- Information

- AI Chat

This is a Premium Document. Some documents on Studocu are Premium. Upgrade to Premium to unlock it.

Was this document helpful?

This is a Premium Document. Some documents on Studocu are Premium. Upgrade to Premium to unlock it.

GOVERNMENT ACCOUNTING Reviewer

Course: Acctng For Governmental,Not-For-Profit Entities (ACT GOV)

34 Documents

Students shared 34 documents in this course

University: Far Eastern University

Was this document helpful?

This is a preview

Do you want full access? Go Premium and unlock all 9 pages

Access to all documents

Get Unlimited Downloads

Improve your grades

Already Premium?

CHAPTER 1: Overview of Government Accounting

● The commission on Audit (COA) is responsible for

- Promulgating accounting and auditing rules and regulations

● The implication that users must be informed of the entity’s policies, changes to

those policies, and the effects of those changes refers to

- Comparability

● According to the GAM for NGAs, information has its qualitative characteristic if it

can be used to assist in evaluating past, present, or future events or in confirming

or correcting past evaluations

- Relevance

● It compases the processes of analyzing, recording, classifying, summarizing, and

communicating all transactions involving the receipt and disposition of

government funds and property, and interpreting the results thereof.

- Government Accounting

● This refers to the comparability between the financial statements of different

entities

- Inter-comparability

● Which of the following qualitative characteristics may be sacrificed when

reporting information on a timely basis?

- Reliability

● In the financial reporting system of the national government, to which of the

following shall an entity reconcile its cash records?

- Bureau of Treasury

● Which of the following is not charged with government accounting responsibility?

- Non-stock, non-profit, private hospital

● The GAM for NGAs is promulgated by

- Commission on Audit

● When the substance of a transaction or event differs from its legal form, the entity

should report transaction’s or event’s

- Substance

CHAPTER 2: Budget Process

● Entity A, a government entity, receives notice that for the current year, the

maximum amount it can spend on maintenance and other operating expenses is

P10B. This event can be described as

- APPROPRIATION

● Entity A, a government entity, receives notice that OUT OF ITS P10B approved

budget for the year, Entity A can incur obligations up to P4B in then first quarter.

This event can be described as

- ALLOTMENT

● After receiving its obligational authority amounting 4B, Entity A enters into binding

agreements for the eventual payments of a total sum of P3B. The P3B event can

describe as

- OBLIGATION

Why is this page out of focus?

This is a Premium document. Become Premium to read the whole document.

Why is this page out of focus?

This is a Premium document. Become Premium to read the whole document.

Why is this page out of focus?

This is a Premium document. Become Premium to read the whole document.

Students also viewed

Related documents

- Quiz 1 - Overview, Budget Process & Government Accounting Process 20over20

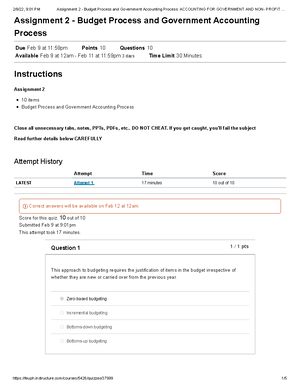

- Assignment 2 - Budget Process and Government Accounting Process Accounting FOR Government AND NON- Profit Organizations 10over10

- Govact summary

- Sample/practice exam, questions and answers

- My thoughts on this

- Taxation 1ST PRE- Board (MAY 2023)