- Information

- AI Chat

Chapter 4 Extinguishment

Business Administration (BSBA)

Tarlac State University

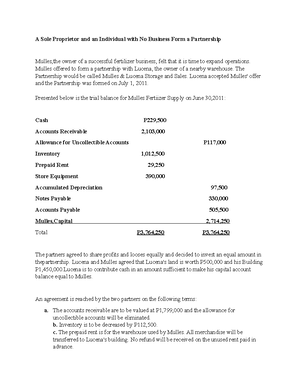

Preview text

C H A P T E R 4

EXTINGUISHMENT OF OBLIGATIONS

GENERAL PROVISIONS

ART. 1231

Obligations are extinguished: 1. By the payment or performance; 2. By the loss of the thing due; 3. By the condonation or remission of the debts; 4. By the confusion or merger of the rights of the creditor and debtor; 5. By compensation; 6. By novation. Other causes of extinguishment of obligations, such as annulment, rescission, fulfillment of resolutory condition, and prescription, are governed elsewhere in this Code.

EXTINGUISHMENT OF OBLIGATIONS (PaL C 3 NARF Pre) 1. Payment or performance 2. Loss of the thing due 3. Condonation or remission 4. Confusion or merger 5. Compensation 6. Novation 7. Annulment 8. Rescission 9. Fulfillment of resolutory condition 10. Prescription

OTHER FORMS OF EXTINGUISHMENT (FC - MAID)

- Happening of fortuitous event (Art. 1174)

- Compromise (Art. 2028)

- Mutual desistance or withdrawal

- Arrival of resolutory period (Art. 1193, par. 2)

- Impossibility of fulfillment of condition (Art 1266)

- Death, for personal or intransmissible obligation. (Art. 1311 par. 1 )

Illustration of Death: On 1 Jan 2017, A promised to B the amount of P5M to be paid on 31 Dec. 2018. On 1 June 2017, A died leaving X as the only heir. B cannot compel X to pay the debt of his father for Art. 1178 states that only rights shall be transmissible, obligation not included.

S E C T I O N 1

PAYMENT OR PERFORMANCE

ART. 1232

Payment means not only the delivery of money but also the performance, in any other manner, of an obligation.

CONCEPT OF PAYMENT AND PERFORMANCE

It consists in the normal and voluntary fulfillment of the obligation by the realization of the purposes for which it was constituted.

ART. 1233

A debt shall not be understood to have been paid unless the thing or service in which the obligation consists has been completely delivered or rendered, as the case may be.

ART. 1234

If the obligation has been substantially performed in good faith, the obligor may recover as though there had been strict and complete fulfillment, less damages suffered by the obligee.

ART. 1235

When the obligee accepts the performance, knowing its incompleteness or irregularity, and without expressing any protest or objection, the obligation is deemed fully complied with.

GENERAL RULE

An obligation is understood to have been paid or performed when: TO GIVE The debtor or obligor has completely delivered the thing which he had obligated himself to deliver. TO DO The obligor has completely rendered the service which he had obligated himself to render. NOT TO DO The obligor has completely refrained from doing that which he had obligated himself not to do.

EXCEPTIONS [SAC] 1. When the obligation has been substantially performed in good faith. REASON: In the case of substantial performance, the obligee is benefited. 2. When the obligee accepts the performance, knowing its incompleteness or irregularity, and without expressing any protest or objection. REASON: Base on the principle of estoppels. 3. When the obligation to give, to do or not to do is converted into an obligation to indemnify the obligee or creditor because of breach or non-fulfillment.

NOTE: For payment to properly exist, the creditor has to accept the same, expressly or implicitly. Payment, for valid reasons, may properly be rejected.

BURDEN OF PROVING PAYMENT GENERAL RULE Debtor has the burden of showing with legal certainty that the obligation has been discharged by payment.

EXCEPTION When the debtor introduces evidences that the obligation has been extinguished, the burden shifts to the creditor.

REQUISITES OF PAYMENT [I 3 FCM] 1. Identity – only the prestation agreed upon and no other must be complied with; 2. Integrity/Completeness – the thing or service must be completely delivered or rendered; 3. Intention – the debtor must have the intention to fulfill the obligation; 4. Free and voluntary fulfilled. 5. The debtor and creditor must have the capacity to give and receive the payment respectively; 6. Must be made by the proper payor to proper payee.

KINDS OF PAYMENT

- Normal – when the debtor voluntarily performs or pays

- Abnormal – the debtor is forced by means of a judicial proceeding either to comply with the prestation or pay indemnity.

PRINCIPLE OF INTEGRITY/COMPLETENESS OF PAYMENT

For debt to have been paid, the thing or service in which the obligation consists must have been completely delivered or rendered, as the case may be.

REQUISITES

- The very thing or service contemplated must be paid;

- Fulfillment must be complete.

HOW PAYMENT IS MADE DEBT PAYMENT Monetary Delivery of money. The amount paid must be full, unless otherwise stipulated in the contract. To give Delivery of the thing/s To do Performance of the personal

undertaking. Not to do Refraining from doing the action.

ART. 1236

The creditor is not bound to accept payment or performance by a third person who has no interest in the fulfillment of the obligation, unless there is a stipulation to the contrary. Whoever pays for another may demand from the debtor what he has paid, except that if he paid without the knowledge or against the will of the debtor, he can recover only insofar as the payment has been beneficial to the debtor.

NOTE In case the third person acquired the consent of the debtor, there arise a new juridical relationship between the debtor and the third person.

NOTE Extinguishment of the principal obligation gives rise to extinguishment of the accessory obligation such as mortgage, surety, and guarantee.

ART. 1237

Whoever pays on behalf of the debtor without the knowledge or against the will of the latter, cannot compel the creditor to subrogate him in his rights, such as those arising from a mortgage, guaranty, or penalty.

NOTE Whether or not a third person secured the consent of the debtor, the obligation with respect to the creditor is validly extinguished.

ART. 1238

Payment made by a third person who does not intend to be reimbursed by the debtor is deemed to be a donation, which requires the debtor's consent. But the payment is in any case valid as to the creditor who has accepted it.

NOTE If a third person intends to pay the debtor’s obligation as a donation without securing first the debtor’s consent, the third person shall have the right for reimbursement.

NOTE A third person who intends to pay the debtor’s obligation must secure the debtor’s consent (Art. 734) in order to eradicate the sense of obligation on the part of the debtor to return the favour owed to the third person (to avoid the so called “utang na loob”).

NOTE If the value of the donation is P5,000 or less, the donation may be made either orally or in writing. Should the donation exceed P5,000, the donation must be written in public or private document (see Art. 748).

PERSON WHO MAY PAY THE OBLIGATION

- Debtor himself

- His legal representative

- Any third person interested in the fulfillment of obligation.

NOTE The rule on the third person does not apply in case a third person who pays the redemption price in sales with right of repurchase (pacto de retro) because the vendor a retro is not a debtor within the meaning of the law.

THIRD PERSON INTERESTED IN THE PARTY

- Co-debtor

- Sureties

- Guarantors

- Owners of mortgages property or pledge

- When there is a stipulation to the contrary (JURADO, 235)

EFFECTS OF PAYMENT 1. The obligation is extinguished; 2. The debtor is to fully reimburse the third person who is an interested party; 3. The third person interested is subrogated to the rights of the creditor.

THIRD PERSON WHO IS NOT AN INTERESTED PARTY BUT

WITH DEBTOR’S CONSENT

GENERAL RULE

The creditor is not bound to accept payment or performance by a third person who has no interest in the fulfillment of the obligation.

EXCEPTION

Unless there is a stipulation to the contrary.

REASON The creditor should have the right to insist on the liability of the debtor. The creditor should not be compelled to accept payment from a third person whom he may dislike or distrust. He may not desire to have any business dealings with a third person; or the creditor may not have confidence in the honesty of the third person who might deliver a defective thing or pay with a check which may not be honoured.

EFFECTS OF PAYMENT

- Third person is entitled to full reimbursement;

- There is legal subrogation as the third person, i., steps into the shoes of the creditor.

NOTE The creditor may refuse to accept payment.

THIRD PERSON, NOT INTERESTED AND WITHOUT CONSENT GENERAL RULE Whoever pays for another may demand from the debtor what he has paid.

EXCEPTION If payment was made without the knowledge or against the will of the debtor. In such case, he can only recover insofar as the payment has been beneficial to the debtor, also known as beneficial reimbursement.

EFFECT OF PAYMENT Third person can only be reimbursed insofar as payment has been beneficial to the debtor.

Illustration: A owes P5M to B payable on 31 Dec. 2018. C, the father of A, went to B and said, “compañero, I’m going to pay na yung debt ng magaling ko na son.” Is B compelled to accept the same? No. C, though he may be the father of A, is not an interested party in the fulfillment of the obligation for he is not a party to the contract.

Some instances wherein a third person can pay the obligation of the debtor: In Arts. 94, 121, 146 of the Family Code.

SUBROGATION

The person who pays for the debtor is put into the shoes of the creditor thereby acquiring not only the right to be reimbursed for what he has paid but also all other rights which the creditor could have exercised pertaining to the credit either against the debtor or against the third persons, be they guarantors or possessors of mortgages. Only applies when the payment by a third person is with the knowledge of the debtor.

SUBROGATION REIMBURSEMENT

Third person is entitled to demand reimbursement and exercise all the rights which the creditor could have exercised against the debtor and against the third persons.

A simple personal action available to the third person or payor against the debtor to recover from the latter what he has paid insofar as the payment has been beneficial to said debtor.

Illustration: In 2018, A executed a promissory note promising to pay to B P1M within a period of 4 years. The payment of debt was guaranteed by C. In 2022, D, a third person, paid the entire amount of the indebtedness with the knowledge and consent of A. D shall be subrogated to all the rights of B not only against A but also against C. This is so because the law expressly states that if a third person pays the obligation with the express or tacit approval of the debtor, he shall be legally subrogated to all the rights of the creditor, not only against the debtor, but even against third persons, be they guarantors or possessors of mortgages.

Illustration: If in the above problem, B had condoned one-half of the obligation in 2021, and subsequently, in 2022, E, an epal third person, unaware of the

fulfill his obligation by substituting another act or forbearance against the obligee’s will.

GENERAL RULE In both cases, the creditor cannot be compelled to accept the delivery of the thing or the substitution of the act or forbearance.

EXCEPTION If the creditor accepts the same, such acceptance shall give the same effect as a fulfillment or performance of the obligation, which shall be governed by the law on sales or dation (dacion en pago).

OTHER EXCEPTION Aside from dacion en pago, a debtor can compel the creditor to accept another thing or vice versa when: 1. There is an express stipulation by the contracting parties; 2. The nature of the obligation is facultative.

SPECIAL FORMS OF PAYMENT 1. Dacion en Pago 2. Application of Payment 3. Cession 4. Consignation

DATION (DACION EN PAGO)

The delivery and transmission of ownership of a thing by the debtor to the creditor as an accepted equivalent of the performance of obligation. A special form of payment which is most analogous to a contract of sales. The law on sales shall govern with the credit as the price of the thing.

REQUISITES

- Existence of a money obligation; It is in obligations which are not money debts, in which the true juridical nature of dation in payment becomes manifest. A prior agreement of the parties on the delivery of the thing in lieu of the original prestation shows that there is a novation which extinguishes the original obligation, and the delivery is a mere performance of the obligation. If the creditor is evicted from the thing given in dation, the original obligation is not revived.

- Alienation to the creditor of a property by the debtor with the consent of the former;

- Satisfaction of the money obligation of the debtor.

Illustration: If A executed a promissory note in 2018 promising to pay to B P1M with four years from the execution of the note, and in 2021 when the obligation became demandable the two entered into an agreement by virtue of which A shall deliver his automobile to C as the equivalent of the performance of the obligation, the effect is the transformation of the previous contract into a contract of sale with the automobile as the object and the loan of P1M as the purchase price.

Illustration: A bound himself to pay B P5M on 31 Dec. 2018. The said date arrived and A gave to B, instead of the P5M cash, a particular cellular phone which he bought in the very lucrative and luxurious Divisoria amounting to P5M. In this case, there is no dation of payment but rather novation.

LAW ON SALES GOVERNS DACION EN PAGO Dacion en pago is governed by the law on sales for both have the same elements. 1. There is a consent on both parties; 2. There is a specific object stipulated to be delivered; 3. There is a price consideration.

DIFFERENCE OF DATION AND CONTRACT OF SALE

DATION - there is a pre-existing contract or obligation. SALE – there is none. DATION – once the dation is perfected, it results to extinguishment of the obligation. SALE – once the contract of sale is perfected, it gives rise to 2 obligations: to deliver the thing and to pay the price.

EFFECT IF OBJECT IS GENERIC If there is no precise declaration in the obligation with regard to the quality and circumstances of the indeterminate thing which constitutes its object, the creditor cannot demand a thing of the best quality; neither can the debtor deliver a thing of the worst quality. If there is disagreement, the law

steps in and declares whether the obligation has been complied with or not, depending upon the purpose of such obligation and other circumstances.

ART. 1247

Unless it is other stipulated, the extrajudicial expenses required by the payment shall be for the account of the debtor. With regard to judicial costs, the Rules of Court shall govern.

NOTE Payment made to the creditor by the debtor after the latter has been judicially ordered to retain the debt shall not be valid (Art. 1243), unless otherwise stipulated, extrajudicial expenses required by the payment shall be for the account of the debtor (Art. 1247)

EXPENSES OF PAYMENT If the debtor changes his domicile in bad faith or after he has incurred in delay, the additional expenses shall be borne by him (Art. 1251).

ART. 1248

Unless there is an express stipulation to that effect, the creditor cannot be compelled partially to receive the prestations in which the obligation consists. Neither may the debtor be required to make partial payments. However, when the debt is in part liquidated and in part unliquidated, the creditor may demand and the debtor may effect the payment of the former without waiting for the liquidation of the latter.

GENERAL RULE

Art. 1248 (1) only applies to obligation where there is only one debtor and one creditor.

RULES IN DELIVERY OF GENERIC THINGS 1. Creditor cannot demand a thing of superior quality but, he may demand and accept one of inferior quality; 2. Debtor cannot deliver a thing of inferior quality but he may deliver one of superior quality, provided it is not of a different kind.

EXCEPTION 1. When the obligation expressly stipulates the contrary; 2. When different prestations which constitute the object of obligation are subject to different terms and conditions; 3. When the obligation is part liquidated and in part unliquidated.

ART. 1249

The payment of debts in money shall be made in the currency stipulated, and if it is not possible to deliver such currency, then in the currency which is legal tender in the Philippines. The delivery of promissory notes payable to order, or bills of exchange or other mercantile documents shall produce the effect of payment only when they have been cashed, or when through the fault of the creditor they have been impaired. In the meantime, the action derived from the original obligation shall be held in abeyance.

RULE IN MONETARY OBLIGATIONS

- Must be made in the currency stipulated; if it is impossible to deliver such or when there is no stipulation regarding the currency, then in the Philippine currency.

- For mercantile documents, it shall only produce the same effect only when: a. They have been cashed; b. They have been impaired by the fault of the creditor. REASON: For the 2nd rule, the reason behind is that the creditor cannot be compelled to accept another thing other than that agreed upon.

NOTE The impairment of the negotiable instrument through the fault of the creditor contemplated by Art. 1249 is applicable only to a document executed by a third person and delivered by the debtor to the creditor and does not apply to instrument executed by debtor himself and delivered to the creditor.

NOTE Pending the cashing of the mercantile document, the creditor cannot bring an action against the debtor during the intervening period as the action derived from the original obligation shall be held in abeyance.

R. No. 529 (Sec. 1) “Every provision contained in, or made with respect to any obligation which provision purports to give the oblige the right to require payment.. than Philippine currency.. hereby declared against public policy, and null, void and of no effect...”

NOTE RA 529 was repealed by RA 8183. There is no longer any legal impediment to having obligations or transactions paid in a foreign currency as long as the parties agree to such arrangement. (DBP v CA, 494 SCRA 25 [2006])

LEGAL TENDER

Any currency which may be used for the payment of all debts, whether public or private. Its significance is manifested by the fact that it is such which the debtor may compel a creditor to accept in payment of the debt.

NOTE Under BSP Circular No. 537 which took effect on 11 Aug. 2006, the maximum amount of coins to be considered legal is adjusted Sec. 25 of RA 7653 as follows: 1. P1,000, for denominations P1, P5, and P10; 2. P100, for denominations P, P, P, P and P.

R. No. 8183 All monetary obligations shall be settled in the Philippine currency. However, the parties may agree that the obligation or transaction shall be settled in any other currency at the time of payment.

PAYMENT BY MEANS OF INSTRUMENTS OF CREDITORS

Promissory notes, checks, bills of exchange and other commercial documents are not legal tender and the creditor cannot be compelled to accept them. Nevertheless, the creditor may accept them without producing the effect of payment.

Illustration: On 1 Jan. 2017, A borrowed money from B amounting to P5M to be paid on 1 Mar. 2018. Upon the arrival of the stipulated date, A gave a personal check to B to pay his debt. Is the obligation already extinguished? No. Art. 1249 (2) provides that monetary papers shall only extinguish the obligation if it was already converted to cash. Upon the delivery of the personal check of A to B, the obligation still subsists.

ART. 1250

In case an extraordinary inflation or deflation of the currency stipulated should supervene, the value of the currency at the time of the establishment of the obligation shall be the basis of payment, unless there in an agreement to the contrary.

REASON It is a debt in value.

INFLATION It is caused by an increase in the volume of money and credit relative to available goods resulting in a substantial and continuing rise in the general price level.

DEFLATION

It is the reduction in volume and circulation of the available money or credit, resulting in a decline of the general price level.

EXTRAORDINARY INFLATION OR DEFLATION It is the uncommon decrease or increase in the purchasing power of the currency which could not have been foreseen or which was manifestly beyond the contemplation at the time when the obligation was established

REQUISITES 1. There must be a decrease or increase in the purchasing power of the currency which is unusual or beyond the common fluctuation in the value of the currency; 2. Such decrease or increase could not have been reasonable foreseen or which was manifestly beyond the contemplation of the parties at the time the obligation was established; 3. The obligation is contractual in nature. REASON From the employment of the words “extraordinary inflation or deflation of the currency stipulated,” it can be

seen that the legal rule in Art. 1250 envisages ”contractual” obligations where a currency is selected by the parties as the medium of payment.

NOTE The value of the currency at the time of the establishment of the obligation shall be the basis of payment. The law does not say it should be the amount paid.

NOTE Even if the price index of the goods and services may have risen during the intervening period, this increase, without more, cannot be considered as resulting in “extraordinary inflation” as to justify the application of Art. 1250. There must be a declaration of such extraordinary inflation or deflation by the Bangko Sentral.

DEVALUATION Involves an official reduction in the value of one currency from an officially fixed level imposed by monetary authorities.

DEPRECIATION Refers to the downward change in the value of one currency in terms of the currency of other nations which occurs as a result of market forces in the foreign exchange market.

ART. 1251

Payment shall be made in the place designated in the obligation. There being no express stipulation and if the undertaking is to deliver a determinate thing, the payment shall be made whenever the thing might be at the moment the obligation was constituted. In any other case, the place of payment shall be the domicile of the debtor. If the debtor changes his domicile in bad faith or after he has incurred in delay, the additional expenses shall be borne by him These provisions are without prejudice to venue under the Rules of Court

NOTE Art. 1251 must be read with Art. 1521.

NOTE Art. 1251 governs unilateral obligations. Reciprocal obligations are govern by special rules.

NOTE The term “domicile,” as used in Art. 1251, connotes “actual” or “physical” habitation of a person as distinguished from “legal” residence (De Leon, 320).

Illustration: A and B constituted a contract binding A to pay P5M to B. A is from Cagayan and B is from Sulo. In this case, the place of payment should be in Cagayan.

Illustration: A bound himself to give a specific motorcycle with the plate number FVCK 1111 to B on 31 Dec 2018. At the time of the constitution of the obligation, the car FVCK 1111 was parked in San Beda University. The said date arrived and for an unknown reason, the motorcycle is now parked on the roof of the Manila City Hall. In this case, the place of payment must be in San Beda University for the law provides that payment of the determinate thing must be at the place where the thing is during the time of constitution and not the time of fulfillment of the obligation.

NOTE In payment, any expenses incurred by the creditor must be borne by the creditor alone for it is incumbent for him to do such.

NOTE In putting the thing to be deliverable state, the expenses must be borne by the debtor.

S U B S E C T I O N 1

APPLICATION OF PAYMENT

ART. 1252

He who has various debts of the same kind in favour of one and the same creditor, may declare at the time of making the payment to which of them the same must be applied. Unless the parties so stipulate, or when the application of payment is made by the party for whose benefit the term has been constituted, application shall not be made as to debts which are not yet due.

- As between two debts with interest, that with higher interest rate is more onerous.

- A secured debt is more onerous than that which is not.

- A debt in which the debtor is principally bound is more onerous than that which he is merely a guarantor or surety.

- A debt in which he is solidarily bound is more onerous than that which he is only a sole debtor.

- An obligation for indemnity is more onerous than that which is by way of penalty.

- Liquidated debts are more onerous than unliquidated ones.

NOTE When it is fairly impossible to determine which of the debts due is the most onerous or burdensome to the debtor, or when the debts due are of the same nature and burden, payment shall be applied proportionately or pro rata, in accordance to the general rules on payment in Arts. 1232-1251.

NOTE If the debt produces interests, payment of the principal shall not be deemed to have been made until the interests have been covered (Art. 1253); applies only in the absence of an agreement to the contrary and is merely directory and not mandatory, hence, the benefits of Art. 1253 may be waived by way of stipulation.

Illustration: The debtor owes his creditor several debts, all of them due: 1) an unsecured debt; 2) a debt secured with mortgage of the debtor’s property; 3) a debt bearing interest; 4) a debt in which the debtor is solidarily liable with another. Partial payment was made by the debtor. Assuming that the debtor had not specified the debts to which the payment should be applied and, on the other hand, the creditor had not specified in the receipt he issued the application of payment, the order of payment should be: 4, 2, 3 and 1.

S U B S E C T I O N 2

PAYMENT BY CESSION

ART. 1255

The debtor may cede or assign his property to his creditors in payment of his debts. This cession, unless there is stipulation to the contrary, shall only release the debtor from responsibility for the net proceeds of the thing assigned. The agreements which, on the effect of the cession, are made between the debtor and his creditors shall be governed by special laws.

CESSION OR ASSIGNMENT

A special form of payment whereby the debtor abandons all of his property for the benefit of his creditors in order that from the proceeds thereof the latter may obtain payment of their credits.

NOTE What is transferred in cession, unlike dacion en pago which transfers ownership, is the management and/or administration of the property in order to sell the thing of the debtor for the fulfillment of obligation.

REQUISITES [ 22 – I AA] 1. 2 or more debts; 2. 2 or more creditors; 3. Insolvency of the debtor; 4. Abandonment of all debtor’s property not exempt from execution in favor of creditors, unless exemption is validly waived by the debtor; 5. Acceptance of the cession by the creditors.

Illustration: A owes P5M to B payable on or before 31 Dec 2018. On 28 Feb 2018, A went to B to deliver a personal check amounting to P5M. B refused to accept the same. Can A go to court to compel B to accept the personal check? No. (see Art. 1249).

NOTE In case the creditors do not accept the cession, a similar result may be obtained by proceeding in accordance with the Insolvency Law, Act No. 1956.

EFFECT OF PAYMENT BY CESSION The assignment does not make the creditors the owners of the property and the debtor is released from obligation only up to the net proceeds of the sale of the property assigned. Unless there is a stipulation to the contrary.

KINDS OF CESSIONS

- Contractual (Art. 1255) NOTE Refers to voluntary or contractual assignment which requires the consent of all the creditors. It involves a change of the object of the obligation by agreement of the parties and at the same time fulfilling the same voluntarily.

- Judicial (regulated by Insolvency Law) a. Voluntary b. Involuntary

[#FOE 3 N]

DATION CESSION

As to number of parties One creditor Plurality of creditors As to financial condition of parties Debtor is not necessarily in state of financial difficulty or insolvency.

Debtor must be insolvent.

As to object Thing delivered is considered as equivalent of performance.

Universality of property of debtor is what is ceded. As to effect to the obligation Extinguishes obligation to the extent of the value of the thing delivered as agreed upon; implied from the conduct of the creditor.

Merely releases debtor for net proceeds of things ceded or assigned, unless there is contrary intention.

As to the extent of properties involved Does not involve all properties of debtor.

Involves all the properties of the debtor. As to the effect to the creditor Creditor becomes owner of the property of the debtor.

The creditors only acquire the right to sell the thing and apply the proceeds to their credits pro rata. As to nature An act of novation (Art. 1291 [1]) Not an act of novation.

NOTE Both are substitute forms of payment or performance. They are governed by the law on sales.

S U B S E C T I O N 3

TENDER OF PAYMENT AND CONSIGNATION

ART. 1256

If the creditor to whom tender of payment has been made refuses without just cause to accept it, the debtor shall be released from responsibility by the consignation of the thing or sum due. Consignation alone shall produce the same effect in the following cases: 1. When the creditor is absent or unknown, or does not appear at the place of payment; 2. When he is incapacitated to receive the payment at the time it is due; 3. When, without just cause, he refuses to give a receipt; 4. When two or more persons claim the same right to collect; 5. When the title of the obligation has been lost.

NOTE For the 2nd enumeration, kindly read Art. 1241.

ART. 1257

In order that the consignation of the thing due may release the obligor, it must first be announced to the person interested in the fulfillment of the obligation. The consignation shall be ineffectual if it is not made strictly in consonance with the provisions which regulate payment.

ART. 1258

Consignation shall be made by depositing the things due at the disposal of judicial authority, before whom the tender of payment shall be proved, in a proper case, and the announcement of the consignation in other cases. The consignation having been made, the interested parties shall be notified thereof.

TENDER OF PAYMENT

It consists in the manifestation made by the debtor to the creditor of his intention to comply immediately with his obligation. Even if it is valid, it does not by itself produce legal payment, unless it is completed by consignation. It is the act, on the part of the part of the debtor, of offering to the creditor the thing or amount due. It is an act preparatory to consignation, which is the principal, and from which are derived the immediate consequences which the debtor desires or seeks to obtain.

NOTE There must be a fusion of intent, ability and capability to make good such offer, which must be absolute and must cover the amount due.

REQUIREMENTS FOR VALID TENDER OF PAYMENT [CUA] 1. Must comply with the rules on payment (Arts. 1256-1258); 2. Must be unconditional and for the whole amount; 3. Must be actually made for manifestation of a desire or intention to pay is not enough;

EFFECTS ON INTEREST 1. When a tender of payment is followed by consignation – accrual of interest on the obligation will be suspended from the date of such tender; 2. When the tender of payment is not accompanied by consignation – then interest is not suspended from the time of such tender.

EXERCISE OF RIGHT OF REPURCHASE

In case of exercise of right of repurchase by tender of check, such tender is valid because it is an exercise of a right and not made as a mode of payment of an obligation. Art. 1249 is not applicable.

WHEN TENDER OF PAYMENT NOT REQUIRED BEFORE

DEBTOR CAN CONSIGN THE THING DUE WITH THE COURT

- When the creditor waives payment on the date when the payment will be due (Kapisanan Banahaw v Dejarme and Alvero, 55 Phil 229 [1930]);

- When the mortgagee had long foreclosed the mortgage extrajudicially and the sale of the mortgaged property had already been scheduled for non-payment of the obligation, and that despite the fact that mortgagee already knew of the deposit made by the mortgagor because the receipt of the deposit was already attached to the record of the case. (Rural Bank of Caloocan v CA, 104 SCRA 151 [1981]).

CONSIGNATION

The act of depositing the thing or amount due with the proper court when the creditor does not desire, or refuses to accept payment, or cannot receive it, after complying with the formalities required by law.

NOTE Consignation, being a form of payment, presupposes that there must be a debt that must be paid. Tender of payment alone would be sufficient to preserve the right of the redemptioner or the vendee a retro.

NATURE OF CONSIGNATION A facultative remedy which the debtor may or may not avail of. If made by the debtor, the creditor merely accepts it if he wishes; or the court declares that it has been properly made, in either of which events the obligation is extinguished. The debtor can withdraw the thing before acceptance by the creditor or cancellation by the court. The debtor has the right to refuse to make the deposit and has the right to withdrawal. If he refuses, the creditor must fall back on the proper coercive processes provided by law to secure or satisfy his credit.

RATIONALE OF CONSIGNATION Tender of payment and consignation produces the effect of payment and extinguishes an obligation in order to avoid greater liability. 1. Failure to consign, the debtor may become liable for damages and/or interest but such failure is not tantamount to a breach where by the fact of tendering payment he was willing and able to comply with his obligation (see Art. 1260). 2. The matter of suspension of the running of interest on the loan is governed by principles which regard reality rather than technicality, substance rather than form. Good faith of the offeror or ability to make good the offer should in simple justice excuse the debtor from paying interest after the offer was rejected. (Gregorio Araneta, Inc. v De Palerno, 91 Phil. 786 [1952]).

TENDER OF PAYMENT CONSIGNATION

As to description Manifestation of the debtor to the creditor of his decision to comply immediately with his obligation.

Deposit of the object of the obligation in a competent court in accordance with the rules prescribed by law, after refusal or inability of the creditor to accept the tender of payment. As to the at involved Preparatory act Principal act As to character Extrajudicial Judicial

GENERAL REQUISITE OF CONSIGNATION

Refers to those requisites in connection with payment in general (Art. 1232-1251) such as person who pays, the person to whom payment is made, the object of the obligation which must be paid or performed, and the time when obligation or performance becomes demandable.

SPECIAL REQUISITES OF CONSIGNATION [VRP - PlaceS] 1. There is a valid debt (Art 1256, par. 1);

- The creditor refused to accept the payment without just cause, or because any of the causes stated by law for effective consignation without previous tender of payment exists (Ibid.);

In order that consignation will be effective, there must have been a tender of payment made by the debtor to the creditor. It is required [PUR] a. That tender of payment must have been made prior to the consignation; b. That it must have been unconditional; c. That the creditor must have refused to accept the payment without just cause

- That previous notice of the consignation had been given to the persons interested in the fulfillment of the obligation; NOTE Lack of prior or previous notice will not make the obligation void or invalid; the debtor will bear all the expenses for the consignation was not made properly (see Art. 1259).

NOTE The purpose of the notice is to give the creditor a chance to reflect on his previous refusal to accept payment considering that the expenses of consignation shall be charged against him (Art. 1259)

That the thing or amount due had been placed at the disposal of judicial authority; This requirement is complied with if the debtor deposits the thing or amount, which the creditor had refused or had been unable to accept, with the Clerk of Court.

Subsequent notice made to the person interested with the fulfillment of the obligation REASON To enable the creditor to withdraw the goods or money deposited.

NOTE The court gives the subsequent notice in order to acquire the jurisdiction over the parties particularly the defendant creditor. Hence, lack of subsequent notice will render the consignation void for lack of jurisdiction of the court.

NOTE The absence of any of the requisites is enough ground to render consignation ineffective. Compliance with the requirements is mandatory. The law speaks of “thing.” It makes no distinction between real and personal property.

VALID CONSIGNATION WITHOUT PRIOR TENDER OF PAYMENT [AIR – TL]

Creditor is absent or unknown, or does not appear at the place of payment; NOTE absence need not be judicially declared. He must, however, have no legal representative to accept the payment.

When he is incapacitated to receive the payment at the time it is due;

When without just cause, he refuses to give a receipt;

When two or more persons claim the right to collect;

When the title of the obligation has been lost.

The thing is lost before the debtor has incurred in delay.

EFFECTS OF FORTUITOUS EVENT If the thing which constitutes the object of obligation is lost or destroyed through a fortuitous event, the debtor cannot be held responsible ; the obligation is extinguished.

EXCEPTIONS [PLAS - OTOG] 1. Loss of thing is partly due to the fault of the debtor; 2. When the law so provides (Art. 1262); 3. When the nature of the obligation requires an assumption of risk (Art. 1262); 4. When the stipulation so provides (Art. 1262); 5. Loss of the thing occurs after the debtor incurred in delay (Art. 1262 ); 6. When the debtor promised to deliver the same thing to two person who do not have the same interest (Art. 1165); 7. When the obligation to deliver arises from a criminal offense (Art. 1268 ); 8. When the obligation is generic (Art. 1263).

NOTE If the loss is through theft, the debtor is considered negligent having placed the thing within the reach of thieves and not in a secure and safe place. In theft, taking is accomplished without the use of violence or force.

ART. 1263

In an obligation to deliver a generic thing, the loss or destruction of anything of the same kind does not extinguish the obligation.

GENERAL RULE

The loss or destruction of anything of the same kind even without the debtor’s fault and before he has incurred in delay will not have the effect of extinguishing the obligation.

REASON The genus of a thing can never perish (genus nunquam peruit). Hence, the debtor can still be compelled to deliver a thing which must be neither of superior nor inferior quality.

EXCEPTION

Delimited Generic Thing – when there is a limitation of the generic object to a particular existing mass or a particular group of things, the obligation is extinguished by the loss of the particular mass or group or limited quantity from which the prestation has to be taken.

ART. 1264

The Courts shall determine whether, under the circumstances, the partial loss of the object of the obligation is so important as to extinguish the obligation.

EFFECT OF PARTIAL LOSS

GENERAL RULE

Partial loss does not extinguish the obligation.

EXCEPTION

When the partial loss or destruction of the thing is of such importance that would be tantamount to a complete loss or destruction.

Illustration: A obliged himself to deliver to B a specific race horse. The horse met an accident as a result of which it suffered a broken leg. The injury is permanent. Here, the partial loss is so important as to extinguish the obligation. If the loss is due to the fault of A, he shall be obliged to pay the value of the horse with indemnity for damages. If the horse to be delivered is to be slaughtered by B, the injury is clearly not important. Even if there was fault on the part of A, he can still deliver the horse with liability for damages, if any, suffered by B.

ART. 1265

Whenever the thing is lost in the possession of the debtor, it shall be presumed that the loss was due to his fault, unless there is proof to the contrary, and without prejudice to the provisions of Art. 1165. This

presumption does not apply in case of earthquake, flood, storm or other natural calamity.

RULE IF THING IS IN DEBTOR’S POSSESSION

GENERAL RULE

If the thing is lost while in the possession of the debtor it shall be presumed that the loss was due to his fault, unless there is proof to the contrary and without prejudice to the provisions of Art. 1165.

EXCEPTION

No such presumption in case of earthquake, flood, storm or other natural calamity. Lack of fault on the part of the debtor is more likely. So it is unjust to presume negligence on his part.

Illustration: A borrowed a specific car from B. on the due date of the obligation, A told A that the car was stolen and that he was not at fault. That is not enough to extinguish A’s obligation. It is presumed that the loss was due to his fault. Hence, he is liable unless he proves the contrary. Suppose the house of B was destroyed because of fire. It is admitted that there was a fire and it was accidental and that the car was in the house at the time it occurred. Here, A is not liable unless B proves fault on the part of A.

ART. 1266

The debtor in obligations to do shall also be released when the prestation becomes legally or physically impossible without the fault of the obligor.

The prestation constituting the object of the obligation must have become legally or physically impossible of compliance without the fault of the obligor and before he has incurred in delay, otherwise, the obligation shall be converted into one of indemnity for damages. Impossibility must have occurred after the constitution of the obligation.

KINDS OF IMPOSSIBILITY 1. Legal impossibility – the law imposes duties of a superior character upon the obligor which are incompatible with the work agreed upon, although the latter may be perfectly licit. 2. Physical impossibility – arises principally from the death of the obligor, when the act to be performed requires his personal qualifications, or from the death of the obligee, when the act can be of possible benefit only to him.

NOTE Does not apply to obligations to give.

NATURAL IMPOSSIBILITY IMPOSSIBILITY IN FACT

As to the thing Must consist in the nature of the thing to be done and not the inability of the party to do so.

In the absence of inherent impossibility in the nature of the thing stipulated to be performed, which is only improbable or out of the power of the obligor. As to the effect Renders the contract void. Does not render the contract void.

NOTE Natural impossibility is reckoned from the time of constitution of the obligation. Thus, the obligation remains void even if the prestation subsequently becomes possible.

NOTE In subsequent partial impossibility, Art. 1264 applies.

NOTE Temporary impossibility does not extinguish the obligation but merely delays its fulfillment. This presupposes that the duration of impossibility has been contemplated by the parties; otherwise, the same may extinguish the obligation under Art. 1267. In the latter case, the fact that the prestation later becomes possible does not revive the obligation.

ART. 1267

When the service has become so difficult as to be manifestly beyond the contemplation of the parties, the obligor may also be released therefrom, in whole or in part.

EFFECT OF RELATIVE IMPOSSIBILITY

The impossibility is relative because the difficulty of performance triggers a manifest disequilibrium in the prestations, such that one party would be placed at a disadvantage by the unforeseen event. Impossibility shall release the obligor. There is no physical or legal loss but the object of the obligation belongs to another, the performance by the debtor becomes impossible. Failure of performance is imputable to the debtor. Thus, the debtor must indemnify the creditor for the damages suffered by the latter.

NOTE Under Art. 1267, the remedy of the obligor is not annulment but to be released from his obligation, in whole or in part.

DOCTRINE OF UNFORESEEN EVENTS/ FRUSTRATION OF ENTERPRISE When the service has become so difficult as to be manifestly beyond the contemplation of the parties, the court should be authorized to release the obligor in whole or in part. The intention of the parties should govern and if it appears that the service turns out to be so difficult as to have been beyond their contemplation, it would be doing violence to that intention to hold the obligor still responsible.

DOCTRINE OF REBUS SIC STANTIBUS

Things thus standing. The parties stipulate in the light of certain prevailing conditions and once these conditions cease to exist, the contract also ceases to exist.

NOTE Art. 1267 speaks of a “service,” – a personal obligation. Thus real obligations are not within its scope. It refers to the “performance” of the obligation.

EFFECT OF LOSS ON RECIPROCAL OBLIGATIONS

If an obligation is extinguished by the loss of the thing or impossibility of performance through fortuitous events, the counter-prestation is also extinguished. The debtor is released from the liability but he cannot demand the prestation which has been stipulated for his benefit. He who gives nothing has no reason to demand. The loss or impossibility of performance must be due to the fault of the debtor. In this case, the injured party may ask for rescission under Art. 1191 plus damages. if the loss or impossibility was due to a fortuitous event, the other party is still obliged to give the prestation due to the other.

ART. 1268

When the debt of a thing certain and determinate proceeds from a criminal offense, the debtor shall not be exempted from the payment of its price whatever may be the cause for the loss, unless the thing having been offered by him to the person who should receive it, the latter refused without justification to accept it.

NOTE Kindly read alongside Art. 1268 the provisions of Art. 552

RULE IF OBLIGATION ARISES FROM CRIMINAL OFFENSE Applicable not only to the case where there is an obligation of restitution of a certain and determinate thing on the part of the person criminally liable as provided for in the Penal Code, but also to the case where such obligation arises by virtue of reparation or indemnification. Also applies to those subsidiarily liable.

GENERAL RULE

Debtor shall not be exempted from the payment of the price whatever may be the cause for the loss.

EXCEPTION

When the thing having been offered by the debtor to the person who should receive it, the latter refused without justification.

NOTE The offer referred in Art. 1268 should not be confused with consignation; the latter refers only to the payment of the obligation, the former refers to the extinguishment of the obligation through loss by fortuitous event.

NOTE When the offer was refused to be accepted without justification, the debtor may either: 1. Make a consignation of the thing and thereby completely relieve himself of further liability;

- He may keep the thing in his possession, in which the case, the obligation shall still subsist but if the thing is lost through fortuitous event, Arts. 1262 and 1265 shall govern.

NOTE Art. 1268 specifically applies only to determinate things.

ART. 1269

The obligation having been extinguished by the loss of the thing, the creditor shall have all the rights of action which the debtor may have against the third persons by reason of the loss.

RIGHT OF THE CREDITOR TO PROCEED AGAINST THIRD

PERSON

The creditor is given the right to proceed against the third person responsible for the loss. There is no need for an assignment by the debtor. The rights of action of the debtor are transferred to the creditor from the moment the obligation is extinguished, by operation of law to protect the interest of the latter by reason of the loss.

S E C T I O N 3

CONDONATION OR REMISSION OF DEBT

ART. 1270

Condonation or remission is essentially gratuitous, and requires the acceptance by the obligor. It may be made expressly or impliedly. One and the other kind shall be subject to the rules which govern inofficious donations. Express condonation shall, furthermore, comply with the forms of donation.

CONDONATION

It is an act of liberality by virtue of which the obligee, without receiving any price or equivalent, renounces the enforcement of the obligation, as a result of which it is extinguished in its entirety or in that part or aspect of the same to which the remission refers. It is the gratuitous abandonment by the creditor of his right.

REQUISITES [GAD-PIC]

- Must be gratuitous;

- The obligor must accept the same;

- Obligation must be due;

- Parties must be capacitated;

- Must not be inofficious;

- If made expressly, it must comply with the forms of donation.

EXTENT OF REMISSION Whether express or implied, the extent of remission or condonation shall be governed by the rules regarding inofficious donation. Hence, the following rules are applicable: Art. 750. The donation may comprehend all the present property of the donor, or part thereof, provided he reserves, in full ownership or in usufruct, sufficient means for the support of himself, and of all relatives who, at the time of the acceptance of the donation, are by law entitled to be supported by the donor. Without such reservation, the donation shall be reduced on petition of any person affected. Art. 751. Donations cannot comprehend future property. By future property is understood anything which the donor cannot dispose of at the time of the donation. Art. 752. The provisions of Art. 750 notwithstanding, no person may give or receive by way of donation, more than he may give or receive by will. Donation shall be inofficious in all that it may exceed this limit. Art. 771. Donations which in accordance with the provisions of Art. 751, are inofficious, bearing in mind the estimated net value of the donor’s property at the time of his death, shall be reduced with regard to the excess, but this reduction shall not prevent the donations from taking effect during the life of the donor, nor shall it bar the done from appropriating the fruits.

Illustration: A is indebted of a certain amount of money to B. On the payment should be made, B condoned the debt of A because of their friendship. A

P1,000, however, is not affected. B may disapprove the remission by proving the he gave the watch temporarily to the debtor to be repaired or that A was able to take possession thereof without his consent or authority.

S E C T I O N 4

CONFUSION OR MERGER OF RIGHTS

ART. 1275

The obligation is extinguished from the time the character of creditors and debtor are merged in the same person.

CONFUSION

It is the merger of the character of the creditor and debtor in one and the same person by virtue of which the obligation is extinguished. It is the meeting in one and the same person of the qualities of creditor and debtor with respect to one and the same obligation.

REASON OR BASIS FOR CONFUSION Obligation is presumed extinguished for if a debtor is his own creditor, enforcement of the obligation becomes absurd since a person cannot claim payment from himself. Furthermore, the purposes of the obligation are deemed realized.

REQUISITES [SEC]

- The merger of the character of creditor and debtor must be in the same person;

- It must take place in the person of either the principal creditor or the principal debtor;

- It must be complete and definite. NOTE A confusion or merger is complete if the obligation is extinguished.

Illustration: A owes B P5M for which A executed a negotiable promissory note in favor of B. B indorsed the note to C who, in turn, indorsed it to D. Now, D bought goods from the store of A. Instead of paying cash, D just indorsed the promissory note to A. In the case at bar, A owes himself. Consequently, his obligation is extinguished by merger or confusion.

KINDS OF CONFUSION As to cause or constitutions 1. Inter Vivos – constituted by agreement of the parties; 2. Mortis Causa – constituted by succession.

As to extent or effect 1. Total – if it results in the extinguishment of the entire obligation; 2. Partial – if it results in the extinguishment of only the part of the obligation or when obligation is joint.

EFFECT OF TRANSFER OF RIGHTS Mere transfer to a third person of rights belonging to both the debtor and the creditor but not the credit as against the debt does not result in merger.

Illustration: A and B were co-owners of a piece of property worth P5M. B paid P200,000 for some repairs thereof. Since they were co-owners, A had to share in said expenses, and so A owed B P100,000. A and B sold their shares to the property to C. Later, B brought this action to recover P100,000 from A but A refused contending that since C is now the owner, C owes himself. In the case at bar, A should pay B, since there was really no merger. What had been sold to C were the half shares of each of the co-owners. C did not acquired the indebtedness of P100,000 for the repairs, hence there can be no merger with reference to that debt.

EXTINCTION OF REAL RIGHTS Real rights like usufruct may be extinguished by merger when any of such rights is merged with ownership which is the most comprehensive real right, or when the owner himself become the usufructuary.

NOTE This is also denominated “consolidation of ownership” which may take place by any of the causes which are sufficient to transmit title to an obligation.

Illustration: A had two brothers B and C. A gave a parcel of land to B in usufruct (Usufruct gives a right to enjoy the property of another with the obligation of preserving its form and substance, unless the title constituting it or the law otherwise provides. [Art. 562]), and the same parcel to C in naked ownership (ownership of a property which is subject to the usufructuary’s rights). If later C donates the naked ownership of the land to B, B will now have the full ownership, and it is as if merger had resulted.

NOTE If the reason for the confusion ceases, the obligation is revived (PARAS, 457).

MORTGAGEE BECOMES THE OWNER OF THE MORTGAGED PROPERTY If the mortgagee becomes the owner of the property that had been mortgaged to him, the mortgage is naturally extinguished, but the principal obligation may remain (See Yek Ton Lin Five v Yusingco, 64 Phil. 1062). In this case, there is a confusion or merger, but not complete or total.

Illustration: A borrowed P5M from his brother B, and as security, A mortgaged his land in B’s favor. Later A sold the parcel to B. The mortgage is extinguished but A still owe B P5M.

ART. 1276

Merger which takes place in the person of the principal debtor or creditor benefits the guarantors. Confusion which takes place in the person of any of the latter does not extinguish the obligation.

EFFECT OF MERGER IN THE PERSON OF PRINCIPAL DEBTOR

OR CREDITOR

“Accessory follows the principal” (the guaranty being considered the accessory obligation); hence, if there is merger with respect to the principal debt, the guaranty is extinguished.

Illustration: A owes B with C as guarantor. The merger of the characters of debtor and creditor in A shall free C from liability as guarantor. Confusion which takes place in the person of B benefits C because the extinction of the principal obligation carries with it that of the accessory obligation of guaranty.

EFFECT OF MERGER IN THE PERSON OF GUARANTOR The extinguishment of the accessory obligation does not carry with it that of the principal obligation. Consequently, merger which takes place in the person of the guarantor, while it extinguishes the guaranty, leaves the principal obligation in force.

Illustration: Suppose, in the example above, B assigns his credit to D, who, in turn, assigns the credit to C, the guarantor. In this case, the contract of guaranty is extinguished. However, A’s obligation to pay the principal obligation subsists. C now, as the new creditor, can demand payment from A.

ART. 1277

Confusion does not extinguish a joint obligation except as regards the share corresponding to the creditor or debtor in whom the two characters concur.

CONFUSION IN JOINT OBLIGATIONS

Confusion with takes place in one of the debtors shall only refer to the share which corresponds to him. Consequently, there is a partial extinguishment of the debt. The creditor can still proceed against the other debtors.

Illustration: A and B jointly owe C P5M. If C assigns the entire credit to A, A’s share is extinguished, but B’s share remains. In other words, B would still owe A the sum of P2. In a joint obligation, the debts are distinct and separate from each other.

CONFUSION IN SOLIDARY OBLIGATIONS The provision of Art. 1215 shall apply: the entire obligation is extinguished, without prejudice to the rights and obligations of the solidary creditors and solidary debtors among themselves.

EFFECT OF REVOCATION OF CONFUSION

Confusion is constituted by agreement – may be revoked by the presence of any of the causes for the rescission, annulment, nullity or inexistence of contracts or by some special cause such as redemption; Confusion is constituted by inheritance – may be revoked by the nullity of the will, or by the subsequent appearance of an heir with a better right, or by any other cause which will nullify the merger. In both cases, the original obligation is recreated in the same form and under the same condition before confusion took place. The period which has elapsed from the moment the merger took place until its revocation cannot be computed in the determination of the period of prescription, because during such period the creditor could not possibly have made a demand for the fulfillment of the obligation.

S E C T I O N 5

COMPENSATION

ART. 1278

Compensation shall take place when two persons, in their own right, are creditors and debtors of each other.

COMPENSATION

From the Latin word cum ponder, which means “to weigh together.” It is a mode of extinguishing in their concurrent amount those obligations of persons who in their own right are creditors and debtors of each other. It is a figurative operation of weighing two obligations simultaneously in order to extinguish them to the extent in which the amount of one is covered by the amount of the other.

Illustration: A owes B the amount of P5M. B owes A the amount of P4M. Both debts are due and payable today. Here the compensation takes place partially to the concurrent amount of P4M. So, A shall be liable to B for only P1M. If the two debts are of the same amount, there is total compensation (see Art. 1281)

IMPORTANCE OF COMPENSATION Simplified payment; a more convenient and less expensive realization of two payments.

COMPENSATION PAYMENT

Partial extinguishment is permitted; Must be complete and indivisible; Takes place by operation of law; Involves action or delivery;

It is not required that the parties have the capacity to give or to receive (see Art. 1290).

The parties must have the free disposal of the thing due and capacity to alienate it (see Art. 1239), and to receive payments (see Arts. 1240-1241).

COMPENSATION CONFUSION

There must be two person who are mutually creditor and debtor to each other;

There is only one person in whom is merged the qualities of creditor and debtor;

There must be two obligations; There can be only one obligation; There is indirect payment. There is impossibility of payment.

NOTE There may be compensation in joint and solidary obligations (see Arts. 1207, 1208, and 1215).

COMPENSATION COUNTERCLAIM

Takes place by mere operation of law, and extinguishes reciprocally the two debts as soon as they exist simultaneously, to the amount of their respective sums;

Must be pleaded to be effectual;

Requires that both debts consist in money, or if the things due are consumable, they be of the same kind and quality (Art. 1279);

Such requirement is not provided;

Requires that two debts must be Such requirement is not provided.

liquidated.

KINDS OF COMPENSATION

As to effect or extent 1. Total – both obligations are of the same amount and are entirely extinguished (Art. 1281); 2. Partial – the two obligations are of different amounts and a balance remains (Ibid.). The extinctive effect of compensation will be partial only as regards the larger debt.

As to cause or origin 1. Legal – when it takes place by operation of law when all the requisites are present even without the knowledge of the parties (Arts. 1279, 1290); 2. Conventional or voluntary – when it takes place by agreement of the parties (Art. 1282); 3. Judicial – when it takes place by order from a court in a litigation (Art. 1283). Merely a form of legal or voluntary compensation when declared by the courts by virtue of an action by one of the parties, who refuses to admit it, and by the defense of the other who invokes it; 4. Facultative – when it can be set up only by one of the parties (Arts. 1287, par. 1; 1288).

Illustration: A owes B P5M demandable and due on 1 Dec 2018. B owes A P5M demandable and due on or before 31 Dec 2018. On 1 Dec 2018 B, who was given the benefit of the term, may claim compensation because he could then choose to pay his debt on said date, which is “on or before 31 Dec 2018.” If, upon the other hand A claims compensation, B can properly oppose it because B could not be made to pay until 31 Dec 2018.

NOTE Under the law, the two persons concerned are creditors and debtors of each other; therefore, a debtor of a corporation cannot compensate his debt with his share of stock in the corporation since the corporation is not considered his debtor.

ART. 1279

In order that compensation may be proper, it is necessary: 1. That each one of the obligors be bound principally, and that he be at the same time a principal creditor of the other; 2. That both debts consist in a sum of money, or if the things due are consumable, they be of the same kind, and also of the same quality if the latter has been stated; 3. That the two debts be due; 4. That they be liquidated and demandable; 5. That over neither of them there be any retention or controversy, commenced by third persons and communicated in due time to the debtor.

NOTE The requisites enumerated under Art. 1279 are those for Legal Compensation. Voluntary Compensation in general requires no requisites except that the agreement be voluntarily and validly entered into.

REQUISITES OF COMPENSATION [BCD - LCR] 1. The part

Chapter 4 Extinguishment

Course: Business Administration (BSBA)

University: Tarlac State University

- Discover more from: