- Information

- AI Chat

FABM1 WEEK2-3 Module 2 - ABM

Accounting

University of Manila

Recommended for you

Preview text

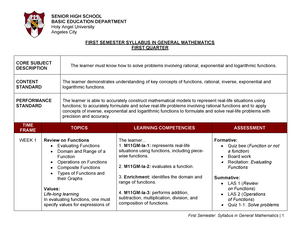

Republic of the Philippines Department of Education Region 02 Division of Isabela

Infant Jesus de Providencia Learning

& Development Center, Inc.

#16 Vallejo Street, Barangay 01, Jones, Isabela CP#: 0939-9026-258/0956-994-3232E-mail add.: ijpldci@gmail

Learning Module for

Fundamentals of

Accountancy, Business

and Management 1

ABM 11

First Quarter

Week 2-

__________________

MODULE 2

Basic Accounting Concepts and Principles

__________________________________________

Name of Learner

Prepared and Submitted by:

Ms. Lovely Hope M. Ramos Facebook/Messenger Account: Lovely Ramos Contact number: 09458041784

Checked and approved by:

Principal: Janet Ciencia-Colobong FB/Messenger Account: Janet Colobong Contact Number: 09569943232

DURATION: ______________________________________________________________________

DATE GIVEN: ______________________________________________________________________

DATE SUBMITTED:

______________________________________________________________________

I. INTRODUCTION

Welcome to another meaningful and packed of a knowledge learning session. I am here once again; I am your learning pal. How are you doing so far? I hope you are COVID-free and ready for another learning session.

In your previous lessons in Fundamentals of ABM1, you have learned the definition, function, history of accounting and cite the users of financial information. Let’s move on to our next topic and I hope you enjoy learning and answering your activities.

Be ready! This time, you are about to begin another journey of meaningful and filled with learnings academic session.

II. LESSON

Accounting concepts and Principles a. Elements of financial statements b. Qualitative characteristics of information in Financial Statements c. Underlying assumptions d. The accounting equation

III. LEARNING COMPETENCIES/LESSON OBJECTIVES

At the end of this module, you are expected to :

explain the varied accounting concepts and principles

solve exercises on accounting principles as applied in various cases

illustrate the accounting equation

perform operations involving simple cases with the use of accounting equation

IV. BACKGROUND INFORMATION FOR THE LEARNER

Accounting Elements or Values

There are three accounting elements or values, namely: assets, liabilities, and capital.

Assets. Are economic resources owned by the business. They include properties and other things of value whose ownership title is in the name of the business. Assets can be grouped into current assets and noncurrent assets. You may read your book on page 49-50 for the examples.

Liabilities. Are debts or obligations of the business to a party other than its owner. There are two classifications of liabilities:

a. Current or short- term liabilities b. Fixed or long- term liabilities (noncurrent liabilities)

Capital. Represents the owner’s equity or investment in the business other terms also used synonymously are Owner’s Equity and Proprietorship.

The other two major accounts are the income and expense. Income I a special kind of growth in the firm’s assets while expenses is the use up of the firm’s assets.

of a given utterance and

do not readily

X. lend themselves to

inflectional variation unlike

the open class system. For

instance:

XI. 1) is at

the viewing centre

Personally, $ don#t

like beans

unconscious at

the moment

is # 1 room

Accounting Assumptions Accounting assumptions are the foundation of all accounting practices and principles:

- Accounting entity

- Going concern

- Time Period

- Monetary Unit

The Accounting Equation

ASSETS= LIABILITY + OWNER’S EQUITY

For you to be able to answer the activities here in your module, you should have a firm knowledge on the basic concepts of accounting. In solving the problems given in this module, I encourage you to study the accounting equation and its examples on your textbook that can found on page 53. In the event that you still have questions, you can send me private message.

V. LEARNING ACTIVITIES/ EXERCISES

Activity 1 To check whether you have grasped the fundamentals of the lesson or not, turn your textbook to page 54-56 and answer exercises 4-1 to 4-3. Before you begin, it is important for you to read the directions of the activity. Congratulations! For accomplishing your first task. You are now all set to proceed to your next activity. Good luck.

Activity 2 This activity will test how much you have learned about the basic concepts of accounting. Write TRUE if the statement is correct and FALSE if it is incorrect.

_______1. The accounting equation is most often stated as: Assets+ Liabilities= Owner’s Equity. _______2. After each transaction, the accounting equation must remain in balance. _______3. Total assets are the amount the owner has invested in the business. _______4. When items are bought and paid for at a future date, another way to state this is to say these items are bought on account. _______5. An expense is a decrease in owner’s equity resulting from the operation of the business. _______6. Payments for advertising, equipment repairs, utilities, and rent are expense transactions. _______7. Withdrawals are assets taken out of a business for the owner’s personal use. _______8. The most common type of withdrawal by an owner from a business is the withdrawal of cash. _______9. A withdrawal is an expense. _______10. Transactions for the sale of goods or services result in a decrease in owner’s equity.

Activity 3 Now, we’re going to test your knowledge on how much you have understand the elements of Financial statements. Identify each of the following as to ASSET or LIABILITY.

Example: Cash on hand Asset

- Petty cash fund ____________

- Prepaid rent expense ____________

- Salaries payable ____________

- Cash in bank ____________

- Furniture ____________

- Notes receivable ____________

- Notes payable ____________

- Land ____________

- Building ____________

- Interest payable ____________

- Accounts receivable ____________

- Accounts payable ____________

- Taxes payable ____________

- Supplies inventory ____________

- Prepaid insurance ____________

Activity 4 Well done for making this far. I hope you’re ready to solve problems applying the accounting equation. For this activity, show your solutions and do not forget to double rule your final answer. Compute missing figures from the following:

- Assets = P50,000, Liabilities = P20,000, Owner’s equity =?

- Assets = ?, Liabilities = P10,000, Owner’s equity = P15,

- Assets = P60,000, Liabilities = ?, Owner’s equity = P40,

- Assets = ?, Liabilities + Owner’s equity = P150,

- Assets = P10,000, Liabilities = P5,000, Owner’s equity =?

- Assets = ?, Liabilities +Owner’s equity = P1,000,

FABM1 WEEK2-3 Module 2 - ABM

Course: Accounting

University: University of Manila

- More from:AccountingUniversity of Manila999+ Documents