- Information

- AI Chat

Taxation 1ST PRE- Board (MAY 2023)

Acctng For Governmental,Not-For-Profit Entities (ACT GOV)

Far Eastern University

Recommended for you

Related documents

- Quiz 1 - Overview, Budget Process & Government Accounting Process 20over20

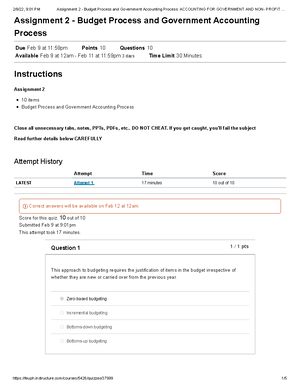

- Assignment 2 - Budget Process and Government Accounting Process Accounting FOR Government AND NON- Profit Organizations 10over10

- ASTR273-Chapter-8 - The earliest laboratory according to the present evidence is a home laboratory

- Strategy

- Civil Code-Book IV Title-IX-Partnership

- Govact summary

Preview text

TAXATION MAY 2023 BATCH

FIRST PRE-BOARD EXAMINATION FEB 1 1 , 2023; 330-630PM

INSTRUCTIONS: Select the correct answer for each of the following questions. Mark only one answer for each item by Shading the corresponding letter of your choice on the answer sheet provided. STRICTLY NO ERASURES ALLOWED. Use Pencil No. 2 only.

- Generally, dividend income received by a domestic corporation from a foreign corporation is includible as gross income of the recipient domestic corporation and subject to corporate income tax. However, said foreign corporation dividend is exempt from income tax provided the following requisites are met, except: A. The dividends actually received or remitted into the Philippines are reinvested in the business operations of the domestic corporation within the next taxable year from the time the foreign-source dividends were received or remitted. B. The dividends received shall only be used to fund the working capital requirements, capital expenditures, dividend payments, investment in domestic subsidiaries, and infrastructure project. C. The domestic corporation holds directly or indirectly at least 20% in value of the outstanding shares of the foreign corporation. D. The domestic corporation has held the shareholdings uninterruptedly for a minimum of 2 years at the time of the dividends distribution. In case the foreign corporation has been in existence for less than 2 years at the time of dividends distribution, then the domestic corporation must have continuously held directly at least 20% in value of the foreign corporation's outstanding shares during the entire existence of the corporation.

- For value-added tax purposes, which of the following transactions of VAT-registered taxpayer may not be zero-rated? A. Export sales B. Foreign currency denominated sales C. Sale of goods to the Asian Development Bank D. Sale of goods to an export oriented enterprise

- Who are allowed to withhold vat from its vat suppliers? A. Nonresident individual and corporations B. Resident foreign corporation doing business in the Philippines C. Government or any of its instrumentalities including government owned and controlled corporation D. Entities, organization, business or corporation duly registered with Philippine Economic Zone Authority (PEZA).

- Statement 1: Upon the effectivity of the TRAIN Law, payment of stock transaction tax of 6/10 of 1% is within five (5) banking days from the date withheld by the broker. Statement 2: Payment of stock transaction tax of 4%, 2% and 1% on primary offering should be within thirty (30) days from the date of listing in the local stock exchange. A. Both statements are correct B. Both statements are incorrect C. Only the first statement is correct D. Only the second statement is correct

- The following are taxable on income derived from sources within the Philippines only, except A. A resident and citizen of Canada who went for a 9 month holiday in Boracay, Aklan B. A Citizen of the Philippines who has permanently migrated into the United States of America C. A Filipino who is a resident of Batanes Island D. A British Racecar driver, residing in Switzerland and on a weeklong beach holiday in Amanpulo Island.

T Thhee PPrrooffeessssiioonnaall CCPPAA RReevviieeww SScchhooooll

Davao 3/F GCAM Bldg. Monteverde St. Davao City 0917 - 1332365 Baguio 2 nd Flr. #12 CURAMED Bldg. Marcos Highway, Baguio City (074) 6200710/0967- 3847348 Main: 3F C. Villaroman Bldg. 873 P. Campa St. cor Espana, Sampaloc, Manila (02) 735 8901 / 0917 - 1332365 email add: crc_ace@yahoo

Dr. Poster, an expert American Virologist was hired by a Philippine Pharmaceutical company to assist the development of a vaccine, for which he had to stay in the Philippines for an indefinite period. His coming to the Philippines was for a definite purpose which in its nature would require an extended stay and to that end makes his home temporarily in the Philippines. The American virologist intends to leave the Philippines as soon as his Philippine assignment is completed. For income tax purposes, the American virologist shall be classified as: A. Resident alien B. Resident citizen. C. Nonresident alien engaged in trade or business D. Nonresident alien not engaged in trade or business

First Statement – An Overseas Filipino Worker is taxable on income derived from sources within the Philippines only. Second Statement – Seafarers, who are Filipino Citizens, who receive compensation as a complement for services rendered abroad as a member and complement of a vessel engaged exclusively in international trade, shall be exempt from Philippine income tax from the aforesaid compensation income. Provided has a valid overseas employment certificate (OEC), valid Seafarers Identification Record Book (SIRB) or Seaman’s Book duly issued by the Maritime Industry Authority (MARINA) A. True, True B. True, False C. False, False D. False, True

For purposes of income taxation, the following are considered “Corporation”, except: A. Joint Venture B. Ordinary Partnership C. One person corporation D. General Professional Partnership

Which of the following is subject to the income tax? A. A non-stock and non-profit educational institution B. Public educational institution C. Civic league or organization not organized for profit and operated exclusively for the promotion of social welfare D. Mutual savings bank and cooperative bank having a capital stock represented by shares organized and operated for mutual purposes and profit

First Statement - When an estate, under administration, has income-producing properties, the annual income of the estate becomes part of the taxable gross estate. Second Statement - When an estate, under administration, has income-producing properties and its income during the year is distributed to the heirs, the income so distributed is taxable to the heirs as part of their gross income for the year. A. True, True B. True, False C. False, False D. False, True

First Statement - A “fringe benefit” is defined as being any good, service or other benefit furnished or granted in cash or in kind by an employer to an individual employee. Second Statement – It is the employer who is required to pay the income tax on the fringe benefit. A. True, True B. True, False C. False, False D. False, True

Share based payments, e., stock options, restricted stock units and alike, given by the employer to his/her/its employees, are: A. Exempt income of the employee B. Subject to the fringe benefits tax in all cases C. Reportable as compensation income of the employee in all cases D. Subject to the Fringe Benefits tax in case of an employee holding a managerial position

The payor of passive income subject to final tax is require to withhold the final tax from the payment due to the recipient. The withholding of the tax, has the effect of A. A final settlement of the tax liability on the income B. .../A credit from the recipient’s taxable income C. Consummating the transaction resulting in an income D. A deduction in the recipient’s income tax return

What is the rule on the taxability of income that a government educational institution derives from its school operations? Such income is

A. Subject to 10% tax on its net taxable income as if it is a propriety educational institution.

B. Exempt from income taxation if it is actually, directly and exclusively used for educational

purposes.

C. Subject to the ordinary income tax rates with respect to incomes derived from

educationalactivities.

D. Exempt from income taxation in the same manner as government-owned and

controlledcorporations. 22. A corporation may change its taxable year to calendar or fiscal year in filing its annual income tax return, provided A. It seeks prior BIR approval of its proposed change in the accounting period. B. It simultaneously seeks BIR approval of its new account period. C. It should change its accounting period two years prior to changing its taxable year.

D. Its constitution and by-laws authorizes the change.

- 1 st Statement - The BIR is authorized to collect estate tax deficiency through the summary remedy of levying upon and sale of real properties of a decedent, without the cognition and authority of the court. 2 nd Statement - The CIR may examine the bank records of the deceased in order to determine the latter's taxable net estate.

A. True; False C. False; True

B. True; True D. False; False

- Taxation, just like other fields of human learning is dynamic, not static, keeps on changing; so we must all study, otherwise we might be facing the battles of today with the antiquated weapons of yesterday. Regardless of economic and business conditions, a sound tax system should provide for thecollection of sufficient revenue to run the government. A. True, true C. False, false B. True, false D. False, true

- A non-resident foreign corporation (NRFC) shall generally be subject to a 25% final tax on gross income received from all sources within the Philippines. However, a NRFC shall be exempt from tax on: A. Philippine Charity and Sweepstakes Office (PCSO) winnings less than ₱10,000. B. De minimis prizes of less than ₱10,000. C. Interest income paid by a depositary bank under the foreign currency deposit system. D. Interest income from a long-term deposit or investment certificate issued by a bank in thePhilippines, and held for a period exceeding 5 years.

- One of the following represents taxable income: A. Refund of 3% OPT paid in a prior year. B. Refund of donors’ tax paid in prior year C. Refund of income tax in prior year D. Refund of special assessment paid in prior year

- Which of the following individual taxpayers is NOT entitled to claim the P250,000 tax exemption from their gross business income? A. A Japanese residing in his home country, who stayed in the Philippines for two (2) months for vacation B. A Filipino citizen who stayed in the Philippines for 183 days during the taxable year

C. An American citizen not doing business in the Philippines who stayed in the Philippines for more than 180 days during the taxable year

D. An Arab businessman who stayed in the Philippines for more than one (1) year

Under the TRAIN Law, who among the following alien individual/s, is/are entitled to an exemption of P250,000 for purposes of computing their income tax? I. Resident alien II. Non-resident alien engaged in trade or business in the Philippines III. Non-resident alien not engaged in trade or business in the Philippines A. I only C. I and III B. I and II D. I, II, and III

Which of the following statement/s is/are CORRECT? I. Excise tax on domestic goods shall be paid by the manufacturer or producer before the removal of such goods from the place of production. II. Excise tax for indigenous petroleum, locally extracted natural gas and liquefied natural gas shall be paid by the manufacturer or producer. III. Excise tax on exported products shall be paid the owner, lessee, concessionaire or operator of the mining claim. A. Statements II and I are correct. B. Only Statement I is correct. C. Statements I, II and III are correct. D. Only Statement II is correct.

Who is liable to pay the excise tax on indigenous petroleum? A. Taxpayer processing the petroleum B. First buyer or purchaser of petroleum C. End user of petroleum D. Taxpayer extracting the petroleum

Persons liable to excise tax on Imported Articles are the following except: A. Person who is found in possession of articles which are exempt from excise taxes other than those legally entitled to exemption B. Producer C. Owner D. Importer

Mr. RJ established a private hospital and a private educational institution. Are the two entities subject to value added tax (VAT) on their primary course of business? A. Both entities are not exempt from VAT B. Both entities are not subject to VAT C. Only the hospital is subject to VAT D. Both entities are exempt from VAT

One of the following franchise grantees is not subject to VAT. Which is it? A. Franchise grantees of gas and water utilities whose annual gross receipts of the preceding year exceed P10,000, B. Franchise grantees of telephone and telegraph businesses C. Franchise grantees on toll road operations D. VAT-registered franchise grantees of radio and television broadcasting businesses whose annual gross receipts of the preceding year do not exceed P10,000,

Which of the following benefits received by an employee may be subject to the regular income tax rates in the ITR? (1) Use of employer’s bus for its drivers’ summer outing (2) Uniform and clothing allowance of ₱6,000 per year (3) Payment of tuition fee of eldest child of a rank-and-file employee (4) Housing provided to a rank-and-file employee A. All except (1) B. All except (3) C. All except (2) D. None of the above

On July 1, 2020, a ALVARO sold directly to a buyer shares of stock of a domestic corporation held as capital asset, as follows: Cost P500, Holding period 12 months Selling price at prevailing market value of P900,000, paid as follows: Cash: 7/1/2020 Down payment 50, 12/1/2020 Installment 75, 7/1/2021 Installment 75, 12/1/2021 Installment 100, Assumption by the buyer of an indebtedness of the shares 600, The total final gain tax paid on the payments received in 2020 was: A. P19,687. B. P33,750. C. P30,625. D. P39,375.

David Austria sold his principal residence for P16,000,000 when the cost to him of the same was P5,000,000. At the time of the sale the zonal and assessed value are Php20,000,000 and P15,000,000, respectively. The capital gains tax on the sale is. A. P 0 B. P 300, C. P 900, D. P 1,200,

Situational 2 (TRAIN LAW) - LUQUE, married to ANNA, died leaving the following: Car acquired before marriage by LUQUE P 3,000, Car acquired before marriage by ANNA 4,500, House and lot acquired during marriage 15,000, Jewelries of ANNA (received as gift during the marriage) 1,000, Personal properties inherited by LUQUE during marriage 2,500, Land inherited by ANNA during marriage 10,000, Rental income on land inherited by ANNA (25% of which was earned after LUQUE’s death) 2,000, Benefits from SSS 3,500, Proceeds of group insurance taken by LUQUE’s employer 1,750, How much is the correct gross estate if the property relationship is absolute community of property? A. 19,500, B. 25,000, C. 26,500, D. 36,000,

Bryan Lopez sold his principal residence for P16,000,000 when the cost to him of the same was P5,000,000. At the time of the sale the zonal and assessed value are P20,000,000 and P15,000,000, respectively. Ten months after the sale, Bryan acquired another principal residence for P12,000,000. The capital gains tax on the sale is A. P 0 B. P 300, C. P 900, D. P 1,200,

Cecilia, is employed and paid a monthly salary equivalent to the statutory minimum wage. The following are his employment income during the year: Statutory minimum wage P 150, 13th month pay 15, Overtime pay earned during the year 25, Night shift differential pay 20, Hazard pay 75, Holiday pay 15, Total P300, The taxable income of Cecilia during the year is A. P 0 B. P 35, C. P 90, D. P 300,

Robert is an MWE receiving salary equal to the statutory minimum wage (SMW). He got promoted and beginning July 1, 2020 his salary exceeds the SMW. Choose the correct statement from the following: A. His income for the entire year ended 2020 is subject to compensation withholding tax. B. Considering that income tax period is one calendar year, Robert will be subjected to compensation withholding beginning January 1, 2021. C. Only his earnings beginning July 1, 2020 is subjected to compensation withholding tax. D. Holiday, overtime, nightshift and hazard pay is exempt from withholding tax.

Anna Santiago, the Chief Financial Officer of SAVEMORE, INC., earned annual compensation income in 2020 of P2,500,000, inclusive of 13th month and other benefits in the amount of P220,000 but net of mandatory contributions to SSS and Philhealth. Aside from employment income, she owns a convenience store, with gross sales of P800,000. Her Cost of Sales and operating expenses are P500,000 and P150,000, respectively, and with non-operating income of P100,000. How much is the total income tax of Anna? A. P 52 , 000 B. P621, C. P693, D. P701,

Corporation A, a retailer, has a gross sales of P1,400,000,000 with a cost of sales of P560,000, and allowable deductions of 150,000,000 for the calendar year 2021. Its total assets of P180,000,000 as of December 31, 2021 per Audited Financial Statements includes the land costing P50,000,000 and the building of P25,000,000 in which the business entity is situated, with an aggregate amount of P75,000,000 as Fixed Assets. Assuming CY 2021 is the 5th year of operation of Corporation A. Corporation A’s regular corporate income tax for CY 2021 is: (CREATE LAW) A. P 0 B. P 8,400, C. P 138,000, D. P 172,500,

The Black Corporation provided the following data for the calendar year ending December 31, 2021 ($1=P50): Philippines USA Gross Income P4,000,000 $40, Deductions 2,500,00 0 15, Income Tax Paid 3 , If it is a domestic corporation, its income tax after tax credit is: (CREATE LAW) A. P 400, B. P 537, C. P 812, D. P 962,

B. Ordinary gain of P3,100,000. C. Capital or ordinary gain of P3,000,000. D. None, being a transfer of property to a controlled corporation. 53. Dalisay has 30% interest in Wagas Corporation. He transferred a personal property he bought in 2017 for P3,000,000 to the corporation and gained control to the extent of 80% percent. He received in 2019, for his property transfer, shares of Wagas Corporation with a fair market value of P2,900,000; cash of P1,500,000 and an idle lot with a fair market value of P1,600,000. Right after, he simultaneously sold the Wagas Corporation shares and the lot he received for P3,500,000 and P1,700,000, respectively. The NIRC (as amended) tax due on the subsequent sale of the shares in Wagas Corporation is: A. P 3,500 other percentage tax. B. P 55,000 final capital gains tax. C. P 90,000 final capital gains tax. D. Include whatever gain recognized in the 2019 income tax return and tax the arising globalized taxable income using the 0%-35% graduated rates under Sec. 24 (A)(2)(a) of the tax code as amended. 54. Dalisay has 30% interest in Wagas Corporation. He transferred a personal property he bought in 2017 for P3,000,000 to the corporation and gained control to the extent of 80% percent. He received in 2019, for his property transfer, shares of Wagas Corporation with a fair market value of P2,900,000; cash of P1,500,000 and an idle lot with a fair market value of P1,600,000. Right after, he simultaneously sold the Wagas Corporation shares and the lot he received for P3,500,000 and P1,700,000, respectively. The income tax due on the subsequent sale also of the idle lot is: A. P 96,000 final capital gains tax. B. P 102,000 final capital gains tax. C. Any arising gain (100%) shall be taxed the graduated income tax rates of 0%-35% under Sec. 24 (A)(2)(a) of the tax code as amended. D. Any arising gain (50% only) shall be taxed the graduated income tax rates of 0%-35% under Sec. 24 (A)(2)(a) of the tax code, as amended. 55. The taxpayer is a resident citizen who is married. For 2019, which is under investigation by the BIR, he had the following data: Net worth, December 31, 2019 P 1,700, Net worth, December 31, 2018 1,000, Interest received on money market placement in bank preterminated in year 4, from an original term of 6 years 95, Dividend on shares of stock of domestic corporation 75, Amount withdrawn from a P157,500 share in the net income after tax of a business partnership 50, Compensation received as the Managing Partner of a General Professional Partnership that earned P400,000 in 2019. The taxpayer has a 25% profit share 108, Rent income per books (out of an advance rental by tenants of P120,000) 20, Income tax paid for 2018 130, Interest paid on money borrowed for use in acquiring long term bond investments 25, Personal, living and family expenditures 150, Cost to repair residential house partially destroyed by typhoon 120, Premiums paid on family health and hospitalization insurance 7, Capital gain on bonds of a domestic corporation held for 10 months 40, Capital loss on bonds of a domestic corporation held for 18 months 70, In the event of conflict between the Philippine Accounting Standards (PAS) or the Philippine Financial Reporting Standards (PFRS) and the National Internal Revenue Code (as amended) and you are resolving on taxation issues: A. PAS/PFRS shall prevail over the Tax Code. B. The Tax Code shall prevail over the PAS/PFRS. C. Both the Tax Code and the PAS/PFRS shall be disregarded. D. The taxpayer at his/her/its option may choose either the PAS/PFRS or the Tax Code.

The taxpayer is a resident citizen who is married. For 2019, which is under investigation by the BIR, he had the following data: Net worth, December 31, 2019 P 1,700, Net worth, December 31, 2018 1,000, Interest received on money market placement in bank preterminated in year 4, from an original term of 6 years 95, Dividend on shares of stock of domestic corporation 75, Amount withdrawn from a P157,500 share in the net income after tax of a business partnership 50, Compensation received as the Managing Partner of a General Professional Partnership that earned P400,000 in 2019. The taxpayer has a 25% profit share 108, Rent income per books (out of an advance rental by tenants of P120,000) 20, Income tax paid for 2018 130, Interest paid on money borrowed for use in acquiring long term bond investments 25, Personal, living and family expenditures 150, Cost to repair residential house partially destroyed by typhoon 120, Premiums paid on family health and hospitalization insurance 7, Capital gain on bonds of a domestic corporation held for 10 months 40, Capital loss on bonds of a domestic corporation held for 18 months 70, The taxable income per investigation by the BIR Examiners is: A. P 985, B. P 990, C. P 995, D. P 1,098,

Decedent was married at the time of death and was survived by his wife and their five legitimate children when he was still alive. He died on November 1, 2018, leaving the following: Real and personal properties in the Philippines P 11,000, Proceeds of life insurance: Receivable by the estate as revocable beneficiary 5,000, Receivable by the spouse as irrevocable beneficiary 3,900, Medical expenses within one year prior to death: Paid by the time of death 500, Unpaid as at the time of death 400, Funeral expenses: Paid by the time of death 200, Unpaid at the time of death 300, Other obligations of the decedent 1,500, The net taxable estate is: A. P 1,250, B. P 1,900, C. P 2,250, D. P 3,700,

Decedent was married at the time of death and was survived by his wife and their five legitimate children when he was still alive. He died on November 1, 2018, leaving the following: Real and personal properties in the Philippines P 11,000, Proceeds of life insurance: Receivable by the estate as revocable beneficiary 5,000, Receivable by the spouse as irrevocable beneficiary 3,900, Medical expenses within one year prior to death: Paid by the time of death 500, Unpaid as at the time of death 400, Funeral expenses: Paid by the time of death 200, Unpaid at the time of death 300, Other obligations of the decedent 1,500,

ABC, is a domestic corporation engaged in merchandising business. For the calendar year 2022 , it had a net income per books of P500,000, after considering, among others, the following: a. Dividend received from a domestic corporation P 30, b. Provision for doubtful accounts 10, c. Dividend received from a foreign corporation 20, d. Portion of P150,000 advance rental already earned 100, e. Recovery of receivables previously written off (included as part of net income above): Allowed by the BIR as deduction 10, Disallowed by the BIR as deduction 30, f. Refund of taxes (included as part of net income above): Allowed by the BIR as deduction 25, Disallowed by the BIR as deduction 15, g. Bank interest income: Philippine Bank 80, USA Bank 100, The taxable income is A. P485, B. P365, C. P 375, D. P405,

MIREN, a VAT registered taxpayer has the following data taken from its books for the month of December 2022 (assume all amounts are exclusive of VAT:

- Revenues on credit for the month of December 2022 – P500,

- Cash revenues for the month of December 2022 – P800,

- Increase on outstanding balance of trade receivables from December 1 to 31, 2022 – P100,000. How much is the output tax due for the month of December 2022 assuming the taxpayer is engaged in sale of services? A. P144, B. P156, C. P168, D. P 96,

Dolores is the winning bidder to exclusively supply face shield and equipment required by their city. During the month it had the following (amount given are exclusive of the VAT): Sales Php400, Purchases of merchandise 80, Purchases of delivery equipment 5 years life 1,200, Purchases of utilities (paid to Paleco) 30, How much VAT payable for the month: A. 36, B. 32, C. 13, D. 10,

The following information was gathered pertaining to the business of Linda, a VAT-registered person for a taxable period: Taxable sales P800, Zero-rated sales 400, Exempt sales 300, Input tax – taxable sales 45, Input tax – zero-rated sales 10, Input tax – exempt sales 15, Input tax that cannot be attributed to any transaction

20,

Assuming all applicable input taxes are to be claimed as credits against output taxes, the VAT payable is: A. P51, B. P35, C. P25, D. P6, 66. VILLAR REALTY is a VAT-registered real estate lessor. It owned a building which is leased for residential and commercial use. During the month of April 2021, the following information was made available (all amounts are VAT exclusive): Gross receipts from lease of commercial spaces P450, Gross receipts from lease of residential spaces at P15,000 per unit 150, Uncollected rentals for the month of April 2021: ➢ Commercial spaces 300, ➢ Residential spaces 100, Purchases from VAT suppliers: ➢ Final payment made to contractor of the building for lease (20 years)

1,200,

➢ Purchase of generator set for the whole building (10 years life)

1,000,

➢ Purchase of furniture and equipment (3 years life) 300, ➢ Purchase for office supplies 50, How much is the deferred input VAT as of May 1, 2021? A. P294, B. P118, C. P159, D. P153, 67. Guiron, a VAT taxpayer made a P100,000 sales to the government invoiced at P112,000 inclusive of output vat. He purchased the same for P90,000, net of P10,800 input vat from Leopold Corporation. The government effected payment, net of the 5% final tax. The actual input vat that will be charged to cost or expense is A. 2, B. 3, C. 5, D. 7,

- Rosana Singson, resident citizen, is a real estate lessor in the Philippines. She has the following financial information in the current taxable year 2021: (a) Interest income on receivable from her mother ₱ 25, (b) Interest expense on loan owed to cousin 15, (c) Royalty income from book, net of FT 75, (d) Loss on sale of rental property to grandfather 350, (e) Gain on sale of personal car bought in 2018 90, (f) Rental receipts from real property, gross of 5% CWT 600, (g) Cost of revenues related real property leasing 100, (h) Liquidating dividend paid by X Corporation 187, Cost of investment made in January 2021 in X Corporation 200, (i) Dividend received from Microsoft Corporation with headquarters in Seattle, Washington, USA 75, (j) Dividend from Jollibee Corporation, net of FT 5, (k) Expenses for boxing lessons taught by Senator Pacquiao 50, (l) OPT paid 18, (m) Taxes paid in her first 3 quarterly ITRs for 2021 16, If Rosana chose to be taxed under the graduated rates with OSD in her 1 st Quarterly ITR, what BIR form shall she file for her annual return? A. BIR Form No. 17 00 – Individuals Earning Purely Compensation Income (including Non Business/Non-Profession Related Income) B. BIR Form No. 1701 – Individuals (including Mixed Income Earners), Estates, and Trusts C. BIR Form No. 1701A – Individuals Earning Purely From Business/Profession [Those under the graduated income tax rates with OSD as mode of deduction OR those who optedto avail of the 8% flat income tax rate]. D. None of the above. reh/cde

Taxation 1ST PRE- Board (MAY 2023)

Course: Acctng For Governmental,Not-For-Profit Entities (ACT GOV)

University: Far Eastern University

- Discover more from:

Recommended for you

Students also viewed

Related documents

- Quiz 1 - Overview, Budget Process & Government Accounting Process 20over20

- Assignment 2 - Budget Process and Government Accounting Process Accounting FOR Government AND NON- Profit Organizations 10over10

- ASTR273-Chapter-8 - The earliest laboratory according to the present evidence is a home laboratory

- Strategy

- Civil Code-Book IV Title-IX-Partnership

- Govact summary