- Information

- AI Chat

100-questions document compress sample question

Accountancy and Business Management (ABM001)

Preview text

Regine G. Gotis

BSAIS 1B

1). Which of the following statement is incorrect regarding general purpose financial statements?

a) General purpose financial statements are those intended to meet the needs of users who are not in a position to require an entity to prepare reports tailored to their particular information needs. b) General purpose financial statements are not the subjectatter of the Conceptual Framework and the PFRS. c) General purpose financial statement cater to the most of common needs of a wide range of external users. d) General purpose financial statement include balance sheet, income statement of owner's equity/retained earnings and statements of cash flow.

Answer: b

2). Which of the following is a change in accounting estimate?

a) Change from the cost model to the fair value model of measuring investment property. b) Change in business model for classifying financial assets resulting to the reclassification of a financial assets from being measured at amortized cost to fair value. c) Change in the method of recognizing revenue from long term construction contracts. d) Change in the depreciation method, useful life or residual value of an item of property, plant and equipment.

Answer: d

3). Which of the following are not included in non-adjusting events after the reporting period?

a) Litigations arising solely from events occuring after the reporting period. b) Major business combination after the reporting period. c) Discovery of fraud or errors that indicate that the financial statements are incorrect. d) Change in tax rate enacted after the reporting period.

Answer: c

4). Which of the following events after the reporting period are treated as adjusting events?

a) A significant decline in the fair value of investment in stocks. b) A litigation arising from an accident that occurred after the reporting period. c) Declaration of dividends after the reporting period. d) Discovery of prior-period fraud or errors.

Answer: d

5). Identify where in these are included in the definition of accounting.

a) Identifying b) Measuring c) Communicating d) All of the above

Answer: d

6). What is the basic purpose of accounting?

a) To provide information that is useful in making economic decision. b) To meet the common needs of most statement users. c) To.

Answer: a

7). The choices below are the sectors in the practice of accountancy, which of these are NOT included?

a) Public practice b) Commerce and industry c) Exchanges d) Government

Answer: c

8). Which of the following events is considered a nonreciprocal transfer?

a) Production of finished goods b) Donation c) Sale of an asset d) Loss from a calamity

Answer: b

9). This qualitative characteristics is unique in the sense that it necessarily requires at least two items.

a) Faithful representation b) Timeliness c) Verifiability d) Comparability

Answer: a

10). Which of the following is NOT one of the primary users listed in the Conceptual Framework?

a) Creditors b) Debtors c) Lenders d) Investors

Answer: b

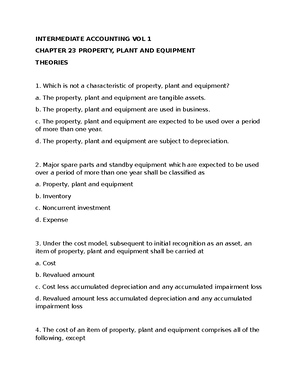

11). Which of the following is not classified as property, plant and equipment?

a) Land held for future plant site b) Minor spare parts and short-lived stand-by equipment c) Building used in business d) Equipment held for environmental and safety reasons

Answer: b

12). The depreciation method prescribed by PAS 16 is

a) Straight-line

b) An amount that can be determined by refference to the plan formula c) Equal to the contribution made to the plan d) The actuarial present value of all contribution to the fund, adjusted for investment income and costs of managing the fund.

Answer: a

19). Investment in subsidiaries, associates or joint ventures are accounted for in the separate financial statements

a) At cost b) In accordance ith PFRS 9 Financial Intruments c) Using the equity method under PAS 28 Investment in Associates and Joint Ventures d) Any of these, asa matter of accounting policy choice

Answer: d

20). A contract that evidences a residual interest in the assets of an entity after deducting all of it's liabilities is

a) Equity instrument b) Financial asset c) Both are correct d) Both are incorrect

Answer: a

21). According to PAS 29, which of the following are restated in case an entity's functional currency is that of a hyperinflationary economy?

a) Monetary items b) Non- monetary items c) Physical assets d) Intangible assets

Answer: b

22). It is any contract that gives rise to a financial asset of one entity and a financial liability or equity instrument of another entity

a) Financial instrument b) Financial asset c) Contracts d) Physical asset

Answer: a

23). it is a cash, equity instrument of another entity, contract right to receive cash or to exchange financial instrument under favorable condition.

a) Financial asset b) Financial liability c) Financial instrument d) None of these

Answer: a

24). It is a computation made for ordinary shares

a) Earnings per share b) Equity instrument c) Share capital d) None of these

Answer: a

25). It is an equity instrument that is subordinated to all other classes of equity instruments

a) Ordinary share b) Preference share c) Basic earning per share d) Diluted earnings per share

Answer: a

26). Which of the following is a financial reporting period shorter than a full financial year?

a) Intern period b) Prior period c) Post-financial period d) None of these

Answer: a

27). The following are PAS 34 condensed set of FS, except;

a) Condensed statement of financial position b) Condensed statement of cash flow c) Selected explanatory notes d) Notes

Answer: d

28). According to PAS 36, the following is the present value of the future cash flows expected to be derived from an asset or cash - generating unit

a) Value in use b) Cost of disposal c) Fair value d) Carrying amount

Answer: a

29). The following are required testing for impairment, except;

a) Intangible asset with indefinite useful life b) Intangible asset not yet available for use c) Goodwill acquired in a business combination d) Statement of financial position and an income statement

Answer: d

30). It is the smallest identifiable group of assets that generates cash inflows that are largely independent of the cash inflows from other assets or group of assets

b) Fair value of the asset received c) Carrying amount of the asset given up d) Measured at the carrying amount of the asset

Answer: d

37). Which of the following asset received is measured at the carrying amount of the asset given up?

a) Lacks commercial substance b) With commercial substance c) Directly attributed cost d) Cost

Answer:

38). Which of the following assets may be classified as investment property?

a) Land held for long term capital appreciation b) Equipment held for lease c) Building held for lease d) Both a & c

Answer: d

39). PAS 41 applies to the following when they relate to agricultural activity, except;

a) Biological assets, except bearer plants b) Agricultural produce at the point of harvest c) Unconditional government grants related to a biological asset measured at it's fair value less costs to sell d) Intangible assets realted to agricultural activity

Answer: d

40). According to PAS 41, it is a living animal or plant

a) Biological assets b) Agriculture c) Bearer d) Bearer plants

Answer: a

41). This is the harvested produce of the enity's biological assets

a) Agricultural produce b) Bearer plants c) Both a & b d) None of these

Answer: a

42). This is the first annual financial statement in which an entity adopts PFRSs, by an explicit and unresearvwd statement of compliance with PFRS

a) First PFRS financial statement b) First reporting standard

c) Philippine financial reporting standard d) All of these

Answer: a

43). It provides numerous other exemptions from retrospective application

a) PFRS 1 b) PFRS 2 c) PFRS 3 d) PFRS 4

Answer: a

44). Which of the following share-based payment transaction in which the entity receives goods or services and pays for them by issuing it's shares of stocks or share option?

a) Equity settled share-based payment b) Cash settled share-based payment c) A & b d) None of these

Answer:a

45). This is a transaction or other event in which an acquirer obtains control of one or more businesses

a) Business combination b) Business transaction c) Control d) Business

Answer: a

46). Which of the following is accounted for using the acquisition method?

a) Acquirer b) Goodwill c) Business combination d) None of these

Answer: c

47). It is the risk that one party to a financial instrument will cause a financial loss for the other party by failing to discharge an obligation

a) Credit risk b) Liquidity risk c) FVPL d) FVOCI

Answer: a

48). The following are the types of market risk, except;

a) Currency risk b) Interest rate risk

d) Prospective application

Answer: d

55). Restating the comparative amount for the prior periods presented in which the error occurred is accounted for by?

a) Retrospective application b) Retrospective statement c) Prospective application d) Impracticable application

Answer: b

56). Changes in accounting estimates are accounted for by

a) Retrospective application b) Prospective application c) Transitional provision d) Prospective restatement

Answer: b

57). A voluntary change in accounting policy is accounted for by

a) Retrospective application b) Prospective application c) Transitional provision d) Prospective restatement

Answer: a

58). It is the misapplication of accounting policies, mathematical mistakes, oversights or misinterpretation of facts and fraud

a) Changes in accounting policy b) Changes in accounting estimates c) Error d) Any of these

Answer: c

59). Which of the following are the events, favorable and non favorable, that occur between the end of reporting period and the date when the financial statement are authorized for issue?

a) Events after the reporting period b) Events after adjusting period c) Events in ordinary transaction d) Events in declaration of dividends

Answer: a

60). These event doesn't require adjustments of amounts in the financial statement

a) Adjustable events b) Non- adjustable events

c) Adjusting d) Non-adjusting

Answer: b

61). These are events that provide evidence of conditios that existed at the end of the reporting period.

a) Adjusting events after reporting period b) Non-adjusting events c) None of these d) All of these

Answer: a

62). It shows the historical changes in cash and each equivalents during the period.

a) Historical cost b) Statement of cash flows c) Operating activities d) None of these

Answer: b

63). This is a profit or loss for a period before deducting tax expense

a) Accounting profit b) Taxable profit c) Current tax d) Defferd tax

Answer: a

64). This is a profit or loss for a period, determined in accordance with the rules established by the taxation authorities, upon which income taxes are payable.

a) Accounting profit b) Taxable profit c) Current tax d) Deffered tax

Answer: b

65). What are those differences that do not have future tax consequences?

a) Permanent differences b) Temporary differences c) Both a & b d) None of these

Answer: a

66). According to PAS 12, current tax expense is computed as

a) Tax laws b) Tax assets & liabilities c) Tax income

Answer: b

73). This are all forms of consideration given by an entity in exchange for service rendered by employee or for the termination of employment

a) Employee benefits b) Revaluation c) Share-based payment d) None of these

Answer: a

74). Under accumulating, this is the unused entitlement that are paid in cash when the employee leaves the entity

a) Vesting b) Non- vesting c) Monetizing d) Contributory

Answer: a

75). What kind of benefit the employee has that are payable after the completion of employment?

a) Short-term employee benefit b) Post-employee benefit c) Long-term employee benefit d) Past- employee benefit

Answer: b

76). Under the post-employee benefits,the retrement benefit cost is equal the contribution due for the period

a) Defined contribution plan b) Defined benefit plan c) State plan d) Multi- employee plan

Answer: a

77). Arrange the following steps in the accounting for defined benefit plan in the correct order

I the net defined benefit liability (asset)

II. Determine the components of the defined benefit cost to be recognized in profit or loss and OCI

III the deficit or surplus

a) II,III,I

b) III,I,II

c) I,II,III

d) II,I,III

Answer: b

78). This is a type of government grants whose primary conditions is that the recipient entity should acquire or construct long -term assets

a) Monetary grants b) Non-monetary grants c) Grant related to assets d) Grant related to income

Answer: c

79). What is the accounting for government grant approach that grant is recognized in profit or loss over one or more periods

a) Capital approach b) Income approach c) Monetary approach d) Non- monetary approach

Answer: b

80). These are assistance received from the government in the form of transfer of resources in exchange for compliance with certain conditions

a) Government grants b) Subsidies c) Premiums d) All of these

Answer: d

81). Monetary grants are measured at

a) The amount of cash received b) The fair value of the amount received c) Nominal amount d) A or b

Answer: d

82). Which of the following principles applies most to the accounting for government grants?

a) Accrual basis b) Cash basis c) Materiality d) Prudence

Answer: a

83). According to PAS 20, government grants are presented in which type of financial statement?

a) Gross presentation b) Net presentation c) Functional presentation d) Both a & b

Answer: d

84). Which of the following is one of the two ways of conducting foreign activities?

b) General borrowing c) Specific borrowings d) Borrowing

Answer: c

91). Which of the following is not an example of related parties?

a) Parent and it's subsidiary b) Fellow subsidiaries with a common parent c) A joint venture and an associate of a common investor d) Two joint ventures simply because they are co-venture in a joint venture

Answer: d

92). Which of the following is a transfer of resources, services on obligations between a reporting entity and a related party, regardless of whether a price is charged?

a) Related party transaction b) Close family member c) Government related entity d) Both c & b

Answer: a

93). Which of the following is an entity that is controlled, jointly controlled or significantly influenced by a government?

a) Government related entity b) Close family member c) Government related entity d) Both c & b

Answer: a

94). These are the assets of a plan less liabilities other than the actuarial present value of promised retirement benefits

a) Net asset available for benefits b) Vested benefits c) Retirement benefits d) Hybrid plan

Answer: a

95). Which of the following are the benefits, the right to which, under the condition of a retirement benefit plan, are not conditional on continued employment?

a) Net asset available for benefits b) Vested benefits c) Retirement benefits d) Hybrid plan

Answer: b

96). According to PAS 26, a hybrid plan is accounted for as

a) Defined benefit plan b) Defined contribution plan c) A & b d) A or b

Answer: a

97). It is an entity over which the investor has significant influence

a) Associate b) Investment entity c) Joint venture d) None of these

Answer: a

98). According to PAS 28, the investment is initially measured at

a) Associate b) Cost c) Savings d) Purchase

Answer: b

99). When an associate has this, the investor computes for its share in profit or loss after deducting one- year dividends on those shares, whether declared or not. What is this?

a) Significant influence b) Cumulative preferences shares c) Investment d) A & c

Answer: b

100). According to PAS 29, it refers to a general increase in prices and decreases in the purchasing power of money

a) Inflation b) Monetary items c) Non- monetary items d) Both b & c

Answer: a

100-questions document compress sample question

Course: Accountancy and Business Management (ABM001)

- Discover more from: