- Information

- AI Chat

Was this document helpful?

Syllabus-Auditing-and-Assurance Concepts-and-Applications-1

Course: Accountancy (BSA2)

729 Documents

Students shared 729 documents in this course

University: Quezon City University

Was this document helpful?

BACHELOR OF SCIENCE IN ACCOUNTANCY

COURSE TITLE : Auditing and Assurance: Concepts and Applications 1

COURSE CODE : ACPAUD2

NUMBER OFUNITS : 3 Units

PRE-REQUISITE SUBJECT : Auditing and Assurance Principles

Course Description:

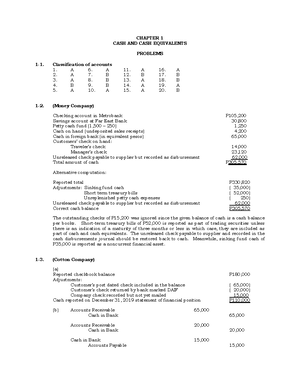

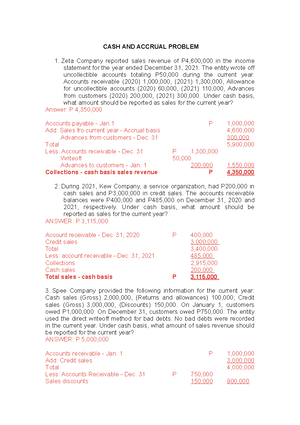

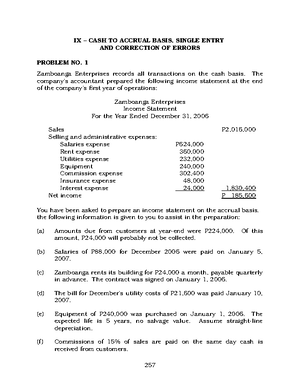

This course deals with the study and application of audit procedures in the external audit

of financial statements. It tackles detailed process and approaches to situational problems

usually encountered in the audit of cash, revenue and receipt cycle, expenditure and

disbursement cycle, and production cycle.

Course Learning Outcomes:

Upon completion of the course the students will be able to:

A. Cognitive

1. Identify audit objectives and evaluate internal controls considerations for audit of

cash, revenue and receipt cycle, expenditure and disbursement cycle, and

production cycle

2. Understand the process for audit of cash, revenue and receipt cycle, expenditure

and disbursement cycle, and production cycle

B. Affective

1. Appreciate the importance of the audit planning and internal control considerations

in audit process

2. Appreciate the importance of audit documentation in the audit process

Psychomotor

1. Formulate and apply appropriate audit procedures for audit of cash, revenue and

receipt cycle, expenditure and disbursement cycle, and production cycle

2. Prepare and complete audit documentations related to cash, revenue and receipt

cycle, expenditure and disbursement cycle, and production cycle as bases for the

audit report