- Information

- AI Chat

Was this document helpful?

Horizontal-Vertical-Analysis

Course: Accountancy

999+ Documents

Students shared 15764 documents in this course

University: STI College

Was this document helpful?

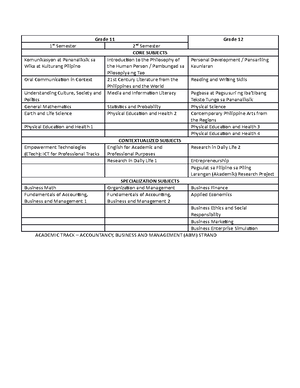

2021 2020

Amount Amount

Revenue

Sales

395,000.00

₱

285,000.00

₱

Less: Sales returns and allowances

3960.00

2950.00

Net Sales

391,040.00

₱

282,050.00

₱

Cost of goods sold

Merchandise inventory, January 1

42,000.00

₱

53,000.00

₱

Purchases less returns and allowances

95100.00

75000.00

Total Cost of merchandise available for sale

137,100.00

₱

128,000.00

₱

Less: Merchandise inventiry, March 31

52200.00

53000.00

Cost of goods sold

84,900.00

₱

75,000.00

₱

Gross Profit

306,140.00

₱

207,050.00

₱

Operating Expenses

Delivery expenses

560.00

₱

250.00

₱

Depreciation expenses-equipment

4200

4200

Payroll taxes expenses

458

286

Salary expenses

11538

11500

Supplies expense

300

435

Telephone expense

185

215

Utilities expense

1590

1200

Total operating expenses

18,831.00

₱

18,086.00

₱

Net Income before federal income tax

287,309.00

₱

188,964.00

₱

Federal income tax

14,500.00

₱

13,105.00

₱

Net Income after federal income tax

272,809.00

₱

175,859.00

₱

Company

Horizontal Analysis INCOME STATEMENT

For Years Ended December 31, 2021 and 2020