications for how entrepreneurs structure and operate their ventures, as they must adapt their operations to benefit from the affordances of establishing technologies such as open source (Lerner & Tirole, 2002), peer-to- peer platforms (P2P; Helfat & Raubitschek, 2018) and more recent advances such as cryptocurrency and Initial Coin Offerings (ICOs; Fisch, 2018). As with previous eras of technological progress, scholars have queried the applicability of

Chalmers et al. 1037

Decision Systems One of the fundamental uses of AI is to aid decision making processes (Agrawal et al., 2018). Entrepreneurial firms’ use of “big data” to evaluate strategic options, is now so common as to be unremarkable. However, AI-driven decision making can be considered distinct from current widely- used data-driven approaches. The latter involves applications that summarize complex data to form an input for some form of human judgment whereas AI can make automated deci- sions and suggested actions based on all available data, removing biases inherent to judgment, and the need to aggregate data to make it comprehensible to humans (Colson, 2019). Agrawal et al. (2017) argue, accordingly, that while the cost of this prediction will fall, human judgment as the other input to decision making will become more valuable. Scholars have been particularly attentive to ways in which AI-enabled decision-making is being integrated into firm structures (Raisch & Krakowski, in press). Shrestha et al. (2019) pro- pose a typology of configurations that can be implemented, ranging from full human-AI delega- tion (typically used for automated fraud detection or advertising recommendations) to hybrid AI- human or human-AI sequential decision making (used for hiring or health monitoring for example), and finally, aggregated human-AI decision making (e., using AI as an independent counterbalance to other board member decisions). Of specific interest to entrepreneurial firms is the AI-human sequential decision-making model that can be used to optimize open innovation strategies that are being used to source and select innovation ideas. Such an approach is benefi- cial as the “cost of problem- solving shifts from generating solutions to evaluating and selecting solutions” (Shrestha et al., 2019, p. 74).

Research Opportunities What is known of the effects of AI on organizational design is largely confined to large resource- rich corporations (Davenport & Ronanki, 2018). In this context, there is recognition that adapt- ing to AI involves more than simply automating existing processes, and instead requires developing whole new ways of working - something larger organizations traditionally find chal- lenging. Notionally this creates an opportunity for more nimble entrepreneurial ventures who can design a challenger business model to take full advantage of an enabling technology, without being encumbered by existing processes and capabilities. This therefore will have implications for existing conceptualizations of new ventures and corporate entrepreneurship and will require novel empirical insights at a firm-level to understand these new dynamics. We identify a number of further research opportunities relating to the organizational design of firms in the AI era. First, we suggest that scholars extend recent work (Nambisan, 2017) which posits that digital technologies are leading to a distribution of agency across the firm. Nambisan (2017) includes many nonfirm actors within this less predefined notion of entrepreneurial agency but stops short of including AI systems as agentic actors. We echo Agrawal et al. (2019b, p. 5) who suggest that “if a decision is determined exclusively by a machine’s prediction, then that authority may be abrogated.” Thus, if machines have truly delegated agency within a new ven- ture, and the decision parameters can change based on experience, how does this affect overall decisions relating to new venture ideas? Does superhuman analytical ability necessarily lead to superior real-world outcomes, for example? Second, we recognize that the industry architecture of the technology sector, and the narrowly concentrated distribution of AI assets may profoundly impact upon the structure and form of new ventures. Montes and Goertzel (2019) and Hartmann and Henkel (in press) draw attention to the dominance of an “oligopoly” of tech firms who control most AI resources (i., data, hardware, IP and algorithms) and thus shape the trajectory and focus of technological development. The consequence of this is often fragmentation and decreased interoperability as knowledge resides in “skyscraper” high silos (Montes & Goertzel, 2019). Smaller firms, in their current

1038 Entrepreneurship Theory and Practice 45(5)

organizational form, are habitually prevented from contributing to the development of AI as they do not have access to the larger firms’ resources 6 and often either license from or partner with a dominant firm. 7 We suggest the literature on digital platform ecosystems is a valuable foundation for understanding how new ventures are structurally enabled and constrained within the ambit of a powerful platform owner (e., Zhu & Liu, 2018).

Exploiting: Selling and Scaling

For our final firm- level activity we consider how tasks associated with exploiting new venture ideas may be impacted by AI. Opportunity exploitation is multidimensional construct within the entrepreneurship literature and is taken by some to constitute mobilizing resources and building capabilities (Sarason et al., 2006) while others focus on market selection (Hsieh et al., 2007) or market exchange (Dimov, 2011). For our framework, we have focussed on two AI-relevant exploiting activities: selling and scaling the venture.

Selling Selling has been underexplored by entrepreneurship scholars, despite the fundamental impor- tance of the activity to the sustainability and growth of new ventures (Gimmon & Levie, 2020; Matthews et al., 2018). It is an area that entrepreneurs promoting innovative market offerings identify as a challenge (Renko, 2013) and is one of the main skills deficits that restrict venture growth (Fogel et al., 2012). In short, many entrepreneurial ventures fail or underperform, not because of weak product-market fit, but because they have insufficient sales capabilities to capi- talize on the venture idea. Several issues permeate the sales function in entrepreneurial organiza- tions, including high turnover and “burnout” owing to the emotional labor associated with routine sales work (Bande et al., 2015). It is often repetitive and challenging work and therefore sales- people can command relatively high salaries, eating into venture funding and impacting signifi- cantly on burn rates. Given these managerial challenges, AI-enabled automation of selling activities is considered a promising area of development for entrepreneurial firms. We identify an automation continuum amongst AI start-ups seeking to improve the selling function. This ranges from those who seek to provide tools that augment existing sales processes to free up time for higher-value customer- facing tasks (e., Incomaker, exceed), to firms that provide tools to replace human salespeo- ple entirely (e., Drift). In the former case, a number of firms are using ML approaches to assist human salespeople, primarily by identifying warm leads, qualifying them and then funnel- ing them to the correct salesperson at the moment they are primed to buy goods or services. The alternative group of ventures meanwhile, go further by fully capitalizing on rapid advances in natural language processing and DNNs to replace human salespeople with “bots.” For example, in the fintech/proptech sector, start-ups such as Habito have developed a robo-advisor that is capable of soliciting the intricate information required to identify, match and qualify a range of mortgage products to customers. Other organizations such as Drift use conversational AI tech- niques to analyze top-performing human salespeople so they can train ML systems to replicate their performance on a larger scale within an organization. As Power (2017) observes, these emerging conversational AI systems comfortably pass the Turing test, meaning that customers who interact with them are largely unaware they are dealing with a machine. Scholars draw attention to apparently irreducible and contextualized features of human inter- action and intelligence that cannot be so easily mechanized (Huang et al., 2019). Other factors such as physical appearance (e., attractiveness), gender and charisma are also shown to influ- ence decision making in a selling context (Bates, 2002; Chaker et al., 2019; Weierter, 2001). More importantly, a competent salesperson can usually interpret body language, gesture or a

1040 Entrepreneurship Theory and Practice 45(5)

constrained access to social and financial resources (DeSantola & Gulati, 2017). The previous example of an AI-enabled salesbot, that can “clone” an organization’s best salesperson offers a powerful illustration of the emerging relationship between AI and venture growth. Specifically, it demonstrates how costs of scaling can be significantly reduced (to zero marginal cost) as they become decoupled from human labor. Furthermore, a productivity gain can be realized through expanding the number of “bots” interacting with customers as increased volumes of data improve the performance of deep learning algorithms (Esteva et al., 2019). Looking across the broader family of Industry 4 technologies, it is possible to anticipate a new paradigm in scaling, where organizations can grow rapidly without encountering many of the constraints or challenges new ventures traditionally face. For example, a future Industry 4- native organization might use an AI-blockchain hybrid platform to manage financial account- ing, legal work, and compliance requirements (e., Susskind & Susskind, 2015). It may use smart manufacturing to produce any physical products and then deploy automated logistics to deliver them (Kusiak, 2018); customer service can be conducted almost entirely by the afore- mentioned conversational AI-bots (Microsoft, 2018); new employees (of which there will be fewer) can be recruited through systems that screen prospects’ body language in interviews and word choice to assess against desirable traits (Booth, 2019). Finally, sales, marketing and pricing tasks can be automated (or at least partially automated) and dynamic (Microsoft, 2018), meaning there are no commission fees to pay and the cost of customer acquisition stays low (or, rather costs may be transferred to paying for data collection, maintenance and analysis). Such an out- come is not far-fetched; each of these technologies is in use today and market-leading firms such as Unilever (recruitment), Amazon (logistics) and Tesla (manufacturing and logistics) are increasingly finding methods of integrating them in pursuit of competitive advantage.

Research Implications When considering the scale and scope of these converging innovations across various functional aspects of the entrepreneurial venture, the rapidly evolving nature of practice suggests the need for a new frontier of scaling and growth theory whose horizon goes beyond team and financing issues. For example, we suggest there is a need to understand “liabilities of technological lever- age” by considering the implications of a very small number of employees controlling a poten- tially very large (in customer numbers) AI-enabled company. In many regards, new Industry 4. ventures invert the traditional problems associated with scaling, meaning that founders can afford to spend less time on softer, often messy issues such as germinating a productive organizational culture (Schein, 1983) across rapidly expanding business functions. Instead, there are increasing risks associated with having a small number of key staff who are critical failure points for core business functions (e., managing the software or technology stack, writing and adapting algo- rithms, managing the performance of customer service bots, checking on unintended conse- quences of the technology), and the wide span of control associated with a flatter organization potentially burdens high-occupation employees (e., founders) with time-consuming, low value problems if not managed properly. A further danger for rapidly scaling companies can be found in the lack of transparency over how some deep learning systems arrive at their outputs (Castelvecchi, 2016). This is a wide- spread concern across the AI community and is leading to calls for “explainable AI” tools that allow human experts to better understand AI decisions (Samek et al., 2017). We argue that high- growth companies who do not understand the nested and nonlinear “black box” models under- pinning key business decisions and activities, increase the risk of the venture spectacularly imploding, 9 or at the very least burdening founders with legal challenges stemming from unin- tended real-world intransigencies. Thus, we suggest future scaling research should focus on potentially negative consequences of new technological affordances such as AI, specifically by

Chalmers et al. 1041

analyzing the implications of what we consider surprisingly hands-off governance approaches that operate largely on “blind trust” (Obschonka & Audretsch, 2019) that an algorithm is func- tioning appropriately. Finally, turning to issues of growth strategy, O’Reilly and Binns (2019) outline a typology of options that a scaling venture might pursue to grow, including: acquiring, building, partnering and leveraging. Given that data is the fuel of AI, and that new ventures typically do not have access to enough data to operationalise deep learning networks from scratch, this has implica- tions for the scaling approach pursued. Future research exploring companies that decide to “build” would offer a valuable insight into how companies can thrive outside of the orbit of the large technology companies that dominate the sector (and make a significant number of acquisi- tions of AI start-ups).

Entrepreneurial Outcomes

With the foregoing discussion on entrepreneurial intentions, prospecting, organizational design, selling, and scaling, it is important to consider what potential outcomes in terms of how entrepre- neurial rewards may be derived from AI-enabled entrepreneurship. Entrepreneurial rewards have been analyzed by a number of scholars who have identified different constituent parts of rewards including financial rewards (Cagetti & De Nardi, 2006), nonpecuniary benefits (Blanchflower, 2004 ), satisfaction (Binder & Coad, 2016), earnings (Åstebro & Chen, 2014), and wellbeing (Wiklund et al., 2019). Compensating differentials such as autonomy, independence, and flexibil- ity have also been stressed as benefits of being one’s own boss but are often overly simplistic in their explanation of the reasons for pursuing entrepreneurship (Carter, 2011). Consistent within such characterizations is seeking to understand the outcomes that entrepreneurs achieve in their efforts, which can unveil motivations and behaviors across the wider entrepreneurial process. The nature and role of such differentials may change when AI-enabled entrepreneurship starts to become more commonplace. We still do not have a full understanding of the financial returns to entrepreneurship, nor is there a settled agreement on how wellbeing manifests as a result of entrepreneurial behavior. Where there is a degree of agreement, is that socio-economic factors play into entrepreneurial rewards (Carter, 2011; Wiklund et al., 2019). Thus, if AI becomes widely adopted, the socio- economic landscape may be significantly disrupted with consequent effects for entrepreneurial earnings. For example, the aforementioned introduction of UBI (or some other form of regular transfer) as a policy response to increasing automation, may remove some of the risk inherent in entrepreneurship, which in turn will affect how we characterize certain entrepreneurial rewards such as wellbeing or financial returns. Alternatively, the deployment of ML such as in the exam- ple of the t-shirt business Solid Gold Bomb could create significant financial rewards for entre- preneurs that are short-term in nature but potentially life changing in their effect, in exchange for very little effort. Scaling a business using AI-enabled technologies may result in highly techno- logically literate entrepreneurs gaining much higher financial returns with much less effort than more traditional forms of entrepreneurship - witness the financial returns to the founder of WhatsApp as discussed earlier.

Research Implications If businesses are created that are run to a large extent with AI, how do we construct an under- standing of entrepreneurial rewards? Where and to whom do the rewards go? In one respect the answers will remain the same as they are now – those who come up with the idea, fund it, and/or prosecute it; at least in the case of solo entrepreneurs or small team-based businesses. In these cases, the existing conceptualizations may prove sufficient and AI will be viewed in the same

Chalmers et al. 1043

not being fully considered, and policymakers appear unable (or perhaps unwilling) to address predicted negative externalities that will affect small firms such as labor displacement, income distribution, or anticompetitive technology oligopolies (Montes & Goertzel, 2019). In the EU and America for example, policy reports and strategies diagnose some of the problems, but offer only tepid solutions in response (e., The White House Office of Science and Technology Policy, 2018). None appear to be proposing the more substantial recommendations by Korinek and Stiglitz (2017) of nondistortionary taxation to redistribute innovators surpluses, nor do they pro- pose shortening the length of patents in order to enable the benefits of innovation to be more widely shared. The approach we take is informed by the effects of AI on “other” types of entrepreneurship. That is, we consider the more quotidian small businesses that are spread across the length and breadth of most countries, far away from tech hubs, universities and venture capital funders (Audretsch, 2019; Pahnke & Welter, 2019). AI has the potential to further deplete the economy in these areas; where the first wave of mechanical automation disrupted manufacturing, the sec- ond wave of digital innovation destroyed retail and AI looks set to threaten broad swathes of the public and service sectors. A cursory reading of Janesville: An American Story, Amy Goldstein’s (2017) telling of the closure of a General Motors plant in a small Wisconsin town should give pause for thought when considering the ripple effects of rapid industrial change, particularly in economically marginal- ized areas where human capital is often insufficient to adapt quickly to new technologies. As scholars, we should therefore be wary of lionizing a form of “destructive creation” (Mazzucato, 2013) in which innovation rewards the “few at the expense of the many” (Soete, 2013, p. 135) and instead work towards providing evidence and insight that will help steer policymakers towards ensuring the benefits of AI technology are co-opted more equitably by a wide range of economic actors. We highlight research groups such as the AI Now Institute (Crawford et al., 2019 ) as key bulwarks against growing threats to civil liberties, economic inequality and labor market displacement that will negatively impact entrepreneurs in the future, and suggest entre- preneurship scholars contribute more directly to this stream of work.

AI and the New Ethics of Entrepreneurship

It is not only policymakers who must ruminate on the potentially harmful consequences of AI. Entrepreneurs themselves will be forced to reflect on the costs they may be externalizing on society through their new AI-driven ventures. Some of these issues have been vividly illustrated by MacGuineas (2020: para. 5) and others (Odell, 2019) who have examined how technology firms use “turbocharged self-improving algorithms” shaped by insights from behavioral psychol- ogy to create a dependency, or addiction, to their products in order to compete in the “attention economy.” Firms now have such a powerful understanding of individual consumers, accelerated by “data network effects” (Gregory et al., in press), that they can use AI to manipulate behavior in a manner that raises significant questions around the power balance that exists between con- sumers and firms. As Morozov (2019) surmises, tech companies have shifted from “predicting behavior to engineering it” and this requires a contemporary ethical framework that acknowl- edges the powerful capabilities of new AI technologies and their potential for misuse. Tangential to this are issues of privacy. Zuboff (2019) for example, describes an insidious form of surveillance capitalism that has emerged as firms have used AI and other technologies to exploit the ever-growing pool of data that we each produce every day. This has led to significant rewards for founders and venture capitalists who have successfully extracted value from data resources but has equally led to many corporate scandals involving the systemic abuse of per- sonal information (Isaak & Hanna, 2018), partly owing to weak or inadequate regulation. Given

1044 Entrepreneurship Theory and Practice 45(5)

the already-proven capacity for AI to be deployed as a means of oppression and social control (Whittaker et al., 2018), entrepreneurs who are developing and applying this technology face some profound ethical challenges; in sum, just because AI can do something does not necessarily mean an entrepreneur should, and we suggest this emerging tension is a vital area for entrepre- neurship scholars to explore in the coming years.

Harnessing the Positives and Leveraging the Domain Expertise of

Entrepreneurship Scholars

We do not intend to be overly pessimistic in our analysis. There is much to be excited about on the potential of AI; productive advances in disease diagnosis, reduced food wastage through supply chain optimization, computational drug discovery for treatment, and self-driving autono- mous electric vehicles all offer significant improvements to quality of life across societies. We look forward to low-value unrewarding work being automated, and to the scenario Harvard labor economist Lawrence Katz describes where “information technology and robots will eliminate traditional jobs and make possible a new artisanal economy” (Thompson, 2015: para. 40). Should we get to this point, we will finally be stepping closer towards the increased leisure time Keynes (2010 [1930]) predicted would result from technological productivity gains. Our final sugges- tion, therefore, is that entrepreneurship scholars contribute to the development of productive AI by applying their domain expertise to emerging AI systems that will augment entrepreneurial processes and support the development of valuable and socially beneficial new ideas. As Taddy (2018) notes, AI systems perform best in situations where there are high amounts of explicit structure. Therefore, entrepreneurship scholars are well placed to map and clarify the domain structure of entrepreneurship, to understand the myriad tasks undertaken within new ventures to develop and launch new venture ideas: “.. will be made by those who can impose structure on these complex business problems. That is, for business AI to succeed we need to combine the (machine learning) and Big Data with people who know the rules of the “game” in their business domain” (Taddy, 2018, p. 85). We suggest therefore, that scholars draw on existing insights from entrepreneurship research, from topics as broad-ranging as emotions (Cardon et al., 2012), to institutions (Garud et al., 2007) and context (Welter, 2011), and combine these insights with new research that explicitly analyses entrepreneurial “tasks” to support the engineering of useful new AI tools. We believe this can create a new pathway to societal impact for entrepreneurship researchers, addressing recent calls to enhance relevance within the field (Wiklund et al., 2019).

Declaration of Conflicting Interests

The author(s) declared no potential conflicts of interest with respect to the research, authorship, and/or publication of this article.

Funding

The author(s) received no financial support for the research, authorship, and/or publication of this article.

ORCID ID

Dominic Chalmers orcid/0000-0001- 5626- 3692

Notes

- UBI remains a highly contested policy measure and many consider it unlikely that it, or some variance thereof, will be adopted in the future. However, as the COVID-19 pandemic has shown, during times

1046 Entrepreneurship Theory and Practice 45(5)

Andreassen, T. W., van Oest, R. D., & Lervik-Olsen, L. (2017). Customer inconvenience and price compensation: A multiperiod approach to labor-automation trade-offs in services. Journal of Service Research, 21 (2), 173–183. Åstebro, T., & Chen, J. (2014). The entrepreneurial earnings puzzle: Mismeasurement or real? Journal of Business Venturing, 29 (1), 88–105. Audretsch, D. B. (2019). Have we oversold the silicon Valley model of entrepreneurship? Small Business Economics, 78 (4). https://doi. org/10. 1007/ s11187-019- 00272- Bande, B., Fernández-Ferrín, P., Varela, J. A., & Jaramillo, F. (2015). Emotions and salesperson propensity to leave: The effects of emotional intelligence and resilience. Industrial Marketing Management, 44 , 142–153. https://doi. org/10. 1016/ j. indmarman. 10. 011 Bates, T. (2002). Restricted access to markets characterizes women-owned businesses. Journal of Business Venturing, 17 (4), 313–324. https://doi. org/10. 1016/ S0883-9026( 00) 00066- Binder, M., & Coad, A. (2016). How satisfied are the self-employed? A life domain view. Journal of Happiness Studies, 17 (4), 1409–1433. Blanchflower, D. G. (2004). Self-employment: More may not be better. Swedish Economic Policy Review, 11 (2), 15–74. Booth, R. (2019, 25 October 2019). Unilever saves on recruiters by using AI to assess job interviews. The Guardian. theguardian/technology/2019/ oct/ 25/ unilever-saves-on- recruiters-by- using- ai- to- assess- job- interviews Brock, J. K. -U., & von Wangenheim, F. (2019). Demystifying AI: What digital transformation leaders can teach you about realistic artificial intelligence. California Management Review, 61 (4), 110–134. https://doi. org/10. 1177/ 1536504219865226 Brynjolfsson, E., & McAfee, A. (2014). The second machine age: Work, progress, and prosperity in a time of brilliant technologies. WW Norton & Company. Burton, M. D., Colombo, M. G., Rossi‐Lamastra, C., & Wasserman, N. (2019). The organizational design of entrepreneurial ventures. Strategic Entrepreneurship Journal, 13 (3), 243–255. https://doi. org/10. 1002/ sej. 1332 Cagetti, M., & De Nardi, M. (2006). Entrepreneurship, frictions, and wealth. Journal of Political Economy, 114 (5), 835–870. Cardon, M. S., Foo, M. D., Shepherd, D., & Wiklund, J. (2012). Exploring the heart: Entrepreneurial emotion is a hot topic. Entrepreneurship Theory and Practice, 36 (1), 1–10. https://doi. org/10. 1111/j. 1540- 6520. 2011.00501 Carter, S. (2011). The rewards of entrepreneurship: Exploring the incomes, wealth, and economic well- being of entrepreneurial households. Entrepreneurship Theory and Practice, 35 (1), 39–55. https://doi. org/10. 1111/j. 1540- 6520. 2010. 00422 Castelvecchi, D. (2016). Can we open the black box of AI? Nature, 538 (7623), 20–23. https://doi. org/10. 1038/ 538020a Chaker, N. N., Walker, D., Nowlin, E. L., & Anaza, N. A. (2019). When and how does sales manager physical attractiveness impact credibility: A test of two competing hypotheses. Journal of Business Research, 105 , 98–108. https://doi. org/10. 1016/ j. jbusres. 08. 004 Cheng, M. (2018). How Startups Are Grappling With the Artificial Intelligence Talent Hiring Frenzy. Inc., from inc/michelle-cheng/how- startups- are- grappling-with- artificial-intelligence- talent-hiring-frenzy Choi, D. Y., & Kang, J. H. (2019). Net job creation in an increasingly autonomous economy: The challenge of a generation. Journal of Management Inquiry, 28 (3), 300–305. Choudhury, P., Starr, E., & Agarwal, R. (2018). Machine learning and human capital: experimental evidence on productivity complementarities. Harvard Business School. Cockburn, I. M., Henderson, R., & Stern, S. (2018). The impact of artificial intelligence on innovation. National Bureau of Economic Research.

Chalmers et al. 1047

Colson, E. (2019). What AI-Driven decision making looks like. Harvard Business Review. Crawford, K., Dryer, T., Fried, G., Green, B., Kaziunas, E., & Kak, A al. (2019). AI Now 2019 Report. AI Now Instituteo. Cron, W. L., Baldauf, A., Leigh, T. W., & Grossenbacher, S. (2014). The strategic role of the sales force: Perceptions of senior sales executives. Journal of the Academy of Marketing Science, 42 (5), 471–489. https://doi. org/10. 1007/ s11747-014- 0377- Daugherty, P. R., Wilson, H. J., & Michelman, P. (2019). Revisiting the jobs artificial intelligence will create. MIT Sloan Management Review, 60 (4), 0_1–0_8. Davenport, T., Guha, A., Grewal, D., & Bressgott, T. (2019). How artificial intelligence will change the future of marketing. Journal of the Academy of Marketing Science, 1–19. DeSantola, A., & Gulati, R. (2017). Scaling: Organizing and growth in entrepreneurial ventures. Academy of Management Annals, 11 (2), 640–668. https://doi. org/10. 5465/ annals. 0125 Davenport, T., & Ronanki, R. (2018). Artificial intelligence for the real world. Harvard business review, 96 (1), 108–116. Davidsson, P., Recker, J., & von Briel, F. (2018). External enablement of new venture creation: A framework. Academy of Management Perspectives, (ja). https://doi. org/10. 5465/ amp. 2017. 0163 Decker, R. A., Haltiwanger, J., Jarmin, R. S., & Miranda, J. (2016). Declining business dynamism: What we know and the way forward. American Economic Review, 106 (5), 203–207. https://doi. org/10. 1257/ aer. p Decker, R. A., Haltiwanger, J., Jarmin, R. S., & Miranda, J. (2017). Declining dynamism, allocative efficiency, and the productivity slowdown. American Economic Review, 107 (5), 322–326. https://doi. org/10. 1257/ aer Dimov, D. (2011). Grappling with the unbearable elusiveness of entrepreneurial opportunities. Entrepreneurship Theory and Practice, 35 (1), 57–81. https://doi. org/10. 1111/j. 1540- 6520. 2010. 00423 Domingos, P. (2015). The master algorithm: How the quest for the ultimate learning machine will remake our world. Basic Books. Douglas, E. J., & Shepherd, D. A. (2002). Self-employment as a career choice: Attitudes, entrepreneurial intentions, and utility maximization. Entrepreneurship Theory and Practice, 26 (3), 81–90. https://doi. org/10. 1177/ 104225870202600305 Dunjko, V., & Briegel, H. J. (2018). Machine learning & artificial intelligence in the quantum domain: a review of recent progress. Reports on Progress in Physics, 81 (7), 074001. https://doi. org/10. 1088/ 1361- 6633/ aab D’Mello, J. F. (2019). Universal basic income and entrepreneurial pursuit in an autonomous society. Journal of Management Inquiry, 28 (3), 306–310. Eberhart, R. N., Eesley, C. E., & Eisenhardt, K. M. (2017). Failure is an option: Institutional change, entrepreneurial risk, and new firm growth. Organization Science, 28 (1), 93–112. Ertel, W., & Black, N. T. (2018). Introduction to artificial intelligence. Springer International Publishing. Esteva, A., Robicquet, A., Ramsundar, B., Kuleshov, V., DePristo, M., Chou, K., Cui, C., Corrado, G., Thrun, S., & Dean, J. (2019). A guide to deep learning in healthcare. Nature Medicine, 25 (1), 24–29. https://doi. org/10. 1038/ s41591-018-0316-z Ezrachi, A., & Stucke, M. (2016). Virtual competition: The promise and perils of the Algorithm-Driven economy. Harvard University Press. Fisch, C. (2018). Initial coin offerings (ICOs) to finance new ventures. Journal of Business Venturing. Fischer, E., & Reuber, A. R. (2011). Social interaction via new social media: (How) can interactions on Twitter affect effectual thinking and behavior? Journal of business venturing, 26 (1), 1–18. https://doi. org/10. 1016/ j. jbusvent. 09. 002

Artificial Intelligence

Course: Civil Engineering (BSCE 01)

University: Ateneo de Davao University

- Discover more from: