- Information

- AI Chat

Was this document helpful?

Quiz 1 - Overview, Budget Process & Government Accounting Process 20over20

Course: Acctng For Governmental,Not-For-Profit Entities (ACT GOV)

34 Documents

Students shared 34 documents in this course

University: Far Eastern University

Was this document helpful?

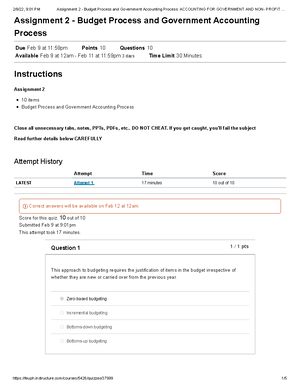

2/23/22, 7:46 PM

Quiz 1 - Overview, Budget Process & Government Accounting Process: ACCOUNTING FOR GOVERNMENT AND NON- PROFI…

https://feuph.instructure.com/courses/5426/quizzes/36982

1/8

Quiz 1 - Overview, Budget Process & Government Accounting

Process

Due Feb 23 at 11:59pm Points 20 Questions 20

Available Feb 20 at 3pm - Feb 25 at 11:59pm 5 days Time Limit 60 Minutes

Instructions

Attempt History

Attempt Time Score

LATEST Attempt 1 55 minutes 20 out of 20

Correct answers will be available on Feb 26 at 12am.

Score for this quiz: 20 out of 20

Submitted Feb 23 at 7:46pm

This attempt took 55 minutes.

Quiz 1

20 items

Overview of Government Accounting, Budget Process and Government Accounting Process

Close all unnecessary tabs, notes, PPTs, PDFs, etc.. DO NOT CHEAT. If you get caught, you'll fail the subject

Read further details below CAREFULLY

1 / 1 pts

Question 1

According to GAM, the government entities shall apply ________ of accounting

Modified Accrual Basis

Accrual Basis

Cash Basis

Any of these

1 / 1 pts

Question 2

Students also viewed

- Feedback Form - form

- Republic Act No. 8188

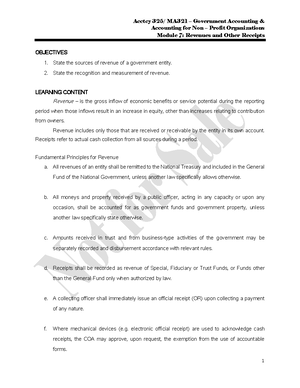

- Module 7 - Revenues and Other Receipts

- Assignment 2 - Budget Process and Government Accounting Process Accounting FOR Government AND NON- Profit Organizations 10over10

- ASTR273-Chapter-8 - The earliest laboratory according to the present evidence is a home laboratory

- Strategy