- Information

- AI Chat

Govact summary

Acctng For Governmental,Not-For-Profit Entities (ACT GOV)

Far Eastern University

Students also viewed

- Feedback Form - form

- Republic Act No. 8188

- 487318125 ASI Chapter 16 NPOs docx

- Pdf-review-materials-for-finals-q compress

- Quiz 2 - Revenue and Other Receipts and Disbursements Accounting FOR Government AND NON- Profit Organizations 18over20

- Quiz 1 - Overview, Budget Process & Government Accounting Process 20over20

Preview text

INTOSAI

COA

GAM PPSAS

PSASB

IPSASB

Standard

Reports

COA RES. NO. 2008- 12 dtd. 10 -12-

COA RES. NO. 2014- 003 dtd. 1- 24 - COA CIRC. NO. 2013- 002 dtd. 1- 30 -

GOVERNMENT ACCOUNTING REVIEWER

(FROM: Punzalan & GAM –Receipts and Disbursements)

CHAPTER 1

General Provisions, Basic Standards and Policies

Government Accounting Manual -Represents basic accounting policies in accordance with PPSAS -shall be used in National Government Agencies

Government Accounting (ARCSC) PD 1445 Sec 109 -Analyzing, Recording, Classifying, Summarizing and Communicating and transactions involving the receipt and distribution of government fund and property and interpreting the results thereof.

OBJECTIVES OF GOVERNMENT ACCOUNTING 1. Information concerning past operations and present conditions 2. basis for guidance of future operation 3. controls acts of public bodies 4. Reports financial position and results of operations

PPSAS Numbering 1. Numbering is same with IPSAS 2. Start with 101 pag gumawa ng bago na wala sa IPSAS

ACCOUNTING RESPONISIBILITY (UACS) 1. COA Consistency of accounts classification and coding structures with the revised chart of accounts 2. DBM Validation and assignment of new codes for funding source organization, sub object codes for expenditure items 3. BTr Consistency of accounts classification with government finance statistics 4. DOF

GOVERNMENT BUSINESS ENTERPRISE

- Power to contract its own name

- Financial and operating authority

- Sale of goods/ services for profit

- Not reliant on continuing govt funds

- Controlled by public sector entity

REGISTRIES:

- Registry of Revenue and Other Receipts

- Registry of Appropriation and Allotments

- Registry of Allotments, Obligations and Disbursement

- Registry of Budget, Utilization and Disbursements

- Registry of Allotments and Notice of Cash Allocation

- Registry of Allotments and Notice of Transfer of Allocation

FUND CLUSTER ACCOUNTING for recording revenues and expenditures associated with a specific activity

FUND CLUSTERS:

- Regular agency fund

- Special accounts – locally funded/ domestic grants fund

- Special accounts – foreign assisted/ foreign grants fund

- Foreign assisted projects fund

- Internally generated funds

- Business related funds

- Trust receipts

RESPONSIBILITY ACCOUNTING system that relates financial results to a responsibility center, which provides access to cost and revenue information under the supervision of manager having direct responsibility for its performance RESPONSIBBILITY ACCOUNTING AIMS TO: 1. Ensure that all cost and revenues are properly charged/ credited to the correct responsibility center 2. Provide a basis for making decisions for future operations 3. Facilitate review activities, monitoring performance of each responsibility center and evaluation of effectiveness of agency’s operations

Responsibility Center – past of a govt agency headed by a manager who is accountable

CHAPTER 2 Unified Accounts Code Structure (UACS) UACS is a government wide harmonized budgetary, treasury and accounting code classification that will facilitate reporting of all financial transactions of gov’t agencies. The key purpose is timely and accurate reporting of actual revenue collections and expenditures against budgeted programmed revenues and expenditures.

Five Key Elemets – FOLMO 8 12 9 15 10 1. Funding Source (FFAF 2123) a. Fund cluster 2 b. Financial source 1 c. Authorizations code 2 d. Fund Category 3 2. Organization Code (DAOL 2325) a. Department code 2 b. Agency code 3 c. Operating unit classification 2 d. Lower level operating unit 5 3. Location code (RPMB 2223) a. Regional 2 b. Provincial 2 c. Municipal 2 d. Barangay 3 4. MFO/PAP (SPPAA 51225) a. Sector outcomes 5 b. Program/project 1 c. Project category 2 d. Project sub category 2 e. Project title 5 5. Object code (RS 82) a. RCA 8 b. Sub object code 2

General Funds are funds available for any purpose Off Budgetary Funds receipt of items that are not part of the national expenditure program Custodial Funds receipt of cash received by any govt agency to fulfil a specific purpose New general appropriations annual authorization for incurring obligations Continuing appropriations authorizations to support obligations for a specified purpose or project

RCA

NGAs

LGUs

GOCCs not GBE

Plan

Supplemental appropriations additional appropriations to augment original appropriations that have been insufficient Automatic appropriations are authorizations made annually or for some other period prescribed by law Unprogrammed funds stand by appropriations for priority programs or project of the government Retained income funds collections that are authorized by law to be used directly by agencies for their operation or specific purpose Revolving funds receipts derived from business type activities of departments as authorized by law and deposited in authorized depository bank Trust receipts are receipts that are officially in possession of govt agencies or public offices as trustee Special accounts in the general fund proceeds from specific revenue for priority projects Special purpose funds lump sum funds which are not within the approved appropriations of department or agencies which are available for allocation Department codes primary subdivision of executive branch. Constitutional, legislative, judiciary Agency codes any various units of govt Operating units organizational entities charged with carrying out specific substantive functions Staff bureau principal subdivision of a department Regional office organizational subdivision responsible for the performance of an entity’s function within a region CDA extension office units established in each of the country’s regions School division with at least 750 public elementary schools and secondary schools Deped secondary school learning institution that offers 6 year secondary course TESDA offers non degree program DFA Consular office established locally and abroad responsible for delivering front line foreign affairs Customs collection district composed of one principal port of entry Revenue regional offices enforce internal revenue laws Revenue district office directly serves tax payers Treatment and rehabilitation centers after care and follow up treatment for drugs District engineering office responsible for highways, flood control, water resource development system and other public works Key budgetary units under armed forces of the Philippines Lower level operating unit code for individual operating units Region 17 regions. Composed of several provinces Province political corporate unit consists of municipal and cities Municipalities political corporate units consists of group of barangays Barangay basic political unit of government Municipality identifier 4 digit number that identifies the identity of municipality Major final output goods or services that a dept or agency is mandated to deliver to external clients through implementation of program, activities or projects Program group of activities Activity work process that contributes to the fulfilment of program or project Project special department or agency undertaking carried out within a reasonable timeframe General administration and support consists of activities involving the provision of overall administration management support to the entire agency operations Support to operations provides technical substantive support to the operations and projects Operations consists of activities directed at fulfilling the department and agency mandate

CHAPTER 3

Revised Chart of Accounts Complete set of Financial Statements:

- Statement of Financial Position

- Statement of Financial Performance

- Statement of changes in net assets/equity

- Statement of cash flows

- Statement of comparison of budget and actual amounts

- Notes to financial statements Elements of Financial Statements

- Assets

- Liabilities

- Equity

- Income

- Expenses

*Under COA Circular No. 203-002, account code structure consists of 8 mandatory digits.

Account Group represents the account classification as to assets, liabilities, equity income and expenses Major account group represents classification within the account group (FA chapters) Sub-major account group represents classification within the major account group (FA topics within the chapter) General ledger accounts represents accounts to be presented in the financial statements

CHAPTER 4 Accounting for Budgetary Accounts Government Accounting Plan shows overall system of a government agency

Accounting systems: (BRDF) 1. Budgetary Accounts system 2. Receipt/ Income and deposit system 3. Disbursement System 4. Financial reporting system

Revenue Approval

Expense Authorization

Balanced Budget Revenue > Expenses

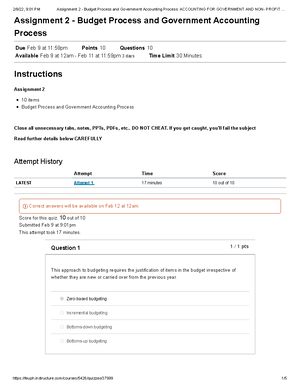

Kinds of Budget (NBA) N Nature (ASS) Annual Supplementary Special B Basis (PL) Performance Line Item A Approach (ZI) Zero Based Incremental

BUDGET CYCLE (PLEA B) 1. Budget preparation 2. Budget legislation 3. Budget execution 4. Budget accountability

Execution

Cash Disbursement Ceiling (CDC) - issued by DBM to DFA & DOLE

ACCOUNTING ENTRIES TO RECOGNIZE RECEIPTS Receipt of NCA. The NCA specifies the maximum amount of withdrawal that an entity can make from a government bank for the period indicated. The Collecting Officer shall not issue an OR for the receipt of NCA Regular Cash – MDS, Regular XX Subsidy from national government XX To recognize receipt of NCA for regular agency fund

Special Account Cash – MDS, Special Account XX Cash – Treasury/Agency Deposit, Special acct. XX To recognize receipt of NCA for special acct. in the general fund

Trust Receipt Cash – MDS, Trust XX Cash – Treasury/Agency Deposit, Trust XX To recognize receipt of NCA for Trust receipts fund

MODES OF DISBURSEMENT

- checks (MDS or commercial checks)

- cash (out of cash advance granted toauthorized Disbursing Officer)

- advice to debit the account

- tax remittance advice

- working Fund/CDC

- direct payment method.

DISBURSEMENTS BY CHECK Checks shall be drawn only on duly approved disbursement voucher payroll. These shall be used for payment of regular expenses which cannot be conveniently nor practically paid using ADA or Petty cash fund advances. Checks issued shall be reported and recorded whether released or unreleased to the respective payees.

Two types of check being issued by govt agencies: 1. Modified disbursement system checks issues against the account of the Treasurer of the Philippines 2. Commercial Checks chargeable against agency checking account with government servicing banks (GSBs) and shall be covered by income/receipts authorized to be deposited with Authorized Government Depository Banks (AGDB)

ACCOUNTING ENTRIES FOR DISBURSEMENT CHECK

1. PAYMENT:

Various expenses XX ; Cash – MDS, Regular XX 2. GRANT OF CASH ADVANCE: Advances to... XX Cash – MDS, Regular XX 3. ADVANCE PAYMENT TO PROCUREMENT SERVICE: Due from NGAs XX Cash – MDS, Regular XX

ACCOUNTING ENTRIES FOR PETTY CASH FUND

1. Establishment of petty cash fund Petty cash fund XX Cash – MDS, Regular XX 2. Replenishment of petty cash fund Various expenses XX Cash – MDS, Regular XX

3. Return of unused PCF upon retirement, resignation, separation and termination of PCF custodian Cash collecting officer XX* Petty cash XX ***** PCF-various expenses=unused 4. To record unreplenished PC at year end Various expenses XX Petty cash XX

ACCOUNTING ENTRIES FOR EMPLOYEE CONTRIBUTIONS

1. Remittance of government’s share Philhealth/sss/pag-ibig CONTRIBUTION XX Cash – MDS, Regular XX

2. Remittance of employee share/ salary deduction DUE TO Philhealth/sss/pag-ibig XX Cash – MDS, Regular XX

DISBURESEMENT BY CASH

Existing rules and regulations per COA circ. No. 997- dtd. Feb. 10, 1997 as amended by COA circ. No. 2006- dtd. July 13, 2006: 1. No cash advance shall be given unless for a legally authorized specific purpose 2. A cash advance shall be reported on and liquidated as soon as the purpose for which it was given has been served 3. No additional cash advance shall be allowed to any official or employee unless the previous cash advance given to him is first settled/ liquidated or a proper accounting thereof is made 4. Except for cash advance for official travel, no officer or employee shall be granted cash advance unless he/she is properly bonded in accordance with existing laws or regulations. The amount of cash advance shall not exceed the maximum accountability covered by his bond 5. Only permanently appointed officials shall be designated as disbursing officer 6. Only duly appointed or designated disbursing officer may perform disbursing functions. Officers and employees who are given cash advances for official travel need not be designated as disbursing officer 7. Transfer of cash advance from one accountable officer to another shall not be allowed 8. The cash advance shall be used solely for specific legal purpose for which it was granted. Under no circumstance shall it be used for encashment of checks or for liquidation of a previous cash advance

CASH ADVANCE FOR PAYROLL

- Granted to regular disbursing officer

- Shall not be used for encashment of checks or for liquidation of previous or other types of cash advances MONITOR : cash disbursement record UTILILIZATION REPORT : report of cash disbursements LIQUIDATION : 5 days after the end of pay period 1. SET UP PAYABLE: Salaries expense XX Due TO Philhealth/sss/pag-ibig XX Due TO officers and employees XX* 2. GRANTING: Advances FOF payroll XX* Cash – MDS, Regular XX 3. LIQUIDATION: Due TO officers and employees XX* Advances FOR... (payroll) XX*

ACCOUNTING FOR OVERPAYMENTS

TAKEN UP AS RECEIVABLE

1. RECOGNIZE OVERPAYMENT

Due FROM... (officers and employees) XX Expense (salaries and wages) XX 2. RECEIPT OF REFUND cash collecting officer XX Due FROM... (officers and employees) XX

3. DEPOSIT OF COLLECTION

Cash - treasury/ agency, regular XX cash collecting officer XX

NOT TAKEN UP AS RECEIVABLE

1. RECEIPT OF REFUND

cash collecting officer XX Expenses (salaries and wages) XX 2. DEPOSIT OF COLLECTION Cash - treasury/ agency, regular XX cash collecting officer XX 3. RECEIPT OF REFUND IN ENSUING YEAR Cash collecting officer XX Accumulated surplus/(deficit) XX 4. DEPOSIT OF COLLECTION Cash - treasury/ agency, regular XX cash collecting officer XX

CASH ADVANCES WITHOUT COMPLETE SET OF BOOKS

Field/extension/satellite offices -Offices that do not have complete set of books. -Offices that can be granted cash advances covering 2 months requirements for MOOE/authorized expenses to finance their operations. MONITOR, UTILIZATION AND LIQUIDATION : cash disbursement register LIQUIDATION : 5 days after month end 1. GRANTING OF CASH ADVANCE Advances FOR... (opex) XX* cash – MDS, regular XX 2. LIQUIDATION OF CASH ADVANCE Various expenses XX Advances FOR... (opex) XX*

ADVANCES FOR TRAVEL

- Travel shall cover only those that are urgent and extremely necessary and will involve the minimum expenditure and are beneficial to the agency concerned and the country

- No govt fund shall be utilized to defray foreign travel expenses except in the training, seminar or conference abroad when the officials or other personnel of the foreign mission cannot effectively represent the country therein.

- No official or employee including uniformed personnel of DILG and DND will be sent to foreign training, conferences or attend international commitments when they are DUE TO RETIRE WITHIN 1 YEAR after the said foreign travel

- No additional cash advance shall be granted to any official unless the previous cash advance given is first liquidated and accounted

- For local travels, liquidation shall be done within the period of 30 days upon return to workstation

- Foreign travels shall be liquidated within 60 days upon return to the Philippines

LOCAL TRAVELS

1. GRANTING

advances TO officers and employees XX cash – MDS, regular XX

2. LIQUIDATION

traveling expenses-local XX advances TO officers and employees XX **FOREIGN TRAVELS

- GRANTING** advances TO officers and employees XX cash – MDS, regular XX 2. LIQUIDATION traveling expenses-foreign XX advances TO officers and employees XX

CASH ADVANCE FOR SPECIFIC PURPOSE/ TIME BOUND

UNDERTAKING

- shall be granted only to authorized accountable officer/ special disbursing officer

- any unutilized cash advance shall be refunded and an OR shall be issued to acknowledge collection 1. GRANTING advances TO special disbursing officer XX cash – MDS, regular XX 2. LIQUIDATION Various expenses XX advances TO special disbursing officer XX

LIST OF DUE AND DEMANDABLE ACCOUNTS PAYABLE-

ADVICE TO DEBIT ACOUNT (LDDAP-ADA)

- Is a mode of settlement of accounts payable due the creditors/payees of all NGAs.

- All LDDAP-ADA prepared/issued during the day shall be recorded chronologically in the CkADADRec

- MDS-GSB shall effect payment through MDPS not earlier than 24 hours but npt later than 48 hours after receipt o f document

EXCLUSIONS FROM THE IMPLEMENTATION OF EXPANDED MODIFIED DIRECT PAYMENT SCHEME (ExMPDS): TSUP 1. Payment of terminal leave and retirement gratuity 2. Remittance of social insurance premium contributions to government corporations such as GSIS, philhealth and HDMF 3. Payment of accounts payable to utility companies 4. Other payables which cannot be conveniently or practically paid using the ADA

ENTRIES USING ADA

1. SET UP PAYABLES

Expense XX Accounts payable XX 2. PAYMENT THROUGH ADA Accounts payable XX cash – MDS, regular XX 3. GRANTING OF PAYROLL Advances FOR payroll XX* Cash – MDS, Regular XX 4. PAYMENT OF SALARIES THROUGH ATM Expense (Salaries) XX Due TO... (Philhealth/sss/pag-ibig) XX Due TO... (officers and employees) XX* 5. DEPOSIT OF SALARIES - PAID THROUGH ATM Cash in bank- local currency, current account XX* Cash – MDS, Regular XX 6. PAYMENT OF SALARIES THROUGH ATM Due TO... (officers and employees) XX* Cash in bank- local currency, current account XX

DISBURSEMENT THROUGH ELECTRONIC MODIFIED

DISBURSEMENT SYSTEM

- Agencies na may account sa GSBs

- Entries same with checks

and Other Like Facilities, Slaughterhouse Operation, Income from Printing and Publication, Sales Revenue, Hospital Fees, Share in the Profit of Joint Venture and Other Business Income. 2. Supply of services Recognized on a straight line basis over the specified period of the services unless an alternative method is better. If the transaction cannot be estimated reliably, revenue should be recognized only to the extent of the expenses recognized that are recoverable. Probable and measurable The stage of completion of the transaction at the reporting date can be measured reliably; and The costs incurred for the transaction and the costs to complete the transaction can be measured reliably. 3. Use by others of entity Assets Recognized when it is probable that the economic benefits or service potential associated with the transaction will flow to the entity; and the amount of the revenue can be measured reliably. Interest – when earned Royalties – when earned Dividends – when declared

MEASUREMENT

Fair value of consideration received or receivable. Any amount of trade discounts and volume rebates allowed by the entity shall be taken into account. Fair value is determined by discounting all future receipts using an imputed rate of interest Difference between FV and consideration received is recognized as interest revenue/income

TO RECOGNIZE SALE

Accounts receivable / notes receivable XX Sales revenue XX TO RECOGNIZE COLLECTION OF NOTES RECEIVABLE Cash collecting officer XX Notes receivable XX Interest income XX

Exchange of goods or services for similar/dissimilar good or services a. similar – no revenue b. dissimilar – with revenue (measured at the FV of goods or services received, adjusted by the amount of any cash or cash equivalent transferred. but If cannot be measured reliably, measured at FV of the goods given up, adjusted by the amount of any cash or cash equivalents transferred)

Impairment Losses and Allowances for Impairment Losses Recognized as an expense (impairment loss) rather than as an adjustment of the amount of revenue originally recognized. (never reverse revenue)

DISCLOSURE

- Disclose accounting policies adopted

- Amount of significant category of revenue recognized

B. NON-EXCHANGE TRANSACTIONS

Transactions in which entity either receives value from another entity without directly giving approximately equal value in exchange, or gives value to another entity without directly receiving approximately equal value in exchange RECOGNITION cash basis shall be applied in recognition of non-exchange transactions. Hence, recognized when collected or when measurable and legally collectible

- Gifts and Donations (other than services in kind) – when probable and measurable

- Donation (in cash or in kind) – shall be recognized as revenue.

- goods in kind – received without conditions and recognized as revenue immediately

- Services in kind

- Fines and penalties

- Shares or grants

- Taxes – at gross amount. It shall not be reduced for expenses paid through the tax system.

MEASUREMENT Shall be measured at the amount of the increase in net assets recognized by the entity unless it is also required to recognize a liability. An asset acquired through a non-exchange transaction shall initially be measured at its fair value as at the date of acquisition Where the time value of money is material, the liability will be measured at the present value of the amount expected to be required to settle the obligation.

Transfer of Internal Revenue Allotment Proceeds collected by NGAs is transferred to LGUs through an appropriation. NGAs recognize assets and revenue for the tax, and a decrease in assets and an expense for the transfer to LGUs. The LGUs will recognize the assets and revenue for the transfer. BOOKS OF DBM Financial assistance to LGUs XX cash – MDS, regular XX To record transfer of IRA to LGUs

Expenses Paid Through the Tax System and Tax Expenditure Expenses of the govt paid through the tax system or as reduction from tax revenue received should NOT be offset or deducted from that tax revenue. Expenses paid through the tax system are those expenses which should be paid irrespective of whether the taxpayer pay taxes, or use a particular mechanism to pay taxes.

Taxation Revenue Shall Not Be Grossed Up For the Amount of Tax Expenditures Tax expenditures are foregone revenue, not expenses and do not give rise to inflows or outflows of resources that is, they do not give rise to assets, liabilities, revenue or expenses of the government.

Recognition of Asset through Transfers RECOGNITION Shall be recognized when the transferred resources meet the definition of an asset and satisfy the criteria of recognition of an asset. Transfers meet the definition of an asset: When the entity controls the resources as a result of a past event (the transfer), and expects to receive future economic benefits or service potential from those resources. Transfers satisfy the criteria for recognition as an asset : probable and measurable

MEASUREMENT

Measured at their fair value as at the date of acquisition. TRANSFERS Recognition Measurement Debt Forgiveness when it no longer meets the definition of liability

carrying amount of debt forgiven

Fines When receivable meets the definition of assets (probable and measurable)

Best estimate

if entity collects fines in the capacity of an agent, the fine will not be recognized as revenue Bequest Probable and measurable

FV of assets received or receivable Gifts, donations and goods in kind

NO STIPULATION: revenue is recognized immediately

FV at the date of acquisition

WITH STIPULATION: liability is recognized, reduced and revenue recognized as the conditions are satisfied. Services in kind Not recognized but encouraged to be disclosed – immediately consumed pleges Not recognized disclosure only as contingent assets– does not meet the definition of asset If subsequently transferred, RECOGNIZED as gift or donation

ENTRIES: 1. RECEIPT OF GRANT Books of National Gov’t –BTr Cash in bank- local currency, BSP XX Other deferred credits XX receipt of grant directly credited to the account of NGA maintained by BSP Books of NGA Cash- MDS, special account XX Subsidy from national Government XX Receipt of NCA by NGA

2. PURCHASE Books of National Gov’t –BTr Subsidy from national Government XX Cash in bank- local currency, BSP XX Record replenishment of MDS checks Books of NGA CIP(related purchases) XX Cash- MDS, special account XX

3. RECEIPT OF REPORT FOR THE COMPLETION

Books of National Gov’t –BTr Other deferred credits XX Income from grants and donations in cash XX Recognize income from grants and donations representing payment for expenses Books of NGA Completed project (eg. Railway system) XX CIP (related purchases) (infra assets) XX Recognize turnover of completed project

CANCELLATION OF OFFICIAL RECEIPT DUE TO

DISHONORED CHECKS

Dishonored check : (pwedeng NSF) 1. Dishonor by non-payment a. the check is duly presented for payment and payment is refused or cannot be obtained; b. presentment is excused and the check is overdue and unpaid 2. Dishonor by non-acceptance a. the check is duly presented for acceptance, and such an acceptance as is prescribed by law is refused or cannot be obtained; b. presentment for acceptance is excused and the check is not accepted

Cancellation for current year’s deposited collection

Other receivables XX Cash – treasury/ agency deposit, regular XX Cancellation for prior year’s deposited collection Other receivables XX Accumulated surplus/(deficit) XX

REDEMPTION OF DISHONORED CHECKS

Recognize replenishment of disb. Checks Cash collecting officer XX Other receivables XX Recognize remittance of replacement Cash – treasury/ agency deposit, regular XX Cash collecting officer XX

CASH SHORTAGE/OVERAGE OF CASH

COLLECTING/DISBURSING OFFICER

Cash overage discovered that cannot be explained shall be forfeited in favour of government and an official receipt shall be issued by the collecting officer Cash overage shall be taken up as MISCELLANEOUS INCOME Cash overage not restituted shall be taken up as receivable from the collecting/disbursing officer

OVERAGE

Cash overage forfeited Cash collecting officer XX Miscellaneous Income XX Remittance of cash overage forfeited to BTr Cash – treasury/agency deposit, regular XX Cash collecting officer XX

SHORTAGE

Recognize cash shortage Due from officers and employees XX Cash collecting officer (if shortage of coll. Officer) XX Advances for payroll (if shortage of disb. Officer) XX Restitution of Cash shortage Cash collecting officer XX Due from officers and employees XX Remittance of cash shortage to BTr Cash – treasury/agency deposit, regular XX Cash collecting officer XX

Tax Remittance Advice refers to a specially-numbered document prescribed by DBM that should be used by the NGAs in the remittance of withheld taxes on funds coming from DBM This shall be used to recognize: 1. NGA books – the constructive remittance to BIR and BOC of taxes and customs’ duties withheld, and the constructive receipt of NCA for those taxes and customs duties 2. BIR and BOC books – the constructive receipt of tax revenue and customs duties; 3. BTr books – the constructive receiptof the taxes and customs duties remitted.

TAX WITHHELD BY NGAs Books of Agency Cash - tax remittance advice XX Subsidy from national government XX Recognize receipt of NCA for TRA Due to BIR XX Cash - tax remittance advice XX Recognize remittance to BIR of taxes withheld through TRA

CANCELLATION AND REPLACEMENT OF STALE/

VOIDED/ SPOILED MDS/ COMMERCIAL CHECK IN THE

CURRENT YEAR AND PRIOR YEAR

Cancellation of stale/ voided/ spoiled check Cash – MDS, regular (MDS check) or; Cash in bank – local currency, current account (commercial check)

XX

Accounts payable XX

Replacement of stale/ voided/ spoiled check Accounts payable XX Cash – MDS, regular (MDS check); Cash in bank – local currency, current account (commercial check)

XX

Cancellation of stale/ voided/ spoiled check without replacement Cash – MDS, regular (MDS check current) or; Accumulated surplus/(deficit) (MDS prior yr/ commercial check)

XX

expense XX

ACCOUNTING FOR DISALLOWANCES

Recognize overpayment of purchased Receivables - disallowances/charges XX Expense overpaid (current year) Accumulated surplus/(deficit) (prior year)

XX

Recognize settlement of disallowance Cash collecting officer XX Receivables - disallowances/charges XX Recognize deposit of cash collection Cash - treasury/ agency, regular XX cash collecting officer XX

REPORTING OF COLLECTIONS AND DEPOSITS

Receipts and deposits shall be reported as follows: a. At the close of the business day, the Collecting Officers shall prepare the Report of Collections and Deposits (RCD) that is submitted to Accounting Office/Unit. The report lists all the ORs issued in numerical sequence including cancelled ones. b. The Collecting government entity issuing electronic Official Receipt (eOR) should generate and submit daily to the Auditor a copy of the RCD. c. Field Offices (FOs)/Operating Units (OUs) without complete set of books shall record their collections of income chronologically in the Cash Receipts Register (CRReg) and shall be submitted within five (5) days after the end of each month to the central/regional/division office

CHAPTER 7 TRIAL BALANCE, FINANCIAL REPORTS AND STATEMENTS Trial Balance Trial Balance is a list of all the GL accounts and their balances at a given time. The accounts are listed in the order in which they appear in the RCA. The TB is prepared to:

- Prove the mathematical equality of the debits and credits after posting;

- Check the accuracy of the postings;

- Uncover errors in journalizing and posting; and

- Serve as basis for the preparation of the financial statements

Adjusting Journal Entries - Adjusting journal entries are made at the end of an accounting period to allocate revenue and expenses to the period in which they actually occurred.

- Accrued and deferred items

Other Adjustments The following adjustments shall also be made if applicable) for fair presentation of the results of operation of the entity in the financial statements: a. Unused NCA (National) b. Petty Cash Fund c. Unreleased Commercial Checks d. Allowance for/Accumulated Impairment Losses of asset accounts e. Write-down of Inventories f. Correction/Reclassification Entries g. Adjustment for reversal of Impairment Losses h. Depreciation Expense i. Exchange differences on foreign currency j. Other adjustments

Petty Cash Fund Adjustments - All unreplenished Petty Cash Fund expenses shall be reported and supporting papers submitted to the Accounting Division/Unit the end of the year. - If no replenishment could be made for lack of fund, a JEV shall be prepared to recognize all the expenses paid under the Petty Cash with a credit to the account “Petty Cash”. - If replenishment is made, the credit shall be the appropriate cash account.

Reversion of Unused Notice of Cash Allocation - Adjusting for the reversion of the unused or unutilized NCA of NGAs receiving subsidies from the national government in the form of NCA Subsidy from national government XX Cash – MDS, regular XX

Adjustments for Unreleased Commercial Checks - All unreleased checks at the end of the year shall be reverted back to the cash accounts. - A Schedule of Unreleased Commercial Checks shall be prepared by the Cashier for submission to the Accounting Division/Unit. Cash in bank – local currency, current account XX Accounts payable XX

Allowance for Impairment Losses - The uncollectible amount, or the amount in respect of which recovery has ceased to be probable, is recognized as an expense (impairment losses), rather than as an adjustment of the amount of revenue originally recognized. Impairment loss - .. XX Allowance for impairment - AR XX

Depreciation expenses - Systematic allocation of depreciable amount of the asset over its useful life. - Useful life of an asset is the asset’s expected utility to the entity. - The estimation of useful life is a matter of judgement - Depreciation is recognized even if the fair value of asset exceeds its carrying amount, as long as its residual value does not exceed the carrying amount. - RV and UL should be reviewed at least each annual reporting date.

Pre-Closing Trial Balance/ Adjusted Trial Balance - shall be prepared after posting the AJE in the GJ and the same to the GL - It shows the adjusted balances of all accounts as at a given period.

- TB shall be supported with the schedule of SL balances of the controlling accounts.

Closing Journal Entries - Entries which close out the balances of all nominal/temporary and intermediate accounts at the end of the year. - The closure will reduce the balance of those accounts to zero. The nominal and intermediate accounts that shall be closed at the end of the year are as follows: 1. Balance of all revenue accounts to the “Revenue and Expense Summary” account; 2. Balance of all expense accounts to the “Revenue and Expense Summary” account; 3. Balance of the “Revenue and Expense Summary” to the “Accumulated Surplus/ (Deficit)” account; 4. Balance of all “Cash-Treasury/Agency Deposit, Regular” to the “Accumulated Surplus/(Deficit)” account; and 5. Other Closing Entries.

Post-Closing Trial Balance - Shall be prepared at the end of the year after preparing and posting the closing journal entries in the GJ and posting to the GL. - Basis of FP and TB

Purpose of Financial Statements The objectives of general purpose financial reporting in the public sector should be to provide information useful for decision making, and to demonstrate the accountability of the entity for the resources entrusted to it, by: 1. providing information about the sources, allocation, and uses of financial resources; 2. providing information about how the entity financed its activities and met its cash requirements; 3. providing information that is useful in evaluating the entity’s ability to finance its activities and to meet its liabilities and commitments; 4. providing information about the financial condition of the entity and changes in it; 5. providing aggregate information useful in evaluating the entity’s performance in terms of service costs, efficiency and accomplishments;

General purpose financial statements – predictive or prospective role by providing information useful in predicting the: 1. level of resources required for continued operations, 2. the resources that may be generated by continued operations, 3. The associated risks and uncertainties. Financial reporting may also provide users with information: 1. indicating whether resources were obtained and used in accordance with the legally adopted budget; and 2. indicating whether resources were obtained and used in accordance with legal and contractual requirements, including financial limits established by appropriate legislative authorities.

Responsibility for Financial Statements - responsibility for the fair presentation and reliability of financial statements rests with the management

Components of Financial Statements Necessary for a person to understand the information presented a. name of the reporting entity or other means of identification and any change in that information from the preceding reporting date b. whether separate or consolidated

c. reporting date or period covered d. name of fund cluster e. reporting currency f. level of rounding used

Complete set of financial statements: (submitted to Government Accountancy Sector, COA FS and TB by cluster) 1. statement of financial position 2. statement of financial performance 3. statement of changes in net assets/ equity 4. statement of cash flows 5. statement of comparison of budget and actual amounts 6. notes to financial statements

Qualitative Characteristics of Financial Reporting 1. understandability 2. relevance 3. materiality 4. timeliness 5. reliability 6. faithful representation 7. substance over form 8. neutrality 9. prudence 10. completeness 11. comparability

Financial reporting for the national government a. each entity of the national govt maintains complete set of accounting books by fund cluster which is reconciled with the records of cash transactions maintained by BTr b. the BTr accounts for cash, public debt and related transactions of the national government c. each entity maintains budget registries which are reconciled with the records maintained by DBM and GAS, COA d. the COA through GAS: a. maintains budget records showing the overall approved budget of the NG and its execution/implementation b. consolidates the FSs and budget accountability report of all NGAs and the BTr with COA’s records come up with an Annual Financial Report (sept. 30 last day) c. prepares other financial reports required by law

Fair Presentation and Compliance with PPSAS A fair presentation also requires an entity: a. To select and apply accounting policies in accordance with PPSAS 3, Accounting Policies, Changes in Accounting Estimates and Errors. PPSAS 3 sets out a hierarchy of authoritative guidance that management considers, in the absence of a Standard that specifically applies to an item. b. To present information, including accounting policies, in a manner that provides relevant, reliable, comparable and understandable information. c. To provide additional disclosures when compliance with the specific requirements in PPSASs is insufficient to enable users to understand the impact of particular transactions, other events and conditions on the entity’s financial position and financial performance.

Consistency of Presentation. The presentation and classification of items in the financial statements shall be retained from one period to the next unless:

Disclosures of Events after the Reporting Date The required disclosures for events after the reporting date are as follows: a. Authorized date for issue of FS and who gave that authorization. If another body has the power to amend the financial statements after issuance, the entity shall disclose that fact b. Information received after the reporting date, but before the financial statements are authorized for issue c. Disclose if material. d. Accordingly, the entity shall disclose the following for each material category of non-adjusting event after the reporting date: a. the nature of the event; and b. an estimate of its financial effect or a statement that such an estimate cannot be made. The following, among others are examples of non-adjusting events after the reporting date which requires disclosure: c. an acquisition or disposal of a major controlled entity; d. announcement of a plan to discontinue an operation or a major program; e. major purchases and disposal of asset; and f. the destruction of a major building by a fire after the reporting date.

Changes in Accounting Policies The entity should be consistent in the application of an accounting policy. Change is not allowed in PPSAS unless the change: a. Is required by PPSAS; or b. Results in the financial statements that providing reliable and more relevant information about the effects of transactions, other events and conditions on the entity’s financial position, financial performance The following are considered changes in accounting policies: a. Change from one basis of accounting to another basis of accounting; and b. Change in the accounting treatment, recognition or measurement of a transaction, event or condition within a basis of accounting.

Changes in Accounting Estimates Changes in accounting estimates resuls from new information or new developments and, accordingly, are not correction of errors.

Errors include the effects of mathematical mistakes, mistakes in applying accounting policies, oversights or misinterpretations of facts, and fraud. Current period errors – are errors committed and discovered within the same period. It shall be corrected by an adjusting entry, within the same year before the financial statements are authorized for issue. Prior period errors – are omissions from, and misstatements in, the entities’ financial statements for one or more prior periods An entity shall correct material prior period errors retrospectively in the first set of financial statements authorized for issue after their discovery by:

- restating the comparative amounts for prior period(s) presented in which the error occurred; or

- if the error occurred before the earliest prior period presented, restating the opening balances of assets, liabilities and net assets/equity for the earliest prior period presented.

Disclosure of Prior Period Errors An entity shall disclose the following: 1. the nature of the prior period error; 2. for each prior period presented, to the extent practicable, the amount of the correction for each financial statements line item affected; 3. the amount of the correction at the beginning of the earliest prior period presented; 4. if retrospective restatement is impracticable for a particular prior period, the circumstances that led to the existence of that condition and a description of how and from when the error has been corrected.

Interim Financial Statements ` Financial statements that are required to be prepared at any given period or at a financial reporting period without closing the books of accounts. Shall be prepared by employing the same accounting principles used for annual reports.

Preparation and Submission of Other Reports. the following reports/ schedules/statements shall be submitted to GAS, COA: a. Pre-Closing Trial Balances b. Post-Closing c. Other schedules -Regional Breakdown of Income -Regional Breakdown of Expenses

Deadlines on Submission of Reports All NGAs shall prepare and submit the following financial statements and schedules as follows, within the prescribed deadline: Provincial Offices and Operating Units Entity/office Statement/report Deadline Submit to Monthly TB and Supp. Scheds

10 days aft. End of mo.

Auditor, Regional Accountant Quarterly TBs, FSs, SSs 10 days aft. End of qtr.

Auditor, Regional Accountant yearend TBs, FSs, SSs On or before January 20 of the following year

Auditor, Regional Accountant

Regional/Branches Offices Entity/office Statement/report Deadline Submit to Monthly TBs and SSs 10 days aft. End of mo.

Regional Auditor, Central Office Chief Accountant Quarterly TBs, FSs, SSs 10 days aft. End of qtr.

Regional Auditor, Central Office Chief Accountant yearend TBs, FSs, SSs (combined CO, ROs and OUs)

On or before January 31 of the following year

Regional Auditor, Central Office Chief Accountant

Central/Head/Main Offices Entity/office Statement/report Deadline Submit to Monthly TBs and SSs 10 days aft. End of mo.

Auditor, DBM, Management, Quarterly TBs, FSs, SSs 10 days aft. End of qtr.

Auditor, DBM, Management yearend TBs, FSs, SSs (combined CO, ROs and OUs)

Feb 14 of the following year

COA Auditor, DBM, COA-GAS

Govact summary

Course: Acctng For Governmental,Not-For-Profit Entities (ACT GOV)

University: Far Eastern University

- Discover more from:

Students also viewed

- Feedback Form - form

- Republic Act No. 8188

- 487318125 ASI Chapter 16 NPOs docx

- Pdf-review-materials-for-finals-q compress

- Quiz 2 - Revenue and Other Receipts and Disbursements Accounting FOR Government AND NON- Profit Organizations 18over20

- Quiz 1 - Overview, Budget Process & Government Accounting Process 20over20