- Information

- AI Chat

Chapter 1 Caselette - Accounting Cycle

Auditing

University of San Carlos

Recommended for you

Preview text

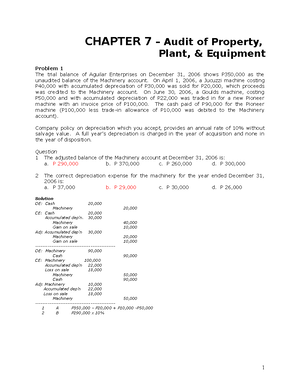

CHAPTER 1 - Accounting Process &

Working Paper Preparation

Exercises: Indicate your answer by encircling the letter that contains your choice in each of the following questions.

One is using periodic inventory system. For the year, its total purchases amounted to P250,000. Its unsold merchandise at the end of the year has a cost of P5,000 which is 80% of its beginning inventory. One’s cost of sale is a. P 250,000 b. P 251,250 c. P 249,000 d. P 248,

Two’s purchase per purchase invoice is P150,000. The purchase discount is 2/10, n/30. Freight is P500, FOB shipping point collect. The net purchase amounts under net method is a. P P147,000 b. P 147,500 c. P 148,500 d. P 150,

Using the information in Item 2, the amount paid by the buyer is a. P P147,000 b. P 147,500 c. P 148,500 d. P 150,

The purchase invoice shows the amount of P250,000, 2/10, 1/20, n/30; FOB destination collect, P200. If the account is paid 15 days after the invoice date, the net payment should be a. P 245,000 b. P 247,500 c. P 247,300 d. P 244,

Using the information in Item 4, the net purchase is a. P 245,000 b. P 247,500 c. P 247,300 d. P 244,

Three purchased merchandise for P5,000 and paid P200 for freight, FOB destination collect. The merchandise was sold at 120% of cost. The gross profit is a. P 1,000 b. P 1,040 c. P 6,000 d. P 6,

The total purchase is P1,176, net of 2% cash discount. Unsold portion of purchase is P176. The sale is at mark-up of 10%. The gross profit is a. P 117 b. P 88 c. P 115 d. P 100.

The term of a P300,000 purchase is 2/20, n/60, FOB shipping point prepaid, P300. If the account is paid on the 25th day from the invoice date, the total payment would be a. P 294,000 b. P 299,700 c. P 294,300 d. P 300,

Four paid freight for P200 on its purchase on account from Five, FOB shipping point. The journal entry in both books of Four and Five would be Books of Four Books of Five a. Freight-out 200 Freight-in 200 Cash 200 Accounts payable 200 b. Freight-in 200 No entry Accounts receivable 200 c. Freight-in 200 No entry Cash 200 d. Freight-in 200 Freight-out 200 Cash 200 Accounts receivable 200

10 sold merchandise at list price of P250,000; 10; 5; n/30. Part of the sale amounting to P10,000 was returned due to defect. The amount to be collected by Six is a. P 205,200 b. P 203,750 c. P 204,000 d. P 195,

11 Company received P96,000 on April 1, 2002 for one year’s rent in advance and recorded the transaction with a credit to a nominal account. The December 31, 2002 adjusting entry is a. Debit rent revenue and credit unearned rent revenue, P24,000. b. Debit rent revenue and credit unearned rent revenue, P72,000. c. Debit unearned rent revenue and credit rent revenue, P24,000. d. Debit unearned rent revenue and credit rent revenue, P72,000.

12 Company paid P72,000 on June 1, 2002 for a two-year insurance policy and recorded the entire amount as insurance expense. The December 31, 2002 adjusting entry is a. Debit insurance expense and credit prepaid insurance, P21,000. b. Debit insurance expense and credit prepaid insurance, P51,000. c. Debit prepaid insurance and credit insurance expense, P21,000. d. Debit prepaid insurance and credit insurance expense, P51,000.

13 Company purchase equipment on November 1, 2002 and gave a 12-month, 9% note with a face value of P480,000. The December 31, 2002 adjusting entry is a. Debit interest expense and credit interest payable, P7,200. b. Debit interest expense and credit interest payable, P10,800. c. Debit interest expense and credit cash, P7,200. d. Debit interest expense and credit interest payable, P43,200.

14 December 31, 2002, Asilo Company’s bookkeeper made an adjusting entry debiting supplies expense and credit supplies inventory for P12,600. The supplies inventory accounts had a P15,300 debit balance on December 31, 2001. The December 31, 2002 balance sheet showed supplies inventory of P11,400. Only one purchase of supplies was made during the month, on account. The entry for that purchase was a. Debit supplies inventory and credit cash, P8,700. b. Debit supplies expense and credit accounts payable, P8,700. c. Debit supplies inventory and credit accounts payable, P8,700. d. Debit supplies inventory and credit accounts payable, P16,500.

15 Company loaned P300,000 to another company on December 1, 2002 and received a 3-month, 15%, interest-bearing note with a face value of P300,000. What adjusting entry should Astillo Company make on December 31, 2002? a. Debit interest receivable and credit interest income, P7,500. b. Debit cash and credit interest income, P3,750. c. Debit interest receivable and credit interest income, P3,750. d. Debit cash and credit interest receivable, P7,500. . 16 supplies inventory account balance at the beginning of the period was P66,000. Supplies totaling P128,250 were purchased during the period and debited to supplies inventory. A physical count shows P38,250 of supplies inventory at the end of the period. The year-end adjusting entry is a. Debit supplies inventory and credit supplies expense, P90,000. b. Debit supplies expense and credit supplies inventory, P128,250. c. Debit supplies inventory and credit supplies expense, P156,000. d. Debit supplies expense and credit supplies inventory, P156,000.

Problem 1 The following is the post-closing trial balance of Abagon Shop dated February 1, 2006:

Debit Credit Cash 120, Accounts Receivable 280, Allowance for doubtful accounts 2, Unused shop supplies 800 Shop Equipment 240, Accumulated depreciation - shop equipment

48,

Accounts payable 88, Notes payable 100, Accrued interest payable 1, Abagon, Capital 400,

Total 640,800 640,

For the month of February, the following are the transactions of Abagon Shop.

- Abagon withdrew P100,000 cash from the business for her personal use.

- Paid P12,000 insurance premium.

- Paid P24,000 rent.

- Total service rendered to various customers, P140,000, 40% of total sales are on cash basis and the balance on open account.

- Received promissory note from customer to replace P40,000 accounts receivable.

- Collected in cash P164,000 of accounts receivable.

- Paid the notes payable of P100,000 plus the P2,400 interest.

- Purchased P2,400 shop supplies on cash basis.

- Paid salaries, P24,000.

At the end of the month, the following information are available to effect adjustments.

a. The insurance in number 2 for P12,000 is applicable for six months starting February. b. The rent of P24,000 paid in number 3 is for 3 months, starting February. c. The note receivable is number 5 is earning 12% interest per year. The note is dated February 1, and is due on April 30. d. Bad debts expense is estimated at 2% of accounts receivable balance. e. The annual depreciation is P48,000. f. The unused supplies balance is P1,000.

Questions

Cash at end of February is: a. P 103,200 b. P 85,200 c. P 75,200 d. P 72,

Net Realizable value of Accounts Receivable at end of February is a. P 156,800 b. P 157,200 c. P 196,800 d. P 197,

Unused shop supplies at end of February is a. P 1,800 b. P 1,000 c. P 800 d. P 200

Net book value of Shop Equipment at end of February is a. P 188,000 b. P 189,000 c. P 184,000 d. P 144,

Accounts Payable at end of February is

To reverse the beg. accrued interest payable

d. Purchased merchandise for resale at cash cost of P140,000; paid cash. Assume a periodic inventory system; therefore, debit Purchases.

e. Purchased merchandise for resale on credit terms of 2/10, n/60. The merchandise will cost P9,800 if paid within 10 days; after 10 days, the payment will be P10,000. The company always takes the discount; therefore, such purchased are recorded at net of the discount.

f. Sold merchandise for P180,000; collected P165,000 cash, and the balance is due in one month.

g. Paid P30,000 cash for operating expenses.

h. Paid ¾ of the balance for the merchandise purchased in (e) within 10 days; the balance remains unpaid.

i. Collected 50% of the balance due on the sale in (f); the remaining balance is uncollected.

j. Paid cash for an insurance premium, P600; the premium was for two years’ coverage (debit Prepaid insurance).

k. Purchased a tract of land for a future building for company operations, P63,000 cash.

l. Paid damages to a customer who was injured on the company premises, P10, cash.

Questions Using the unadjusted trial balance, answer the following:

Cash balance is: a. P 157,550 b. P 157,400 c. P 157,250 d. P 149,

Accounts receivable balance is: a. P 15,000 b. P 10,000 c. P 7,700 d. P 7,

Prepaid insurance balance is: a. P 600 b. P 400 c. P 300 d. P 200

Land account balance is: a. P 227,000 b. P 164,000 c. P 101,000 d. P 63,

Equipment account balance is: a. P 227,000 b. P 164,000 c. P 101,000 d. P 63,

Accounts payable balance is: a. P 2,650 b. P 2,500 c. P 2,450 d. P 2,

Notes payable balance is: a. P 112,000 b. P 109,000 c. P 100,000 d. P 88,00 0

Common stock balance is: a. P 300,000 b. P 280,000 c. P 200,000 d. P 20,

Premium on capital stock balance is:

_ANSWER

- b 2. d 3. a 4. d 5. b 6. b 7. c 8. d 9. b 10. a_

Answer:

Adjusting entry:

1. Salaries expense 73, Accrued salaries 73,

2. Insurance expense 2, Prepaid insurance 2,

3. Depreciation 7, Accum. Dep’n – bldg 3, Accum. Dep’n – equip 4,

4. Supplies expense 24, Office supplies 24,

5. Inventory – BS 453, Inventory – IS 453,

_ANSWER:

- C 2. C 3. B 4. A 5. C 6. A 7. C 8. B 9. D 10. C

- A 12. D 13. C 14. B 15. A_

Problem 5 The Righter Shoe Store Company prepares monthly financial statements for its bank. The November 30 and December 31, 2006, trial balances contained the following information:

Nov. 30 Dec. 31 Dr. Cr. Dr. Cr. Supplies 1,000 3, Prepaid insurance 6,000 4, Wages payable 10,000 15, Unearned rent revenue 2,000 1,

The following information also is known:

a. The December income statement (accrual basis) reported P2,000 in supplies expense. b. No insurance payments were made in December. c. P10,000 was paid to employees during December for wages. d. On November 1, 2006, a tenant paid Righter P3,000 in advance rent for the period November through January. Unearned revenue was credited.

Questions

What was the cost of supplies purchased during December? a. P 1,000 b. P 2,000 c. P 3,000 d. P 4,

What was the adjusting entry recorded at the end of December for prepaid insurance? a. Prepaid insurance 4, Insurance expense 4, b. Insurance expense 4, Prepaid insurance 4, c. Insurance expense 1, Prepaid insurance 1, d. No adjusting entry

Sales salaries 28, Commission expense 15, Miscellaneous expense 2, Rent expense 13, Office salaries 19, Light and Water 1, Insurance expense 1, Taxes and licenses 4, General expense 16, Interest expense 4, Interest income 910

Your examination of the company’s account has the need for adjustments based on the following items:

a. The cash account included a customer’s check for P1,500 deposited on September 25, 2006 but returned by the bank on September 29, 2006 for lack of countersignature. No entry was made for the returned check.

b. Unrecorded bank charge for September 2006, P

c. The allowance for doubtful accounts should be adjusted to 5% of the outstanding accounts receivable balance on September 30, 2006.

d. A physical inventory of merchandise taken at the end of the fiscal year 2006 amounted to P60,120.

e. Goods received on consignment, still unsold costing P2,000 were included in the physical inventory.

f. The merchandise inventory on September 30, were correctly stated.

g. Depreciation of furniture and equipment at 10% annually has not been recognized.

h. Accrued salesmen’s salaries not recorded P5,

i. An insurance policy was taken on the inventory and equipment on March 1, 2006 with the annual insurance premium of P1,080 paid on that date.

j. Rent expense account considered of rent for the store and office space for thirteen months starting August 1, 2006.

Based on the aforementioned data, answer the following questions;

The adjusting entry on item A is a. Cash 1, Accounts receivable 1, b. Accounts payable 1, Cash 1, c. Accounts receivable 1, Cash 1, d. No adjustment

The adjusting entry on item B is

d. No adjustment

d. No adjustment

d. No adjustment

d. No adjustment

- a. P 128,800 b. P 88,800 c. P 86,400 d. P 48,

- a. P 100,000 b. P 102,400 c. P 97,600 d. P 6. Notes Payable at end of February is

- a. P 398,600 b. P 397,400 c. P 397,800 d. P 388, 7. Abagon Capital, net of drawing at end of February is

- a. P 98,600 b. P 97,400 c. P 97,800 d. P 88, 8. Net income of the company at end of February is

- a. P 142,800 b. P 142,400 c. P 140,400 d. P 140, 9. Total Revenue of the company at end of February is

- a. P 52,600 b. P 41,800 c. P 41,400 d. P 41, 10 Expenses of the Company at end of February is

- 1 Abagon, drawing 100, Solution

- Cash 100,

- 2 Insurance expense 12,

- Cash 12,

- 3 Rent expense 24,

- Cash 24,

- 4 Cash 56,

- Accounts receivable 84,

- Revenue 140,

- 5 Notes receivable 40,

- Accounts receivable 40,

- 6 Cash 164,

- Accounts receivable 164,

- 7 Notes payable 100,

- Interest expense 2,

- Cash 102,

- 8 Supplies expense 2,

- Cash 2,

- 9 Salaries 24,

- Cash 24,

- a Prepaid Insurance 10, Adjusting Entry:

- Insurance expense 10,

- b Prepaid rent 16,

- Rent expense 16,

- c Interest receivable

- Interest income

- d Bad debts (P40,000 x 12% x 1/12)

- Allowance for bad debts

- e Depreciation 4,

- Accum. depreciation 4,

- f Unused supplies 1,

- Supplies expense 1,

- Supplies expense

- Unused supplies

- g Accrued interest payable 1,

- Interest expense 1,

- a. P 300,000 b. P 280,000 c. P 200,000 d. P 20,

- a. P 180,000 b. P 160,000 c. P 100,000 d. P 80, 2. Sales balance is:

- a. P 149,800 b. P 149,600 c. P 150,000 d. P 150, 3. Purchases balance is:

- a. P 49,800 b. P 40,200 c. P 40,000 d. P 38, 4. Operating expenses and other expenses is:

- 1 Abagon, drawing 100, Solution

- (a) Cash 300, Solution - Common stock 20, - Premium on capital stock 280,

- (b) Cash 100, - Notes payable 100,

- (c) Equipment 164, - Cash 164,

- (d) Purchases 140, - Cash 140,

- (e) Purchases 9, - Accounts payable 9,

- (f) Cash 165, - Accounts receivable 15, - Sales 180,

- (g) Operating expenses 30, - Cash 30,

- (h) Purchase disc. lost - Accounts payable - Accounts payable 7, - Cash 7,

- (i) Cash 7, - Accounts receivable 7,

- (j) Prepaid insurance - Cash

- (k) Land 63, - Cash 63,

- (l) Loss on damages 10, - Cash 10,

- Cash 157,

- Accounts receivable 7,

- Prepaid insurance

- Land 63,

- Equipment 164,

- Accounts payable 2,

- Notes payable 100,

- Common stock 20,

- Premium on capital stock 280,

- Sales 180,

- Purchases 149,

- Operating expenses 30,

- Purchase disc. lost

- _Total 582,500 582, Loss on damages 10,000 ________

- a. P 18,000 b. P 16,800 c. P 16,000 d. P 15,

- a. P 64,500 b. P 45,000 c. P 35,000 d. P 32, 3. Inventory at December 31, 20J is:

- a. P 360 b. P 562 c. P 900 d. P 4. Prepaid insurance at December 31, 20J is:

- a. P 95,000 b. P 60,000 c. P 50,900 d. P 50, 5. Equipment at December 31, 20J is:

- a. P 30,000 b. P 25,000 c. P 22,500 d. P 20, 6. Accumulated depreciation at December 31, 20J is:

- a. P 15,000 b. P 14,500 c. P 10,500 d. P 8, 7. Accounts payable at December 31, 20J is:

- a. P 9,600 b. P 9,427 c. P 5,651 d. P 4, 8. Income taxes payable at December 31, 20J is:

- a. P 39,300 b. P 38,933 c. P 30,909 d. P 27, 9. Retained earnings at December 31, 20J is:

- a. P 110,500 b. P 128,000 c. P 130,000 d. P 132,00 10. Cost of goods sold at December 31, 20J is:

- a. P 30,000 b. P 29,460 c. P 17,660 d. P 12, 11. Net income before taxes at December 20J is:

- (1) Cash 20, Solution - Accounts receivable 10, - Sales 30, - Cost of sales 19, - Inventory 19,

- (2) Cash 17, - Accounts receivable 17,

- (3) Income taxes payable 4, - Cash 4,

- (4) Inventory 40, - Cash 32, - Accounts payable 8,

- (5) Accounts payable 6, - Cash 6,

- (6) Cash 72, - Sales 72, - Cost of sales 46, - Inventory 46,

- (7) Operating expenses 19, - Cash 19,

- (8) Cash 1, - Common stock 1,

- (9) Inventory 100, - Cash 73, - Accounts payable 27,

- (10) Cash 68,

- Accounts receivable 30,

- Sales 98,

- Cost of sales 63,

- Inventory 63,

- (11) Cash 26,

- Accounts receivable 26,

- (12) Accounts payable 28,

- Cash 28,

- (13) Operating expenses 18,

- Cash 18,

- (a) Operating expenses (ins. Exp) Adjusting Entry:

- Prepaid insurance

- (b) Operating expenses (depreciation) 2, (P900 x 12/20)

- Accumulated depreciation 2,

- (c) Operating expenses (bad debts)

- Allowance for bad debts

- (d) Operating expenses

- Wages payable

- Cash 51, FINANCIAL STATEMENTS

- Accounts receivable 18,

- Inventory 45, Allowance for bad debts (1,200)

- Prepaid insurance

- Equipment 50,

- Total Assets 138, Accumulated depreciation (25,000)

- Accounts payable 8,

- Wages payable

- Income taxes payable 9,

- Common stock 81,

- Retained earnings 38,

- Total Liability/SHE 138,

- Sales revenue 200,

- Cost of sales 130,

- Gross profit 70,

- Operating expenses 40,

- Income before taxes 29,

- Income taxes expense 9,

- Net income 20,

- Retained earnings – beg 18,

- Retained earnings – end 38,

- Problem 1. a 2. b 3. b 4. a 5. d 6. b 7. d 8. b 9. b 10 11

- Cash 214, The account of PEQUIT COMPANY as at December 1, 2006 are listed below:

- Accounts receivable 338,

- Marketable securities 426,

- Office supplies 31,

- Prepaid insurance 48,

- Land 370,

- Building 900,

- Accum. depreciation – bldg 250,

- Equipment 800,

- Accum. depreciation – equip. 200,

- Accounts payable 172,

- a. P 3,253,950 b. P 3,250,950 c. P 3,203,950 d. P 3,153, 6. Total assets at December 31, 2006 is:

- a. P 289,000 b. P 279,000 c. P 277,000 d. P 257, 7. Accounts payable at December 31, 2006 is:

- a. P 97,000 b. P 73,000 c. P 24,000 d. P 9, 8. Accrued expenses at December 31, 2006 is:

- a. P 782,000 b. P 718,950 c. P 718,240 d. P 718, 9. Net sales at December 31, 2006 is:

- a. P 232,000 b. P 212,000 c. P 199,700 d. P 197, 10. Total purchases at December 31, 2006 is:

- a. P 126,500 b. P 118,500 c. P 109,500 d. P 101, 11. Operating expenses at December 31, 2006 is:

- a. P 482,800 b. P 426,950 c. P 419,040 d. P 418, 12. Net income at December 31, 2006 is:

- a. P 1,704,040 b. P 1,703,950 c. P 1,305,000 d. P 1,285, 13. Capital balance at December 1, 2006 is:

- a. P 1,704,040 b. P 1,703,950 c. P 1,305,000 d. P 1,285, 14. Capital balance at December 31, 2006 is:

- a. P 3,253,950 b. P 3,250,950 c. P 3,203,950 d. P 3,153, 15. Total liabilities and capital at December 31, 2006 is:

- Dec 1 Accounts payable 115,000 Dec 10 Interest expense 8, Solution - Cash 112,700 Cash 8, - Purchases (discount) 2, - Dec 11 Cash 176,

- Dec 3 Cash 174,600 Sales (discount) 5, - Sales (discount) 5,400 Accounts receivable 182, - Accounts receivable 180, - Dec 12 Accounts receivable 330,

- Dec 4 Accounts receivable 207,000 Sales 330, - Transportation exp 3, - Sales 210,000 Dec 18 Cash 320, - Sales (discount) 9.

- Dec 5 Sales (returns) 25,000 Accounts receivable 330, - Accounts receivable 25, - Dec 19 Accounts receivable 247,

- Dec 7 Purchases 232,000 Cash 5, - Freight-in 2,000 Sales 242, - Cash 2, - Accounts payable 232,000 Dec 20 Representation exp 9, - Cash 9,

- Dec 9 Accounts payable 12, - Purchases (returns) 12,000 Dec 29Sales (returns) 18 , - Accounts receivable 18,

- Dec 30 Drawing 20, - Purchases 20,

- a. Cash

- Accounts receivable

- b. Cash

- General expenses

- c. General Expenses

- Cash

- a. Accounts receivable 4, 3. The adjusting entry on item C is

- Allowance for Doubtful Accounts 4,

- b. Doubtful Accounts 1,

- Allowance for Doubtful Accounts 1,

- c. Allowance for Doubtful Accounts 1,

- Doubtful Accounts 1,

- d. Doubtful Accounts 1,

- Allowance for Doubtful Accounts 1,

- a. Merchandise Inv. 60, 4. The adjusting entry on item D is

- Income Summary 60,

- b. Merchandise Inv. 60,

- Purchases 60,

- c. Income summary 60,

- Merchandise inventory 60,

- a. Income summary 2, 5. The adjusting entry on item E

- Merchandise Inv. 2,

- b. Sales 2,

- Merchandise Inv. 2,

- c. Merchandise inventory 2,

- Income summary 2,

- a. Merchandise Inv. 56, 6. The adjusting entry on item F is

- Income summary 56,

- b. Merchandise Inv. 56,

- Purchases 56,

- c. Income summary 56,

- Merchandise inventory 56,

- a. Depreciation Exp. 6, 7. The adjusting entry on item G is

- Accumulated Depreciation 6,

- b. Accumulated Depreciation 6,

- Furniture and Equipment 6,

- c. Accumulated depreciation 6,

17 income, September 30, 2006 (disregard tax effect) a. P31,635 b. P31,625 c. P38,935 d. P38,

18 insurance a. P630 b. P450 c. P1,080 d. P

19 rent a. P11,000 b. P2,000 c. P13,000 d. P10,

_Answer:

- C 2. C 3. B 4. A 5. A 6. D 7. A 8. D 9. D 10. C

- C 12. B 13. D 14. B 15. A 16. A 17. D 18. B 19. A_

Problem 7 Selected pre-adjustment account balances and adjusting information of NAPPY COMPANY for the year ended December 31, 2006, are as follows:

Retained earnings, January 1, 2006 440, Sales Salaries and Commissions 35, Advertising Expense 16, Legal Services 2, Insurance and Licenses 8, Travel Expense – Sales Representative 4, Depreciation Expense 10, Interest Revenue 700 Utilities expense 6, Telephone and Postage Expense 1, Supplies inventory 2, Miscellaneous Selling Expense 2, Dividends 33, Dividend Revenue 7, Interest expense 4, Allowance for bad debts (Cr. Balance) 370 Officers’ Salaries Expense 36, Sales 495, Sales returns and allowances 11, Sales discounts 880 Gain on sales of assets 18, Inventory, January 1, 2006 89, Inventory, December 31, 2006 20, Purchases 173, Freight-in 5, Accounts Receivable, December 31, 2006 261, Shares of common stock outstanding 39,

Adjusting information:

Cost of inventory in the possession of consignee as of December 31, 2006, was not included in the ending inventory balance, P33,600.

After preparing an analysis of aged accounts receivable, a decision was made to increase the allowance for bad debts to a percentage of the ending account receivable balance to 3%. Accounts totaling P7,480 were written off as uncollectible during the year.

Purchase returns and allowances amounting to 6% of purchases (not including freight- in) were not recorded at year-end.

Sales commission for the last day of the year had not been accrued. Total sales for the day, P3,600. Average sales commission as a percent of sales is 3%.

No accrual has been made for a freight bill received on January 3, 2007, for goods received on December 29, 2006, P800.

An advertising campaign for P1,818 was initiated November 1, 2006. This amount was recorded as “prepaid advertising” and should be amortized over a 6-month period. No amortization was recorded.

Freight charges paid on sold merchandise and not passed to the buyer were netted against sales. Freight charges on sales during 2006 is P4,200.

Interest earned but not accrued, P690.

Depreciation expense on a new forklift (estimated life is 10 years) purchased for P7, on March 1, 2006 had not been recognized. (Assume all equipment will have no salvage value and the SLM is used. Depreciation is calculated to the nearest month.)

10 “real” account is debited upon the receipt of supplies. Supplies on hand at year-end is P1,600.

11 tax rate (on all items) is 32%.

Questions

Net Sales is a. P 499,200 b. P 489,300 c. P 488,500 d. P 487,

Purchases net of returns and allowances is a. P 165,200 b. P 164,000 c. P 162,620 d. P 161,20 0

Freight-in is a. P 6,325 b. P 5,200 c. P 5,000 d. P 4,

Inventory – 12/31/02 is a. P 54,700 b. P 54,150 c. P 53,600 d. P 52,

Cost of sales is a. P 265,440 b. P 205,350 c. P 204,495 d. P 114,79 5

Sales salaries and commission is a. P 35,108 b. P 35,100 c. P 35,000 d. P 34,

Advertising expense is a. P 24,696 b. P 16,800 c. P 16,750 d. P 16,

Depreciation expense is a. P 14,600 b. P 12,500 c. P 12,000 d. P 11,

Chapter 1 Caselette - Accounting Cycle

Course: Auditing

University: University of San Carlos

- Discover more from:AuditingUniversity of San Carlos213 Documents

- More from:AuditingUniversity of San Carlos213 Documents