- Information

- AI Chat

Was this document helpful?

FABM1 WEEK 4 - ABM

Course: Accounting

999+ Documents

Students shared 2579 documents in this course

University: University of Manila

Was this document helpful?

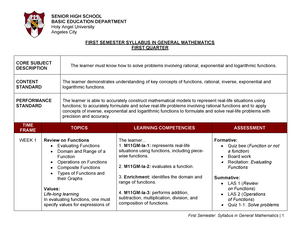

Republic of the Philippines

Department of Education

Region 02

Division of Isabela

Infant Jesus de Providencia Learning

& Development Center, Inc.

#16 Vallejo Street, Barangay 01, Jones, Isabela CP#: 0939-9026-258/0956-994-3232E-mail add.: ijpldci@gmail.com

Learning Module for

Fundamentals of

Accountancy, Business

and Management 1

ABM 11

First Quarter

Week 4

__________________

MODULE 3

Books of Accounts

__________________________________________

Name of Learner

Prepared and Submitted by:

Ms. Lovely Hope M. Ramos

Facebook/Messenger Account: Lovely Ramos

Contact number: 09458041784

Checked and approved by:

Principal: Janet Ciencia-Colobong

FB/Messenger Account: Janet Colobong

Contact Number: 09569943232

DURATION: 1 WEEK

DATE GIVEN: ______________________________________________________________________