- Information

- AI Chat

Was this document helpful?

487318125 ASI Chapter 16 NPOs docx

Course: Acctng For Governmental,Not-For-Profit Entities (ACT GOV)

34 Documents

Students shared 34 documents in this course

University: Far Eastern University

Was this document helpful?

Chapter 16

Non-profit Organizations

PROBLEM 16-1: MULTIPLE CHOICE

1. D6. C 11. D

2. D7. D 12. D

3. C8. B 13. C

4. C9. D 14. D

5. D10. D 15. C

PROBLEM 16-2: MULTIPLE CHOICE

1. D6. D 11. C

2. A7. D 12. A

3. D8. B 13. C

4. B9. D 14. C

5. C10. A 15. C

PROBLEM 16-3: MULTIPLE CHOICE

1. B = 4M fair value of donated land. The 240K

dividends are treated as dividend income rather than

contributions revenue.

2. A = 8M cash donation for acquisition of truck

3. D = 2M investment in equity securities

4. C = 8M cash donation for acquisition of truck

5. B = (4M land + 8M truck + 240K cash dividends) =

12,240,000

6. D = 8M cash – 8M net asset released from restriction

= 0

7. A = 2M investment in equity securities

Students also viewed

- Module 7 - Revenues and Other Receipts

- Pdf-review-materials-for-finals-q compress

- Quiz 2 - Revenue and Other Receipts and Disbursements Accounting FOR Government AND NON- Profit Organizations 18over20

- Quiz 1 - Overview, Budget Process & Government Accounting Process 20over20

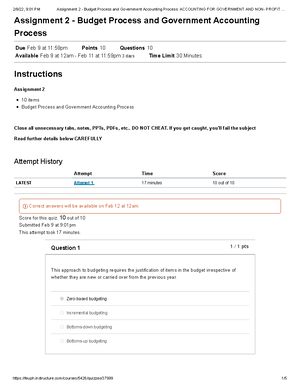

- Assignment 2 - Budget Process and Government Accounting Process Accounting FOR Government AND NON- Profit Organizations 10over10

- ASTR273-Chapter-8 - The earliest laboratory according to the present evidence is a home laboratory